Did you know that the first algorithmic trading program was developed in the 1970s and had more in common with a calculator than today's sophisticated systems? In the fast-paced world of day trading, algorithmic trading strategies play a crucial role in executing trades with precision and speed. This article dives into the essentials of algorithmic trading, covering what it is, how it works, and the various types of strategies available. You'll learn about the benefits and risks involved, how to create your own algorithm, and the programming languages that power these systems. Additionally, we’ll explore backtesting methods, the best tools for implementation, and the impact of market conditions. Whether you're looking to optimize your strategy or avoid common pitfalls, this guide from DayTradingBusiness provides the insights you need to navigate the complex landscape of algorithmic trading.

What is Algorithmic Trading in Day Trading?

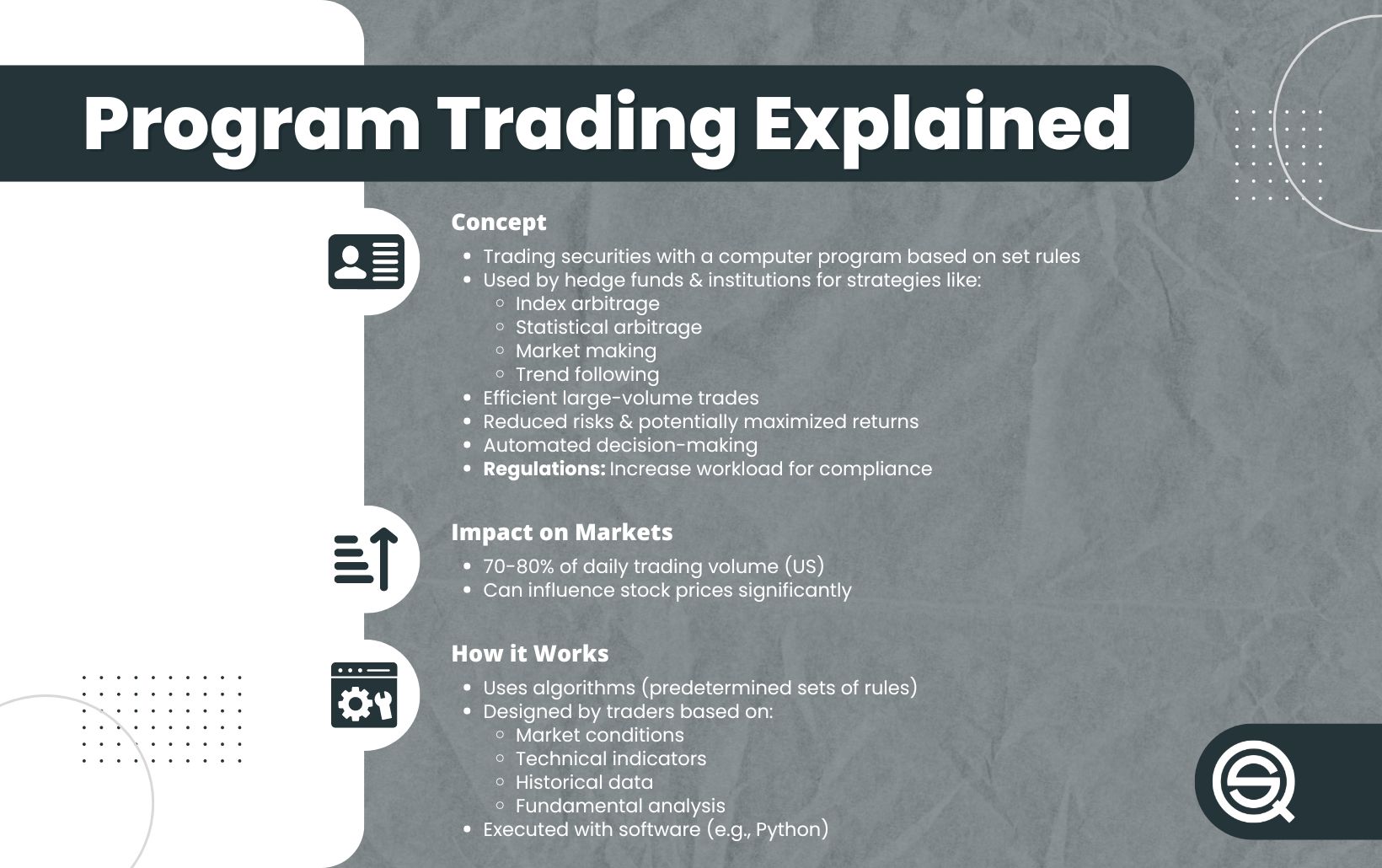

Algorithmic trading in day trading refers to using computer algorithms to execute trades based on predefined criteria. These strategies analyze market data and execute orders at optimal times, often in milliseconds. Common algorithmic trading strategies include trend following, arbitrage, market making, and statistical arbitrage. By automating trades, day traders can capitalize on price discrepancies and market fluctuations without emotional bias, improving efficiency and speed.

How Do Algorithmic Trading Strategies Work?

Algorithmic trading strategies in day trading use computer algorithms to execute trades based on predefined criteria, such as price, volume, and timing. These strategies analyze market data to identify patterns and make split-second decisions to buy or sell assets. They can be programmed to react to market movements in real-time, reducing emotional trading and improving efficiency. Common strategies include trend following, arbitrage, and market making. By automating the trading process, algorithms can exploit small price discrepancies and capitalize on short-term market fluctuations.

What Are the Different Types of Algorithmic Trading Strategies?

Algorithmic trading strategies in day trading include:

1. Trend Following: Capitalizes on upward or downward market trends using indicators like moving averages.

2. Mean Reversion: Assumes prices will revert to their historical average, allowing traders to buy low and sell high.

3. Arbitrage: Exploits price discrepancies between different markets or instruments, buying low in one and selling high in another.

4. Market Making: Provides liquidity by placing buy and sell orders, profiting from the bid-ask spread.

5. Momentum Trading: Identifies stocks moving significantly in one direction, aiming to ride the momentum for quick profits.

