Did you know that the average day trader spends more time analyzing risks than actually trading? In the fast-paced world of day trading, effective risk analysis is crucial for success. This article covers the key principles of risk analysis, how to identify specific risks, and the essential tools you need to mitigate them. You'll learn how to assess your risk tolerance, implement stop-loss orders, and the importance of position sizing. We’ll also discuss strategies to minimize losses, analyze market volatility, and common pitfalls to avoid. Plus, discover how historical data and a solid trading plan can enhance your risk management. With insights into psychological factors and economic indicators, this guide offers best practices for continuous risk assessment. Let DayTradingBusiness help you navigate these complexities and elevate your trading game.

What are the key principles of risk analysis in day trading?

The key principles of risk analysis in day trading include:

1. Position Sizing: Determine how much capital to risk on each trade, typically 1-2% of your total account balance.

2. Stop-Loss Orders: Set predetermined exit points to limit losses on losing trades.

3. Risk-Reward Ratio: Aim for a favorable ratio, such as 1:2 or 1:3, ensuring potential profits outweigh risks.

4. Market Analysis: Use technical and fundamental analysis to assess market conditions and identify potential risks.

5. Diversification: Spread investments across different assets to reduce exposure to any single trade.

6. Continuous Monitoring: Regularly review trades and market conditions to adjust strategies and manage risks effectively.

These principles help mitigate losses and enhance profitability in day trading.

How can I identify risks specific to day trading?

To identify risks specific to day trading, start by assessing market volatility. Monitor price swings and trading volume, as high volatility can lead to rapid losses. Next, evaluate your trading strategy—ensure it includes stop-loss orders to limit potential losses. Analyze your emotional responses; fear and greed can significantly impact decision-making. Additionally, consider systemic risks like market news and economic indicators that can cause sudden price changes. Lastly, keep track of your trading performance to identify patterns of risk exposure over time.

What tools are essential for effective risk analysis in day trading?

Essential tools for effective risk analysis in day trading include:

1. Risk Management Software: Helps track potential losses and set stop-loss orders.

2. Charting Platforms: Analyze price movements and identify trends with tools like TradingView or Thinkorswim.

3. Technical Indicators: Use indicators like RSI, MACD, and Bollinger Bands to assess market conditions.

4. Economic Calendars: Stay updated on economic events that could impact market volatility.

5. Position Sizing Calculators: Determine the optimal trade size based on risk tolerance and account balance.

6. Backtesting Tools: Test strategies against historical data to evaluate performance and risk.

Utilizing these tools can enhance your risk analysis and improve trading outcomes.

How do I assess my risk tolerance as a day trader?

To assess your risk tolerance as a day trader, start by evaluating your financial situation. Determine how much capital you can afford to lose without impacting your lifestyle. Next, consider your emotional response to risk; reflect on how you handle losses and volatility.

Use a risk-reward ratio to gauge your comfort level with potential trades—aim for a ratio that aligns with your financial goals. Also, practice with a demo account to test strategies without real stakes. Finally, set clear limits on daily losses and adhere to them, adjusting as you gain experience.

What strategies can minimize losses in day trading?

To minimize losses in day trading, implement these strategies:

1. Set Stop-Loss Orders: Automatically limit losses by placing stop-loss orders to exit trades at predetermined levels.

2. Use Position Sizing: Determine the amount to invest based on your risk tolerance, ensuring no single trade can significantly impact your capital.

3. Diversify Trades: Spread your investments across different assets to reduce risk exposure.

4. Develop a Trading Plan: clear entry and exit points, along with criteria for evaluating trades to maintain discipline.

5. Monitor Market News: Stay updated on economic indicators and news that can affect market volatility and prices.

6. Practice Risk-Reward Ratio: Aim for trades with favorable risk-reward ratios, typically at least 1:2, to enhance potential gains.

7. Review and Adapt: Regularly analyze past trades to identify mistakes and adjust strategies accordingly.

8. Limit Trading Frequency: Avoid overtrading by focusing on high-probability setups, which can reduce transaction costs and emotional stress.

