Did you know that the first automated trading system was developed in the 1970s, long before most of us even knew what a computer was? Fast forward to today, and day trading software for automated trading has revolutionized the trading landscape. This article dives into what automated trading software is, how it operates, and the essential features to consider when choosing the right tool for your needs. We’ll explore the best options available, the benefits and risks involved, and how to enhance your trading strategies. Additionally, we’ll cover costs, setup instructions, and tips for integrating with your brokerage account. Whether you're a beginner or a seasoned trader, DayTradingBusiness will guide you through the process of leveraging automated software to maximize your trading potential.

What is day trading software for automated trading?

Day trading software for automated trading is a platform that allows traders to execute buy and sell orders automatically based on predefined criteria. This software typically includes features like algorithmic trading, backtesting capabilities, real-time market data, and customizable trading strategies. Popular examples include MetaTrader, TradeStation, and NinjaTrader. These tools help traders capitalize on market opportunities quickly without manual intervention.

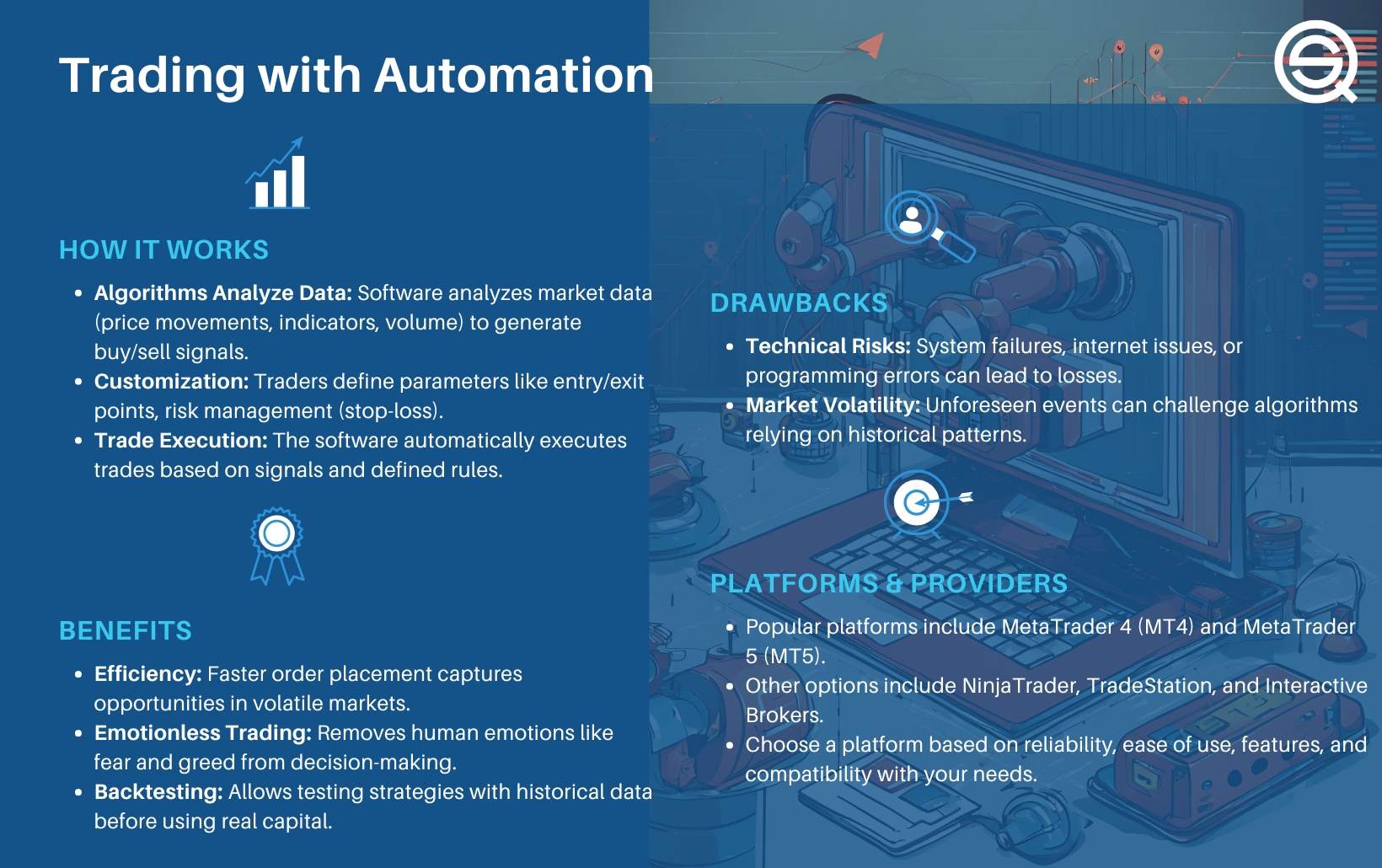

How does automated trading software work for day traders?

