Did you know that some day traders have more caffeine in their system than actual stock? While the caffeine might keep them alert, choosing the right day trading platform is crucial for success. In this article, we dive into the best day trading platforms of 2023, comparing features, fees, and user-friendliness. Discover which platforms excel in order execution speed, mobile accessibility, and asset class diversity. We also explore automated trading capabilities, security features, and the quality of customer support and educational resources. Whether you're a beginner or a high-volume trader, DayTradingBusiness has you covered with insights on real-time data, margin options, and the pros and cons of free versus paid platforms. Get ready to optimize your trading experience!

What are the best day trading platforms in 2023?

The best day trading platforms in 2023 are Thinkorswim by TD Ameritrade for powerful tools and reliability, Interactive Brokers for low costs and global access, and TradingView for user-friendly charts and social trading features.

eToro is popular for social trading and copy trading, while Webull offers commission-free trades and advanced analysis tools.

Each platform excels in specific areas—choose based on your trading style, budget, and need for research tools.

How do top day trading platforms compare in features?

Top day trading platforms in 2023 like TD Ameritrade’s Thinkorswim, Interactive Brokers, and E*TRADE offer advanced charting, real-time data, fast order execution, and customizable tools. Thinkorswim shines with its powerful analysis features and paper trading, while Interactive Brokers provides low commissions and access to global markets. E*TRADE balances user-friendliness with robust research tools. All feature mobile trading, but Thinkorswim and Interactive Brokers excel in technical analysis capabilities.

Which day trading platforms offer the lowest fees and commissions?

Fidelity, Webull, and Interactive Brokers offer the lowest fees and commissions for day trading in 2023. Webull charges zero commissions on stocks and ETFs, with minimal fees on options. Interactive Brokers has low per-share fees and a tiered pricing structure that benefits active traders. Fidelity's commission-free trading applies to stocks and ETFs, with low-cost options trading.

Are there any user-friendly day trading platforms for beginners?

Yes, platforms like eToro, TD Ameritrade's Thinkorswim, and Webull are user-friendly for beginners. They offer intuitive interfaces, educational resources, and demo accounts to practice trading. These platforms simplify complex tools, making them accessible for new day traders.

Which platforms provide the fastest order execution for day trading?

Interactive Brokers and TD Ameritrade offer the fastest order execution for day trading. They have low latency, advanced routing technology, and minimal order delays, making them ideal for quick trades.

What are the top mobile day trading apps in 2023?

The top mobile day trading apps in 2023 are Interactive Brokers, TD Ameritrade’s thinkorswim, E*TRADE, Webull, and TradingView. These platforms offer fast execution, real-time data, and user-friendly interfaces for active traders on the go.

How do day trading platforms differ in charting and analysis tools?

Day trading platforms vary in charting and analysis tools by offering different levels of customization, technical indicators, and real-time data. Some platforms provide advanced charting features like multiple timeframes, drawing tools, and pattern recognition, while others focus on simplicity with basic indicators. The quality of analysis tools—such as volume analysis, trend lines, and oscillators—also differs, impacting how traders spot opportunities. Additionally, integration with news feeds and sentiment analysis can enhance decision-making. Overall, top platforms in 2023 balance user-friendly interfaces with sophisticated charting options for different trading styles.

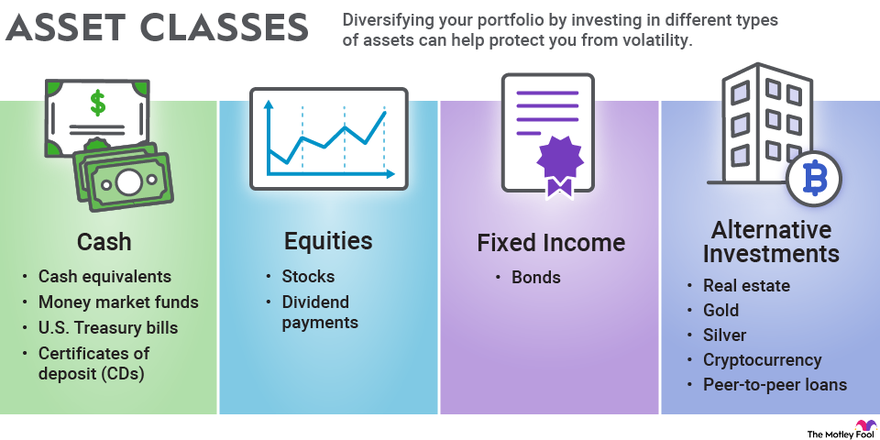

Which platforms support trading multiple asset classes like stocks, options, and cryptocurrencies?