By employing these strategies, you can effectively minimize losses and enhance your day trading success.

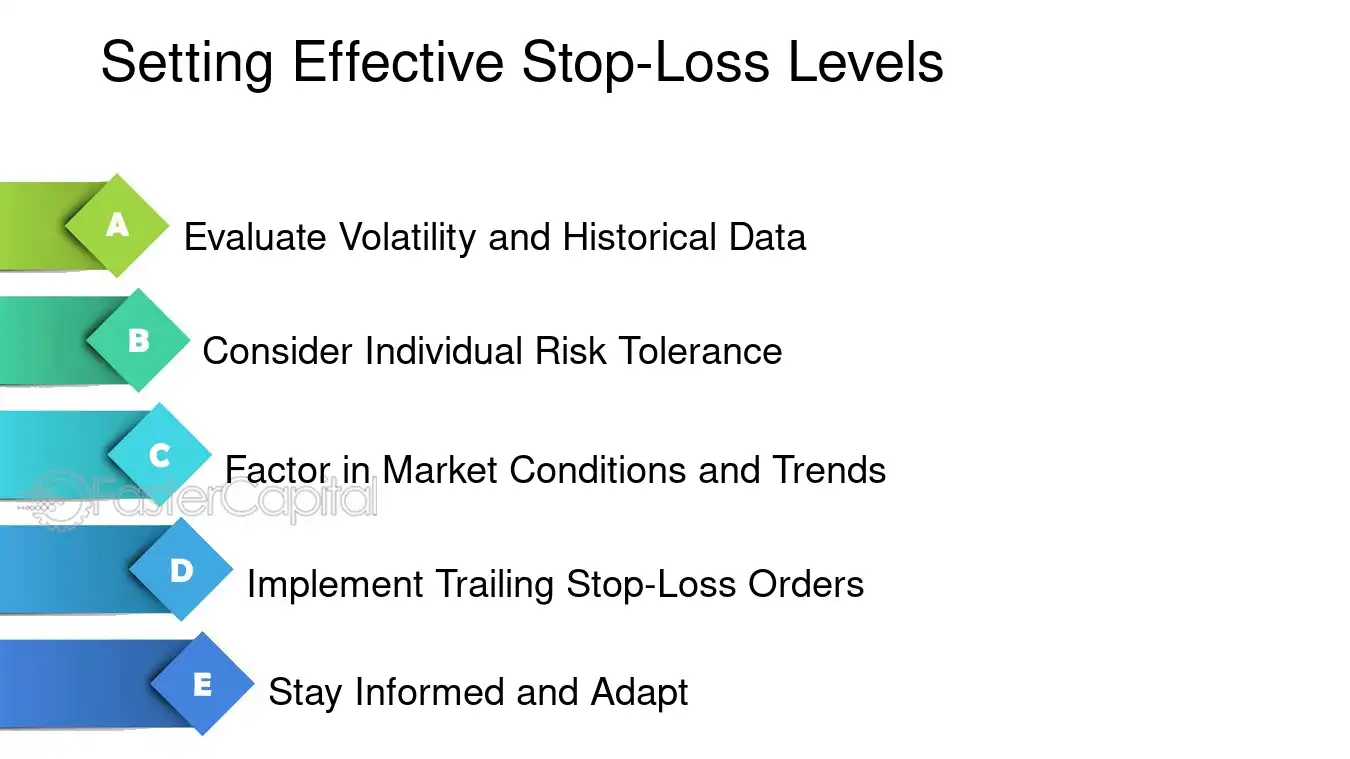

How can I implement stop-loss orders effectively?

To implement stop-loss orders effectively in day trading, follow these strategies:

1. Determine Risk Tolerance: Decide how much of your capital you're willing to risk on a trade. This often ranges from 1% to 3%.

2. Set Stop-Loss Levels: Place stop-loss orders based on technical analysis, such as below support levels or recent lows. Use percentage-based stops (e.g., 2% below entry) for volatility.

