Did you know that choosing a day trading platform is almost as crucial as picking the right pair of socks for a marathon—get it wrong, and you might be left with blisters instead of profits? In this guide, we break down everything you need to know about selecting the ideal day trading platform. From essential features and commission structures to mobile app usability and security measures, we cover the key factors that will enhance your trading experience. You’ll also learn how to compare platforms, find the best options for beginners, and assess user interfaces. Plus, we’ll discuss the importance of customer support, payment methods, and leveraging tools. With insights from DayTradingBusiness, you’ll be well-equipped to navigate the trading landscape and avoid common pitfalls along the way.

What Features Should I Look for in a Day Trading Platform?

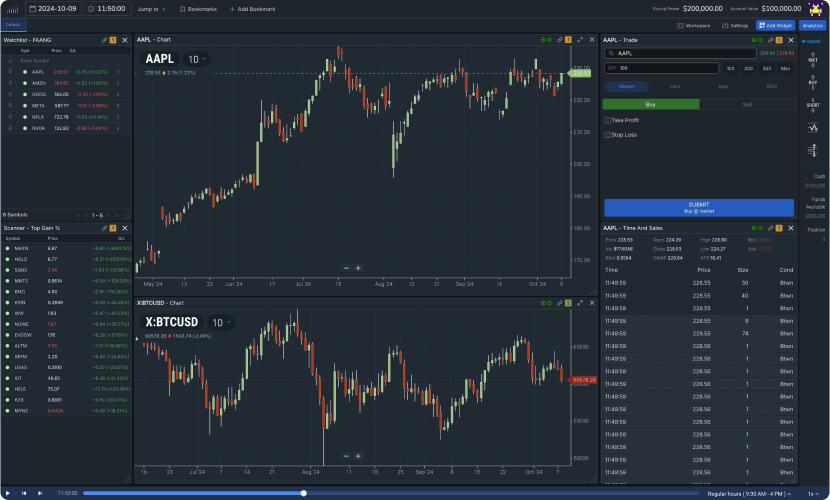

When choosing a day trading platform, look for these key features:

1. Low Commissions: Check for competitive fees to maximize your profits.

2. Real-Time Data: Ensure the platform offers live market data for accurate trading decisions.

3. Advanced Charting Tools: Look for customizable charts that help analyze market trends.

4. User-Friendly Interface: A clean, intuitive layout makes trading more efficient.

5. Risk Management Tools: Features like stop-loss orders are essential for protecting your capital.

6. Order Execution Speed: Fast execution minimizes slippage and enhances trading effectiveness.

7. Mobile Access: A reliable mobile app allows you to trade on the go.

8. Research and Analysis: Access to market research and analysis tools can inform your strategies.

9. Customer Support: Responsive support is crucial for quick issue resolution.

10. Regulatory Compliance: Ensure the platform is regulated for security and trustworthiness.

These features will help you trade effectively and manage your risks.

How Do I Compare Day Trading Platforms?

To compare day trading platforms, consider the following key factors:

1. Fees and Commissions: Look at trading fees, commissions, and any hidden costs.

2. User Interface: Evaluate ease of use and navigation; a clean, intuitive design is crucial.

3. Trading Tools: Check for advanced charting tools, technical analysis features, and research resources.

4. Execution Speed: Assess the platform’s order execution speed and reliability during peak hours.

5. Asset Variety: Ensure the platform offers a wide range of securities, including stocks, options, and ETFs.

6. Customer Support: Test responsiveness and availability of support channels.

7. Mobile Access: If you trade on the go, ensure the mobile app is robust and user-friendly.

8. Regulatory Compliance: Verify that the platform is regulated and has a good reputation in the industry.

By focusing on these areas, you can find a day trading platform that suits your trading style and needs.

What Are the Best Day Trading Platforms for Beginners?

