Did you know that the first computer-based trading system was developed in the 1970s, and it was so complex that it could only be used by a select few? Fast forward to today, and day trading software has become much more accessible and user-friendly, making it easier for traders of all levels to dive into the market. In this article, we’ll explore the best user-friendly day trading software options available, how to choose the right one for beginners, and the essential features to look for. We’ll also discuss free alternatives, mobile compatibility, and automated trading features. Additionally, we'll highlight the importance of customer support, costs involved, and the impact of software on trading performance. Whether you're an experienced trader or just starting out, DayTradingBusiness has you covered with insights and tips to optimize your trading journey.

What are the best user-friendly day trading software options?

The best user-friendly day trading software options include:

1. TD Ameritrade’s thinkorswim: Offers an intuitive interface with advanced charting tools.

2. E*TRADE: Provides a simple platform with robust educational resources and tools.

3. Fidelity: Features easy navigation and comprehensive research tools for traders.

4. Webull: Delivers a sleek, modern interface with commission-free trades and real-time data.

5. Charles Schwab’s StreetSmart Edge: Combines a user-friendly design with powerful analytics.

These platforms cater well to both beginners and experienced traders, focusing on ease of use and essential trading features.

How do I choose the right day trading software for beginners?

To choose the right day trading software for beginners, consider the following factors:

1. User Interface: Look for software with an intuitive and easy-to-navigate interface. Beginners should avoid complex designs that can be overwhelming.

2. Features: Ensure it offers essential features like real-time data, charting tools, and customizable watchlists. A demo account is a plus for practice.

3. Cost: Check for reasonable pricing. Some platforms offer free versions or low commissions, which can be beneficial for beginners.

4. Customer Support: Reliable customer service is crucial. Look for platforms that provide tutorials, responsive support, and community forums.

5. Broker Integration: Choose software that integrates seamlessly with your preferred brokerage to simplify trading.

Popular beginner-friendly options include TD Ameritrade’s thinkorswim, Webull, and TradingView.

What features should I look for in day trading software?