Automated trading software for day traders uses algorithms to execute trades based on predefined criteria. These programs analyze market data in real time, identifying patterns and signals to make buy or sell decisions without human intervention. Traders can customize parameters like entry and exit points, risk levels, and asset selections. The software can operate 24/7, ensuring trades are executed instantly, capturing fleeting opportunities. It minimizes emotional decision-making, allowing for consistent strategy application. Examples include platforms like MetaTrader and TradeStation, which offer various tools for automation and backtesting strategies.

What features should I look for in day trading software?

Look for day trading software that offers real-time market data, advanced charting tools, and customizable indicators. Ensure it supports automated trading with algorithmic capabilities and backtesting features. A user-friendly interface and quick execution speeds are crucial. Also, check for reliable risk management tools and integration with your brokerage. Finally, consider mobile access for trading on the go.

What are the best day trading software options available?

The best day trading software options for automated trading include:

1. MetaTrader 4/5 – Popular for forex, offering robust automation through Expert Advisors.

2. TradeStation – Known for its powerful analysis tools and easy-to-set-up automated strategies.

3. NinjaTrader – Excellent for futures and forex, with advanced charting and automated trading capabilities.

4. Thinkorswim – Offers a comprehensive trading platform with strong automation features for stocks and options.

5. Interactive Brokers – Provides a customizable trading platform with API access for automated trading.

6. eToro – Features social trading and automated copy trading options, ideal for beginners.

Choose based on your trading style, asset focus, and required features.

How can I choose the right automated trading software for my needs?

To choose the right automated trading software for day trading, first identify your trading goals and strategies. Look for software that supports your preferred markets and trading styles. Check for user-friendly interfaces and robust backtesting features to evaluate performance. Ensure it offers reliable customer support and regular updates. Analyze costs, including fees and commissions. Read reviews and testimonials from other users to gauge reliability and effectiveness. Finally, consider a demo version to test the software before committing.

What are the benefits of using automated trading software for day trading?

Automated trading software offers several benefits for day trading:

1. Speed: Executes trades within milliseconds, capitalizing on market opportunities faster than manual trading.

2. Consistency: Removes emotional decision-making, applying strategies uniformly without second-guessing.

3. Backtesting: Allows traders to test strategies on historical data, optimizing performance before real investment.

4. 24/7 Monitoring: Continuously analyzes market conditions, ensuring trades occur even when you're not actively monitoring.

5. Diversification: Manages multiple accounts or strategies simultaneously, spreading risk and increasing potential returns.

6. Reduced Costs: Minimizes transaction fees through efficient trade execution and can lower operational costs for traders.

7. Customizability: Offers tailored strategies to fit individual trading styles and risk tolerance.

Using automated trading software can enhance your day trading experience by improving efficiency and effectiveness.

Are there any risks associated with automated trading software?

Yes, there are several risks associated with automated trading software. These include technical failures, such as system crashes or connectivity issues, which can lead to significant losses. Market volatility can cause unexpected price movements, potentially triggering large trades at inopportune times. There's also the risk of relying on flawed algorithms, which might not adapt well to changing market conditions. Additionally, over-optimization can lead to poor performance in live trading. Finally, emotional detachment may result in missed opportunities or failure to react appropriately to market changes.

How can I improve my day trading strategies with software?

To improve your day trading strategies with software, start by selecting a robust trading platform that offers automated trading features. Use algorithmic trading tools to analyze market trends and execute trades based on predefined criteria. Backtest your strategies with historical data to identify strengths and weaknesses. Implement risk management features, like stop-loss orders, to protect your capital. Leverage real-time data feeds for timely decision-making and use customizable alerts to stay informed about market movements. Regularly review and tweak your strategies based on performance analytics provided by the software.