The best day trading platforms for beginners include:

1. TD Ameritrade – Offers a user-friendly interface and extensive educational resources.

2. E*TRADE – Features powerful trading tools and easy navigation for new traders.

3. Robinhood – Great for commission-free trading and a simple app experience.

4. Fidelity – Provides research tools and a solid reputation for customer service.

5. Charles Schwab – Combines a user-friendly platform with a wealth of learning materials.

Choose a platform based on ease of use, educational support, and low fees to kickstart your day trading journey.

How Important Is Commission Structure in Day Trading Platforms?

Commission structure is crucial in day trading platforms because it directly impacts your profitability. Lower commissions mean you keep more of your gains, especially since day traders execute multiple trades daily. Compare fees across platforms to find the most cost-effective option. Look for platforms that offer competitive rates and consider how commissions affect your trading strategy. A favorable commission structure can significantly enhance your overall trading performance.

Can I Use a Mobile App for Day Trading?

Yes, you can use a mobile app for day trading. When choosing the right day trading platform, look for features like real-time data, charting tools, and strong security. Ensure the app has a user-friendly interface and supports your preferred trading strategy. Check for low commission fees and good customer support. Popular options include TD Ameritrade, E*TRADE, and Robinhood. Test the app with a demo account if possible before committing.

What Security Measures Should Day Trading Platforms Have?

Day trading platforms should have robust security measures, including two-factor authentication (2FA), encryption of sensitive data, regular security audits, and secure payment methods. Look for platforms that offer real-time monitoring for suspicious activities and provide insurance for account protection. Ensure they comply with regulatory standards and have a clear privacy policy to safeguard your personal information.

How Do Trading Tools and Analytics Affect My Choice?

Trading tools and analytics significantly influence your choice of a day trading platform by providing essential data and insights. Look for features like real-time charts, technical indicators, and customizable dashboards that suit your trading style. Access to news feeds and market analysis can enhance decision-making. A platform that integrates backtesting tools allows you to evaluate strategies before risking real money. Ultimately, the right tools can improve your execution speed and help you identify opportunities more effectively. Choose a platform that aligns with your trading needs and offers the analytics you trust.

Are There Any Free Day Trading Platforms Available?

Yes, there are free day trading platforms available. Popular options include Robinhood, Webull, and Thinkorswim by TD Ameritrade. These platforms offer commission-free trading, user-friendly interfaces, and essential tools for day traders. When choosing a platform, consider factors like ease of use, available market data, and customer support.

What Customer Support Options Should I Expect?

When choosing a day trading platform, expect these customer support options:

1. Live Chat: Immediate assistance during trading hours.

2. Phone Support: Direct contact with support agents for urgent issues.

3. Email Support: For non-urgent questions and detailed inquiries.

4. Help Center/FAQs: Self-service resources for common issues.

5. Webinars/Tutorials: Training sessions to understand platform features.

Evaluate the availability and responsiveness of these options to ensure you get the help you need when trading.

How Do I Evaluate the User Interface of a Trading Platform?

To evaluate the user interface of a trading platform, focus on these key aspects:

1. Ease of Navigation: Check if you can quickly find tools and features you need.

2. Charting Tools: Look for customizable charts that display data clearly and allow for technical analysis.

3. Order Execution: Test how easily you can place trades and manage orders; speed and simplicity matter.

4. Mobile Compatibility: Assess the mobile app for functionality and user experience.

5. Customization Options: Determine if you can tailor the layout and features to suit your trading style.

6. Help and Support: Ensure there’s accessible help, tutorials, or customer support for any questions.

Use a demo account to explore these elements in practice before committing.

What Payment Methods Do Day Trading Platforms Accept?

Day trading platforms typically accept various payment methods, including bank transfers, credit and debit cards, and electronic wallets like PayPal and Skrill. Some may also allow cryptocurrency deposits. When choosing a platform, check for fees associated with each payment method, transaction speeds, and security measures.

How Can Reviews Help Me Choose a Day Trading Platform?

Reviews can help you choose a day trading platform by providing insights into user experiences, highlighting features, and revealing strengths and weaknesses of different platforms. They can inform you about factors like fees, ease of use, order execution speed, and customer support. Look for reviews that discuss specific tools you need, such as charting features or mobile access, and pay attention to ratings from traders with similar goals. This information can guide you to a platform that aligns with your trading style and needs.

