Did you know that more people are bitten by New Yorkers each year than by sharks? Just like navigating the bustling streets of the Big Apple, day trading can be a wild ride, but with the right tools, you can steer clear of potential pitfalls. In this article, we delve into the essential features of day trading software equipped with risk management tools. You'll discover how these features enhance your trading experience, from understanding stop-loss mechanisms to the benefits of real-time risk monitoring. We’ll also explore automated risk controls, common risk management strategies, and key tools for beginners. With insights from DayTradingBusiness, learn how to customize your risk settings and leverage backtesting to safeguard your investments. Prepare to trade smart and minimize emotional mistakes as you navigate the fast-paced world of day trading!

What is day trading software with risk management tools?

Day trading software with risk management tools helps traders control losses and protect profits through features like stop-loss orders, position sizing, and real-time alerts. It automates risk limits, monitors market volatility, and offers analytics to optimize trading strategies while minimizing financial exposure.

How do risk management features improve day trading?

Risk management features in day trading software help limit losses by setting stop-loss and take-profit orders. They automatically exit trades when predefined thresholds are reached, reducing emotional decision-making. These tools protect your capital during volatile market swings and help maintain consistent trading discipline. By managing risk effectively, traders can avoid large losses and preserve gains, leading to more stable, confident trading.

Which features should I look for in day trading software?

Look for real-time data, advanced charting, customizable alerts, and automated trading options. Prioritize risk management tools like stop-loss and take-profit orders, position sizing, and volatility filters. User-friendly interface and reliable execution speed also matter. Ensure it offers clear risk analytics and stress testing features to manage potential losses effectively.

How does stop-loss work in trading platforms?

Stop-loss in trading platforms automatically sells a position when its price hits a preset level, limiting potential losses. It acts as a safety net, closing trades before losses grow too large. You set the stop-loss order when entering a trade, and the platform executes it if the market moves against you. This tool helps manage risk, especially in fast-moving day trading environments.

Can automated risk controls prevent major losses?

Yes, automated risk controls in day trading software can prevent major losses by setting stop-loss orders, limiting position sizes, and monitoring market volatility in real-time. They help react quickly to adverse movements, reducing emotional trading errors. While not foolproof, these tools significantly lower the risk of catastrophic losses when properly configured.

What are the best day trading tools for beginners?

The best day trading tools for beginners include platforms like Thinkorswim, TradingView, and TD Ameritrade's thinkorswim, which offer robust risk management features like stop-loss and limit orders. MetaTrader 4 and 5 are also popular, providing real-time data, customizable alerts, and risk controls. These tools help manage risk with easy-to-set stop-loss orders, position sizing, and alerts to prevent emotional trading. They’re user-friendly and provide educational resources to help beginners learn effective risk management.

How reliable are risk alerts in trading software?

Risk alerts in trading software are generally reliable but not foolproof. They depend on the accuracy of the algorithms and data inputs, which can sometimes miss sudden market shifts. While they help manage exposure and reduce emotional trading, false positives or missed signals can occur. Use risk alerts as a helpful guide, not a guarantee of safety.

How do trading algorithms help manage risk?

Trading algorithms help manage risk by automatically setting stop-loss and take-profit levels, reducing emotional trading errors. They analyze market data in real-time to adapt to price swings and avoid large losses. Algorithms can diversify trades across multiple assets, spreading out risk. They also monitor position sizes to prevent overexposure. By executing trades swiftly based on predefined criteria, they minimize the impact of sudden market movements. Overall, they provide disciplined, data-driven risk control in day trading.

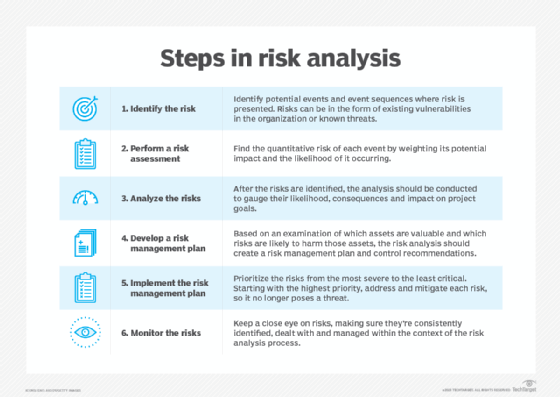

What are the common risk management strategies used?