What is the cost of day trading software for automated trading?

The cost of day trading software for automated trading typically ranges from $50 to $500 per month. Some platforms charge a one-time fee of $1,000 to $3,000 for a lifetime license. Additionally, some brokers offer free tools with a trading account, but may have commissions or fees per trade.

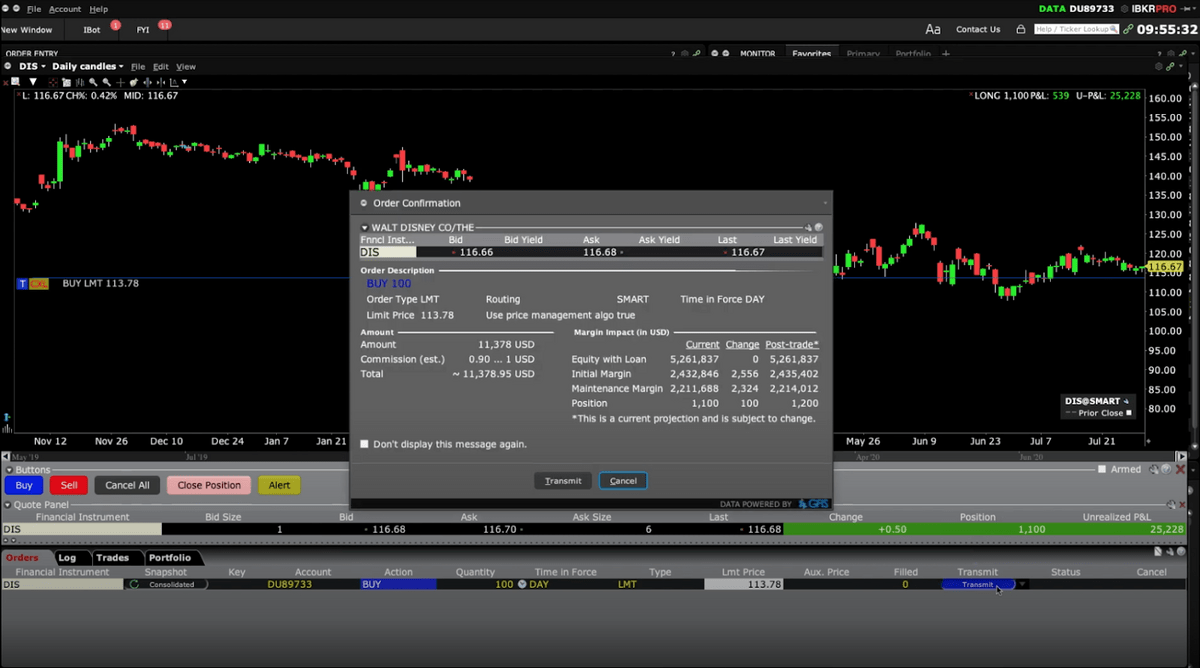

How do I set up automated trading software on my platform?

To set up automated trading software on your platform, follow these steps:

1. Choose Your Software: Select a reputable day trading software that supports automated trading, like MetaTrader, NinjaTrader, or TradeStation.

2. Install the Software: Download and install the software on your computer or access it via a web-based platform.

3. Create an Account: Register for an account with the trading platform if you haven't already. Fund your account as required.

4. Connect to Your Broker: Link the software to your brokerage account through the platform's settings. Ensure your broker supports automated trading.

5. Configure Trading Strategies: Set up your preferred trading strategies within the software. This could involve programming custom algorithms or using pre-built strategies.

6. Backtest the Strategies: Run backtests using historical data to evaluate how your strategies would have performed.

7. Set Risk Management Parameters: Define stop-loss and take-profit levels to manage risk effectively.

8. Activate Automated Trading: Turn on the automated trading feature in the software settings.

9. Monitor Performance: Regularly check your trades and adjust settings as needed to optimize performance.

Following these steps will help you successfully set up automated trading software for day trading.

Can I backtest my trading strategies with automated software?

Yes, you can backtest your trading strategies with automated software. Many day trading platforms offer built-in backtesting features that allow you to simulate trades based on historical data. This helps you evaluate the performance of your strategies before using them in live markets. Look for software that provides robust analytics and the ability to customize parameters for accurate testing.

