Did you know that the first stock exchange was established in the 17th century, and traders used to exchange notes on tulip bulbs? Fast forward to today, integrating day trading software with brokers has become a vital step for modern traders. This article dives into the essential aspects of connecting your trading platforms with broker accounts. We’ll explore how to link your software effectively, the best APIs for integration, and tips for setting up automatic trades. Additionally, we’ll cover security measures, compatibility checks, and troubleshooting common issues. If you're eager to optimize your trading experience, DayTradingBusiness offers the insights you need to navigate these integrations smoothly.

How do I connect day trading software to my broker account?

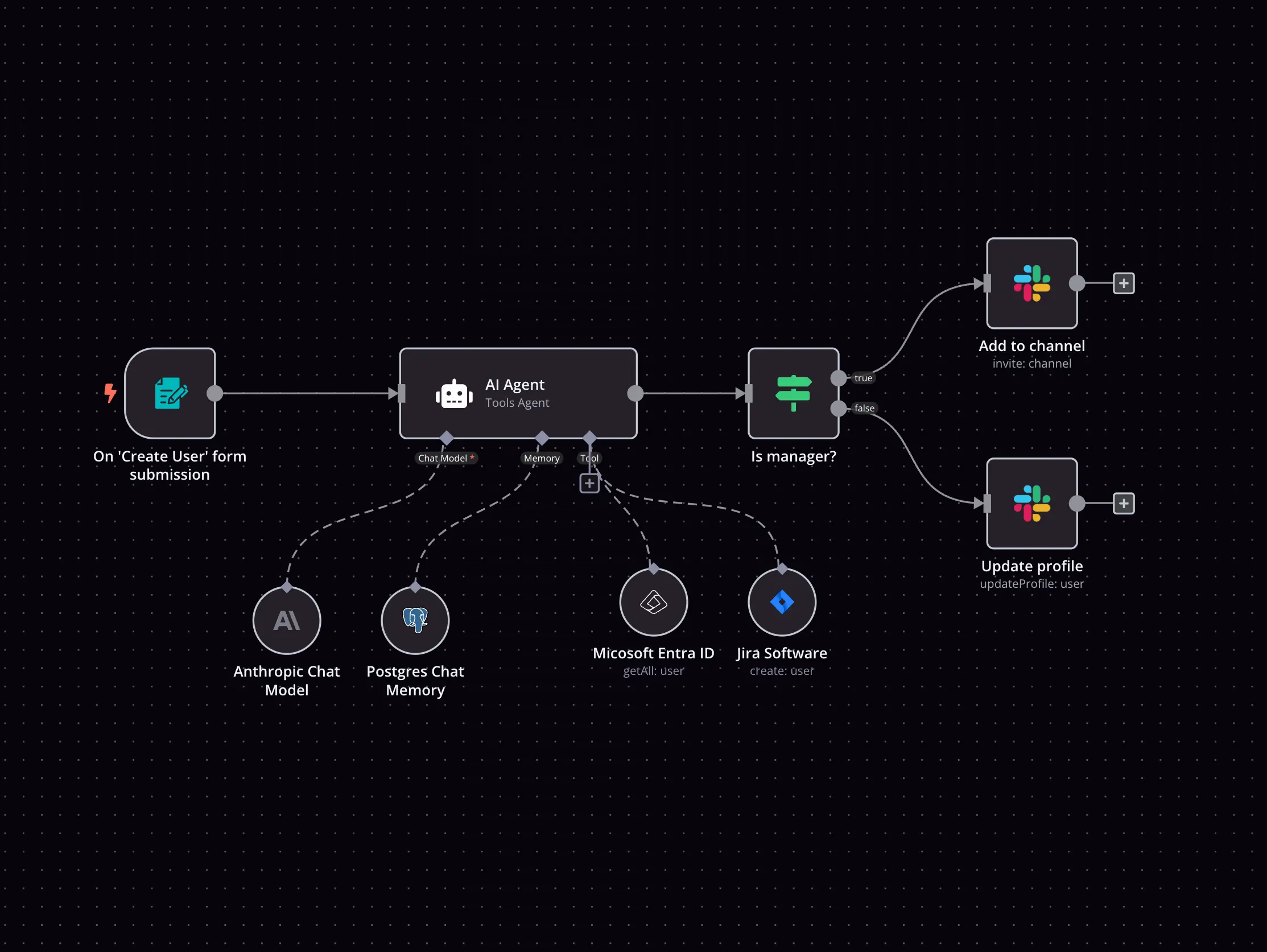

To connect your day trading software to your broker account, log into your trading platform, find the API or integration settings, and generate an API key from your broker’s account dashboard. Enter that API key into your trading software’s connection or integration section. Make sure your broker supports API connections and enable any necessary permissions. Test the connection to ensure real-time data and order execution work smoothly.

What are the best ways to link trading platforms with brokers?

Use API integrations provided by brokers, ensuring your trading platform supports their API. Connect via FIX protocol for real-time data and order execution. Use third-party linking tools or middleware like MetaTrader bridges if available. Ensure secure API keys management and verify compatibility with your trading software. Test the connection thoroughly before live trading to avoid issues.

Which APIs are used to integrate trading software with brokers?

