Did you know that over 90% of day traders lose money, often due to a lack of solid analysis? In the fast-paced world of day trading, effective fundamental analysis is crucial for making informed decisions. This article dives into the best tools and strategies for conducting fundamental analysis, highlighting the importance of financial statements, earnings reports, and analyst ratings. We’ll explore how news and economic indicators can sway stock prices and the significance of evaluating management and insider trading. Plus, discover the software and websites that can enhance your analysis. With insights on common pitfalls and how to utilize historical data, DayTradingBusiness equips you with the knowledge to navigate the complex landscape of day trading confidently.

What are the best tools for fundamental analysis in day trading?

The best tools for fundamental analysis in day trading include:

1. Financial News Websites: Bloomberg, CNBC, and Reuters provide real-time news that impacts stock prices.

2. Earnings Reports: Access platforms like Yahoo Finance or MarketWatch for timely earnings releases and analysis.

3. Stock Screeners: Use tools like Finviz or StockCharts to filter stocks based on key fundamental metrics.

4. Economic Calendars: Calendars from Investing.com or Forex Factory help track important economic events and releases.

5. Analyst Ratings: Platforms like TipRanks or MarketBeat offer insights on analyst recommendations and price targets.

6. Social Media: Twitter and StockTwits can provide immediate sentiment and reactions to news events.

These tools help you make informed decisions based on fundamental data while trading.

How can I use financial statements for day trading?

You can use financial statements for day trading by focusing on key metrics that impact stock price movements. Look at earnings reports, revenue growth, profit margins, and guidance updates. Analyze the balance sheet for liquidity and debt levels, and review cash flow statements for operational health. Pay attention to trends in these metrics, as they can signal potential price shifts. Use this information to make informed trades based on anticipated market reactions. Regularly check for news and market sentiment that may influence these financial figures.

What role does earnings reports play in day trading?

Earnings reports are crucial for day trading as they provide insights into a company's financial health and performance. Traders use these reports to identify potential price movements, capitalize on volatility, and make informed buy or sell decisions. Positive earnings surprises often lead to upward price momentum, while negative results can trigger sharp declines. By analyzing key metrics like earnings per share (EPS) and revenue, day traders can spot trends and adjust their strategies quickly.

How do analyst ratings influence day trading decisions?

Analyst ratings can significantly influence day trading decisions by providing insights into stock sentiment and potential price movements. Positive ratings may encourage traders to buy, anticipating upward momentum, while negative ratings can trigger sell-offs. Traders often monitor these ratings closely, using them as indicators for entry and exit points. Additionally, shifts in analyst ratings can lead to increased volatility, offering day traders opportunities to capitalize on quick price changes.

What are key ratios to consider for fundamental analysis?

Key ratios for fundamental analysis in day trading include:

1. Price-to-Earnings (P/E) Ratio: Measures a company's current share price relative to its earnings per share, indicating valuation.

2. Price-to-Book (P/B) Ratio: Compares a company's market value to its book value, helping assess if a stock is undervalued or overvalued.

3. Debt-to-Equity (D/E) Ratio: Evaluates a company's financial leverage by comparing total liabilities to shareholders' equity.

4. Current Ratio: Assesses liquidity by comparing current assets to current liabilities, indicating short-term financial health.

5. Return on Equity (ROE): Measures profitability by showing how much profit a company generates with shareholders' equity.

6. Dividend Yield: Indicates how much a company pays in dividends relative to its stock price, useful for income-focused investors.

7. Operating Margin: Reveals the percentage of revenue that remains after covering operating expenses, indicating operational efficiency.

These ratios provide essential insights into a company's financial health and help inform trading decisions.

How can news impact stock prices in day trading?

News impacts stock prices in day trading by influencing investor sentiment and market perception. Positive news can drive stock prices up, while negative news often causes declines. Traders use tools like news aggregators, financial news websites, and real-time alerts to stay informed. Earnings reports, economic indicators, and geopolitical events are key news types that can lead to rapid price movements. Understanding how to interpret this information helps traders make quick, informed decisions.

What is the importance of economic indicators in day trading?

Economic indicators are crucial in day trading because they provide insights into market trends and potential price movements. Key indicators like GDP, unemployment rates, and inflation data help traders gauge the economy's health. For example, a strong jobs report can boost market confidence, leading to rising stock prices. Traders use these indicators to make informed decisions, manage risk, and identify entry and exit points. Understanding economic indicators enhances a trader’s ability to anticipate market reactions and capitalize on short-term opportunities.

How do I evaluate a company's management for day trading?

Evaluate a company's management for day trading by analyzing their track record, communication style, and decision-making history. Look for their experience in the industry, past performance during market fluctuations, and how they handle crises. Check earnings calls and press releases for transparency and clarity in communication. Review their strategic vision and whether it aligns with market trends. Use tools like news aggregators to track management-related news and social media sentiment for real-time insights.

What software can assist with real-time fundamental analysis?

