Did you know that the average human blinks around 15 times per minute, while high-frequency trading (HFT) can execute thousands of trades in the same timeframe? This lightning-fast approach offers day traders significant advantages, including improved execution speed and enhanced market efficiency. In this article, we explore how HFT strategies can lower costs, minimize risks, and boost liquidity, all while enabling better price discovery and capitalizing on market volatility. We’ll also discuss the vital role of technology, the tools used for HFT, regulatory considerations, and the skills necessary for successful implementation. Join us as we delve into the competitive edge HFT can provide day traders, presented by DayTradingBusiness.

What are the main advantages of HFT strategies for day traders?

The main advantages of high-frequency trading (HFT) strategies for day traders include:

1. Speed: HFT allows traders to execute orders in milliseconds, capitalizing on small price movements quickly.

2. Liquidity: HFT strategies often provide increased liquidity in the market, making it easier for day traders to enter and exit positions.

3. Reduced Transaction Costs: Frequent trading can lower per-trade costs, especially when using advanced algorithms.

4. Data Analysis: HFT relies on sophisticated algorithms that analyze vast amounts of data, helping traders identify profitable opportunities.

5. Market Inefficiencies: HFT can exploit inefficiencies in pricing across different markets, allowing traders to profit from discrepancies.

6. Diversification: HFT enables day traders to manage multiple positions simultaneously, spreading risk across various assets.

How do HFT strategies improve trade execution speed?

HFT strategies improve trade execution speed by leveraging advanced algorithms and high-speed data feeds to analyze market conditions in real time. They utilize co-location services to place trading servers close to exchange data centers, minimizing latency. This allows traders to execute orders within milliseconds, capitalizing on fleeting market opportunities. Additionally, HFT strategies often employ direct market access, reducing the time it takes to route orders. Overall, these techniques enable day traders to react faster than traditional traders, enhancing their chances of profit.

What cost benefits do day traders gain from using HFT?

Day traders gain several cost benefits from using high-frequency trading (HFT) strategies. First, HFT reduces transaction costs through lower spreads and more liquidity, allowing traders to enter and exit positions quickly without significant price impact. Second, the high turnover of trades can capitalize on small price movements, increasing potential profits. Third, HFT systems can minimize slippage by executing trades at optimal prices, which further enhances profitability. Additionally, automation in HFT reduces the need for extensive research and manual trading, saving time and operational costs. Overall, HFT provides day traders with efficiency and cost-effectiveness that can boost their returns.

How can HFT strategies enhance market efficiency for day traders?

High-frequency trading (HFT) strategies enhance market efficiency for day traders by increasing liquidity and reducing bid-ask spreads. This means day traders can enter and exit positions more easily and at better prices. HFT also helps in price discovery, ensuring that asset prices reflect real-time information more accurately. By executing large volumes of trades at high speeds, HFT strategies can quickly adjust to market changes, benefiting day traders who rely on timely data. Overall, HFT creates a more dynamic trading environment that can lead to improved opportunities for day traders.

What role does technology play in HFT strategies for day trading?

Technology is crucial in high-frequency trading (HFT) strategies for day trading. It enables rapid execution of trades, allowing traders to capitalize on minute price fluctuations. Algorithms analyze vast amounts of market data in real time, identifying trends and making split-second decisions that human traders can't match. Low-latency connections and advanced infrastructure reduce delays, ensuring trades are executed faster than competitors. Additionally, technology facilitates risk management and enhances market analysis, giving day traders a significant edge in volatile markets.

How do HFT strategies minimize trading risks for day traders?

HFT strategies minimize trading risks for day traders by leveraging algorithmic trading to execute orders at high speeds, reducing the chance of price fluctuations during trades. They use real-time data analysis to identify market inefficiencies quickly, allowing traders to capitalize on small price movements with tight stop-loss orders. By diversifying trades across multiple securities and employing strategies like market-making, HFT can also spread risk and enhance liquidity. Additionally, automated systems help eliminate emotional decision-making, further minimizing risks associated with human error.