3. Adjust for Volatility: In volatile markets, consider using wider stop-loss levels to avoid getting stopped out prematurely.

4. Use Trailing Stops: Implement trailing stops to lock in profits while allowing for upward movement. This adjusts your stop-loss as the price increases.

5. Review and Adapt: Regularly evaluate your stop-loss strategies based on market conditions and your performance. Adjust your approach as needed.

6. Stay Disciplined: Stick to your stop-loss orders to manage risk effectively. Avoid emotional decisions that can lead to increased losses.

By integrating these techniques, you can enhance your risk management and protect your capital in day trading.

What role does position sizing play in risk management?

Position sizing determines how much capital to allocate to each trade, directly impacting risk management in day trading. By adjusting position sizes based on account balance and risk tolerance, traders can limit potential losses while maximizing profit opportunities. Effective position sizing helps ensure that no single trade can significantly damage the trading account, allowing for better emotional control and decision-making. For example, risking only 1-2% of your capital on each trade can prevent large drawdowns, keeping your trading strategy viable over the long term.

How can I analyze market volatility for risk assessment?

To analyze market volatility for risk assessment in day trading, use the following strategies:

1. Volatility Indicators: Utilize indicators like the Average True Range (ATR) and Bollinger Bands to measure price fluctuations.

2. Historical Data: Review historical price movements and calculate standard deviations to understand past volatility patterns.

3. News Impact: Monitor economic news and events that may cause sudden market shifts, affecting volatility.

4. Volume Analysis: Analyze trading volume alongside price movements; high volume often correlates with increased volatility.

5. Options Pricing: Check the implied volatility from options pricing; higher implied volatility suggests greater expected price swings.

6. Market Sentiment: Gauge market sentiment through tools like the Fear & Greed Index to anticipate potential volatility spikes.

Implement these methods regularly to enhance your risk assessment and make informed decisions in day trading.

What are common mistakes in risk analysis for day trading?

Common mistakes in risk analysis for day trading include:

1. Ignoring Stop-Loss Orders: Failing to set or adhere to stop-loss levels can lead to significant losses.

2. Overleveraging: Using too much leverage increases risk and can quickly wipe out capital.

3. Underestimating Market Volatility: Not accounting for volatility can result in unexpected price swings and losses.

4. Lack of Diversification: Concentrating on a single asset can amplify risk; diversifying helps mitigate it.

5. Emotional Trading: Allowing emotions to dictate decisions can lead to poor risk management.

6. Neglecting Risk-Reward Ratios: Failing to evaluate risk-reward ratios can lead to unprofitable trades.

7. Overtrading: Taking too many trades increases exposure and can dilute focus and strategy.

8. Ignoring Market Conditions: Not considering overall market trends or news can skew risk assessments.

Avoid these pitfalls to enhance your day trading risk analysis.

