Did you know that some traders claim they can predict the market's next move just by staring at their screens? While that might be a stretch, having the right day trading software is essential for making informed decisions. In this article, we’ll explore the best day trading software for beginners, focusing on how to choose the right platform, key features to look for, and the importance of charting tools. We’ll also highlight free options, discuss mobile app effectiveness, and address the risks involved. Plus, learn about the top recommended tools, customer support considerations, and how to set up your first account. With insights from DayTradingBusiness, you’ll be well-equipped to navigate the world of day trading software confidently.

What is the best day trading software for beginners?

The best day trading software for beginners includes platforms like TD Ameritrade's Thinkorswim, E*TRADE, and Webull. Thinkorswim offers a robust set of tools and educational resources. E*TRADE has user-friendly features and excellent customer support. Webull provides commission-free trading and a straightforward interface. Consider your trading style and the specific features you need when choosing.

How do I choose the right day trading platform?

To choose the right day trading platform, consider these key factors:

1. User Interface: Look for a platform that's easy to navigate, especially if you're a beginner. A clean, intuitive layout will help you focus on trading.

2. Fees and Commissions: Compare trading fees, commissions, and any hidden costs. Lower fees can significantly impact your profitability.

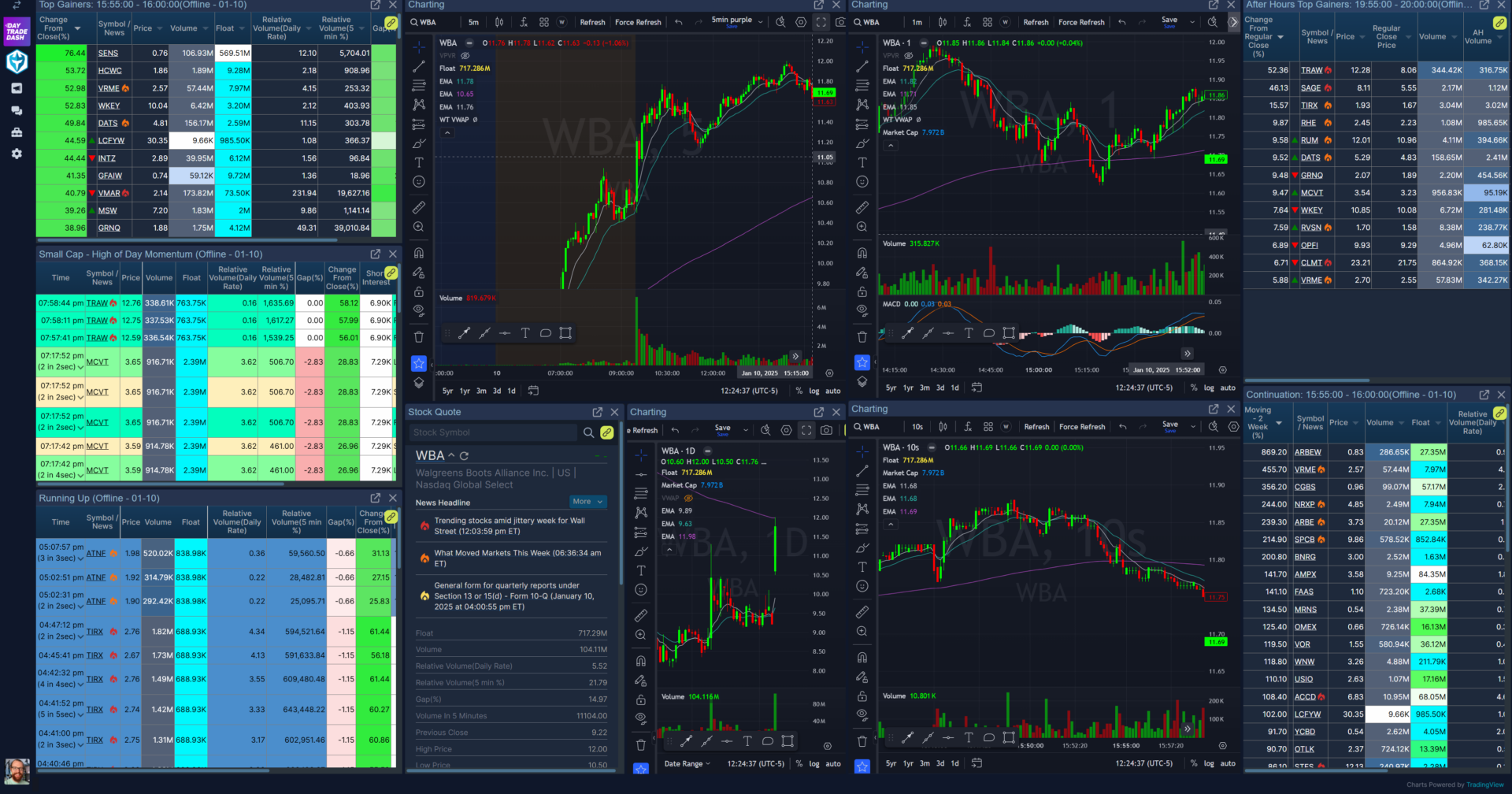

3. Tools and Features: Ensure the platform offers essential tools like real-time data, charting features, and technical indicators, which are crucial for day trading.

4. Customer Support: Opt for a platform with reliable customer service. Quick assistance can be vital when issues arise during trading.

5. Educational Resources: Choose a platform that provides educational materials, tutorials, and webinars to help you learn day trading strategies.

6. Mobile Access: If you plan to trade on the go, ensure the platform has a robust mobile app that mirrors its desktop features.

7. Reputation and Reviews: Research user reviews and ratings to gauge the platform’s reliability and performance.

By focusing on these aspects, you can find the best day trading software that suits your needs as a beginner.

What features should I look for in day trading software?

Look for day trading software that offers real-time data, customizable charts, and straightforward order execution. Ensure it has a user-friendly interface, risk management tools, and access to educational resources. Check for mobile compatibility, low fees, and strong customer support. Integration with brokerages and additional features like backtesting and paper trading can also enhance your experience.

Are there free day trading software options available?

Yes, there are several free day trading software options available for beginners. Some popular choices include:

1. TD Ameritrade's thinkorswim – Offers a powerful trading platform with advanced charting tools and paper trading.

2. TradingView – Provides free access to charts and a social community for sharing trading ideas.