6. Statistical Arbitrage: Uses complex mathematical models to identify mispricing between correlated assets.

7. Sentiment Analysis: Leverages news or social media sentiment to predict price movements based on public perception.

Each strategy has its own risk and reward profile, tailored to different market conditions and trader preferences.

What Are the Benefits of Using Algorithmic Trading in Day Trading?

Algorithmic trading in day trading offers several key benefits:

1. Speed: Algorithms execute trades in milliseconds, capitalizing on market opportunities faster than humans.

2. Precision: They eliminate emotional decision-making, ensuring trades are based on data and predefined strategies.

3. Backtesting: Traders can test strategies on historical data to refine approaches before live trading.

4. Diversification: Algorithms can monitor multiple markets and assets simultaneously, spreading risk.

5. Cost Efficiency: Reduced transaction costs through automated trading can lead to higher profit margins.

6. Consistency: Maintaining a disciplined approach to trading helps in achieving consistent results over time.

What Risks Are Involved in Algorithmic Trading Strategies?

Algorithmic trading strategies in day trading involve several risks:

1. Market Risk: Sudden price movements can lead to significant losses if algorithms don’t react quickly enough.

2. Technical Risk: Systems can fail due to software bugs or hardware malfunctions, disrupting trades.

3. Liquidity Risk: Algorithms may struggle to execute trades at desired prices in low-volume markets.

4. Over-Optimization: Strategies may work well in backtesting but fail in live conditions due to market changes.

5. Regulatory Risk: Compliance issues with trading regulations can lead to penalties or restrictions.

6. Data Risk: Inaccurate or delayed data can result in poor trading decisions.

Understanding these risks is crucial for successful algorithmic trading in day trading.

How Can I Create My Own Algorithmic Trading Strategy?

To create your own algorithmic trading strategy for day trading, start by defining your goals and risk tolerance. Choose a market or asset class that interests you. Develop a clear trading plan that outlines entry and exit points based on technical indicators, price action, or market trends.

Next, select a programming language or trading platform to implement your strategy, such as Python or MetaTrader. Backtest your strategy using historical data to assess its performance and make necessary adjustments. Once satisfied, paper trade to test it in real-time without risking money. Finally, monitor and refine your strategy based on ongoing results and market conditions.

What Programming Languages Are Used for Algorithmic Trading?