Software that can assist with real-time fundamental analysis in day trading includes:

1. Bloomberg Terminal – Provides comprehensive financial data, news, and analytics.

2. FactSet – Offers in-depth financial data, analytics, and reporting tools.

3. Morningstar Direct – Focuses on investment research and analytics.

4. TradingView – Integrates real-time data with fundamental metrics for stocks.

5. Yahoo Finance – Provides news, quotes, and basic financials in real-time.

6. Zacks Investment Research – Offers stock research, analysis, and ratings.

These tools help traders access critical financial metrics and news to make informed trading decisions.

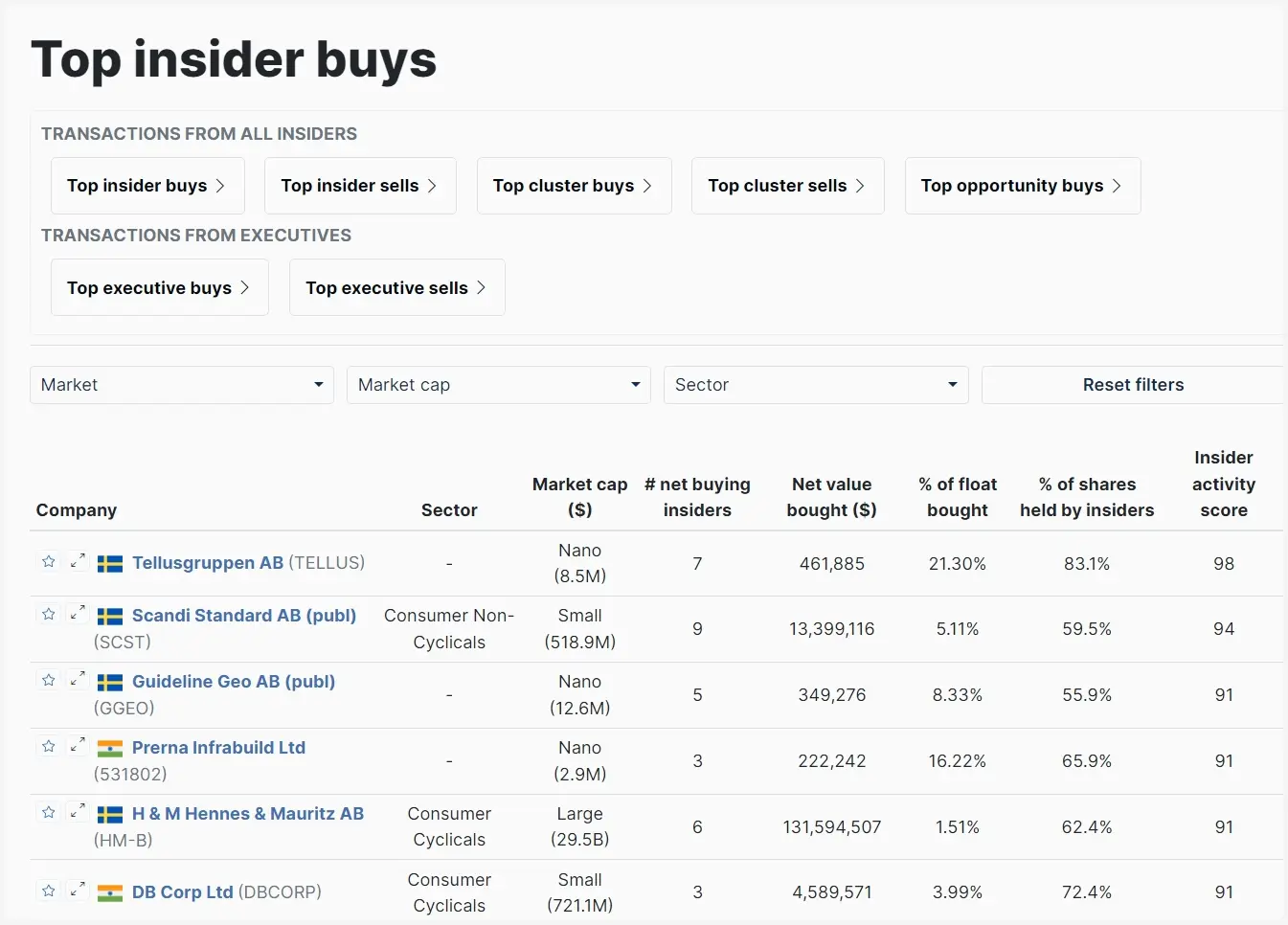

How can I track insider trading activities for day trading?

To track insider trading activities for day trading, use resources like the SEC's EDGAR database to find Form 4 filings. Websites like OpenInsider and Insider Monkey aggregate insider trading data, allowing you to filter by stock or trading volume. Set alerts on these platforms to get real-time updates on significant trades. Additionally, consider using brokerage tools that include insider trading information as part of their market research features.

