Did you know that even the most seasoned traders can sometimes feel like they’re chasing their own tails? In the fast-paced world of day trading, understanding key indicators is crucial for success. This article dives into the essential indicators that can make or break your trading strategy, including moving averages, momentum indicators, and volume analysis. We’ll also discuss the significance of volatility, price action, and economic indicators, providing you with insights on how to choose and combine these tools effectively. Plus, we’ll highlight common mistakes to avoid and best practices for interpreting signals, ensuring you’re equipped to enhance your trading performance. Let DayTradingBusiness guide you through these pivotal concepts for a more informed trading journey.

What are the essential indicators for day trading success?

The essential indicators for day trading success include:

1. Volume: High trading volume indicates strong interest and can lead to better price movement.

2. Volatility: Look for stocks with significant price fluctuations; this creates opportunities for profit.

3. Moving Averages: Use short-term moving averages (like the 5-day and 20-day) to identify trends and entry/exit points.

4. Relative Strength Index (RSI): This momentum oscillator helps identify overbought or oversold conditions, guiding buy/sell decisions.

5. Bollinger Bands: They show price volatility and potential reversals, helping to time trades.

6. Level II Quotes: Provides insight into market depth, helping you gauge supply and demand.

7. Economic Indicators: Pay attention to news and reports that can impact market sentiment and stock prices.

These indicators help make informed trading decisions and increase the chances of success in day trading.

How do I choose the right trading indicators?

To choose the right trading indicators for day trading success, focus on a few key factors:

1. Market Type: Identify if you're trading stocks, forex, or commodities, as different markets may favor different indicators.

2. Volatility: Use indicators like Bollinger Bands or Average True Range (ATR) to gauge market volatility, which is crucial for day trading.

3. Trend Identification: Incorporate moving averages (like the 50-day or 200-day) to spot trends quickly.

4. Momentum Indicators: Utilize tools like the Relative Strength Index (RSI) or Stochastic Oscillator to assess the strength of price movements.

5. Volume Analysis: Pay attention to volume indicators, such as On-Balance Volume (OBV), to confirm trends and reversals.

6. Simplicity: Start with a few indicators to avoid analysis paralysis. Test them on a demo account to see what works best for your trading style.

Choose indicators that complement your strategy and provide clear signals for your trading decisions.

What role does volatility play in day trading indicators?

Volatility is crucial in day trading indicators as it measures price fluctuations over time. High volatility often signals potential trading opportunities, allowing traders to capitalize on rapid price movements. Indicators like the Average True Range (ATR) and Bollinger Bands use volatility to help identify entry and exit points. Traders often look for increased volatility to confirm trends, set stop-loss levels, and determine the risk-reward ratio. In short, understanding volatility enhances decision-making and can significantly impact day trading success.

How can I use moving averages for day trading?

To use moving averages for day trading, follow these steps:

1. Choose Your Averages: Use short-term moving averages like the 5-day or 10-day for quick signals, and longer ones like the 50-day for trend direction.

2. Identify Crossovers: Look for crossover signals. A bullish signal occurs when a short-term moving average crosses above a long-term one; a bearish signal happens when it crosses below.

3. Set Entry and Exit Points: Enter trades based on crossover signals. Set stop-loss orders just below support levels or moving averages to manage risk.

4. Combine with Other Indicators: Use moving averages alongside other indicators, like RSI or MACD, for confirmation of trends and to avoid false signals.

5. Adjust for Volatility: In highly volatile markets, consider using exponential moving averages (EMAs) for quicker responses to price changes.

6. Monitor Market Conditions: Be aware of overall market trends and news that could impact price movements, adjusting your strategy as needed.

Using these methods can enhance your day trading effectiveness with moving averages.

What are the best momentum indicators for day trading?

The best momentum indicators for day trading include:

1. Relative Strength Index (RSI): Measures overbought or oversold conditions.

2. Moving Average Convergence Divergence (MACD): Identifies trend direction and momentum shifts.

3. Stochastic Oscillator: Compares a security's closing price to its price range over a specific period.

4. Average True Range (ATR): Assesses market volatility to inform position sizing.

5. Volume: Confirms trends; rising volume can validate momentum.

Using these indicators can enhance your day trading strategy and improve decision-making.

How do volume indicators affect day trading strategies?

Volume indicators are crucial for day trading strategies as they reveal market activity and strength behind price movements. High volume often confirms trends, signaling traders to enter or exit positions. Conversely, low volume can indicate weak trends, suggesting caution. Using volume alongside price action helps identify potential reversals or breakouts, enhancing decision-making. Integrating tools like the Volume Weighted Average Price (VWAP) can refine entry and exit points, making trades more effective.