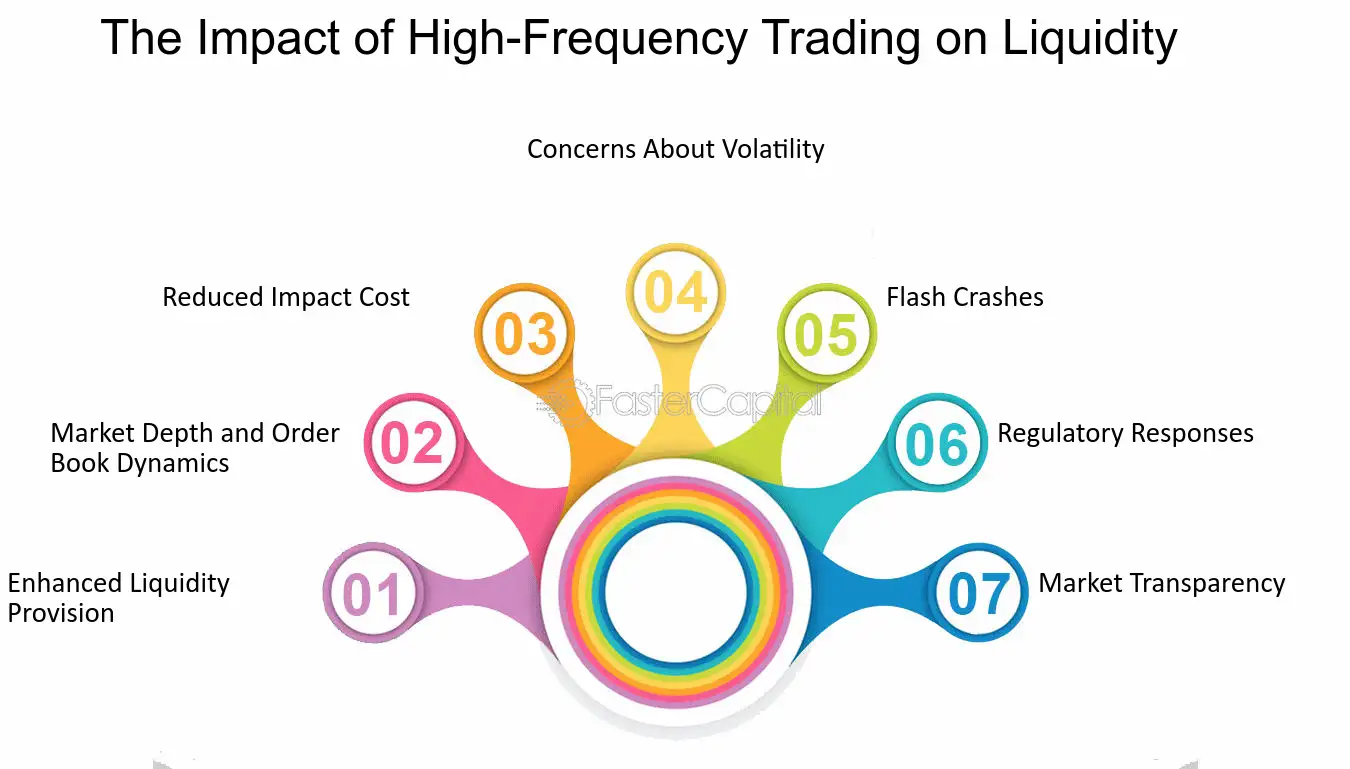

What is the impact of HFT on liquidity in day trading?

High-frequency trading (HFT) enhances liquidity in day trading by providing more buy and sell orders, which narrows spreads and makes it easier for traders to enter and exit positions quickly. This increased liquidity means that day traders can execute trades without significant price impact. Additionally, HFT strategies often lead to faster price discovery, allowing traders to capitalize on market movements more effectively. Overall, HFT contributes to a more dynamic trading environment, benefiting day traders with improved opportunities and reduced costs.

How do day traders leverage HFT for better price discovery?

Day traders leverage high-frequency trading (HFT) for better price discovery by executing numerous trades at high speeds, allowing them to capitalize on minute price fluctuations. HFT algorithms analyze market data in real-time, identifying trends and anomalies faster than traditional methods. This rapid execution helps day traders enter and exit positions quickly, optimizing their profit margins. By accessing the liquidity provided by HFT, day traders can also benefit from tighter bid-ask spreads, which enhances their trading efficiency. Overall, HFT strategies empower day traders to make informed decisions based on real-time market dynamics.

What are the competitive advantages of HFT for day traders?

High-frequency trading (HFT) offers day traders several competitive advantages:

1. Speed: HFT systems execute trades in milliseconds, allowing traders to capitalize on market movements before others can react.

2. Liquidity: HFT firms often provide liquidity, making it easier for day traders to enter and exit positions without significant price impact.

3. Data Analysis: HFT strategies utilize advanced algorithms to analyze market data and trends quickly, helping traders make informed decisions.

4. Reduced Transaction Costs: High-frequency trading can lower costs through tighter spreads and lower commissions due to large volumes.

5. Arbitrage Opportunities: HFT can identify and exploit price discrepancies across different markets or exchanges almost instantaneously.

These advantages enable day traders to enhance their trading strategies and increase potential profits.

How can HFT strategies help day traders capitalize on market volatility?

High-frequency trading (HFT) strategies can help day traders capitalize on market volatility by leveraging speed and efficiency. HFT algorithms analyze vast amounts of market data in real-time, identifying price discrepancies and executing trades within milliseconds. This rapid execution allows traders to take advantage of short-lived market movements that would be missed with slower methods.

Additionally, HFT strategies often involve arbitrage opportunities, allowing day traders to profit from price differences across markets or assets. The ability to process information faster than competitors gives day traders a critical edge, enabling them to enter and exit positions quickly. Overall, HFT enhances risk management through automated trading, allowing traders to set predefined parameters for loss limits and profit targets, which is essential in volatile markets.