Common programming languages used for algorithmic trading in day trading include Python, R, C++, Java, and MATLAB. Python is popular for its simplicity and extensive libraries for data analysis. R is favored for statistical analysis and visualization. C++ offers high performance crucial for speed-sensitive trading. Java provides cross-platform capabilities, while MATLAB is used for mathematical modeling and algorithm development.

How Do I Backtest an Algorithmic Trading Strategy?

To backtest an algorithmic trading strategy, follow these steps:

1. Define Your Strategy: Clearly the rules for entry, exit, and risk management.

2. Collect Historical Data: Obtain relevant price data for the asset you want to trade.

3. Choose a Backtesting Platform: Use software like MetaTrader, Amibroker, or Python libraries like Backtrader.

4. Implement the Strategy: Code your trading rules into the chosen platform.

5. Run the Backtest: Execute the backtest on historical data to simulate trading performance.

6. Analyze Results: Evaluate metrics like profit factor, drawdown, win rate, and Sharpe ratio.

7. Refine and Iterate: Adjust your strategy based on the results and backtest again.

This process helps ensure your algorithmic trading strategy is robust before applying it in live markets.

What Tools and Software Are Best for Algorithmic Trading?

The best tools and software for algorithmic trading in day trading include:

1. MetaTrader 4/5: Popular for its user-friendly interface and extensive community support.

2. NinjaTrader: Great for strategy development and backtesting with advanced charting tools.

3. TradingView: Offers powerful charting capabilities and social features for strategy sharing.

4. QuantConnect: A cloud-based platform for quantitative trading, ideal for coding and backtesting algorithms.

5. Interactive Brokers: Comes with a robust API for custom algorithmic trading solutions.

6. AlgoTrader: Focuses on institutional trading with comprehensive risk management tools.

Each tool provides unique features suited for different trading strategies and preferences.

How Do Market Conditions Affect Algorithmic Trading Strategies?

Market conditions significantly influence algorithmic trading strategies in day trading. In volatile markets, strategies may focus on quick trades to capitalize on price swings. During stable conditions, algorithms might prioritize trend-following or mean-reversion strategies.

Liquidity is also crucial; high liquidity allows for faster execution and tighter spreads, making scalping strategies more effective. Conversely, in low liquidity, algorithms may need to adjust their parameters to avoid slippage.

Overall, successful algorithmic trading adapts to changing market conditions, ensuring strategies remain effective regardless of the environment.

Learn about How Does Market Microstructure Affect Day Trading Strategies?

What Are the Key Metrics to Evaluate Algorithmic Trading Performance?

Key metrics to evaluate algorithmic trading performance include:

1. Sharpe Ratio: Measures risk-adjusted return. Higher values indicate better performance.

2. Maximum Drawdown: Shows the largest peak-to-trough decline. Lower values indicate better risk management.

3. Win Rate: Percentage of profitable trades versus total trades. A higher win rate suggests effective strategy execution.

4. Return on Investment (ROI): Measures the gain or loss relative to the initial investment. Positive ROI indicates profitability.

5. Average Trade Duration: Indicates how long trades are held. Helps assess strategy speed and turnover.

6. Slippage: The difference between expected and actual trade execution prices. Lower slippage enhances performance.

7. Cost of Trading: Total trading costs, including commissions and fees. Keeping costs low improves net returns.

These metrics provide a comprehensive view of an algorithm's effectiveness in day trading.

Learn about Key Metrics to Evaluate Day Trading Algorithms

How Can I Optimize My Algorithmic Trading Strategy?

To optimize your algorithmic trading strategy in day trading, focus on these key areas:

1. Backtesting: Use historical data to test your strategy's performance. Adjust parameters based on results to increase profitability.

2. Risk Management: Set strict stop-loss and take-profit levels. Use position sizing techniques to limit exposure.

3. Data Analysis: Incorporate technical indicators and market sentiment analysis to refine entry and exit points.

4. Execution Speed: Ensure your trading platform has low latency to capitalize on market opportunities quickly.

5. Diversification: Trade multiple strategies or assets to reduce risk and increase potential returns.

6. Continuous Monitoring: Regularly review and tweak your strategy based on market conditions and performance metrics.

7. Machine Learning: Explore machine learning techniques to adapt and improve your strategy over time.

Implementing these steps will enhance your algorithmic trading strategy for better day trading results.

