Did you know that most people can’t even find their car keys, yet they confidently dive into day trading without a solid plan? In the world of day trading, fundamental analysis is crucial, but many traders stumble over common pitfalls that can cost them dearly. This article explores frequent mistakes, such as misinterpreting market sentiment and overreacting to short-term news, while also highlighting the importance of financial statements and economic indicators. Beginners will discover strategies to avoid these errors and the significance of risk management. With insights from DayTradingBusiness, you’ll learn how to enhance your trading skills and make informed decisions in a volatile market.

What are the most common mistakes in day trading fundamental analysis?

The most common mistakes in day trading fundamental analysis include:

1. Ignoring Economic Indicators: Traders often overlook key indicators like GDP, unemployment rates, and inflation, which can drastically affect stock prices.

2. Overreacting to News: Many traders react impulsively to news releases without considering the broader context, leading to poor decisions.

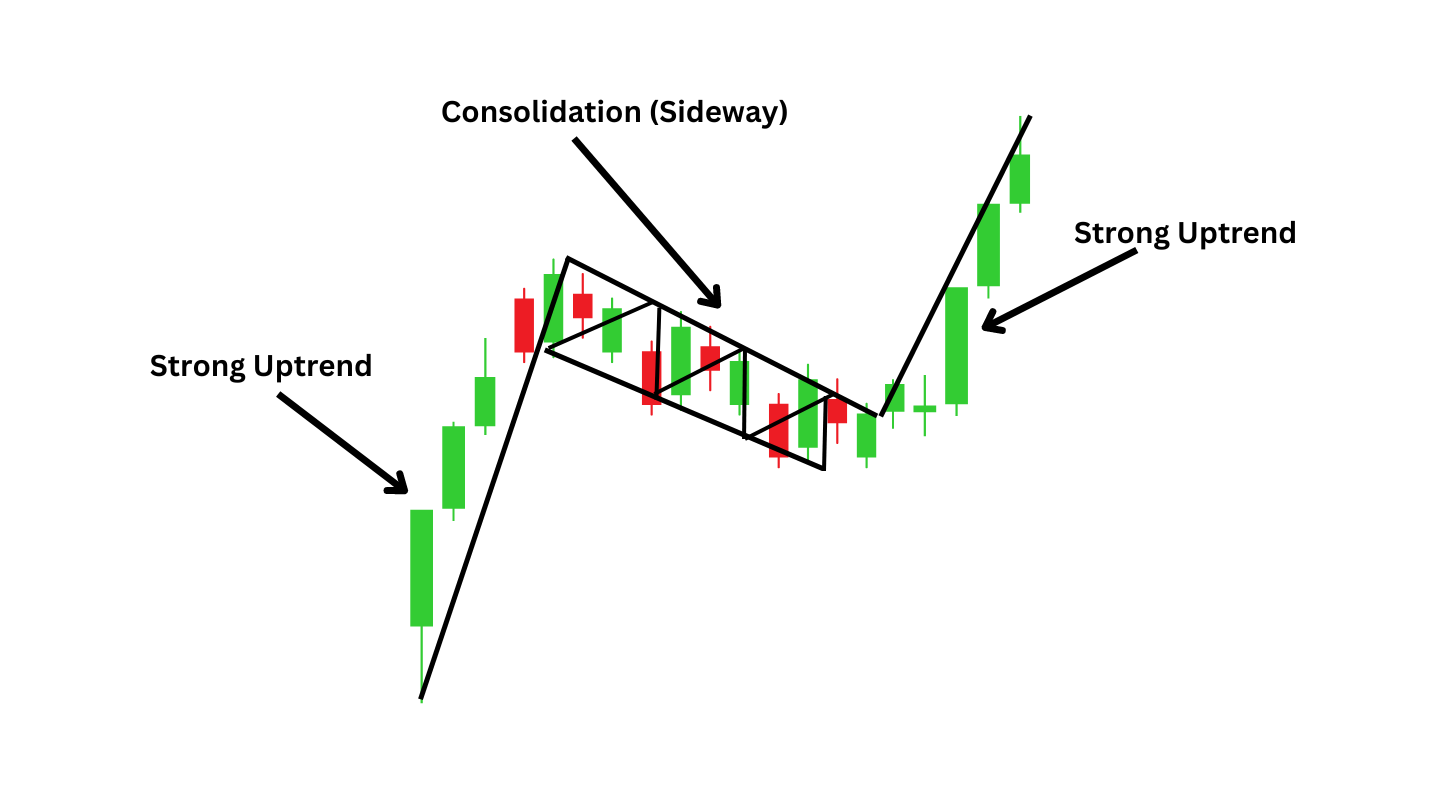

3. Focusing on Short-Term Data: Relying solely on short-term results can mislead traders; long-term trends provide a clearer picture.