What is the significance of price action in day trading?

Price action is crucial in day trading because it reflects real-time market sentiment and momentum. Traders analyze price movements to identify trends, support and resistance levels, and potential reversals. This helps them make informed decisions quickly, maximizing profit opportunities. By focusing on price action, day traders can react to market changes without relying on lagging indicators, allowing for agile trading strategies. Understanding price action empowers traders to anticipate short-term price movements and improve overall trading performance.

How can I effectively use RSI in day trading?

To effectively use RSI (Relative Strength Index) in day trading, follow these steps:

1. Identify Overbought and Oversold Levels: Use the traditional 70 and 30 levels. An RSI above 70 indicates overbought conditions, while below 30 indicates oversold.

2. Look for Divergences: Watch for price movements diverging from RSI. For example, if the price makes a new high but RSI doesn't, it could signal a reversal.

3. Combine with Other Indicators: Pair RSI with moving averages or support/resistance levels for stronger signals.

4. Set Entry and Exit Points: Use RSI crossovers. Enter trades when RSI crosses above 30 (bullish) or below 70 (bearish) and set stop-loss orders to manage risk.

5. Adjust for Timeframes: For day trading, use shorter timeframes like 5-minute or 15-minute charts to capture quick moves.

6. Monitor Market Conditions: Be aware of overall market trends; RSI signals can be less reliable in strong trends.

7. Practice Risk Management: Always define your risk per trade and stick to your trading plan.

Using RSI effectively can enhance decision-making and improve day trading success.

What are the top technical indicators for day trading?

The top technical indicators for day trading include:

1. Moving Averages: Simple (SMA) and Exponential (EMA) help identify trends.

2. Relative Strength Index (RSI): Measures overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Signals trend reversals and momentum.

4. Bollinger Bands: Indicates volatility and potential price reversals.

5. Volume: Confirms trends and strength of price movements.

6. Stochastic Oscillator: Compares closing price to a range over time, indicating momentum.

Utilizing these indicators can enhance decision-making for day trading.

How does support and resistance impact day trading success?

Support and resistance levels are crucial for day trading success as they help identify potential entry and exit points. When a price approaches a support level, it may bounce back up, indicating a buying opportunity. Conversely, if it nears resistance, it might drop, suggesting a good point to sell or short. Traders use these levels to set stop-loss orders, manage risk, and optimize profits. Recognizing patterns at these key indicators can enhance decision-making and increase the likelihood of profitable trades.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What is the importance of trend analysis in day trading?

Trend analysis is crucial in day trading because it helps traders identify the direction of price movements. By analyzing trends, traders can make informed decisions about when to enter or exit positions, maximizing profits and minimizing losses. Recognizing patterns in price data allows for better risk management and enhances the ability to predict future market behavior. Additionally, understanding trends aids in selecting key indicators, such as moving averages and momentum indicators, that further guide trading strategies.

Learn about The Importance of Trend Analysis in Day Trading

How can I combine multiple indicators for better trading decisions?

To combine multiple indicators for better trading decisions, start by selecting a mix of trend, momentum, and volatility indicators. Use moving averages to identify the overall trend, RSI or Stochastic Oscillator for momentum, and Bollinger Bands for volatility.

For example, look for a buy signal when the price is above the moving average, RSI is below 30 (indicating oversold conditions), and the price touches the lower Bollinger Band. Conversely, for a sell signal, look for the price below the moving average, RSI above 70 (overbought), and the price hitting the upper Bollinger Band.

Always backtest your strategy to ensure it aligns with your trading style and risk tolerance. Adjust settings based on market conditions for optimal results.

