Did you know that some traders can juggle more assets than a circus performer juggles balls? In the fast-paced world of day trading, multi-asset platforms offer the flexibility to trade various asset classes all in one place. This article dives deep into multi-asset day trading platforms, covering what they are, how they differ from single-asset platforms, and the types of assets you can trade. We’ll also explore essential features to look for, the suitability for beginners, security measures, costs, and whether you can manage multiple asset classes from a single account. Additionally, we’ll discuss the importance of real-time data, the tools available, regulatory concerns, order types, and the inherent risks of multi-asset trading. Finally, we’ll highlight some of the best multi-asset platforms for day traders. Join us as we unpack everything you need to know about maximizing your trading potential with DayTradingBusiness.

What is a multi-asset day trading platform?

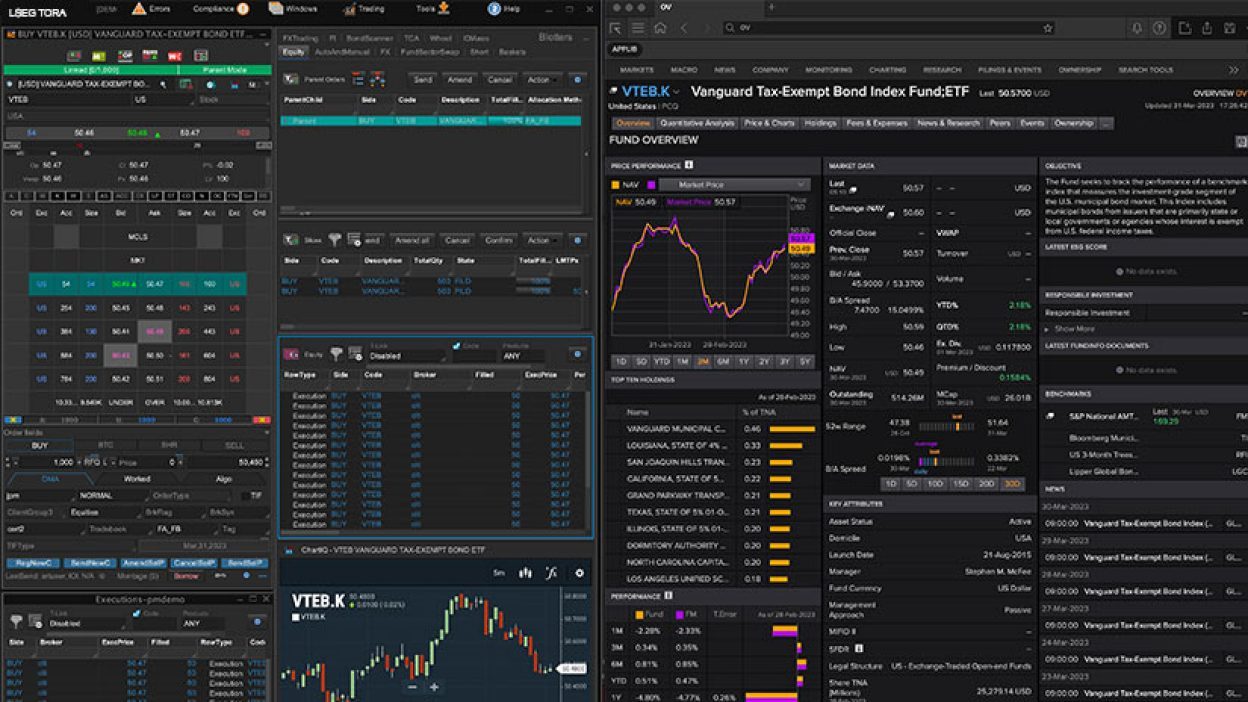

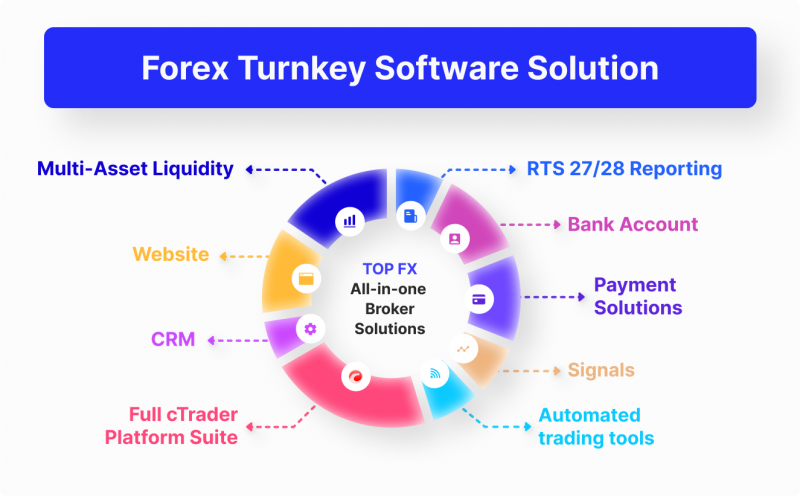

A multi-asset day trading platform lets traders buy and sell different asset classes—like stocks, forex, commodities, and cryptocurrencies—on one interface. It provides real-time data, advanced tools, and fast execution across markets, so traders can switch between assets quickly. This platform streamlines day trading by combining multiple markets in a single, user-friendly environment.

How do multi-asset platforms differ from single-asset platforms?

Multi-asset platforms let traders access stocks, forex, commodities, and cryptocurrencies in one place, streamlining diversified trading. Single-asset platforms focus solely on one market, like stocks or forex, limiting exposure but offering specialized tools. Multi-asset platforms provide broader market opportunities and integrated analysis, while single-asset platforms often deliver deeper, more tailored features for that specific asset class.

Which assets can you trade on a multi-asset platform?

On a multi-asset day trading platform, you can trade stocks, forex, commodities, indices, ETFs, cryptocurrencies, and options.