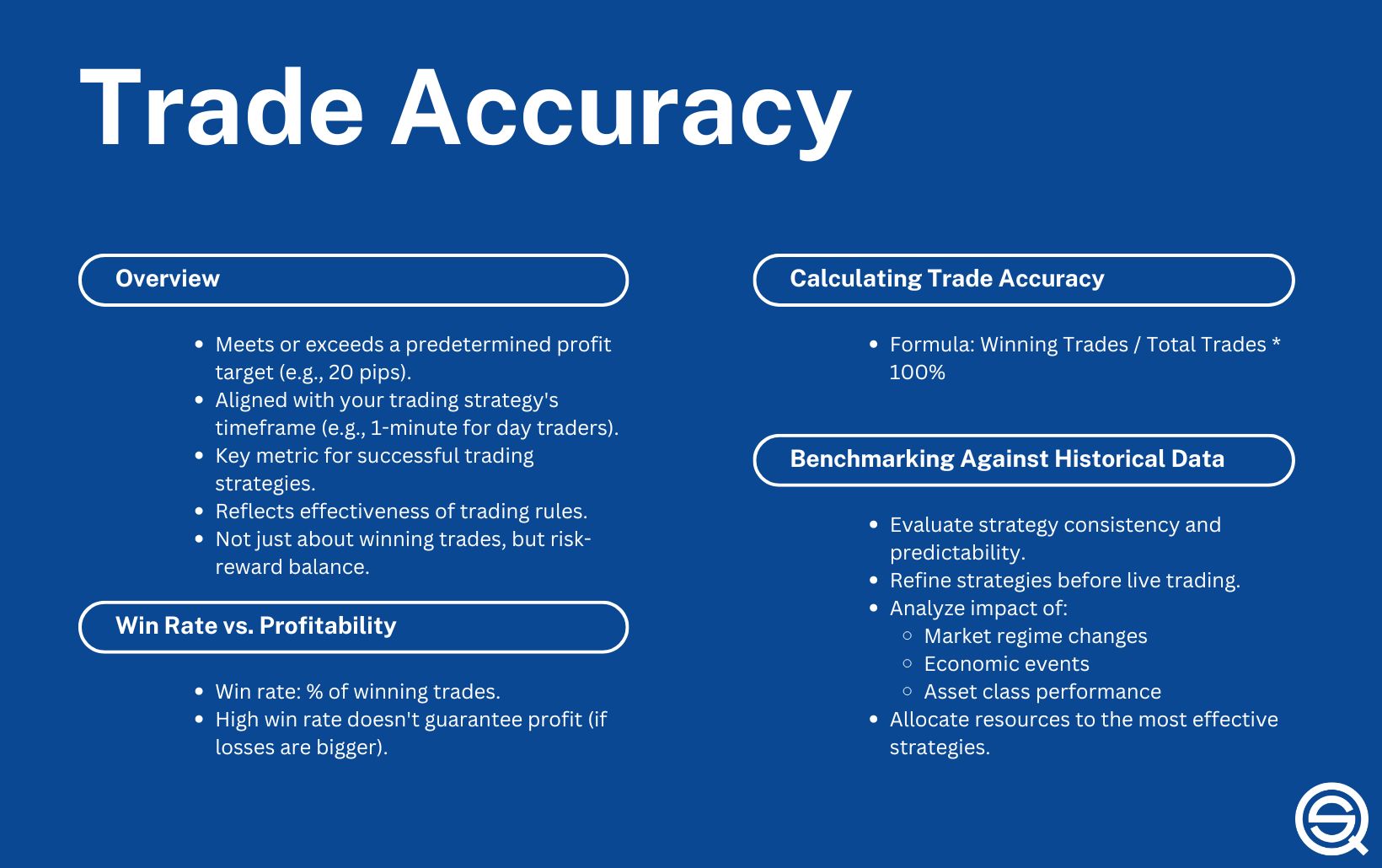

How do I use historical data in risk analysis?

Use historical data in risk analysis by identifying patterns in price movements, volatility, and trading volume. Analyze past performance of assets to forecast potential future risks. Establish risk metrics, such as Value at Risk (VaR), based on historical price fluctuations. Implement backtesting strategies to evaluate how your trading plan would have performed under different market conditions. Use historical data to set stop-loss and take-profit levels, ensuring they reflect realistic price movements. Regularly update your analysis with new data to adapt to changing market conditions.

Learn about How to Use Historical Data in Day Trading Analysis

What is the importance of a trading plan in risk management?

A trading plan is crucial for risk management because it sets clear guidelines for entry and exit points, position sizes, and loss limits. This structure helps traders avoid emotional decisions, ensuring they stick to predefined strategies. By defining risk tolerance and establishing rules, a trading plan minimizes potential losses and enhances decision-making. It also promotes consistency, allowing traders to analyze their performance objectively and adjust strategies as needed.

How can I evaluate my trading performance against risks?

To evaluate your trading performance against risks, start by calculating your risk-reward ratio for each trade. Analyze your win rate—how often you profit compared to your losses. Track your drawdowns to see how much you lose during losing streaks. Utilize performance metrics like the Sharpe ratio to assess returns relative to risk. Review your trading journal for patterns in decisions and outcomes. Adjust your strategies based on this analysis to improve future performance and manage risks effectively.