4. Lack of Research: Failing to thoroughly research a company’s financial health can result in missed warning signs.

5. Neglecting Market Sentiment: Traders often ignore the impact of market sentiment and investor psychology, which can drive price movements.

6. Misunderstanding Valuation Metrics: Misinterpreting P/E ratios or other valuation metrics can lead to investing in overvalued stocks.

7. Poor Risk Management: Not setting stop-loss orders or position sizes can amplify losses during volatile market conditions.

Avoiding these pitfalls can improve decision-making and enhance trading success.

How can beginners avoid errors in fundamental analysis for day trading?

Beginners can avoid errors in fundamental analysis for day trading by focusing on a few key practices. First, stay updated on earnings reports and economic indicators relevant to your trades; this helps you understand market movements. Second, avoid overreacting to news; assess its long-term impact rather than just short-term fluctuations. Third, use reliable sources for data to avoid misinformation. Fourth, practice risk management; never invest more than you can afford to lose, and set stop-loss orders. Lastly, keep emotions in check; stick to your analysis and trading plan instead of making impulsive decisions based on market hype.

What role does news impact play in day trading fundamental analysis?

News impact plays a crucial role in day trading fundamental analysis by influencing stock prices and market sentiment. Traders often react to earnings reports, economic indicators, and geopolitical events, which can lead to volatility. A common mistake is failing to assess how news affects a stock's fundamentals, leading to impulsive decisions. Another error is ignoring the timing of news releases; trading right before or after significant news can increase risk. Understanding the news impact helps traders make informed, strategic decisions rather than emotional ones.

Why is it important to understand financial statements in day trading?

Understanding financial statements in day trading is crucial because they reveal a company's financial health, profitability, and growth potential. This knowledge helps traders make informed decisions about which stocks to buy or sell. Ignoring financial statements can lead to poor trades based on speculation rather than solid data. For instance, a company with strong earnings may see its stock rise, while one with mounting debt might face a decline. By analyzing these statements, traders can identify trends, avoid common pitfalls, and enhance their overall trading strategy.

How does ignoring economic indicators affect day trading outcomes?

Ignoring economic indicators can lead to poor day trading outcomes. Traders miss crucial information about market trends, volatility, and potential price movements. For example, ignoring a major jobs report might result in unexpected market shifts, catching a trader off guard. This oversight can result in larger losses or missed profit opportunities. Ultimately, staying informed about economic indicators helps traders make more informed decisions, enhancing their chances of success.

What are the pitfalls of overreacting to short-term news in trading?

Overreacting to short-term news in trading can lead to several pitfalls. First, it can cause impulsive decisions, resulting in poor entries and exits. Traders may buy or sell based on fleeting headlines rather than solid analysis, risking significant losses. Second, it often results in excessive volatility in a trader's portfolio, creating unnecessary stress and emotional trading. Third, this behavior can lead to missed opportunities, as traders focus on reacting to noise instead of long-term trends. Finally, overreacting can erode confidence, making it harder to stick to a well-thought-out strategy.

How can traders misinterpret market sentiment in fundamental analysis?

Traders can misinterpret market sentiment in fundamental analysis by overreacting to news events, misreading economic indicators, or failing to consider the broader context. For instance, they might see a positive earnings report and jump in, ignoring that the overall market trend is bearish. Additionally, traders often confuse speculation with actual sentiment, mistaking short-term price movements for long-term trends. Misunderstanding investor behavior and sentiment can lead to poor decision-making, such as buying high on hype or selling low in panic.

What mistakes do traders make when evaluating a company's fundamentals?

Traders often overlook key financial metrics, such as earnings per share (EPS) and price-to-earnings (P/E) ratios, leading to poor assessments. They may focus too heavily on recent performance without considering long-term trends or industry context. Ignoring the impact of economic indicators and news can skew evaluations. Some traders fail to analyze cash flow statements, which are crucial for understanding a company's liquidity. Additionally, they might misinterpret growth rates, confusing short-term spikes for sustainable trends. Over-reliance on a single metric, like revenue growth, can result in misleading conclusions. Lastly, neglecting to compare a company with its peers can lead to an incomplete analysis.

How can confirmation bias lead to errors in day trading analysis?

Confirmation bias can lead to errors in day trading analysis by causing traders to favor information that supports their existing beliefs while ignoring contradictory data. For example, if a trader believes a stock will rise, they may only focus on positive news about the company and overlook negative earnings reports or market trends. This selective attention can result in poor investment decisions, as the trader may underestimate risks and overestimate potential gains. Ultimately, confirmation bias can distort judgment and lead to significant losses in day trading.