What features should I look for in a multi-asset trading platform?

Look for real-time data, advanced charting tools, quick order execution, and a wide range of assets like stocks, forex, commodities, and cryptocurrencies. Ensure the platform offers robust risk management features, customizable interfaces, and reliable customer support. Integration with analytical tools, mobile access, and low trading fees are also key for effective multi-asset day trading.

Are multi-asset platforms suitable for beginners?

Multi-asset platforms can be suitable for beginners if they offer user-friendly interfaces, educational resources, and simplified trading tools. However, their complexity and variety of assets may overwhelm new traders without proper guidance. It's best if beginners start with platforms that provide demo accounts and clear tutorials.

How secure are multi-asset trading platforms?

Multi-asset trading platforms vary in security, but reputable ones use strong encryption, two-factor authentication, and regular security audits. They often partner with regulated brokers, adding extra safety layers. However, risks like hacking or fraud exist, so choose platforms with transparent security measures and a good track record. Always use strong passwords and enable all available security features.

What are the costs associated with multi-asset trading platforms?

Costs for multi-asset trading platforms include commissions or spreads on trades, platform fees or subscriptions, data feed charges, and possibly margin interest. Some platforms charge a flat fee, while others take a percentage or per-trade fee. Additional costs can come from premium market data, advanced analytics, and order execution fees.

Can I use a single account across multiple asset classes?

Yes, you can use a single account across multiple asset classes on multi-asset day trading platforms. These platforms allow you to trade stocks, forex, commodities, and cryptocurrencies within one account, providing flexibility and streamlined management of diverse assets.

How do multi-asset platforms handle real-time data?