APIs like MetaTrader 4 and 5 (MT4/MT5) API, Interactive Brokers API, REST APIs from brokers like TD Ameritrade, E*TRADE, and Alpaca, as well as FIX protocol are used to connect trading software with brokers.

How do I set up automatic trades between my software and broker?

Connect your trading software’s API key or login credentials to your broker’s API platform. Download or configure the software’s trading automation settings, then specify your trading strategies and risk parameters. Ensure your broker supports API trading, and test the connection with a demo account before going live.

What security measures should I consider when connecting trading apps?

Use strong, unique passwords and enable two-factor authentication on your trading accounts. Ensure your device has updated security patches and antivirus software. Use a secure, encrypted internet connection, preferably a VPN. Verify the broker's security protocols, like SSL encryption and cold storage for funds. Regularly review account activity for unauthorized access. Limit app permissions and avoid public Wi-Fi when trading. Keep your trading software and operating system current to patch vulnerabilities. Use biometric authentication if available for added security.

How can I ensure my trading software is compatible with my broker?

Check your broker’s supported platforms and API documentation. Ensure your trading software uses the same API standards or platform compatibility. Contact your broker’s support to confirm integration options. Test the software in a demo environment before live trading. Keep software and broker updates aligned to prevent compatibility issues.

What are common issues faced when integrating trading tools with brokers?

Common issues when integrating day trading software with brokers include API connectivity problems, data synchronization errors, limited API documentation, delays in order execution, account permission restrictions, and compatibility issues with trading platforms.

How do I customize trading software for broker-specific features?

To customize trading software for broker-specific features, connect the software’s API with your broker’s API documentation. Use the broker’s API keys and endpoints to access unique order types, trading instruments, or account info. Modify the software’s code to include broker-specific functions like custom order execution, margin settings, or real-time data feeds. Test the integration thoroughly to ensure it handles broker-specific protocols and error handling. Adjust user interface elements to display broker-specific features clearly.

What are the steps to test the connection between software and broker?

To test the connection between your trading software and broker, follow these steps:

1. Enter your broker’s sandbox or demo environment.

2. Configure API keys and credentials in your software.

3. Initiate a test connection or ping command.

4. Check for successful handshake or response messages.

5. Place a small, simulated order to verify order execution.

6. Confirm order status updates and data feeds in your software.

7. Monitor logs for errors or connectivity issues.

8. Repeat with different order types or data requests to ensure stability.

How do I troubleshoot connection problems with broker APIs?

Check your API keys and credentials—they must be correct and active. Ensure your internet connection is stable. Verify API endpoints and URLs match the broker’s documentation. Look for error messages in logs; they reveal connection issues. Test your network firewall and security settings to allow API traffic. Update your software or API libraries if needed. Contact broker support if problems persist beyond configuration fixes.

Can I use third-party plugins to connect software with brokers?

Yes, third-party plugins can connect your day trading software with brokers. Many trading platforms support plugins or APIs that facilitate integration, allowing seamless data flow and order execution. Check if your software and broker offer compatible plugins or APIs to ensure smooth connection.

What are the regulatory considerations for broker-software integration?

Regulatory considerations for broker-software integration include ensuring compliance with SEC, FINRA, and CFTC rules, especially around data security, transparency, and fair trading practices. You must adhere to anti-money laundering (AML) and know-your-customer (KYC) requirements. Properly managing order routing, execution quality, and reporting obligations is critical. Additionally, ensure your software meets industry standards for cybersecurity and audit trails. Regulatory approval might be necessary if the integration involves significant changes to trading operations.

How do I update my trading software for broker compatibility?

Download the latest software update from the provider’s website or app store. Install the update, then open the software and go to the settings or broker connection section. Select or re-enter your broker’s credentials, and choose the correct API or integration option for your broker. Restart the software to ensure the update takes effect. Check for any new broker-specific features or compatibility notes.

What are the best practices for managing multiple broker integrations?

Use standardized APIs like FIX or REST for smooth communication. Keep detailed documentation for each broker’s setup and requirements. Automate onboarding with scripts to reduce errors. Regularly test integrations to catch issues early. Maintain secure API keys and credentials, rotating them periodically. Use centralized monitoring to track connection health and data flow. Communicate clearly with brokers about updates or changes. Document workflows and troubleshooting steps for quick fixes. Prioritize scalable architecture to add more broker integrations efficiently.

How do I ensure real-time data sync between my software and broker?

Use an API connection for real-time data synchronization, ensuring your trading platform supports live data feeds. Implement WebSocket or FIX protocol for instant updates. Regularly test the data flow and set up automatic reconnection in case of disconnections. Keep your API credentials secure and monitor latency to maintain synchronization accuracy.

Conclusion about Integrating Day Trading Software with Brokers

Successfully integrating day trading software with your broker is crucial for optimizing your trading strategy. By understanding the connection process, utilizing the right APIs, and implementing security measures, traders can enhance their trading experience. Additionally, ensuring compatibility and addressing common integration issues will pave the way for seamless operations. Following best practices and staying updated on regulatory considerations will further support effective trading. For tailored guidance and in-depth insights, DayTradingBusiness is here to assist you on your trading journey.