Learn about How Market Conditions Affect HFT Strategies

What are the common tools and platforms used for HFT in day trading?

Common tools and platforms for high-frequency trading (HFT) in day trading include:

1. Trading Platforms: Interactive Brokers, TradeStation, and MetaTrader 4/5 offer robust features for executing rapid trades.

2. Algorithmic Trading Software: Tools like QuantConnect and AlgoTrader allow traders to create and test automated strategies.

3. Market Data Feeds: Services from Bloomberg or Reuters provide real-time data essential for HFT.

4. Direct Market Access (DMA): Platforms like Lightspeed and CQG enable traders to access markets directly for faster execution.

5. Co-location Services: Firms like Amazon Web Services provide physical proximity to exchanges, reducing latency.

6. Risk Management Tools: Software such as RiskMetrics helps monitor and manage risk in fast-paced trading environments.

Using these tools effectively can enhance execution speed and strategy performance in HFT for day traders.

Learn about Common HFT Strategies Used in Day Trading

How do HFT algorithms adapt to market conditions for day traders?

HFT algorithms adapt to market conditions by using real-time data analysis to identify trends and execute trades at lightning speed. They leverage advanced statistical models and machine learning to predict price movements, quickly adjusting strategies based on market volatility, liquidity, and order flow. For day traders, this means access to precise entry and exit points, reduced slippage, and the ability to capitalize on fleeting opportunities. By continuously learning from market behavior, HFT algorithms optimize trading decisions, enhancing profitability and reducing risk for day traders.

Learn about How Market Conditions Affect HFT Strategies

What regulatory considerations should day traders be aware of with HFT?

Day traders using high-frequency trading (HFT) should be aware of several regulatory considerations:

1. Market Access: Ensure compliance with rules regarding direct market access and broker-dealer regulations.

2. Best Execution: Adhere to best execution obligations, ensuring trades are executed at the best available prices.

3. Order Types: Understand regulations surrounding specific order types, like flash orders and dark pools, which may have restrictions.

4. Reporting Requirements: Be familiar with reporting obligations for trades, including the need for real-time reporting in some jurisdictions.

5. Wash Trading: Avoid practices like wash trading, which can lead to regulatory scrutiny.

6. Leverage and Margin: Be aware of leverage limits and margin requirements set by regulatory bodies.

Staying informed about these regulations helps mitigate risks and maintain compliance in HFT strategies.

How can day traders measure the success of their HFT strategies?

Day traders can measure the success of their high-frequency trading (HFT) strategies by analyzing key performance metrics. Focus on metrics like profit and loss (P&L), win rate, average trade duration, and risk-adjusted returns such as the Sharpe ratio. Tracking execution speed and slippage will also reveal how efficiently trades are being executed. Additionally, monitoring market impact and transaction costs helps assess the overall effectiveness of the strategy. Regularly reviewing these metrics allows traders to refine their HFT strategies for better performance.

Learn about How Do Institutional Traders Influence Day Trading Strategies?

What skills do day traders need to effectively implement HFT strategies?

Day traders implementing high-frequency trading (HFT) strategies need strong analytical skills to interpret market data quickly. They must be proficient in algorithmic trading and programming to develop and optimize trading algorithms. Fast decision-making is crucial, as HFT relies on rapid execution of trades. A solid understanding of market mechanics and risk management is essential to navigate volatility. Lastly, familiarity with trading platforms and access to advanced technology boosts efficiency in executing HFT strategies.

What are the challenges faced by day traders using HFT strategies?

Day traders using high-frequency trading (HFT) strategies face several challenges:

1. Market Volatility: Rapid price changes can lead to significant losses if trades are not executed quickly or correctly.

2. Technological Dependence: HFT relies on advanced technology and algorithms, making traders vulnerable to system failures or technical glitches.

3. High Competition: The HFT space is crowded with institutional players, making it tough for individual traders to compete.

4. Regulatory Scrutiny: Increased regulation can impact trading strategies and introduce compliance costs.

5. Data Overload: Analyzing vast amounts of data in real-time can overwhelm traders and lead to decision fatigue.

6. Liquidity Risks: In fast-moving markets, liquidity can dry up, making it difficult to execute trades at desired prices.

7. Cost of Infrastructure: Setting up the necessary infrastructure for HFT can be expensive, including low-latency connections and sophisticated software.

Learn about Challenges Faced by Day Traders Using HFT Strategies

Conclusion about Advantages of HFT Strategies for Day Traders

High-Frequency Trading (HFT) strategies offer numerous advantages for day traders, enhancing trade execution speed, reducing costs, and improving market efficiency. By leveraging advanced technology, these strategies minimize risks and bolster liquidity, enabling better price discovery and opportunities to capitalize on market volatility. However, successful implementation requires a solid understanding of the tools, regulatory landscape, and necessary skills. For those looking to excel in day trading, incorporating HFT strategies can be a game-changer, and DayTradingBusiness is here to provide the insights and support needed to navigate this complex landscape effectively.

Learn about Challenges Faced by Day Traders Using HFT Strategies