Did you know that the first algorithmic trade was executed back in the 1970s? Fast forward to today, and algorithmic trading has transformed the trading landscape, making it accessible for beginners and seasoned pros alike. In this article, we’ll demystify algorithmic trading, covering its workings, key benefits, and how to kickstart your journey with minimal experience. You’ll discover the best programming languages, common strategies, and essential platforms to consider. We’ll also address risks, backtesting methods, necessary data, and legal regulations that govern this dynamic field. Plus, learn how to manage risk effectively and adapt your strategies to changing market conditions. Stay ahead of the curve with tools and resources that will keep you updated on the latest trends in algorithmic trading—all thanks to insights from DayTradingBusiness.

What is algorithmic trading and how does it work?

Algorithmic trading is the use of computer algorithms to execute trading orders automatically based on predefined criteria. It analyzes market data, identifies trading opportunities, and places trades at speeds and volumes that humans can't match.

Traders set parameters like price, timing, and volume. The algorithm scans the market for conditions that meet these criteria, executing trades when the conditions are favorable. This minimizes human emotional bias and enhances efficiency. Examples include arbitrage strategies, trend following, and market making.

What are the key benefits of algorithmic trading for beginners?

Algorithmic trading offers several key benefits for beginners:

1. Automation: It automates trades based on predefined criteria, reducing the need for constant monitoring.

2. Speed: Algorithms can execute trades faster than humans, capitalizing on market opportunities quickly.

3. Emotionless Trading: Removes emotional decision-making, leading to more disciplined and consistent trading strategies.

4. Backtesting: Beginners can backtest strategies on historical data to evaluate performance before live trading.

5. Diversification: Allows for simultaneous trading across multiple markets and assets, spreading risk effectively.

6. Cost Efficiency: Lowers transaction costs by optimizing trade execution and reducing slippage.

These advantages make algorithmic trading an appealing option for those just starting out in the financial markets.

How can I start algorithmic trading with little experience?

Start by learning the basics of algorithmic trading through online courses and resources. Familiarize yourself with programming languages like Python or R, as they're commonly used for developing trading algorithms. Use platforms like QuantConnect or Alpaca for practice, where you can backtest your strategies with historical data. Begin with simple strategies, such as moving averages or momentum trading, and gradually progress to more complex algorithms. Join online trading communities to share ideas and gain insights. Finally, start with a demo account to refine your skills without risking real money.

What programming languages are best for algorithmic trading?

The best programming languages for algorithmic trading are Python, R, C++, Java, and MATLAB.

Python is popular for its simplicity and extensive libraries like Pandas and NumPy. R excels in statistical analysis and visualization. C++ offers high performance for low-latency trading. Java provides portability and scalability, making it suitable for large systems. MATLAB is beneficial for complex mathematical computations. Choose based on your specific needs and familiarity.

What are the common strategies used in algorithmic trading?

Common strategies in algorithmic trading include:

1. Trend Following: Algorithms identify and follow market trends to capitalize on momentum.

2. Mean Reversion: This strategy bets that prices will return to their historical average, identifying overbought or oversold conditions.

3. Arbitrage: Algorithms exploit price differences between markets or related assets to lock in profits.

4. Market Making: Algorithms provide liquidity by placing buy and sell orders, profiting from the bid-ask spread.

5. Statistical Arbitrage: This involves complex mathematical models to identify pricing inefficiencies between correlated assets.

6. Sentiment Analysis: Algorithms analyze news and social media to gauge market sentiment and make trading decisions.

These strategies help traders execute orders quickly and efficiently, maximizing profit potential.

How do I choose the right algorithmic trading platform?

To choose the right algorithmic trading platform, consider the following factors:

1. User Interface: Look for a platform that is intuitive and easy to navigate.

2. Algorithm Development Tools: Ensure it offers robust tools for creating and testing algorithms, such as backtesting features.

3. Data Access: Check the quality and range of market data available; real-time data is crucial.

4. Execution Speed: Choose a platform known for low latency and fast order execution.

5. Costs and Fees: Evaluate trading fees, subscription costs, and any hidden charges.

6. Integration: Ensure compatibility with your existing trading systems or APIs.

7. Support and Community: Look for platforms with strong customer support and an active user community for sharing insights and strategies.

Assess these aspects to find a platform that fits your trading goals and level of expertise.