Learn about How to Choose the Best Prop Firm for Day Trading

What Is the Role of Leverage in Day Trading Platforms?

Leverage in day trading platforms allows traders to control larger positions with a smaller amount of capital. It amplifies potential gains but also increases the risk of significant losses. Choosing a day trading platform with the right leverage involves assessing your risk tolerance and strategy. Look for platforms that offer customizable leverage options, enabling you to adjust based on market conditions. Ensure you understand the margin requirements and fees associated with using leverage. A balanced approach to leverage can enhance your trading effectiveness while managing risk.

Learn about What role does leverage play in day trading success?

How Do I Assess the Reliability of a Day Trading Platform?

To assess the reliability of a day trading platform, check for these key factors:

1. Regulation: Ensure the platform is regulated by a reputable authority like the SEC or FINRA.

2. User Reviews: Look for reviews and testimonials from other traders regarding their experiences.

3. Security Features: Verify the platform’s security measures, including encryption and two-factor authentication.

4. Trade Execution Speed: Test the speed of trade execution and how it handles high-volume trading.

5. Customer Support: Evaluate the availability and responsiveness of customer service.

6. Fees and Commissions: Analyze the fee structure for hidden costs that could affect your profitability.

7. User Interface: Consider the ease of use and functionality of the platform’s interface.

By focusing on these aspects, you can determine if a day trading platform is dependable and suitable for your trading needs.

Learn about How to Integrate AI with My Day Trading Platform?

What Are the Common Mistakes to Avoid When Choosing a Trading Platform?

1. Ignoring Fees: Don’t overlook commissions and spreads; high fees can erode profits quickly.

2. Overlooking User Experience: A complicated interface can hinder your trading efficiency.

3. Neglecting Research Tools: Ensure the platform offers robust charts and analysis features for informed decisions.

4. Not Testing the Platform: Skipping a demo account means missing out on understanding platform functionality.

5. Failing to Check Execution Speed: Slow trade execution can lead to missed opportunities and losses.

6. Underestimating Customer Support: Weak support can be problematic during crucial trading moments.

7. Choosing Based on Popularity: Don’t just follow trends; assess if the platform aligns with your trading style and needs.

8. Ignoring Security: Ensure the platform is regulated and has strong security measures to protect your funds.

Learn about Common Mistakes in Day Trading Analysis to Avoid

How Do I Transition Between Different Day Trading Platforms?

To transition between different day trading platforms, follow these steps:

1. Research Options: Identify platforms that suit your trading style, fees, and tools.

2. Create Accounts: Open accounts on your new platform while keeping your old one active.

3. Transfer Funds: Move your capital to the new platform, ensuring it supports your trading strategy.

4. Familiarize Yourself: Spend time learning the new platform’s interface and features.

5. Test the Waters: Start with small trades to build confidence in the new system.

6. Close Old Account: Once comfortable, close your old account if desired.

Choose a platform that aligns with your trading goals for a smooth transition.

Learn about How to Adapt Day Trading Patterns to Different Markets

Conclusion about How to Choose the Right Day Trading Platform

Selecting the right day trading platform is crucial for your success in the market. Prioritize features such as commission structure, security measures, and user-friendly interfaces to enhance your trading experience. Utilize reviews and comparisons to narrow down your options, especially if you’re a beginner. Remember, a platform that fits your trading style and offers robust tools can make all the difference. For more insights and guidance on choosing the best platform for your trading needs, rely on DayTradingBusiness.

Learn about How to Choose the Right Backtesting Software for Day Trading

Sources:

- Gambling and online trading: emerging risks of real-time stock and ...

- Excessive trading, a gambling disorder in its own right? A case study ...

- What is the best proxy for liquidity in the presence of extreme ...

- The cross-section of speculator skill: Evidence from day trading ...

- Institutional trading and alternative trading systems - ScienceDirect

- Traders' Broker Choice, Market Liquidity and Market Structure