3. Webull – Features commission-free trading, real-time data, and a user-friendly interface.

4. Robinhood – Simple app for commission-free trading, ideal for beginners.

5. MetaTrader 4 (MT4) – Free platform for forex trading with customizable features.

These options can help beginners get started without upfront costs.

How does day trading software help in making profits?

Day trading software helps beginners make profits by providing real-time market data, advanced charting tools, and analytical features. It enables quick trade execution, which is crucial for capitalizing on market fluctuations. Customizable alerts notify traders of significant price movements, allowing them to act swiftly. Additionally, features like backtesting help users develop and refine strategies based on historical data, increasing their chances of success. Overall, the right day trading software simplifies decision-making and enhances trading efficiency.

What are the top day trading software tools recommended for beginners?

The top day trading software tools recommended for beginners include:

1. TD Ameritrade’s thinkorswim – Offers a comprehensive trading platform with educational resources.

2. E*TRADE – User-friendly interface with powerful tools and research options.

3. Interactive Brokers – Low fees and advanced trading features, ideal for those ready to learn.

4. Charles Schwab – Strong research tools and no commission on trades.

5. Webull – Commission-free trading with advanced charting capabilities and a mobile app.

These platforms provide essential features and resources to help beginners build their trading skills.

How important is charting software for day trading?

Charting software is crucial for day trading as it provides real-time data and visual analysis of price movements. It helps traders identify trends, patterns, and entry or exit points. For beginners, effective charting software simplifies complex information, making it easier to make informed decisions quickly. Look for features like customizable indicators, drawing tools, and user-friendly interfaces to enhance your trading experience. Recommended options include TradingView and Thinkorswim, which offer robust charting tools ideal for novice traders.

Can I use mobile apps for day trading effectively?

Yes, you can use mobile apps for day trading effectively. Look for apps that offer real-time data, user-friendly interfaces, and robust charting tools. Popular choices include TD Ameritrade’s thinkorswim, Webull, and Robinhood. These platforms provide features like paper trading, which is great for beginners to practice without risking real money. Ensure the app supports your preferred trading strategies and has low fees to maximize your profits.

What are the risks of using day trading software?

The risks of using day trading software include potential for significant financial loss due to market volatility, reliance on software that may fail or provide inaccurate signals, and the temptation to overtrade based on emotional responses. Additionally, beginners may misinterpret software analytics, leading to poor decision-making. Always conduct thorough research and use demo accounts to practice before committing real capital.