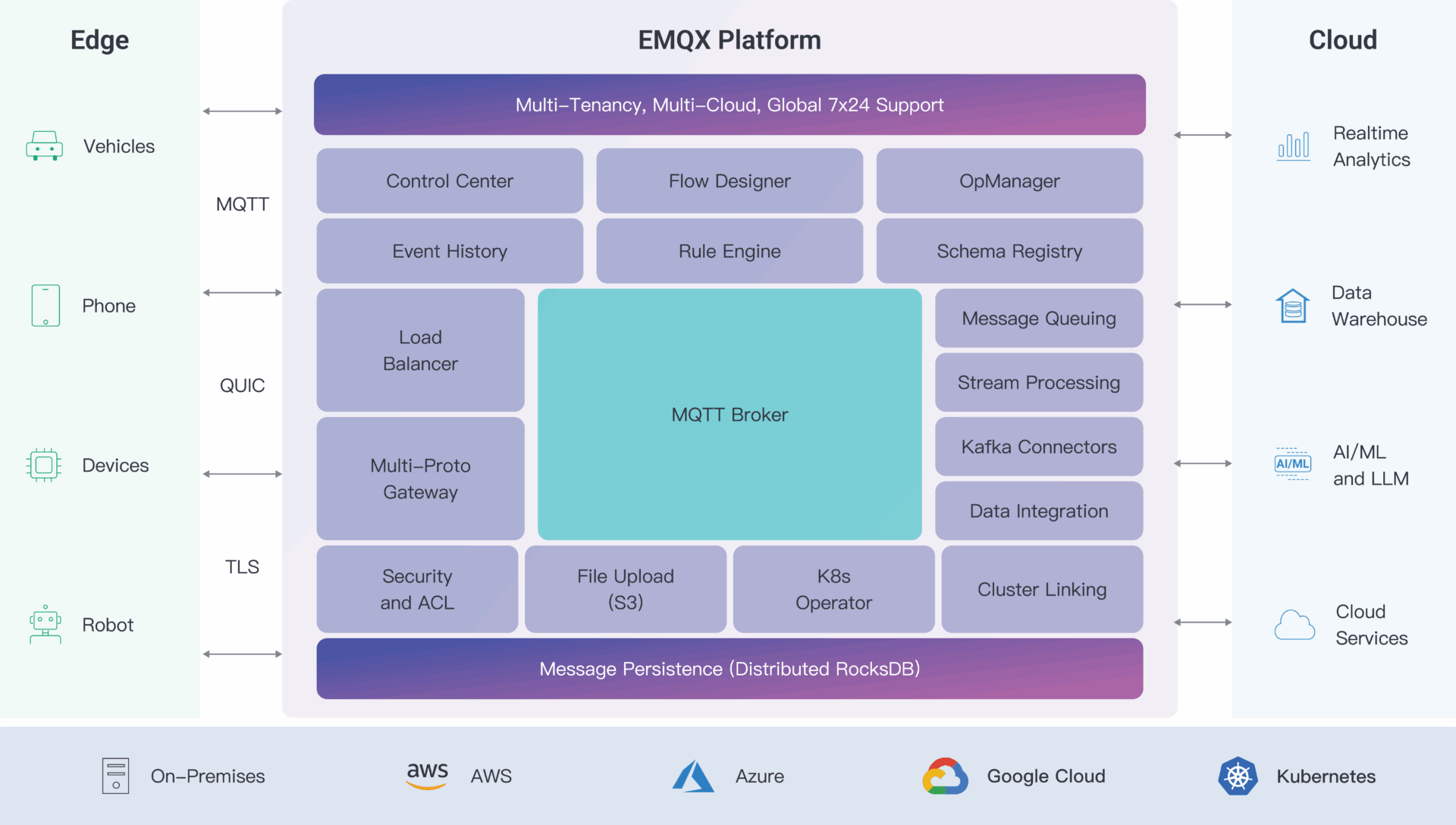

Multi-asset platforms handle real-time data by streaming live prices, news, and market updates across asset classes instantly. They use high-speed data feeds from exchanges and data providers, ensuring traders see the latest information without delay. Advanced APIs and low-latency infrastructure optimize data delivery, enabling quick decision-making for day trading across stocks, forex, commodities, and crypto.