Learn about How Regulators Detect Insider Trading in Day Markets

What websites provide reliable fundamental analysis data?

Websites that provide reliable fundamental analysis data include:

1. Yahoo Finance – Offers comprehensive financial data, news, and analysis tools.

2. Morningstar – Known for in-depth analysis and ratings on stocks and mutual funds.

3. Seeking Alpha – Features articles and insights from investors and analysts.

4. Finviz – Provides stock screeners with fundamental metrics and visual data.

5. Investopedia – Offers educational resources alongside fundamental data.

6. MacroTrends – Focuses on historical financial data and trends for stocks.

7. Zacks Investment Research – Known for earnings estimates and stock analysis.

These sites are valuable for gathering essential data for effective fundamental analysis in day trading.

How do I interpret sector performance for day trading?

To interpret sector performance for day trading, focus on these key tools:

1. Sector ETFs: Track sector-specific ETFs to gauge overall market sentiment and movement.

2. News Analysis: Monitor financial news for sector-specific developments that impact stocks.

3. Economic Indicators: Pay attention to reports like employment data and consumer spending, which can affect sector performance.

4. Correlation Analysis: Analyze how sectors move in relation to each other to identify trends and divergence.

5. Volume and Price Action: Look for unusual volume and price movements in key stocks within a sector to spot potential opportunities.

Use these tools to make informed decisions and capitalize on sector trends for day trading.

What are the common pitfalls in fundamental analysis for day traders?

Common pitfalls in fundamental analysis for day traders include over-relying on news releases without context, failing to consider market sentiment, ignoring industry trends, and not adapting to rapid changes in data. Day traders often misinterpret earnings reports or economic indicators, leading to impulsive decisions. Additionally, neglecting to analyze competitor performance can result in missed opportunities. Finally, underestimating the impact of macroeconomic factors can skew risk assessments.

Learn about What Are the Common Legal Pitfalls for Day Traders?

How can I use historical data for effective day trading?

Use historical data to identify trends and patterns in price movements. Analyze past performance metrics, such as volume and volatility, to predict future price actions. Tools like moving averages and candlestick charts can help visualize these trends. Incorporate economic indicators and earnings reports to assess the fundamentals behind stocks. Utilize backtesting software to simulate trades based on historical data, refining your strategies. Stay updated with news that impacts the market to connect historical patterns with current events. This approach enhances your decision-making and increases your chances of success in day trading.

Learn about How to Use Historical Data in Day Trading Analysis

How do I set up alerts for fundamental news in day trading?

To set up alerts for fundamental news in day trading, follow these steps:

1. Choose a Trading Platform: Use platforms like ThinkorSwim, TradingView, or MetaTrader that offer news alert features.

2. Sign Up for News Services: Subscribe to financial news services like Bloomberg, Reuters, or MarketWatch that provide real-time updates.

3. Set Keywords: Identify relevant keywords related to your trading strategy or specific stocks.

4. Use Alert Features: In your trading platform or news service, set alerts for your chosen keywords to get notifications via email or SMS.

5. Follow Economic Calendars: Keep an eye on economic calendars like Forex Factory or Investing.com for scheduled news releases.

6. Utilize Social Media: Follow financial news accounts on Twitter or use tools like StockTwits for instant updates.

This setup ensures you’re promptly informed about crucial fundamental news affecting your trades.

Learn about How to Set Up an AI Bot for Day Trading?

What is the impact of macroeconomic trends on day trading?

Macroeconomic trends significantly impact day trading by influencing market volatility, liquidity, and investor sentiment. Key indicators like GDP growth, unemployment rates, and inflation can cause rapid price movements. For effective fundamental analysis, traders should monitor economic reports, central bank announcements, and geopolitical events. Tools like economic calendars, news feeds, and financial analysis platforms help traders stay informed and make quick decisions based on macroeconomic shifts. Understanding these trends allows day traders to anticipate market reactions and adjust their strategies accordingly.

Conclusion about Tools for Effective Fundamental Analysis in Day Trading

Incorporating effective fundamental analysis tools is essential for successful day trading. By leveraging financial statements, earnings reports, analyst ratings, and key ratios, traders can make informed decisions. Staying updated with news and economic indicators further enhances your strategy. Utilizing software for real-time analysis and tracking insider activities can provide a competitive edge. Avoid common pitfalls by analyzing sector performance and historical data, and set alerts for critical news to stay ahead. For those seeking expert guidance in mastering these tools, DayTradingBusiness offers invaluable resources and support.

Learn about Tips for Effective Chart Analysis in Day Trading

Sources:

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- Enhancing daily stock trading with a novel fuzzy indicator ...

- Opinion Paper: “So what if ChatGPT wrote it?” Multidisciplinary ...

- The Need for Efficient Investment: Fundamental Analysis and ...

- Analysis & Comparison of Stock Trading Strategies on Pakistan ...

- TradingAgents: Multi-Agents LLM Financial Trading Framework