Did you know that the first automated trading system was developed in the 1970s, long before most of us even knew what a computer was? Fast forward to today, and artificial intelligence (AI) and trading bots have revolutionized day trading, making it more efficient and accessible. In this article, we explore how AI enhances trading strategies, the best tools available, and the mechanics of trading bots. We also discuss the risks involved, data utilization, and optimization techniques. Whether you're a beginner or looking to refine your approach, DayTradingBusiness provides insights on setting up trading bots and avoiding common pitfalls. Join us as we delve into the future trends of AI in the day trading landscape.

How Can AI Improve Day Trading Strategies?

AI can improve day trading strategies by analyzing vast amounts of market data in real-time, identifying patterns, and executing trades based on predictive algorithms. It enhances decision-making through sentiment analysis, using news and social media to gauge market trends. Automated trading bots can execute trades faster than humans, capitalize on small price movements, and manage risk through advanced algorithms. Additionally, AI can optimize portfolios by continuously learning from market fluctuations, enabling adaptive strategies that evolve with changing conditions.

What Are the Best AI Tools for Day Traders?

The best AI tools for day traders include:

1. Trade Ideas: Offers real-time market data and AI-driven alerts to identify trading opportunities.

2. MetaTrader 4/5 with Expert Advisors: Allows traders to automate strategies using custom bots.

3. Kavout: Uses AI to provide stock rankings and insights based on multiple factors.

4. TrendSpider: Employs AI for automated technical analysis and trend detection.

5. QuantConnect: A platform for building and backtesting algorithmic trading strategies with AI capabilities.

6. Alpaca: Provides commission-free trading and supports algorithmic trading with an AI-friendly API.

These tools enhance decision-making, streamline trading processes, and improve overall efficiency for day traders.

How Do Trading Bots Work in Day Trading?

