Did you know that the average day trader spends about six hours a day glued to their screens, sometimes forgetting to eat? As captivating as the market can be, choosing the right day trading platform is crucial for success. In this article, we dive into the top day trading platforms, exploring essential factors like features, fees, mobile accessibility, and customer support. Discover which platforms stand out for beginners, offer the best research tools, and provide demo accounts for practice. We also highlight how to evaluate reliability and security features, ensuring you can trade confidently. Let DayTradingBusiness guide you through the maze of options available in 2023 to help you make informed trading decisions.

What are the best day trading platforms for beginners?

The best day trading platforms for beginners include:

1. TD Ameritrade – Offers a user-friendly interface and extensive educational resources.

2. E*TRADE – Features a powerful trading platform with helpful tools for new traders.

3. Robinhood – Simple app with commission-free trading, ideal for beginners.

4. Webull – Provides advanced charting tools and no commissions, great for learning.

5. Fidelity – Strong research options and no commission trades, good for building skills.

Choose one that fits your trading style and needs.

How do I choose the right day trading platform?

To choose the right day trading platform, consider these key factors:

1. Fees and Commissions: Look for low trading fees and commissions that fit your budget.

2. User Interface: Ensure the platform has an intuitive, easy-to-navigate interface.

3. Tools and Features: Check for essential tools like technical analysis, charting options, and news feeds.

4. Customer Support: Opt for a platform with responsive customer service for quick issue resolution.

5. Security: Confirm the platform has strong security measures to protect your data and funds.

6. Asset Variety: Choose a platform that offers a wide range of assets, including stocks, ETFs, and options.

7. Mobile Access: If you trade on the go, ensure the platform has a reliable mobile app.

Evaluate these aspects to find a day trading platform that suits your trading style and needs.

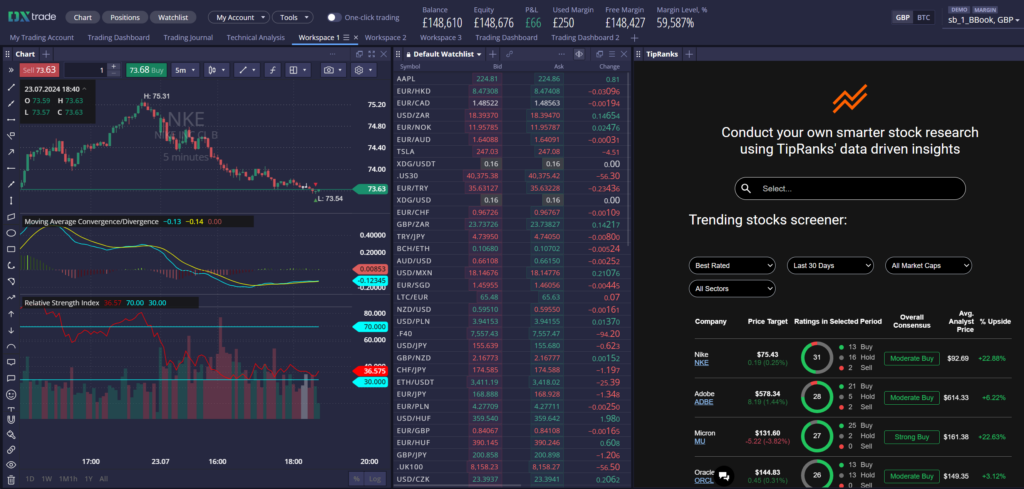

What features should I look for in a day trading platform?

Look for these key features in a day trading platform:

1. Low Commissions: Choose a platform with low trading fees to maximize profits.

2. Real-Time Data: Access to real-time market data is crucial for making informed decisions.

3. Advanced Charting Tools: Look for customizable charts and technical indicators.

4. User-Friendly Interface: A simple, intuitive layout helps execute trades quickly.

5. Fast Execution Speed: Ensure the platform can execute trades rapidly to capitalize on market movements.

6. Mobile Compatibility: A solid mobile app allows trading on-the-go.

7. Research Resources: Access to news, analysis, and educational materials can enhance your trading strategy.

8. Risk Management Tools: Features like stop-loss and limit orders help manage risk effectively.

9. Customer Support: Reliable support can assist with any issues that arise during trading.

These features are essential for effective day trading.