Common risk management strategies in day trading software include setting stop-loss and take-profit orders, using position sizing to limit exposure, implementing trailing stops to lock in gains, diversifying trades to spread risk, and using real-time alerts to monitor market movements. These tools help traders control losses and protect profits effectively.

How do I set effective stop-loss and take-profit levels?

Set stop-loss levels just below recent support or swing lows to limit downside, and place take-profit targets near key resistance or predetermined risk-reward ratios, like 1:2 or 1:3. Use your day trading software’s risk management tools to automate these levels, ensuring quick execution. Adjust stop-loss and take-profit as the trade moves in your favor to lock in gains and minimize losses. Always base levels on technical analysis and your specific risk tolerance.

Learn about How to set effective stop-loss orders to limit risk

Can day trading software prevent emotional trading mistakes?

Day trading software with risk management tools helps reduce emotional trading mistakes by automatically setting stop-losses and take-profits, enforcing discipline, and removing impulsive decisions. It prevents panic-selling or overtrading driven by fear or greed. While it doesn't eliminate emotions entirely, it acts as a safeguard, ensuring trades follow a planned strategy rather than impulsive reactions.

Learn about How does insufficient preparation contribute to day trading mistakes?

What are the benefits of real-time risk monitoring?

Real-time risk monitoring helps day traders spot potential losses instantly, allowing quick adjustments to avoid big setbacks. It provides continuous updates on market changes, so traders can act swiftly to protect profits or minimize damage. Using risk management tools within day trading software, traders stay aware of position sizes, stop-loss levels, and margin use, reducing emotional decisions. It improves decision-making accuracy during volatile markets, increases trading discipline, and helps maintain consistent profit margins. Overall, real-time risk monitoring keeps traders proactive, not reactive, safeguarding their capital in fast-paced trading environments.

How does leverage affect risk in day trading?

Leverage amplifies both potential gains and losses in day trading. Higher leverage means smaller price moves can wipe out your capital quickly, increasing risk. Using day trading software with risk management tools helps set stop-loss orders and control exposure, reducing the danger of overleveraging. Without proper risk controls, leverage can turn small mistakes into significant losses.

Learn about How to minimize leverage risk in day trading?

Are there trading platforms with integrated risk analysis?

Yes, many day trading platforms offer integrated risk analysis tools. Examples include Thinkorswim, TradeStation, and NinjaTrader, which provide real-time risk metrics, position sizing, and stop-loss features to help manage trading risk effectively.

What’s the role of backtesting in risk management?

Backtesting in risk management helps evaluate how a trading strategy performs historically, identifying potential losses and strengths. It allows traders to fine-tune risk controls, like stop-loss and position sizing, before risking real money. By simulating trades on past data, backtesting reveals weaknesses and improves confidence in the day trading software’s risk management tools.

How can I customize risk settings in trading software?

Open your trading software and navigate to the risk management or settings menu. Look for options like "risk parameters," "stop-loss," "take-profit," or "position sizing." Adjust your maximum loss per trade, set stop-loss and take-profit levels, and customize leverage or margin settings. Save your changes, and ensure your risk profile aligns with your trading plan.

What are the limits of risk management tools in day trading?

Risk management tools in day trading software help limit losses but can't prevent all risks. They rely on predefined parameters like stop-loss orders, which may not execute perfectly in volatile markets. Slippage can occur, meaning trades might fill at worse prices than set. Sudden market moves or gaps can bypass stop-losses entirely. Overconfidence in these tools can lead traders to take bigger risks, thinking they’re fully protected. They also depend on accurate data and quick execution; delays can undermine effectiveness. Ultimately, they reduce risk but can't eliminate market unpredictability or emotional decision-making.

Learn about How can poor risk management lead to losses in day trading?

Conclusion about Day Trading Software with Risk Management Tools

Incorporating day trading software with robust risk management tools is crucial for success in the volatile trading environment. Effective risk management features can significantly enhance decision-making and protect against major losses. When selecting software, look for essential features like stop-loss options, automated risk controls, and real-time monitoring capabilities. While no system can eliminate risk entirely, the right tools can help traders maintain discipline and minimize emotional errors. For comprehensive insights and guidance on optimizing your trading strategy, consider exploring the resources offered by DayTradingBusiness.

Learn about Day Trading Platforms with Built-in Risk Management Tools