Did you know that the first algorithmic trade was executed in the late 1970s, long before most of us even knew what a computer was? Fast forward to today, and algorithmic strategies are revolutionizing day trading. This article delves into the intricacies of algorithmic trading, explaining what these strategies are and how they function. You’ll discover the advantages of using algorithms, the various types commonly employed, and the transformative impact of machine learning and big data. We’ll also cover how traders can develop their own strategies, the risks involved, and the importance of backtesting. Plus, we’ll explore the best tools for implementation and the regulatory landscape shaping these practices. Finally, we’ll look ahead to the future of AI in trading, market dynamics, ethical considerations, and real-life success stories. Join DayTradingBusiness as we navigate the exciting realm of algorithmic trading to enhance your trading journey.

What are algorithmic strategies in day trading?

Algorithmic strategies in day trading involve using computer algorithms to execute trades based on predefined criteria. Common strategies include:

1. Trend Following: Algorithms identify and capitalize on upward or downward market trends.

2. Mean Reversion: These strategies assume prices will revert to their historical average, triggering trades when prices deviate significantly.

3. Arbitrage: Algorithms exploit price differences across markets or assets for quick profits.

4. Market Making: Algorithms provide liquidity by placing buy and sell orders, profiting from the spread.

5. Statistical Arbitrage: This involves complex mathematical models to identify trading opportunities based on statistical relationships between assets.

As technology advances, the future of these strategies will likely see enhanced machine learning integration, allowing for more adaptive and responsive trading approaches.

How do algorithmic trading strategies work?

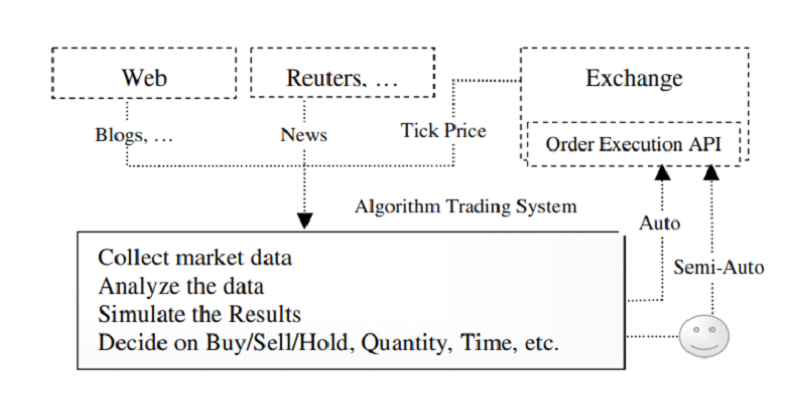

Algorithmic trading strategies use computer algorithms to execute trades based on predefined criteria. These strategies analyze market data, identify patterns, and automatically place trades at optimal times. They can leverage high-frequency trading, statistical arbitrage, and trend-following tactics to capitalize on market inefficiencies. By processing vast amounts of data quickly, algorithmic trading can enhance speed and accuracy, allowing traders to react to market changes in real-time. The future of these strategies in day trading involves increased use of artificial intelligence and machine learning to improve decision-making and adapt to evolving market conditions.

What are the advantages of using algorithms in day trading?

Advantages of using algorithms in day trading include speed and efficiency in executing trades, eliminating emotional bias, and enabling analysis of vast amounts of data quickly. Algorithms can identify patterns and trends in real-time, allowing for more accurate predictions and timely decision-making. They also facilitate backtesting strategies against historical data, improving the likelihood of profitability. Additionally, algorithms can operate continuously without fatigue, capitalizing on market opportunities 24/7.

What types of algorithms are commonly used in day trading?

Common algorithms used in day trading include:

1. Mean Reversion Algorithms: These assume that asset prices will return to their historical average.

2. Momentum Algorithms: They capitalize on existing trends, buying securities that are rising and selling those that are falling.

3. Arbitrage Algorithms: These exploit price discrepancies between different markets or instruments.

4. Market Making Algorithms: They provide liquidity by placing buy and sell orders to profit from the bid-ask spread.

5. Sentiment Analysis Algorithms: These analyze social media and news sentiment to predict price movements.

6. Machine Learning Algorithms: These adapt to new data patterns to enhance decision-making.

Each type aims to maximize profits while managing risk in the fast-paced environment of day trading.

How is machine learning transforming algorithmic trading?

Machine learning is transforming algorithmic trading by enhancing predictive analytics, optimizing trading strategies, and improving risk management. It analyzes vast datasets to identify patterns and trends that traditional methods might miss. Machine learning algorithms adapt in real-time, allowing traders to adjust strategies based on market conditions. This leads to faster decision-making and more efficient trades. As a result, traders can capitalize on micro-movements in the market, increasing profitability and reducing losses.

What role does big data play in algorithmic day trading?

Big data enhances algorithmic day trading by providing vast amounts of real-time market data, historical trends, and social sentiment analysis. Traders use this data to develop predictive models that identify opportunities, optimize strategies, and manage risks. High-frequency trading algorithms leverage big data for rapid decision-making, executing trades in milliseconds based on market fluctuations. Additionally, big data analytics helps in backtesting strategies, improving accuracy and performance. Overall, it allows traders to make informed, data-driven decisions that can increase profitability.

How can traders develop their own algorithmic strategies?