Which day trading platforms offer the lowest fees?

The day trading platforms with the lowest fees include:

1. Robinhood – No commission on trades.

2. Webull – Zero commission trading with no account minimums.

3. TD Ameritrade – No commissions on online stock trades.

4. Charles Schwab – $0 commission for online stock trades.

5. Fidelity – Commission-free trading on U.S. stocks and ETFs.

Compare platforms based on your trading volume and specific needs for the best overall value.

Are there any day trading platforms with good mobile apps?

Yes, several day trading platforms have excellent mobile apps. Two of the best are:

1. TD Ameritrade: Their thinkorswim mobile app offers advanced charting tools, real-time data, and a user-friendly interface.

2. E*TRADE: The E*TRADE mobile app features robust trading capabilities, research tools, and a streamlined design for quick trades.

Other notable mentions include Charles Schwab and Fidelity, both of which provide strong mobile trading experiences.

How do day trading platforms compare on customer support?

Customer support varies significantly among top day trading platforms. Some, like TD Ameritrade, offer 24/7 support through multiple channels, including phone, chat, and email. Others, like Robinhood, have limited hours and predominantly rely on email support, which can lead to delays. E*TRADE provides robust resources, including educational content and responsive chat options. Overall, platforms with comprehensive support systems tend to enhance the trading experience, while those with limited support may frustrate users during critical trading moments. Always consider customer support quality when selecting a day trading platform.

Which platforms provide the best research tools for day traders?

The best research tools for day traders are found on platforms like:

1. TD Ameritrade: Offers advanced charting, technical analysis tools, and a comprehensive news feed.

2. E*TRADE: Features robust research reports, market commentary, and customizable charts.

3. Interactive Brokers: Provides access to a wide range of research, analytics, and real-time data.

4. Fidelity: Known for in-depth research reports and tools for technical analysis.

5. TradeStation: Offers advanced tools for backtesting strategies and real-time data analysis.

Choose based on your specific trading needs and preferences.

What are the most popular day trading platforms in 2023?

The most popular day trading platforms in 2023 are:

1. TD Ameritrade – Known for its powerful thinkorswim platform and extensive research tools.

2. E*TRADE – Offers user-friendly interfaces and robust trading features.

3. Charles Schwab – Combines low fees with a comprehensive trading platform.

4. Fidelity – Great for research and offers zero commissions on trades.

5. Webull – A commission-free platform with advanced tools and a mobile app.

6. Robinhood – Popular for its simplicity and commission-free trading model.

7. Interactive Brokers – Best for professional traders with low margin rates and advanced features.

These platforms cater to various trading styles and preferences, making them top choices for day traders in 2023.

How do I evaluate the reliability of a day trading platform?

To evaluate the reliability of a day trading platform, check for the following:

1. Regulation: Ensure the platform is regulated by recognized authorities like the SEC or FINRA.

2. User Reviews: Look for user feedback on forums and review sites to gauge experiences.

3. Security Measures: Verify if the platform uses strong encryption and two-factor authentication.

4. Trading Tools: Assess the availability of advanced charting, analytics, and real-time data.

5. Fees and Commissions: Compare the fee structures with competitors to avoid hidden costs.

6. Customer Support: Test the responsiveness and availability of customer service.

7. Platform Stability: Research the platform’s uptime history and performance during high volatility.

8. Withdrawal Process: Examine the ease and speed of withdrawals for your funds.

By focusing on these factors, you can determine the reliability of a day trading platform effectively.

What day trading platforms offer demo accounts?

Several day trading platforms offer demo accounts:

1. TD Ameritrade: Their thinkorswim platform provides a robust demo account with virtual trading features.

2. Interactive Brokers: Offers a paper trading account that simulates real market conditions.

3. E*TRADE: Features a virtual trading platform to practice strategies without risk.

4. NinjaTrader: Provides a free demo account for futures and forex trading.

5. TradeStation: Offers a simulated trading environment to test strategies.

6. OANDA: Provides a demo account for forex trading with real-time market data.

These platforms allow you to practice day trading strategies risk-free.