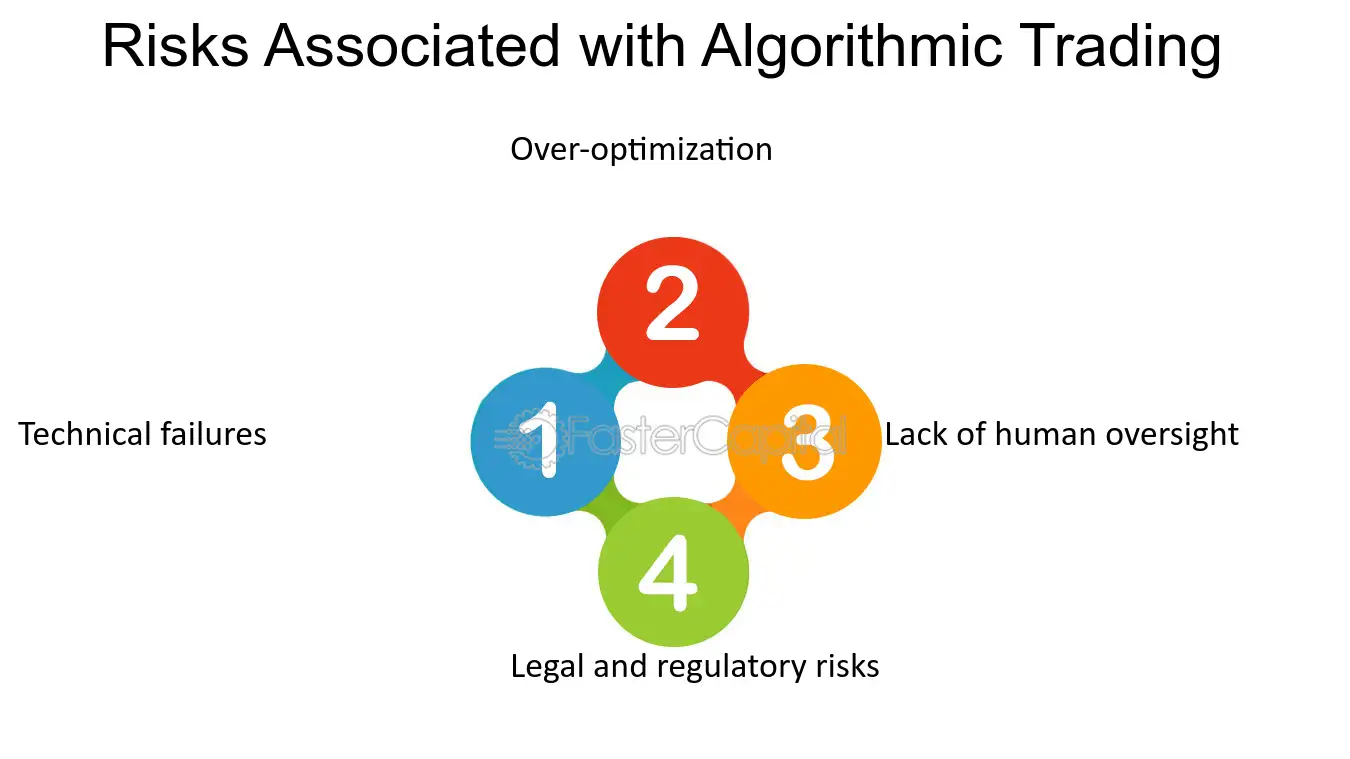

What are the risks associated with algorithmic trading?

Algorithmic trading carries several risks:

1. Market Risk: Sudden market movements can lead to significant losses, especially if algorithms react too slowly.

2. Technical Failures: Software bugs or hardware malfunctions can result in unintended trades or losses.

3. Liquidity Risk: Algorithms may struggle to execute trades in thinly traded markets, leading to unfavorable prices.

4. Overfitting: Algorithms designed based on historical data may perform poorly in live markets due to changing conditions.

5. Regulatory Risk: Changing regulations can impact trading strategies and result in penalties or trading bans.

6. Data Quality: Poor or inaccurate data can lead to faulty algorithms and poor trading decisions.

7. High Competition: Many traders use similar algorithms, leading to diminished returns as strategies become crowded.

Understanding these risks is crucial for anyone venturing into algorithmic trading.

How can I backtest my trading algorithms effectively?

To backtest your trading algorithms effectively, follow these steps:

1. Select Historical Data: Use high-quality, relevant historical market data that reflects the trading conditions you want to test.

2. Define Your Strategy: Clearly the rules of your trading algorithm, including entry and exit points, risk management, and position sizing.

3. Use Backtesting Software: Implement a reliable backtesting platform or software, like MetaTrader, TradingView, or specialized tools like QuantConnect.

4. Run Simulations: Execute your algorithm on the historical data to simulate trades, tracking performance metrics like profit, drawdown, and win rate.

5. Analyze Results: Assess the outcomes critically. Look for patterns, strengths, and weaknesses in your strategy's performance.

6. Refine Your Strategy: Based on the analysis, tweak your algorithm to improve its effectiveness. Avoid overfitting by ensuring it generalizes well to unseen data.

7. Validate with Walk-Forward Testing: After refining, test your algorithm on out-of-sample data to confirm its robustness.

By following these steps, you can backtest your trading algorithms effectively and enhance their performance.

What data do I need for algorithmic trading?

For algorithmic trading, you need market data, which includes historical price data, real-time market data, and order book data. Additionally, you should gather trading indicators, such as moving averages and volume metrics, as well as fundamental data like earnings reports and economic indicators. Risk management data is also crucial, including volatility measures and correlation metrics. Finally, you might need backtesting data to evaluate your trading strategies effectively.

How do I optimize my algorithmic trading strategies?

To optimize your algorithmic trading strategies, follow these steps:

1. Backtest Thoroughly: Use historical data to test your strategies under various market conditions. Look for consistent performance.