What psychological factors should I consider in risk analysis?

Consider these psychological factors in risk analysis for day trading:

1. Emotional Biases: Recognize how fear and greed can skew decision-making. Fear of loss may prevent you from executing trades, while greed can lead to overtrading.

2. Loss Aversion: Understand that traders often prefer avoiding losses over acquiring equivalent gains. This can affect your risk tolerance and lead to holding losing positions too long.

3. Overconfidence: Be aware of the tendency to overestimate your knowledge or abilities. This can lead to taking on excessive risk without proper analysis.

4. Anchoring: Avoid fixating on previous prices or trades. This can distort your perception of current market conditions and influence your trading decisions.

5. Herd Behavior: Watch for the tendency to follow the crowd. This can result in poor decision-making, especially in volatile markets.

6. Confirmation Bias: Stay alert to seeking out information that supports your pre-existing beliefs. This can cloud judgment and lead to overlooking critical data.

7. Mental Fatigue: Recognize that prolonged trading can lead to cognitive overload. This may impair your ability to analyze risks effectively.

Incorporating these factors into your risk analysis can help you make more informed, rational trading decisions.

How do economic indicators affect risk in day trading?

Economic indicators affect risk in day trading by influencing market volatility and investor sentiment. Key indicators like GDP growth, unemployment rates, and inflation reports can lead to rapid price movements. Traders often react to these releases, causing sudden spikes or drops in asset prices.

For effective risk analysis, stay updated on scheduled economic reports and adjust your trading strategies accordingly. Use stop-loss orders to mitigate potential losses when indicators signal market shifts. Additionally, monitor correlation between indicators and specific assets to identify how they might impact your trades.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

What are the best practices for continuous risk assessment?

1. Regular Monitoring: Continuously track market trends and news that could impact your trades.

2. Set Risk Tolerance: Define your risk tolerance level for each trade and stick to it.

3. Use Stop-Loss Orders: Implement stop-loss orders to automatically limit losses on trades.

4. Diversify Investments: Spread your capital across different assets to mitigate risk.

5. Review and Adjust: Frequently review your trading strategy and adjust based on performance and changing market conditions.

6. Keep a Trading Journal: Document trades, decisions, and outcomes to identify patterns and improve future risk assessments.

7. Stay Educated: Continuously learn about new risk management techniques and market dynamics.

8. Utilize Risk Assessment Tools: Employ trading software that offers risk analysis features to better visualize potential risks.

How can I stay updated on market conditions for better risk analysis?

To stay updated on market conditions for better risk analysis in day trading, follow these strategies:

1. Use Real-Time Market News: Subscribe to financial news platforms like Bloomberg or Reuters for instant updates.

2. Follow Economic Calendars: Track key economic events and reports that impact market volatility.

3. Leverage Social Media: Follow traders and analysts on Twitter or LinkedIn for insights and trends.

4. Utilize Trading Platforms: Many trading platforms offer tools for market analysis and real-time data feeds.

5. Join Trading Communities: Participate in forums or chat groups where traders share market updates and strategies.

6. Analyze Technical Indicators: Regularly check charts and indicators for price patterns and signals.

7. Set Alerts: Use alerts on your trading platform for price movements or news that may affect your trades.

Implementing these strategies will enhance your awareness of market conditions and improve your risk analysis in day trading.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Conclusion about Strategies for Effective Risk Analysis in Day Trading

Incorporating effective risk analysis strategies is essential for successful day trading. By understanding key principles, identifying specific risks, and utilizing essential tools, traders can enhance their decision-making process. Assessing risk tolerance, implementing stop-loss orders, and practicing proper position sizing are crucial for minimizing losses. Additionally, analyzing market volatility and leveraging historical data can improve risk assessment outcomes. Psychological factors and economic indicators also play significant roles in shaping risk analysis. For comprehensive support and insights, DayTradingBusiness offers valuable resources to navigate the complexities of risk management in day trading.

Learn about Strategies for Effective Order Flow Analysis in Day Trading