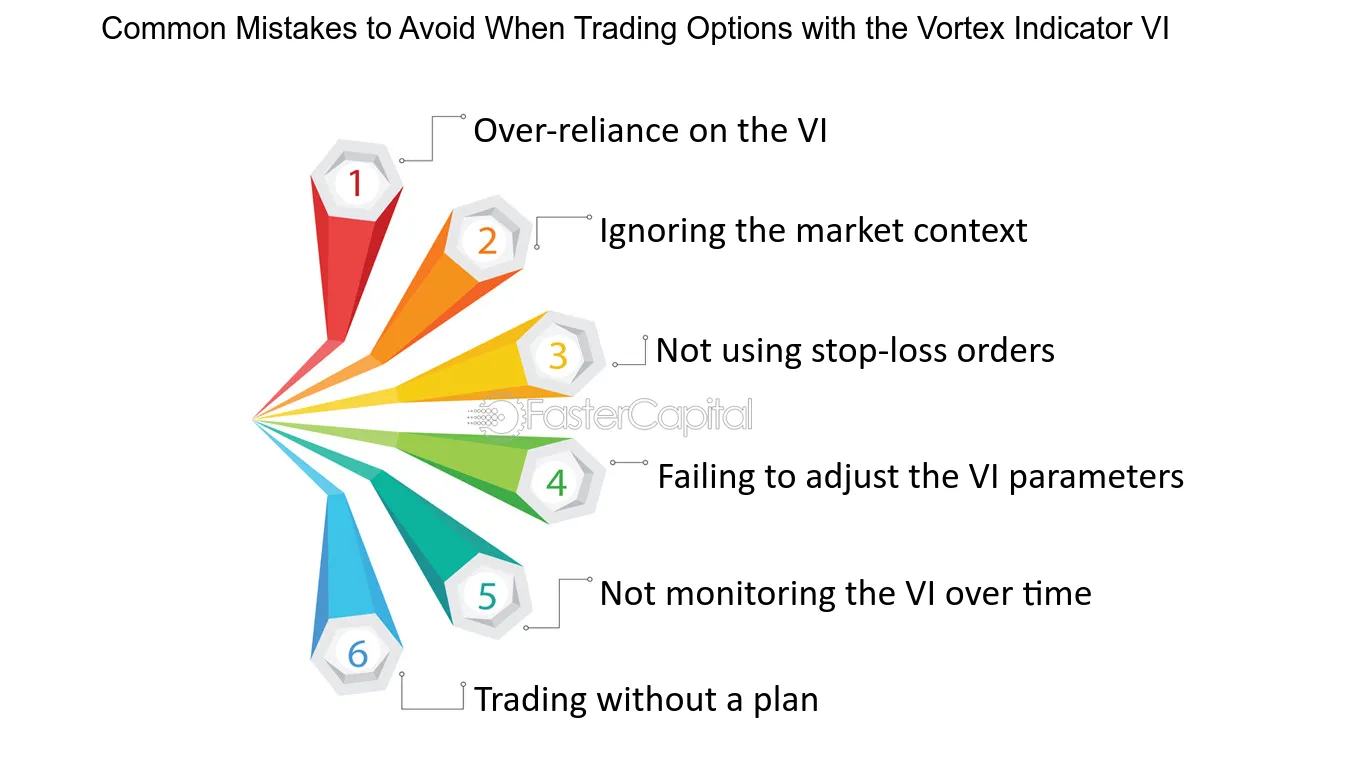

What are the common mistakes to avoid with trading indicators?

Common mistakes to avoid with trading indicators include:

1. Over-reliance on Indicators: Relying solely on indicators without considering market context can lead to poor decisions.

2. Ignoring Timeframes: Using indicators designed for different timeframes can produce misleading signals.

3. Not Backtesting: Failing to backtest indicators on historical data can result in unexpected losses.

4. Overcomplicating Strategies: Using too many indicators can create confusion; stick to a few that complement each other.

5. Neglecting Market Conditions: Indicators can behave differently in trending versus ranging markets; adapt your strategy accordingly.

6. Ignoring Volume: Many traders overlook volume alongside indicators, which is crucial for validating signals.

7. Chasing Signals: Reacting impulsively to indicator signals without waiting for confirmation can lead to trading mistakes.

Avoid these pitfalls to enhance your day trading success with indicators.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How do economic indicators influence day trading?

Economic indicators influence day trading by providing insights into market trends and potential price movements. Key indicators like employment reports, GDP growth, inflation rates, and consumer confidence can impact stock prices. For instance, a strong jobs report may boost market sentiment, leading to higher stock prices, while rising inflation could trigger volatility. Day traders often watch these indicators closely to time their trades, using the information to anticipate market reactions and make quick decisions. Understanding these economic signals can help traders capitalize on short-term price fluctuations.

What are the best practices for interpreting trading signals?

To effectively interpret trading signals, follow these best practices:

1. Understand Key Indicators: Focus on moving averages, RSI, MACD, and volume. These help gauge market momentum and potential reversals.

2. Use Multiple Time Frames: Analyze signals across different time frames to confirm trends and avoid false signals.

3. Look for Confluence: Validate signals by checking if multiple indicators align, increasing the likelihood of a successful trade.

4. Set Clear Entry and Exit Points: Define specific price levels for entering and exiting trades based on your signals to minimize emotional decision-making.

5. Manage Risk: Implement stop-loss orders to protect your capital and ensure proper position sizing based on your trading strategy.