Traders can develop their own algorithmic strategies by following these steps:

1. Define Objectives: Identify goals, such as risk tolerance, profit targets, and trading frequency.

2. Research: Study market trends, historical data, and existing strategies to understand what works.

3. Choose a Programming Language: Select a language like Python or R for coding the algorithm.

4. Data Acquisition: Gather relevant market data from APIs or data providers for analysis.

5. Strategy Development: Create a trading strategy based on technical indicators, price action, or statistical methods.

6. Backtesting: Test the strategy against historical data to evaluate performance and tweak parameters.

7. Optimization: Refine the algorithm to enhance performance while avoiding overfitting.

8. Implementation: Deploy the algorithm on a trading platform, ensuring it complies with regulations.

9. Monitoring: Continuously track performance and make adjustments based on changing market conditions.

By following these steps, traders can effectively create and implement their own algorithmic strategies for day trading.

What are the risks associated with algorithmic trading?

Algorithmic trading risks include market volatility, technical failures, data errors, and liquidity issues. Algorithms can react to market changes faster than humans, potentially leading to significant losses. There's also the risk of over-optimization, where models perform well on historical data but fail in live trading. Regulatory changes can impact strategies, and reliance on technology increases vulnerability to cyber attacks. Finally, lack of human oversight can lead to unintended consequences in trading decisions.

How can backtesting improve algorithmic strategies?

Backtesting improves algorithmic strategies by allowing traders to evaluate how their strategies would have performed using historical data. This process identifies strengths and weaknesses, optimizes parameters, and reduces the risk of losses in real trading. By simulating trades, traders can refine their algorithms, ensuring they are robust and adaptable to market conditions. Ultimately, effective backtesting increases confidence and decision-making speed in day trading.

What tools and software are best for algorithmic day trading?

The best tools and software for algorithmic day trading include:

1. MetaTrader 4/5: Popular for forex trading, it supports automated trading through Expert Advisors.

2. TradeStation: Offers robust backtesting capabilities and a powerful scripting language for custom strategies.

3. NinjaTrader: Ideal for futures and forex, it provides advanced charting and strategy development tools.

4. QuantConnect: A cloud-based platform that supports multiple asset classes and allows for C# and Python coding.

5. Interactive Brokers API: Enables custom algorithm development and direct market access.

6. TradingView: Excellent for charting and sharing strategies, with a scripting language called Pine Script.

7. Amibroker: Known for its speed and flexibility in backtesting and real-time trading.

These tools help traders create, test, and implement algorithmic strategies effectively.

Learn about What Are the Best AI Tools for Day Trading?

How do regulations affect algorithmic trading practices?

Regulations shape algorithmic trading by imposing rules on transparency, reporting, and market manipulation. They require firms to maintain robust compliance systems, leading to increased operational costs. Restrictions on high-frequency trading can limit speed and volume, while rules on order types affect strategy design. Overall, regulatory changes can either constrain or enhance algorithmic strategies, impacting liquidity and market efficiency.

What is the future of AI in algorithmic trading?

The future of AI in algorithmic trading is set to enhance predictive analytics, enabling more accurate market forecasts. Machine learning models will evolve, learning from vast datasets to identify patterns and execute trades faster than humans. AI will also improve risk management by assessing market volatility in real-time, allowing traders to adjust strategies dynamically. Additionally, natural language processing will analyze news and sentiment, providing insights that impact market movements. Overall, AI will drive more efficient, data-driven decision-making in day trading, pushing the boundaries of current algorithmic strategies.

How do market volatility and liquidity impact algorithmic strategies?

Market volatility affects algorithmic strategies by increasing the potential for rapid price movements, which can lead to higher profits or losses. High volatility can trigger algorithms to execute trades more frequently, adjusting to changing market conditions. On the other hand, liquidity determines how easily assets can be bought or sold without significantly affecting their price. Low liquidity can lead to slippage, causing algorithms to execute trades at unfavorable prices. Therefore, in day trading, algorithms must adapt to both volatility and liquidity to optimize performance and manage risk effectively.

What are the ethical considerations in algorithmic trading?

The ethical considerations in algorithmic trading include market manipulation, transparency, fairness, and the impact on market stability. Traders must avoid practices like spoofing or front-running, which distort market prices. Transparency is crucial; firms should disclose how algorithms operate to ensure fair play. Additionally, the potential for algorithms to exacerbate market volatility raises concerns about systemic risk. Ethical algorithmic trading should prioritize responsible data usage and avoid exploiting information asymmetries. Balancing profit motives with market integrity is essential for the future of algorithmic strategies in day trading.

How can traders adapt to changes in algorithmic trading technology?

Traders can adapt to changes in algorithmic trading technology by continuously updating their knowledge and skills. Engage in ongoing education through courses and webinars focused on the latest algorithms and trading software. Utilize backtesting to refine strategies and assess performance with new technologies. Network with other traders to share insights on successful adaptations. Monitor market trends and adjust strategies to leverage advancements like machine learning and AI. Finally, stay flexible and ready to pivot when new tools emerge.

What are successful case studies of algorithmic trading?

One successful case study in algorithmic trading is Renaissance Technologies' Medallion Fund, which has achieved annual returns of over 66% before fees. Another example is Two Sigma, known for using machine learning to develop predictive models that enhance trading strategies. Citadel Securities also exemplifies success, leveraging high-frequency trading algorithms to capitalize on market inefficiencies. Lastly, the development of the QuantConnect platform showcases how retail traders can implement algorithmic strategies, with many users reporting significant profits through systematic trading.

Conclusion about The Future of Algorithmic Strategies in Day Trading

In conclusion, the future of algorithmic strategies in day trading is promising, driven by advancements in machine learning, big data, and AI technologies. Traders can leverage these tools to enhance efficiency and decision-making while remaining aware of the associated risks and ethical considerations. To navigate this evolving landscape successfully, it's crucial for traders to continually adapt their strategies and stay informed about regulatory changes. Engaging with resources like DayTradingBusiness can provide the insights and guidance needed to thrive in this dynamic environment.

Learn about How to Optimize Algorithmic Strategies for Day Trading