Learn about How to Optimize Algorithmic Strategies for Day Trading

What Are Common Mistakes to Avoid in Algorithmic Trading?

Common mistakes to avoid in algorithmic trading include:

1. Overfitting: Creating a strategy that performs well on historical data but fails in real markets.

2. Ignoring Market Conditions: Using strategies without considering current market volatility or trends can lead to losses.

3. Lack of Risk Management: Not setting stop-loss orders or managing position sizes can result in significant drawdowns.

4. Overleveraging: Using too much leverage can amplify losses and lead to rapid account depletion.

5. Neglecting Backtesting: Failing to rigorously backtest strategies can result in unexpected performance issues.

6. Poor Execution: Delays or slippage during trade execution can erode profits.

7. Emotional Trading: Allowing emotions to influence decisions can derail a systematic approach.

8. Ignoring Transaction Costs: Not accounting for fees can impact profitability, especially in high-frequency trading.

Avoid these pitfalls to enhance your algorithmic trading success.

How Do I Choose a Broker for Algorithmic Trading?

To choose a broker for algorithmic trading, focus on these key factors:

1. Execution Speed: Look for brokers that offer low latency and high-speed execution to enhance your trading strategy's effectiveness.

2. API Access: Ensure the broker provides robust APIs for seamless integration with your trading algorithms.

3. Commission Structure: Compare fees and commissions; choose a broker with competitive rates to maximize your profits.

4. Market Access: Verify that the broker gives access to the markets and instruments you plan to trade.

5. Reliability and Reputation: Research the broker’s track record, customer reviews, and regulatory compliance.

6. Trading Platform: Evaluate the trading platform’s features, usability, and support for automated trading systems.

7. Customer Support: Look for responsive customer service to assist with any issues that may arise during trading.

By considering these factors, you'll be better positioned to select a broker that aligns with your algorithmic trading goals.

What is High-Frequency Trading and How Does It Differ?

High-frequency trading (HFT) is a form of algorithmic trading that uses powerful computers to execute a large number of orders at extremely high speeds. It relies on complex algorithms to analyze market data and make trades within milliseconds.

The key difference between HFT and other algorithmic trading strategies is the speed and volume of trades. HFT focuses on short-term opportunities, often holding positions for seconds or minutes, while other strategies may hold trades for longer periods, like hours or days. HFT aims to profit from small price discrepancies, leveraging speed to capitalize on fleeting market inefficiencies.

How Can I Stay Updated on Algorithmic Trading Trends?

To stay updated on algorithmic trading trends, follow these strategies:

1. Subscribe to Financial News: Regularly read publications like Bloomberg, Wall Street Journal, and specialized fintech websites.

2. Join Online Forums and Communities: Engage with platforms like QuantConnect, Elite Trader, or Reddit’s algorithmic trading subreddits for real-time discussions.

3. Attend Webinars and Conferences: Participate in events focused on trading technology and algorithmic strategies to learn from experts.

4. Follow Influential Traders and Analysts: Use social media to track insights from recognized figures in algorithmic trading.

5. Read Research Papers and Journals: Keep an eye on academic publications that discuss recent findings in trading algorithms.

6. Utilize Trading Platforms: Many platforms offer updates and insights on market trends and algorithm performance.

7. Experiment with Backtesting Tools: Use software to test different strategies and see how they perform under various market conditions.

By integrating these methods, you can effectively stay informed about the latest algorithmic trading trends.

Learn about How to Stay Updated on Emerging Day Trading Patterns

Conclusion about What Are Algorithmic Trading Strategies in Day Trading?

In summary, algorithmic trading strategies are essential tools for day traders looking to enhance their trading performance through automation and data analysis. By understanding the various types of strategies, their benefits, and the associated risks, traders can effectively leverage technology to optimize their approaches. Creating and backtesting a personalized algorithmic strategy, while being mindful of market conditions and key performance metrics, can lead to improved decision-making and profitability. For those seeking guidance in navigating the complexities of algorithmic trading, DayTradingBusiness offers valuable insights and resources to help you succeed in this dynamic field.

Learn about The Future of Algorithmic Strategies in Day Trading