Platforms like Interactive Brokers, TD Ameritrade, and eToro support trading multiple asset classes such as stocks, options, and cryptocurrencies.

Are there any platforms with automated trading capabilities?

Yes, platforms like MetaTrader 4 and 5, NinjaTrader, Thinkorswim by TD Ameritrade, and eToro offer automated trading capabilities with customizable algorithms and copy trading features.

What security features do leading day trading platforms offer?

Leading day trading platforms in 2023 offer security features like two-factor authentication (2FA), encryption of data in transit and at rest, regular security audits, and secure login protocols. They also use firewalls and intrusion detection systems to prevent hacking, store funds in segregated accounts, and comply with regulatory standards like FINRA or SEC requirements. Some platforms include biometric login options for added security.

Learn about Evaluating Security Features in Day Trading Platforms

How do customer support and educational resources vary across platforms?

Customer support on top day trading platforms varies from live chat and phone support to email and FAQ sections, with some offering 24/7 assistance and others limited hours. Educational resources range from comprehensive video tutorials, webinars, and in-depth articles to beginner guides and trading simulators. Platforms like eToro focus on user-friendly tutorials, while Interactive Brokers offer advanced research tools and detailed courses. Overall, some prioritize accessible support for beginners, others cater to experienced traders with extensive educational content.

Which platforms provide the best real-time data and market news?

Thinkorswim, TradingView, and MetaTrader 5 deliver top real-time data and market news. Thinkorswim offers fast updates and in-depth news analysis for active traders. TradingView shines with customizable charts and live news feeds, ideal for quick reactions. MetaTrader 5 provides real-time quotes and integrated news sources, great for forex and futures traders.

What are the pros and cons of free vs. paid day trading platforms?

Free day trading platforms offer no-cost access to basic tools, making them great for beginners or casual traders. They often have limited features, slower execution speeds, and fewer advanced analysis tools. Paid platforms provide more sophisticated charting, faster trade execution, and premium customer support but come with monthly fees. They’re better for active traders needing real-time data and advanced features. Free platforms save money but might hinder performance; paid platforms boost trading efficiency but cost more.

Learn about Pros and Cons of Popular Day Trading Platforms

How do margin and leverage options compare on different platforms?

Margin and leverage options vary widely across day trading platforms. Some platforms offer higher leverage, like 100:1 or even 500:1, while others are more conservative, around 10:1 or 20:1. Margin requirements can range from 1% to 10% or more, depending on the platform and asset class. Platforms like eToro and Interactive Brokers tend to provide flexible margin options with transparent leverage limits. Others, like Robinhood, limit leverage for retail traders, emphasizing simplicity over high leverage. When comparing platforms, check their specific margin policies, leverage caps, and whether they allow margin trading on the assets you're interested in.

Which platforms are most suitable for high-volume or professional traders?

Interactive Brokers and Thinkorswim are the best platforms for high-volume or professional traders in 2023. They offer advanced tools, low commissions, and robust execution speeds. MetaTrader 5 and NinjaTrader also suit professional traders with customizable charts, automation, and high liquidity.

Conclusion about Reviews of the Top Day Trading Platforms in 2023

In summary, selecting the right day trading platform in 2023 involves evaluating features, fees, execution speed, and available tools. Each platform has unique strengths, whether catering to beginners or professional traders. Consider your trading style and needs when making a choice. For comprehensive insights and assistance, trust DayTradingBusiness to guide you through the best options available.

Learn about FAQs About Day Trading Platforms

Sources:

- All-to-All Trading in the U.S. Treasury Market

- Small-Cap and Large-Cap Stocks and the Herding Phenomenon ...

- Artificial intelligence techniques in financial trading: A systematic ...

- World Bank Open Data | Data

- Forecasting day-ahead electricity prices: A review of state-of-the-art ...

- Global Financial Stability Report, April 2023: A Financial System ...