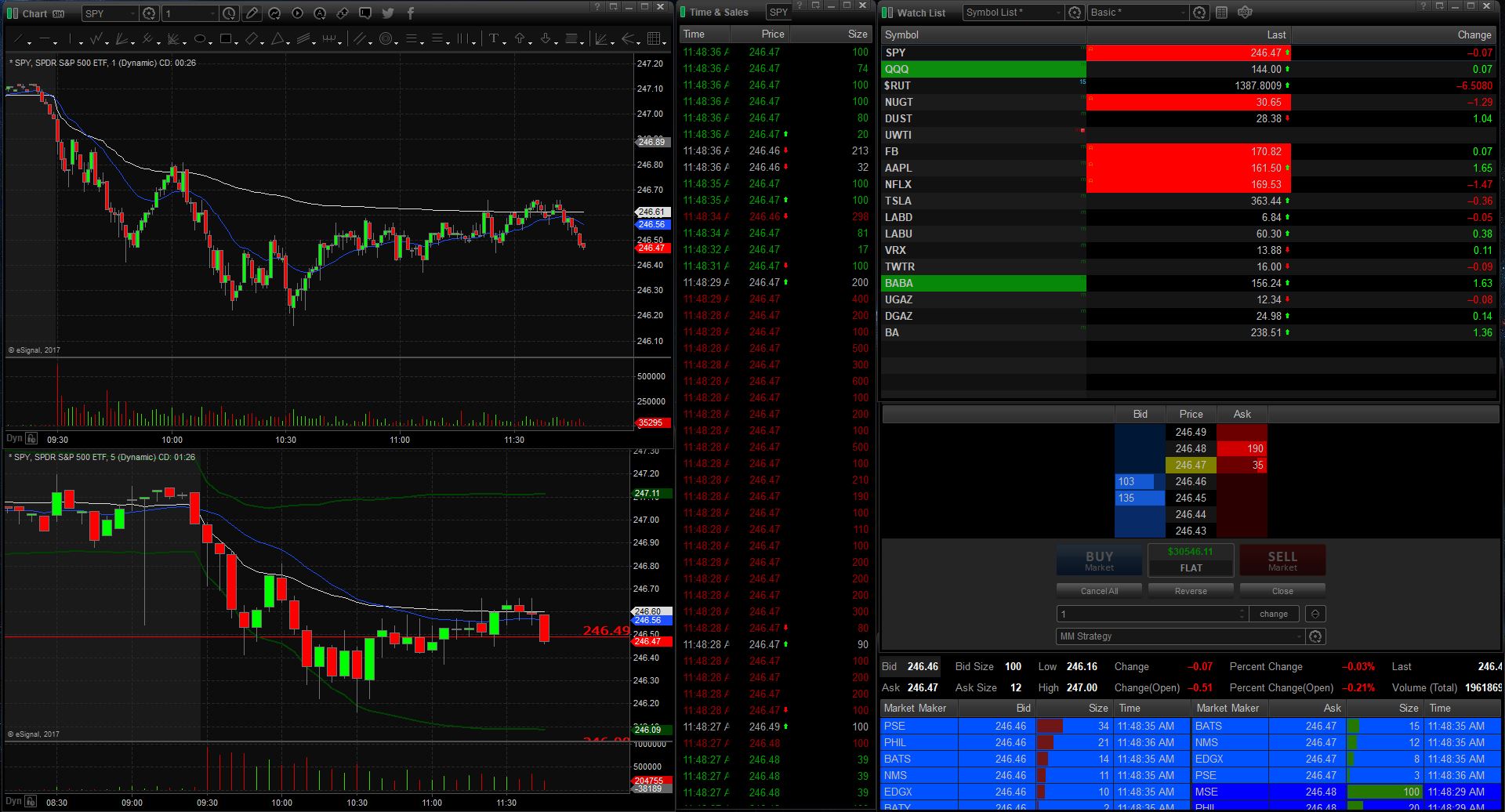

Look for day trading software with real-time market data, customizable charts, and technical indicators. Ensure it offers fast order execution, a user-friendly interface, and reliable customer support. Check for risk management tools, backtesting capabilities, and integration with your brokerage. Additionally, consider mobile accessibility and educational resources to enhance your trading experience.

Are there free day trading software options available?

Yes, there are free day trading software options available. Popular choices include Robinhood, which offers commission-free trading, and Webull, known for its advanced charting tools. Thinkorswim by TD Ameritrade also provides a free version with powerful features for analysis. Each platform has user-friendly interfaces, making them suitable for both beginners and experienced traders.

How does day trading software differ from regular trading platforms?

Day trading software is specifically designed for high-speed trading and often includes advanced charting tools, real-time data feeds, and direct market access. Regular trading platforms may lack these features, focusing instead on longer-term investments and simpler interfaces. Day trading software also typically offers quicker order execution and customizable alerts, which are crucial for managing fast-paced trades. Additionally, it often includes risk management tools tailored for short-term strategies, while regular platforms may not prioritize these functionalities.

Can I use day trading software on mobile devices?

Yes, you can use day trading software on mobile devices. Many platforms offer mobile apps that provide real-time data, charting tools, and trading capabilities. Popular options include TD Ameritrade's thinkorswim, E*TRADE, and Robinhood. These apps are designed for user-friendly navigation, allowing you to execute trades and monitor your portfolio on the go.

What are the top-rated day trading software for experienced traders?

The top-rated day trading software for experienced traders includes:

1. TradeStation – Offers powerful analytics, customizable tools, and extensive backtesting features.

2. NinjaTrader – Known for its advanced charting, automated trading capabilities, and robust market analysis.

3. Thinkorswim by TD Ameritrade – Provides a comprehensive trading platform with advanced tools and real-time data.

4. MetaTrader 4/5 – Popular for forex trading, featuring automated trading and extensive technical indicators.

5. Interactive Brokers – Offers a professional-grade platform with low commissions and a wide range of investment options.

Each of these platforms caters to experienced traders looking for user-friendly tools and advanced trading capabilities.

How important is customer support for day trading software?

Customer support is crucial for day trading software. Traders often face urgent issues that can impact their trading decisions, so having responsive and knowledgeable support helps resolve problems quickly. Effective customer service ensures users can navigate the software confidently, minimizing downtime and enhancing their trading experience. Good support can also provide valuable insights on features and best practices, making it easier for traders to utilize the software effectively.

What are the costs associated with day trading software?

Costs for day trading software typically include subscription fees, which can range from $20 to $300 per month, depending on features. Some platforms charge commissions on trades, either per trade or as a percentage of the trade value. Additional costs may involve data feeds, which can add $10 to $100 monthly, and hardware upgrades for optimal performance. Free options exist, but they often lack advanced features. Overall, expect a total monthly cost between $30 and $500, depending on your selected tools and trading frequency.

How does day trading software impact trading performance?

Day trading software enhances trading performance by providing real-time data, advanced charting tools, and customizable interfaces. User-friendly options streamline decision-making, allowing traders to execute strategies quickly and efficiently. Features like automated alerts and risk management tools help minimize losses and maximize gains. Overall, effective software can significantly improve trade execution and market analysis, leading to better trading outcomes.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What software offers the best charting tools for day traders?

TradingView offers excellent charting tools for day traders, featuring customizable charts, a wide range of indicators, and social networking capabilities. Thinkorswim by TD Ameritrade is also a strong choice, with advanced technical analysis tools and a user-friendly interface. MetaTrader 4 and 5 are popular among forex traders for their robust charting features and automated trading capabilities. Finally, NinjaTrader provides powerful charting tools and extensive market analysis options.

Are there day trading software options with automated trading features?

Yes, several user-friendly day trading software options offer automated trading features. Popular choices include:

1. MetaTrader 4/5 – Widely used for automated trading through Expert Advisors.

2. TradeStation – Features powerful automation tools and scripting capabilities.

3. Thinkorswim – Offers customizable strategies and automated trading options.

4. NinjaTrader – Provides advanced automation and backtesting features.

5. eToro – Allows social trading with automated copy trading functionalities.