Learn about Day Trading Platforms Offering Demo Accounts

Are there any day trading platforms with advanced charting tools?

Yes, several day trading platforms offer advanced charting tools. Top options include:

1. TD Ameritrade's thinkorswim – Features customizable charts, technical indicators, and drawing tools.

2. TradingView – Known for its robust charting capabilities and social networking features.

3. Interactive Brokers – Offers advanced charting with a wide range of technical analysis tools.

4. E*TRADE – Provides comprehensive charting options and real-time data.

5. MetaTrader 4/5 – Popular for forex trading, offering extensive charting features and automated trading options.

These platforms cater to both beginners and experienced traders looking for sophisticated analysis tools.

Learn about Day Trading Platforms with Advanced Charting Tools

How do commissions vary among top day trading platforms?

Commissions among top day trading platforms vary significantly. Some platforms, like Robinhood and Webull, offer commission-free trades, while others, such as E*TRADE and TD Ameritrade, may charge $0 but have fees for certain transactions or services. Additionally, some platforms might implement a per-share fee structure, especially for fractional shares. It's essential to compare not just commission rates but also other costs like margin rates, withdrawal fees, and platform features to determine the best fit for your trading style.

What day trading platforms are best for active traders?

The best day trading platforms for active traders include:

1. TD Ameritrade – Offers powerful tools like Thinkorswim with advanced charting and analytics.

2. Interactive Brokers – Known for low commissions and a wide range of trading options.

3. E*TRADE – Features user-friendly platforms and robust research tools.

4. Charles Schwab – Provides excellent customer service and no commission on trades.

5. Fidelity – Offers comprehensive research and no-fee trading, ideal for active investors.

Choose based on your trading style, tools needed, and commission structure.

Learn about Day Trading Brokers with the Best Trading Platforms

How can I find user reviews for day trading platforms?

To find user reviews for day trading platforms, check financial forums like Reddit or StockTwits. Visit dedicated review sites such as Investopedia or NerdWallet, which often compare top day trading platforms. Look for comments on social media, especially Twitter and Facebook groups focused on trading. Additionally, search for YouTube reviews, where traders share their experiences with different platforms.

Learn about User Reviews of Popular Day Trading Brokers

What security features should a day trading platform have?

A day trading platform should have robust security features, including two-factor authentication (2FA), encryption of sensitive data, and regular security audits. It should also offer account monitoring alerts for suspicious activity, a secure connection (SSL), and compliance with regulatory standards. Additionally, look for features like withdrawal whitelists and the ability to set limits on trading activities to enhance your account's safety.

Learn about Security Features in Day Trading Software

How do I set up my account on a day trading platform?

To set up your account on a day trading platform, follow these steps:

1. Choose a Platform: Select a reputable day trading platform like TD Ameritrade, E*TRADE, or Interactive Brokers.

2. Visit the Website: Go to the platform’s homepage and find the "Sign Up" or "Open Account" button.

3. Fill Out the Application: Enter your personal information, including your name, address, email, and phone number.

4. Provide Financial Information: Complete questions about your trading experience, investment goals, and financial status.

5. Verify Your Identity: Upload necessary documents such as a government-issued ID and proof of address.

6. Read Agreements: Review and accept the terms of service and any trading agreements.

7. Fund Your Account: Link your bank account and deposit funds to start trading.

8. Set Up Two-Factor Authentication: For added security, enable two-factor authentication.

9. Download the Trading App: If available, download the platform's mobile app for on-the-go trading.

Once these steps are complete, your account will be active, and you can start day trading.

Learn about How Does Broker Compliance Impact Day Trading Account Security?

Conclusion about Top Day Trading Platforms Reviewed

In conclusion, selecting the right day trading platform is crucial for both novice and experienced traders. By evaluating key features such as fees, mobile accessibility, customer support, and research tools, you can make an informed choice that aligns with your trading goals. Platforms with demo accounts and advanced charting capabilities can further enhance your trading experience. For tailored insights and comprehensive reviews on the best options available, DayTradingBusiness is your go-to resource.

Learn about FAQs About Day Trading Platforms