2. Refine Parameters: Adjust key parameters like stop-loss, take-profit levels, and entry/exit signals based on backtesting results.

3. Diversify Strategies: Combine different strategies to reduce risk. Use varying timeframes and assets to improve overall performance.

4. Implement Machine Learning: Explore machine learning techniques to adapt and enhance your strategies based on real-time data.

5. Monitor Performance: Continuously track your strategies in live markets. Make adjustments as needed based on performance metrics.

6. Risk Management: Establish strict risk management protocols to protect your capital. Limit exposure on each trade.

7. Keep Learning: Stay updated on market trends, new technologies, and strategies through research and community engagement.

By focusing on these areas, you can enhance the effectiveness of your algorithmic trading strategies.

Learn about How to Optimize Algorithmic Strategies for Day Trading

What are the legal regulations around algorithmic trading?

Legal regulations around algorithmic trading vary by country but generally include requirements for registration, reporting, and compliance with market regulations. In the U.S., the SEC and CFTC oversee trading activities, enforcing rules to prevent market manipulation and ensure fair practices. Traders must comply with the SEC's Regulation SCI, which mandates technology risk management, and the Market Access Rule, which requires firms to have risk controls in place. In Europe, MiFID II governs algorithmic trading, focusing on transparency, reporting obligations, and trading venue regulations. Firms must also ensure their algorithms do not contribute to market instability.

How do I manage risk in algorithmic trading?

To manage risk in algorithmic trading, start by implementing a solid risk management strategy. Use stop-loss orders to limit potential losses on each trade. Diversify your portfolio to spread risk across various assets. Set a maximum drawdown limit to protect your capital from significant losses. Regularly backtest your algorithms on historical data to evaluate their performance under different market conditions. Monitor real-time trading performance and be ready to adjust your algorithms as market dynamics change. Additionally, maintain a disciplined approach to position sizing, ensuring that no single trade disproportionately affects your overall capital.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What tools can help me with algorithmic trading?

For algorithmic trading, consider using these tools:

1. MetaTrader 4/5: Popular platforms for developing and testing trading algorithms with built-in scripting capabilities.

2. TradingView: Offers a user-friendly interface and Pine Script for custom indicators and strategies.

3. QuantConnect: A cloud-based platform for algorithmic trading that supports multiple programming languages.

4. NinjaTrader: Provides advanced charting and analysis tools, plus a scripting environment for strategy development.

5. AlgoTrader: A comprehensive platform for backtesting and executing trading strategies across various markets.

6. Interactive Brokers API: Allows for direct market access and the ability to implement custom algorithms using various programming languages.

These tools will help you design, test, and execute your trading strategies effectively.

How do market conditions affect algorithmic trading performance?

Market conditions significantly impact algorithmic trading performance by influencing volatility, liquidity, and price trends. In volatile markets, algorithms may capitalize on rapid price movements but also face higher risks. Low liquidity can lead to slippage, affecting trade execution. Trending markets may favor momentum strategies, while sideways markets can challenge mean-reversion algorithms. Adapting algorithms to current market conditions is crucial for optimizing performance and managing risk effectively.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

Can I use algorithmic trading for different asset classes?

Yes, you can use algorithmic trading for different asset classes, including stocks, forex, commodities, and cryptocurrencies. Each asset class has unique characteristics, so algorithms need to be tailored to the specific market conditions and trading strategies relevant to that class.

How can I stay updated on algorithmic trading trends?

To stay updated on algorithmic trading trends, follow these steps:

1. Subscribe to Newsletters: Sign up for newsletters from financial and trading websites like Bloomberg, Investopedia, and QuantInsti.

2. Join Online Communities: Participate in forums like QuantConnect, Elite Trader, and Reddit’s r/algotrading to share insights and strategies.

3. Follow Influencers: Track industry experts on Twitter and LinkedIn who regularly post about algorithmic trading developments.

4. Read Research Papers: Access platforms like SSRN and arXiv for the latest research and methodologies in algorithmic trading.

5. Attend Webinars and Conferences: Join events like the Quantitative Finance Conference to learn from professionals and network.

6. Use Trading Platforms: Explore features of platforms like MetaTrader and TradeStation that often provide market analysis and trend reports.

Engaging with these resources will keep you informed on the latest in algorithmic trading.

Learn about How to Stay Updated on Emerging Day Trading Patterns

Conclusion about Understanding Algorithmic Trading for Beginners

Algorithmic trading offers beginners a structured approach to engage with the financial markets, leveraging technology for efficiency and precision. By understanding its benefits, risks, and necessary tools, new traders can confidently start their journey. For continued support and in-depth insights, resources from DayTradingBusiness can help you navigate the complexities of algorithmic trading and enhance your trading skills.

Sources:

- Algorithmic trading and firm value - ScienceDirect

- Using Reinforcement Learning in the Algorithmic Trading Problem

- Bubbles in hybrid markets: How expectations about algorithmic ...

- Algorithmic trading, what if it is just an illusion? Evidence from ...

- Liquidity and Price Discovery of Algorithmic Trading: An Intraday ...