These platforms cater to various experience levels and trading styles.

Learn about What legal considerations are there for automated day trading systems?

How do I set up my day trading software for optimal performance?

To set up your day trading software for optimal performance, follow these steps:

1. Choose Reliable Software: Select user-friendly day trading software like TD Ameritrade’s Thinkorswim, TradeStation, or Interactive Brokers. Ensure it aligns with your trading style.

2. Customize Layout: Organize your workspace by customizing charts, watchlists, and order entry windows. Use multiple monitors if possible for better visibility.

3. Set Up Alerts: Configure price alerts and notifications for key stocks. This helps you stay informed without constantly monitoring the screen.

4. Optimize Chart Settings: Use technical indicators that suit your strategy, like moving averages or RSI. Adjust time frames to fit your trading style—shorter for day trading.

5. Practice with Simulations: Utilize demo accounts to practice your strategies without financial risk. This builds confidence in your setup.

6. Check Internet Connection: Ensure a stable and fast internet connection to avoid lag during trades. Consider a wired connection for reliability.

7. Review and Adjust: Regularly review your performance and adjust your software settings to improve efficiency and effectiveness.

Implement these steps to enhance your day trading software setup for better results.

Learn about How Do Prop Firms Evaluate Day Trading Performance?

What are common pitfalls to avoid when using day trading software?

Common pitfalls to avoid when using day trading software include:

1. Overtrading: Avoid making too many trades in a short time; stick to a planned strategy.

2. Neglecting Risk Management: Always set stop-loss orders to protect your capital.

3. Ignoring Software Capabilities: Familiarize yourself with all features to maximize efficiency.

4. Failing to Test Strategies: Use demo accounts to test your strategies before going live.

5. Emotional Trading: Don't let emotions dictate your decisions; stick to your trading plan.

6. Not Keeping Up with Market News: Stay informed about market changes that can affect your trades.

7. Using Inadequate Tools: Ensure your software is user-friendly and meets your trading needs.

Avoiding these pitfalls can enhance your trading experience and improve your overall success.

Learn about Common Day Trading Risks and How to Avoid Them

How can I integrate day trading software with my brokerage account?

To integrate day trading software with your brokerage account, follow these steps:

1. Select Compatible Software: Choose user-friendly day trading software like TradeStation, NinjaTrader, or MetaTrader that supports your brokerage.

2. Open a Brokerage Account: If you haven't already, set up an account with a broker that allows API access or direct integration.

3. API Access: Obtain API keys from your brokerage. This often involves enabling API settings in your account.

4. Download Software: Install your chosen day trading software on your device.

5. Connect Software to Brokerage: In the software, navigate to the settings or connections tab and enter your API keys or login credentials as required.

6. Test the Connection: Execute a test trade to ensure everything is functioning smoothly.

7. Customize Settings: Adjust your trading parameters and preferences within the software for optimal performance.

This process will allow you to effectively integrate day trading software with your brokerage account for streamlined trading.

Learn about How can poor risk management ruin a day trading account?

What user reviews say about popular day trading software options?

User reviews highlight several key points about popular day trading software options:

1. Ease of Use: Many users praise platforms like TD Ameritrade’s thinkorswim for their intuitive interface, making it accessible for beginners.

2. Customization: Traders appreciate software such as TradeStation for its extensive customization features, allowing them to tailor their trading experience.

3. Performance: Reviews often mention that MetaTrader 4 and 5 offer reliable performance and fast execution speeds, which are crucial for day trading.

4. Customer Support: Users frequently comment on the quality of customer support with platforms like E*TRADE, noting quick responses and helpful resources.

5. Tools and Features: Many traders find that software like NinjaTrader provides robust charting tools and analytical features, enhancing their trading strategies.

6. Cost: Pricing is a common theme, with users noting that platforms like Robinhood attract attention for their commission-free trading, appealing to cost-conscious traders.

Overall, user feedback emphasizes the importance of usability, performance, and support in choosing day trading software.

Learn about User Reviews of Popular Day Trading Brokers

Conclusion about User-Friendly Day Trading Software Options

In conclusion, selecting the right day trading software is crucial for both beginners and experienced traders. Prioritize user-friendly interfaces, essential features, and strong customer support to enhance your trading experience. Keep in mind that free options can also offer valuable tools, while advanced software may provide automated trading capabilities. By carefully considering these factors, you can position yourself for success in the dynamic world of day trading. For more insights and tailored guidance, DayTradingBusiness is here to support your trading journey.

Learn about Comparing Day Trading Software Options

Sources:

- Identification of benefits, challenges, and pathways in E-commerce ...

- The impact of digital transformation on the retailing value chain ...

- Assessment of users' adoption behaviour for stock market ...

- A retentive consumer behavior assessment model of the online ...

- Instructions for Form IT-201 Full-Year Resident Income Tax Return ...

- The ENTSO-E Transparency Platform – A review of Europe's most ...