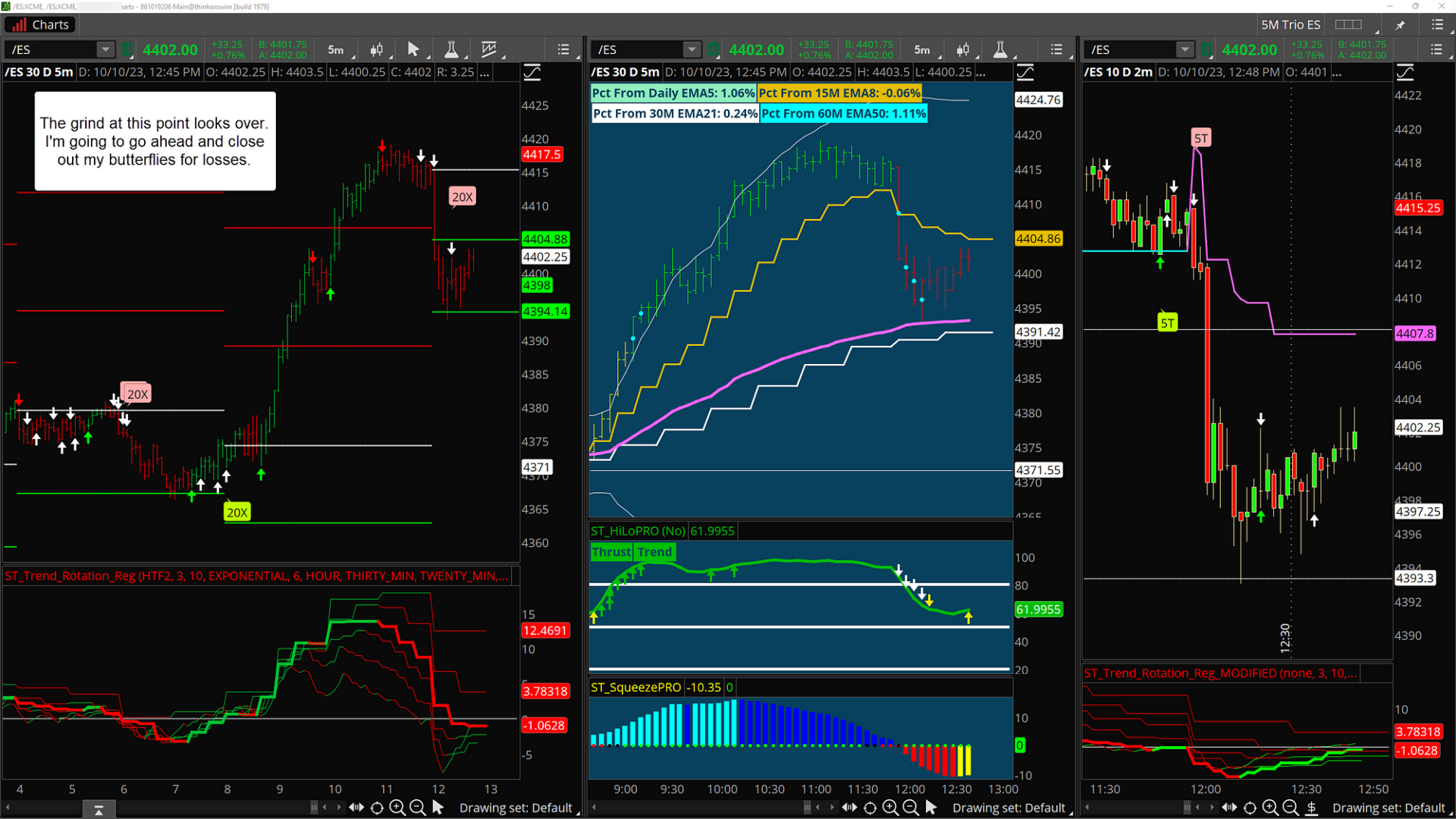

Trading bots in day trading operate by using algorithms to analyze market data and execute trades automatically. They can process vast amounts of information quickly, identifying patterns and trends that human traders might miss. Bots can be programmed for specific strategies, such as arbitrage, trend following, or market making. Once set up, they monitor the market continuously, making buy or sell decisions based on predefined criteria, often executing trades in milliseconds. This automation allows traders to capitalize on short-term price movements without the need for constant manual intervention.

Can AI Predict Stock Market Trends Effectively?

AI can predict stock market trends to some extent by analyzing vast amounts of data, identifying patterns, and making forecasts. However, its effectiveness varies based on the algorithms used, data quality, and market volatility. Many traders use AI bots for day trading to enhance decision-making and automate trades, but they should be combined with human judgment for optimal results.

What Are the Risks of Using AI in Day Trading?

The risks of using AI in day trading include:

1. Market Volatility: AI algorithms may react poorly to sudden market changes, leading to significant losses.

2. Overfitting: Models trained on historical data can perform badly in real-time trading if they don’t generalize well.

3. Technical Failures: System glitches or connectivity issues can disrupt trades and cause financial harm.

4. Lack of Human Judgment: AI lacks intuition; it can miss market nuances that a human trader might catch.

5. Data Quality: Poor or biased data can lead to inaccurate predictions and unprofitable trades.

6. Regulatory Risks: Complying with trading regulations can be complex and may expose traders to legal issues.

Using AI in day trading requires careful consideration of these risks.

How to Choose the Right Trading Bot for Your Needs?

To choose the right trading bot for your needs, consider these key factors:

1. Strategy Compatibility: Ensure the bot aligns with your trading strategy—whether it’s day trading, swing trading, or scalping.

2. Performance History: Look for bots with a proven track record. Review their past performance metrics and user testimonials.

3. Customization Options: Select a bot that allows you to customize parameters like risk management and trading pairs.

4. User Interface: Choose a platform that is intuitive and easy to navigate, especially if you're new to trading.

5. Cost and Fees: Evaluate the pricing structure. Some bots charge a subscription fee, while others take a percentage of profits.

6. Support and Community: Opt for bots with strong customer support and an active user community for troubleshooting and sharing insights.

7. Security Features: Prioritize bots that offer robust security measures to protect your data and funds.

By focusing on these factors, you can find a trading bot that effectively meets your trading needs.

What Data Do AI and Bots Use for Day Trading?

AI and bots in day trading use various types of data, including historical price data, real-time market data, trading volume, technical indicators, and news sentiment analysis. They analyze patterns in price movements, market trends, and volume fluctuations to make informed trading decisions. Additionally, some bots incorporate alternative data sources like social media sentiment and economic indicators to enhance their strategies.

How Can I Optimize My Day Trading with AI?

To optimize your day trading with AI, start by using algorithmic trading bots that analyze market trends and execute trades based on predefined strategies. Implement machine learning models to predict price movements and identify trading patterns. Use AI-driven analytics tools to assess market sentiment from news and social media. Automate your trade execution to reduce emotional bias and increase speed. Finally, backtest your strategies with historical data to refine and enhance your approach continuously.

What Are the Benefits of Automated Trading Systems?

Automated trading systems enhance day trading by executing trades at high speed, reducing the emotional stress of decision-making, and ensuring consistent strategy application. They analyze vast market data quickly, identify patterns, and capitalize on opportunities that human traders might miss. Additionally, these systems can operate 24/7, allowing traders to take advantage of global market movements without constant monitoring. Overall, they improve efficiency, minimize human error, and can lead to better profitability in day trading.

How Do I Set Up a Trading Bot for Day Trading?