What tools and analytics do multi-asset platforms offer?

Multi-asset day trading platforms offer tools like real-time market data, advanced charting, technical analysis indicators, and customizable dashboards. They include risk management features such as stop-loss and take-profit orders. Analytics encompass performance tracking, trade history, and profit-loss reports. Some platforms also provide sentiment analysis, economic calendars, and news feeds to inform quick decisions.

Are multi-asset platforms regulated?

Yes, multi-asset platforms are regulated in many jurisdictions. They must comply with financial authorities like the SEC in the US, FCA in the UK, or ASIC in Australia, depending on where they operate. Regulations ensure transparency, client protection, and market integrity. Always check if the specific platform is licensed by a recognized regulator before trading.

How do order types work on multi-asset platforms?

On multi-asset platforms, order types like market, limit, and stop-loss let you buy or sell different assets—stocks, Forex, crypto—using specific instructions. A market order executes immediately at current prices, while a limit order sets a target price for buying or selling. Stop-loss orders automatically trigger a sell to limit losses once the asset hits a set price. These order types work across assets, allowing seamless trading without switching platforms. You can set complex orders combining different types for multi-asset strategies, ensuring your trades execute precisely as planned.

What are the risks of multi-asset day trading?

Risks of multi-asset day trading include high volatility, rapid market movements, and the potential for significant financial loss. It requires quick decision-making, which can lead to errors. Diversification across assets increases complexity, making it harder to manage risk effectively. Leverage amplifies losses if trades go against you. Market gaps can cause slippage, and emotional stress might lead to impulsive trades. Additionally, unpredictable news or events can cause sudden price swings across multiple assets.

Can I automate trading on a multi-asset platform?

Yes, you can automate trading on a multi-asset platform using algorithms, expert advisors, or API integrations. These platforms support automated strategies across stocks, forex, commodities, and cryptocurrencies simultaneously.

How do multi-asset platforms support risk management?

Multi-asset platforms support risk management by offering integrated tools like real-time analytics, customizable alerts, and diversified portfolio tracking. They allow traders to quickly rebalance assets, set stop-loss and take-profit orders across asset classes, and monitor correlated risks. With centralized data, traders can spot potential drawdowns early and adjust positions promptly, reducing exposure. These platforms also provide stress testing and scenario analysis to evaluate potential losses under different market conditions.

What are the best multi-asset platforms for day traders?

Interactive Brokers and TD Ameritrade's Thinkorswim are top multi-asset platforms for day traders. They offer real-time data, advanced charting, and fast order execution across stocks, options, futures, and forex. MetaTrader 5 also supports multiple asset classes and is popular for forex and CFDs. NinjaTrader provides multi-asset trading with robust analytics and automation tools. These platforms combine speed, flexibility, and comprehensive asset coverage ideal for active day traders.

Conclusion about Multi-Asset Day Trading Platforms Explained

In summary, multi-asset day trading platforms provide diverse trading opportunities, offering a range of features tailored to both beginners and experienced traders. These platforms enhance flexibility, allowing users to trade various assets from a single account while ensuring robust security and real-time data access. As you explore your options, consider factors like costs, regulation, and risk management tools to find the best fit for your trading needs. For comprehensive insights and guidance, DayTradingBusiness remains your trusted resource in navigating the complexities of multi-asset trading.

Learn about FAQs About Day Trading Platforms

Sources:

- Not all traders gamble, but some gamblers trade: a latent class ...

- Brokerage - an overview | ScienceDirect Topics

- October 2015 GFSR Chapter 2: Market Liquidity—Resilient or ...

- Cryptocurrency trading, gambling and problem gambling ...

- A profitable trading algorithm for cryptocurrencies using a Neural ...