Did you know that the average day trader spends more time picking their software than they do picking stocks? Choosing the right day trading software is crucial for success, and this article dives into everything you need to know. Discover the essential features to look for, the best platforms for beginners, and how to effectively compare different options. Learn about the importance of charting tools, real-time data, and automation in your trading journey. We also cover the costs, security features, and mobile compatibility of various software. Finally, avoid common mistakes and find out how backtesting and simulation can enhance your trading strategy. For expert insights and guidance, DayTradingBusiness has you covered!

What features should I look for in day trading software?

Look for real-time market data, fast order execution, customizable charting tools, and technical analysis features. Ensure it has a user-friendly interface, reliable uptime, and robust risk management options like stop-loss orders. Compatibility with your device and low latency are key. Bonus if it offers paper trading to practice without risking real money.

Which day trading platforms are best for beginners?

Robinhood, Webull, and eToro are ideal for beginners because they offer user-friendly interfaces, low or no commission fees, and educational resources. Thinkorswim by TD Ameritrade also works well for new traders with its intuitive tools and demo accounts. These platforms simplify the trading process, making it easier to learn and practice without overwhelming features.

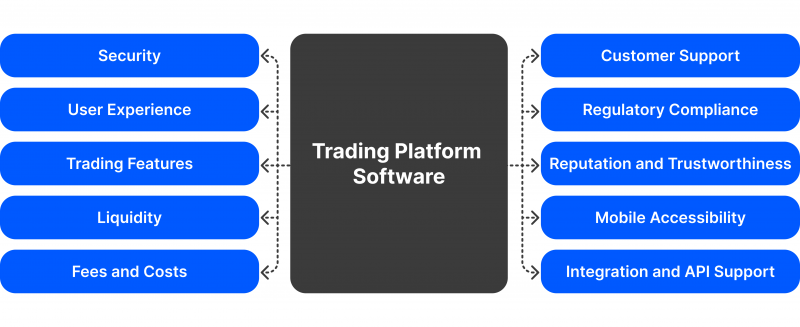

How do I compare different day trading software options?

Compare features like real-time data, charting tools, order execution speed, and customization options. Check user reviews for reliability and customer support. Test demo versions to see how intuitive the interface is and if it fits your trading style. Consider costs, including commissions and platform fees. Look for integrations with your preferred broker and ensure the software offers risk management tools.

What is the most user-friendly day trading software?

MetaTrader 4 and 5 are the most user-friendly day trading software, offering intuitive interfaces, fast execution, and easy customization. Thinkorswim by TD Ameritrade is also popular for its straightforward tools and educational support. Both platforms are ideal for beginners and seasoned traders alike.

How important are charting tools in day trading software?

Charting tools are essential in day trading software because they help identify entry and exit points quickly. They provide real-time technical analysis, pattern recognition, and trend visualization, which are critical for making fast, informed decisions. Good charting features can give you a competitive edge, reduce risk, and improve your trading accuracy. Without reliable charting tools, you might miss crucial market signals or react too late.

Which day trading software offers real-time data?

Thinkorswim, TradingView, Interactive Brokers, and NinjaTrader offer real-time data for day trading.

How do I evaluate the speed and reliability of trading platforms?

Test the platform with a demo account to check execution speed and order accuracy. Read reviews from active traders about their reliability and uptime. Look for low latency and fast order execution during high-volume periods. Check customer support responsiveness and platform stability reports. Use real-time performance metrics to compare options.

What are the costs associated with day trading software?

Day trading software costs range from free options with basic features to premium platforms charging $200 or more monthly. Subscription fees typically include real-time data, charting tools, and order execution. Some advanced platforms charge one-time setup fees or higher monthly rates for premium features like algorithm trading or extensive market data. Additional costs may include data feed subscriptions, advanced research tools, and broker commissions.

How does automation affect day trading software choices?

Automation narrows day trading software choices to platforms with reliable, advanced algorithmic trading, automated order execution, and real-time data analysis. Traders prefer software with customizable bots, backtesting features, and integration with APIs for automated strategies. Automation tools influence the decision toward software that offers seamless, low-latency execution and robust risk management.

Which software supports multiple trading strategies?

MetaTrader 4 and 5 support multiple trading strategies through customizable scripts, expert advisors, and indicators. Thinkorswim offers a range of strategies with advanced charting and automation. NinjaTrader allows backtesting and deploying various trading strategies easily. TradingView supports multiple strategies via its scripting language Pine Script, enabling custom indicators and automated trading. These platforms provide the flexibility to implement and switch between different trading strategies efficiently.

What security features should I consider in trading software?

Look for two-factor authentication, encryption, and secure login protocols to protect your account. Ensure the software has real-time data encryption, regular security updates, and fraud detection features. Check for customizable security settings, like withdrawal alerts and IP restrictions. Prioritize platforms with a solid track record of security and transparency.

How compatible is day trading software with mobile devices?

Most day trading software is mobile-compatible, offering apps for iOS and Android. Many platforms optimize their features for mobile, allowing trading on smartphones and tablets. However, some advanced tools may work better on desktop due to screen size and processing power. Check if the software provides a seamless mobile experience with real-time data and quick trade execution. Compatibility varies; choose software specifically designed for mobile if you need on-the-go trading.

Learn about How to Choose the Right Backtesting Software for Day Trading

Which platforms offer the best customer support?

Platforms like Interactive Brokers, TD Ameritrade, and Fidelity offer the best customer support for day trading software. They provide 24/7 live chat, quick email responses, and dedicated phone support. Look for platforms with responsive support teams, extensive help centers, and real-time assistance to troubleshoot trading issues efficiently.

How do I choose trading software based on my trading style?

Pick trading software that matches your day trading style—if you’re quick and execution-focused, look for real-time data, fast order execution, and low latency. For technical analysis, prioritize platforms with advanced charting tools and customizable indicators. If you trade based on news, choose software with integrated news feeds and alerts. Consider ease of use and whether the platform supports your preferred trading strategies. Test demo versions to see if the interface suits your workflow.

Learn about How to Choose the Right Backtesting Software for Day Trading

What are the common mistakes to avoid when selecting trading software?

Avoid choosing trading software without testing its user interface first. Don’t ignore compatibility with your device or trading platform. Relying solely on paid features without understanding their value leads to unnecessary expenses. Overlooking customer reviews and support options can leave you stranded during issues. Ignoring data security and encryption risks your account. Picking software with complicated setup or steep learning curves slows your trading. Focusing only on advanced tools without considering ease of use hampers quick decision-making. Neglecting to verify if the software offers real-time data and fast execution can cause missed opportunities.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How important are backtesting and simulation features?

Backtesting and simulation features are crucial because they let you test strategies without risking real money. They help identify what works, refine your approach, and build confidence before live trading. Without these tools, you risk costly mistakes and lack of preparedness. They’re essential for understanding how your trading ideas perform in different market conditions.

Conclusion about How to Choose Day Trading Software

In summary, choosing the right day trading software involves evaluating key features such as user-friendliness, real-time data, and robust charting tools. It's essential to compare platforms based on your specific trading style, costs, and the level of customer support they offer. Additionally, consider the importance of automation and security features to protect your investments. By thoroughly assessing these factors, you can enhance your trading experience and make informed decisions. For tailored insights and expert guidance, DayTradingBusiness is here to support your trading journey.

Learn about How to Choose the Right Backtesting Software for Day Trading