6. Stay Informed: Keep up with market news and economic indicators that might influence trading signals.

7. Practice Patience: Wait for confirmed signals rather than acting on impulse, and avoid overtrading.

Applying these practices will enhance your ability to interpret trading signals effectively.

How can I backtest indicators to improve day trading performance?

To backtest indicators for day trading, follow these steps:

1. Select Indicators: Choose key indicators like Moving Averages, RSI, or MACD that align with your trading strategy.

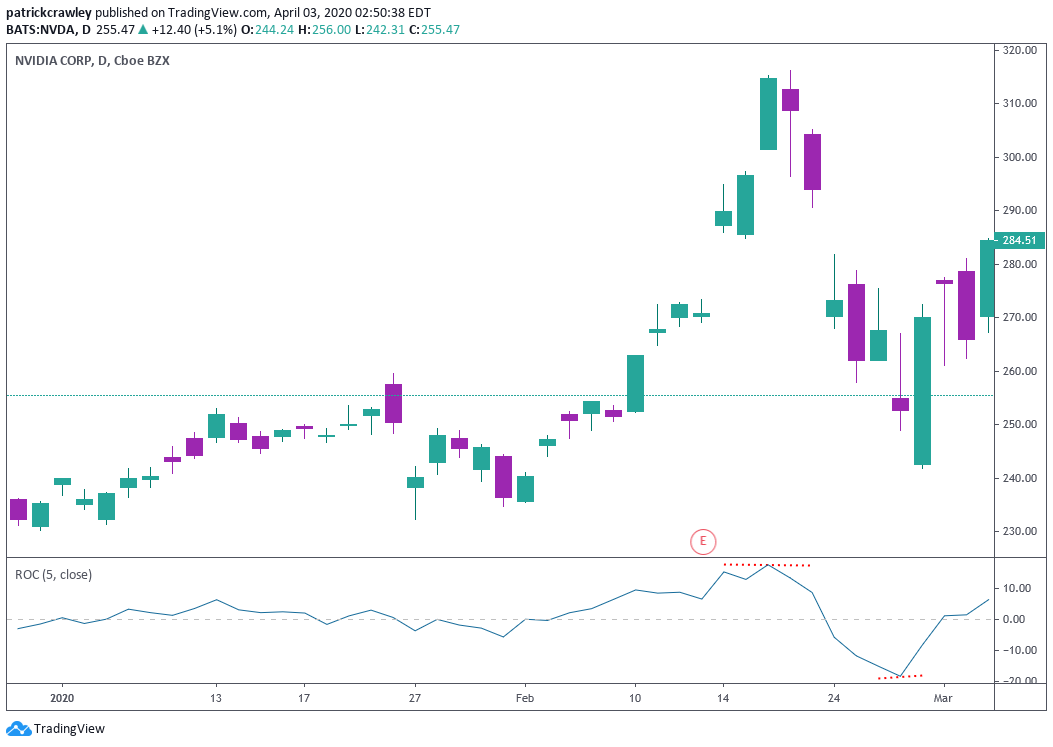

2. Collect Historical Data: Use platforms like TradingView or MetaTrader to gather historical price data for the assets you trade.

3. Set Up Backtesting Software: Utilize tools like Amibroker or QuantConnect to input your chosen indicators and trading rules.

4. Define Parameters: Specify entry and exit signals based on your indicators. For example, buy when the RSI is below 30 and sell when it’s above 70.

5. Run the Backtest: Execute the backtest over a significant time frame to analyze performance metrics, including win rate and drawdown.

6. Analyze Results: Review the results to identify strengths and weaknesses. Look for consistent profitability and risk management effectiveness.

7. Adjust and Optimize: Tweak your indicators or parameters based on findings and re-test to enhance your strategy.

8. Paper Trade: Before live trading, practice your refined strategy in a simulated environment to further validate your approach.

By systematically backtesting indicators, you can refine your day trading strategy and improve performance.

Learn about How to Backtest Day Trading Indicators

Conclusion about Key Indicators for Day Trading Success

Incorporating key indicators is essential for achieving success in day trading. By understanding and effectively using tools like moving averages, momentum indicators, and volume analysis, traders can make informed decisions that enhance their strategies. Additionally, recognizing the importance of price action, trend analysis, and economic indicators can further refine trading approaches. Avoiding common mistakes and learning to backtest these indicators will ultimately lead to improved performance. For comprehensive insights and resources, partnering with DayTradingBusiness can support your journey towards mastering day trading.

Learn about Key Economic Indicators for Day Trading Success