How do I set up my first day trading software account?

To set up your first day trading software account, follow these steps:

1. Research and choose a trading platform that suits beginners, like TD Ameritrade, E*TRADE, or Robinhood.

2. Visit the platform's website and click on "Sign Up" or "Open an Account."

3. Fill out the registration form with your personal information, including name, email, and phone number.

4. Provide financial information, such as your income, net worth, and trading experience.

5. Verify your identity by uploading required documents, like a government-issued ID.

6. Fund your account through bank transfer, wire transfer, or other accepted methods.

7. Download the trading software or app, and log in with your account credentials.

8. Familiarize yourself with the platform’s features, tools, and resources.

9. Start with a demo account if available, to practice trading without risk.

Once you're comfortable, you can begin day trading with real funds.

Learn about How can poor risk management ruin a day trading account?

What is the difference between desktop and web-based trading platforms?

Desktop trading platforms are installed on your computer and typically offer advanced features, faster execution, and more robust tools. They often require a one-time purchase or subscription. Web-based trading platforms, on the other hand, run in a browser, providing accessibility from any device with internet access, but may have fewer features and slower performance. For beginners, web-based platforms can be easier to start with due to their user-friendly interfaces.

How can I test day trading software before committing?

To test day trading software before committing, look for platforms that offer free trials or demo accounts. Sign up for multiple options to compare features, user interface, and tools. Focus on software that provides real-time market data, charting capabilities, and risk management tools. Engage in simulated trading to practice your strategies without financial risk. Check for educational resources and customer support to enhance your learning experience.

Learn about How to Choose the Right Backtesting Software for Day Trading

What are the best indicators to use in day trading software?

The best indicators for day trading software include:

1. Moving Averages: Simple and Exponential Moving Averages help identify trends.

2. Relative Strength Index (RSI): Measures momentum and identifies overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Indicates trend direction and momentum.

4. Bollinger Bands: Shows volatility and potential price reversals.

5. Volume: Confirms trends and price movements based on trading volume.

These indicators help beginners make informed trading decisions.

Learn about How to Use Stochastic Indicators in Day Trading

How does customer support impact my choice of trading software?

Customer support significantly impacts your choice of trading software by ensuring you have immediate assistance when issues arise. Reliable support can help you navigate the software, understand features, and resolve technical problems quickly. Look for platforms that offer 24/7 support, live chat, and comprehensive resources. Good customer service can enhance your trading experience, making it easier for beginners to learn and make informed decisions. Prioritize trading software with strong customer support to avoid frustration and maximize your trading potential.

What should I know about software fees and commissions?

When choosing day trading software for beginners, consider the following about software fees and commissions:

1. Monthly Subscription Fees: Some platforms charge a monthly fee for access. Look for those with free trials to test functionality.

2. Commission Rates: Check the commission per trade. Many platforms now offer commission-free trading, but ensure you understand any hidden fees.

3. Spread Costs: Be aware of the bid-ask spread, which can impact profitability. Lower spreads are generally better for day trading.

4. Inactivity Fees: Some brokers impose fees if you don’t trade within a certain period. Choose a platform with no inactivity fees if you're still learning.

5. Deposit and Withdrawal Fees: Look for software with minimal or no fees for funding your account or withdrawing profits.

6. Data Fees: Real-time market data can come with additional costs. Ensure you know what data fees apply, especially if you need advanced market insights.

7. Education and Tools: Some platforms include educational resources and tools in their fees. Consider these added values when evaluating costs.

Always read the fine print to understand the full cost structure before committing to any software.

Can I integrate day trading software with other financial tools?

Yes, you can integrate day trading software with other financial tools. Many popular day trading platforms, like TradeStation, MetaTrader, and Thinkorswim, offer APIs or built-in features to connect with tools like Excel, charting software, and risk management applications. This integration allows you to analyze data, automate trading strategies, and enhance your overall trading experience.

Conclusion about Best Day Trading Software for Beginners

In summary, choosing the right day trading software is crucial for beginners aiming to navigate the volatile markets effectively. Look for platforms that offer essential features like robust charting tools, user-friendly interfaces, and responsive customer support. Evaluate both free and paid options, and consider testing software through demos to find the best fit. By leveraging the right tools, you can enhance your trading strategy and potentially increase profits. For comprehensive guidance and resources, DayTradingBusiness is here to help you on your trading journey.

Learn about Best Day Trading Software for Beginners