To set up a trading bot for day trading, follow these steps:

1. Choose a Trading Platform: Select a brokerage that supports API access for automated trading, like Binance or Alpaca.

2. Select a Programming Language: Use a language like Python or JavaScript, which are popular for developing trading bots.

3. Define Your Strategy: your trading strategy, including indicators, entry and exit points, and risk management rules.

4. Gather Historical Data: Obtain historical market data to backtest your strategy and refine it based on performance.

5. Develop the Bot: Write the code to implement your strategy, incorporating necessary algorithms and logic for trading decisions.

6. Test the Bot: Run simulations using paper trading to evaluate performance without risking real money.

7. Deploy the Bot: Once satisfied with the testing, deploy your bot on a live account, starting with small trades.

8. Monitor and Adjust: Continuously monitor the bot's performance and make adjustments as needed based on market changes.

By following these steps, you can effectively set up a trading bot for day trading.

Learn about How to Set Up an AI Bot for Day Trading?

What Are Common Mistakes When Using AI in Trading?

Common mistakes when using AI in trading include over-reliance on algorithms without understanding market dynamics, neglecting to backtest strategies thoroughly, and failing to adapt models to changing market conditions. Traders often ignore risk management, leading to significant losses. Additionally, misunderstanding data quality can result in poor decision-making. Lastly, not incorporating human judgment alongside AI insights can hinder overall effectiveness.

How Does Machine Learning Enhance Day Trading?

Machine learning enhances day trading by analyzing vast amounts of data quickly, identifying patterns, and making predictions about price movements. Algorithms can execute trades at optimal times, minimizing human error and emotional decision-making. AI bots can adapt to market changes in real-time, ensuring strategies remain effective. They also provide insights through sentiment analysis, gauging market reactions to news. Overall, machine learning increases efficiency and potentially boosts profitability in day trading.

Learn about How Does Machine Learning Enhance Day Trading?

Can AI Help Minimize Losses in Day Trading?

Yes, AI can help minimize losses in day trading by analyzing vast amounts of market data quickly and identifying patterns that human traders might miss. AI algorithms can execute trades with precision, manage risk, and adjust strategies in real-time based on market conditions. Additionally, trading bots powered by AI can automate trades, reducing emotional decision-making that often leads to losses. By leveraging predictive analytics, AI can enhance decision-making and optimize trading strategies for better performance.

What Role Does Big Data Play in AI-Driven Trading?

Big data is crucial in AI-driven trading as it provides the vast amounts of information needed for algorithms to make informed decisions. It enables the analysis of market trends, historical prices, and trading volumes in real-time, enhancing predictive accuracy. AI uses this data to identify patterns and execute trades at optimal moments, minimizing risk and maximizing profits. In day trading, big data helps bots react quickly to market changes, giving traders a competitive edge.

How Can Beginners Start Using AI in Day Trading?

Beginners can start using AI in day trading by following these steps:

1. Choose an AI Trading Platform: Select a user-friendly platform that offers AI-driven tools. Look for features like backtesting, predictive analytics, and automated trading.

2. Learn Basic Trading Concepts: Understand key trading terms and strategies. Familiarize yourself with technical indicators and market trends.

3. Start with Paper Trading: Use a demo account to practice trading without risking real money. This allows you to test AI tools and strategies in real-time.

4. Analyze Data with AI: Use AI algorithms to analyze historical data and identify patterns. This helps in making informed decisions.

5. Set Clear Goals: Define your trading objectives and risk tolerance. AI can help optimize your strategies but knowing your goals is crucial.

6. Monitor AI Performance: Regularly assess how your AI tools are performing. Adjust settings or strategies based on market changes.

7. Stay Informed: Follow market news and updates. AI can process information quickly, but staying aware of global events is essential for successful trading.

By integrating these steps, beginners can effectively leverage AI and bots in day trading.

Learn about How to Start Day Trading for Beginners

What Are the Future Trends of AI in Day Trading?

Future trends of AI in day trading include enhanced predictive analytics, enabling traders to analyze vast datasets for better decision-making. Machine learning algorithms will increasingly adapt to market changes in real-time, improving trade execution efficiency. Natural language processing will be utilized for sentiment analysis, helping traders gauge market mood from news and social media. AI-driven bots will automate trading strategies, allowing for 24/7 trading with minimal human intervention. Additionally, personalized trading strategies will emerge, where AI tailors approaches based on individual trader profiles and risk tolerance.

Conclusion about Utilizing AI and Bots in Day Trading

Incorporating AI and trading bots into day trading can significantly enhance your strategies and decision-making processes. These advanced tools analyze vast amounts of data, optimize trades, and even help minimize losses. However, it's crucial to understand the associated risks and common pitfalls to maximize their potential. By leveraging the insights and resources provided by DayTradingBusiness, traders of all levels can effectively navigate the evolving landscape of AI-driven trading.