What are the top trading indicators to use with automated software?

The top trading indicators to use with automated software include:

1. Moving Averages: Helps identify trends and potential reversal points.

2. Relative Strength Index (RSI): Measures momentum and identifies overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Highlights changes in momentum and trend direction.

4. Bollinger Bands: Displays volatility and potential price reversals based on standard deviations.

5. Stochastic Oscillator: Compares a particular closing price to a range of prices over time, indicating overbought or oversold conditions.

6. Fibonacci Retracement Levels: Identifies potential support and resistance levels based on key Fibonacci ratios.

Using these indicators can enhance automated trading strategies by providing clear signals for entry and exit points.

How does algorithmic trading differ from manual day trading?

Algorithmic trading uses computer programs to execute trades based on predefined criteria, making decisions at high speed and efficiency. Manual day trading relies on human judgment and intuition to enter and exit trades. While algorithmic trading can analyze vast amounts of data quickly, manual traders may adapt strategies based on market sentiment and news. Automated trading software enhances algorithmic trading by streamlining processes and reducing emotional biases, whereas manual trading can offer more flexibility and personal insight.

Learn about How Do Institutional Trading Strategies Differ from Individual Trading?

What are common mistakes to avoid when using day trading software?

1. Neglecting Backtesting: Always backtest your strategies before live trading to avoid unexpected losses.

2. Ignoring User Interface: Familiarize yourself with the software's interface; confusion can lead to costly mistakes.

3. Overtrading: Avoid placing too many trades in a short period; it can quickly erode your capital.

4. Not Setting Stop Losses: Failing to set stop losses can result in significant losses during market volatility.

5. Disregarding Market Conditions: Don’t ignore broader market trends; they can impact the effectiveness of your strategy.

6. Skipping Risk Management: Always define your risk tolerance and position sizes to protect your capital.

7. Using Default Settings: Customize settings based on your strategy instead of relying on default configurations.

8. Emotional Trading: Don’t let emotions dictate your trades; stick to your plan to avoid impulsive decisions.

9. Forgetting to Review Performance: Regularly analyze your trading performance to identify and learn from mistakes.

10. Not Keeping Software Updated: Ensure your trading software is up to date to access the latest features and security improvements.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How can I integrate day trading software with my brokerage account?

To integrate day trading software with your brokerage account, follow these steps:

1. Choose Compatible Software: Select day trading software that supports your brokerage's API or integration features.

2. Open API Access: Log into your brokerage account and enable API access, if required. This may involve generating an API key.

3. Install Software: Download and install the day trading software on your device.

4. Configure Settings: In the software, navigate to the settings or configuration section to input your brokerage API key and any necessary credentials.

5. Test Connection: Use the software to test the connection to your brokerage account to ensure it’s working properly.

6. Set Up Trading Strategies: Program your trading strategies within the software based on your day trading goals.

7. Monitor Trades: Once integrated, monitor your trades and adjust settings as needed for optimal performance.

Learn about How can poor risk management ruin a day trading account?

Are there any free day trading software options for beginners?

Yes, there are several free day trading software options for beginners. Some popular choices include:

1. Thinkorswim by TD Ameritrade: Offers a powerful trading platform with extensive educational resources.

2. Webull: Provides commission-free trading and advanced charting tools, ideal for beginners.

3. TradingView: Features free access to charts and social networking for traders, though some advanced features require a subscription.

4. Robinhood: Simple interface for commission-free trading, great for beginners looking to start quickly.

5. MetaTrader 4 (MT4): Widely used for forex trading, it’s free and offers automated trading capabilities.

These platforms provide essential tools for automated trading and are suitable for those just starting out in day trading.

Learn about Best Free Day Trading Software Available

Conclusion about Day Trading Software for Automated Trading

In conclusion, utilizing day trading software for automated trading can significantly enhance your trading efficiency and strategy execution. By selecting the right features and understanding the benefits and risks, traders can leverage technology to optimize their performance. DayTradingBusiness is here to guide you in navigating through the best options available, ensuring you make informed decisions that align with your trading goals. Embrace automation, but always remain mindful of the potential pitfalls to maximize your success in the dynamic world of day trading.

Learn about What legal considerations are there for automated day trading systems?