What are the consequences of neglecting risk management in day trading?

Neglecting risk management in day trading can lead to significant financial losses, increased emotional stress, and a higher likelihood of impulsive decisions. Without proper risk controls, traders may over-leverage positions, causing rapid account depletion. They might also experience greater volatility in their trading results, leading to a lack of consistency. Ultimately, failing to manage risk can derail long-term trading success and result in substantial capital loss.

Learn about How can poor risk management lead to losses in day trading?

How does emotional decision-making impact fundamental analysis?

Emotional decision-making can skew fundamental analysis by leading traders to ignore data and overreact to news. For instance, fear might drive a trader to sell a stock after a negative earnings report, despite strong long-term fundamentals. Conversely, greed can cause over-optimism, resulting in poor investment choices based on hype rather than actual performance metrics. This emotional bias can distort risk assessment and lead to inconsistent trading strategies, ultimately affecting profitability. To mitigate this, traders should stick to their analysis framework and avoid letting emotions dictate their trades.

What are the benefits of using multiple data sources in day trading?

Using multiple data sources in day trading enhances decision-making by providing a broader perspective. It allows traders to cross-verify information, reducing reliance on a single source, which can be biased or inaccurate. Diverse data sources improve market analysis, helping identify trends, spot anomalies, and gauge sentiment effectively. Additionally, integrating news, social media, and technical indicators offers a comprehensive view, leading to better risk management and informed timing for trades. This multifaceted approach can significantly increase the chances of success in a volatile market.

Learn about What Are the Benefits of Using a Prop Firm for Day Trading?

How can traders misjudge a stock's value during market volatility?

Traders often misjudge a stock's value during market volatility by overreacting to short-term price changes, leading to impulsive decisions. They may neglect fundamental analysis, focusing instead on technical indicators or market sentiment. This can result in ignoring a company's intrinsic value and potential for growth. Emotional trading, driven by fear or greed, can cloud judgment and cause miscalculations. Additionally, traders might rely too heavily on news headlines without considering their long-term impact on the stock's fundamentals.

Why is it crucial to keep an eye on industry trends in trading?

Keeping an eye on industry trends in trading is crucial because it helps you identify potential market movements and shifts in investor sentiment. Staying updated allows you to make informed decisions, anticipate changes, and avoid common mistakes like holding onto losing positions or missing profitable opportunities. Understanding trends also aids in fundamental analysis, ensuring your strategies align with market dynamics and improving your overall trading performance.

How do mistakes in trade execution affect fundamental analysis results?

Mistakes in trade execution can distort the outcomes of fundamental analysis by leading to incorrect trade timing, impacting the price entry or exit points. For example, executing a trade too late might result in missing a stock's upward movement predicted by strong earnings reports. Additionally, high slippage or incorrect order types can cause traders to buy or sell at prices that don't reflect the underlying fundamentals, skewing profit assessments. These errors undermine the reliability of the analysis, making it difficult to gauge a stock's true value based on its fundamentals.

What strategies can help improve fundamental analysis in day trading?

To improve fundamental analysis in day trading, focus on these strategies:

1. Stay Updated: Regularly follow financial news and reports to track earnings, economic indicators, and industry trends that impact stock prices.

2. Use Key Metrics: Prioritize metrics like P/E ratio, EPS, and revenue growth to evaluate a stock's potential quickly.

3. Understand Market Sentiment: Analyze market sentiment through social media and news sentiment analysis to gauge trader emotions.

4. Set Clear Criteria: Develop specific criteria for selecting stocks based on fundamentals, ensuring consistency in your analysis.

5. Practice Risk Management: Incorporate stop-loss orders and position sizing to protect against unexpected market movements.

6. Review Past Trades: Regularly assess your trades to identify mistakes and refine your analysis process.

7. Utilize Technology: Leverage tools and software for real-time data analysis and alerts to stay ahead of market changes.

Implementing these strategies can enhance your fundamental analysis and improve your day trading outcomes.

Learn about How to Conduct Fundamental Analysis for Day Trading?

Conclusion about Common Mistakes in Day Trading Fundamental Analysis

In summary, avoiding common mistakes in day trading fundamental analysis is crucial for success. Traders should prioritize understanding financial statements, economic indicators, and market sentiment while maintaining a disciplined approach to risk management. By being aware of pitfalls like overreacting to short-term news and confirmation bias, traders can make more informed decisions. Leveraging multiple data sources and staying attuned to industry trends further enhances analysis accuracy. For aspiring traders, integrating these strategies with insights from DayTradingBusiness can significantly improve trading outcomes.

Learn about Common Mistakes in Day Trading Sentiment Analysis