Did you know that some day traders spend more on fees than they do on coffee? In the world of day trading, choosing the right platform with low fees can significantly impact your profitability. This article explores the best day trading platforms that minimize costs, compares them to higher-fee options, and highlights essential features to consider. We'll also dive into hidden fees, ways to reduce costs, and top-rated platforms for beginners. Plus, discover how fees vary across asset classes and what user reviews reveal about these platforms. Join us at DayTradingBusiness to uncover the secrets to maximizing your trading potential while keeping expenses in check.

What are the best day trading platforms with the lowest fees?

The best day trading platforms with the lowest fees include:

1. Robinhood – Commission-free trading with no account minimum.

2. Webull – No commissions on trades, and extended hours trading available.

3. Fidelity – Zero commission on stocks and ETFs, with robust research tools.

4. Charles Schwab – No trading fees, plus a wide range of investment options.

5. TD Ameritrade – Commission-free trading with powerful trading tools.

These platforms offer low fees, making them ideal for day traders looking to maximize profits.

How do low-fee day trading platforms compare to others?

Low-fee day trading platforms often offer lower commissions and tighter spreads, making them cost-effective for frequent traders. They may lack advanced tools and research features found in higher-priced platforms. However, many provide essential functionalities like real-time data and charting tools. The choice depends on your trading style; if you prioritize low costs, these platforms are ideal, but if you need comprehensive analysis tools, consider those with higher fees.

What features should I look for in a low-fee day trading platform?

Look for these features in a low-fee day trading platform:

1. Low Commissions: Ensure the platform offers minimal or zero commissions on trades.

2. Tight Spreads: Check for competitive spreads on assets to reduce overall trading costs.

3. No Hidden Fees: Watch for account maintenance or withdrawal fees that can add up.

4. Advanced Charting Tools: Look for robust charting and analysis tools for informed trading.

5. Fast Execution Speed: Prioritize platforms known for quick trade execution to capitalize on market movements.

6. User-Friendly Interface: Choose a platform that is intuitive and easy to navigate for efficient trading.

7. Mobile Trading Capabilities: Ensure it offers a reliable mobile app for trading on the go.

8. Research and Educational Resources: Access to market research and educational content can enhance your trading skills.

9. Customer Support: Good support can help resolve issues quickly.

These features will help you maximize profitability while minimizing costs in day trading.

Are there any hidden fees in low-cost day trading platforms?

Yes, low-cost day trading platforms can have hidden fees. Common hidden fees include charges for certain types of trades, account maintenance fees, withdrawal fees, and costs associated with margin trading. Always read the fine print and check the fee schedule before choosing a platform to avoid surprises.

How can I minimize costs when using a day trading platform?

To minimize costs on a day trading platform, choose one with low commission fees or zero-commission trading. Look for platforms that offer tight spreads and no account maintenance fees. Utilize a broker that provides free access to trading tools and research, which can help you make informed decisions without extra costs. Consider platforms with low margin rates if you plan to trade on margin. Always compare platforms for hidden fees like withdrawal charges or inactivity fees.

What are the top-rated low-fee day trading platforms for beginners?

The top-rated low-fee day trading platforms for beginners include:

1. Robinhood – No commission fees on trades and user-friendly interface.

2. Webull – Commission-free trades with advanced charting tools.

3. TD Ameritrade – No commission on stock trades, extensive educational resources.

4. Fidelity – Zero commissions on U.S. stocks and ETFs, solid research tools.

5. Charles Schwab – Commission-free trading and strong customer support.

These platforms offer low fees and are suitable for new traders looking to get started.

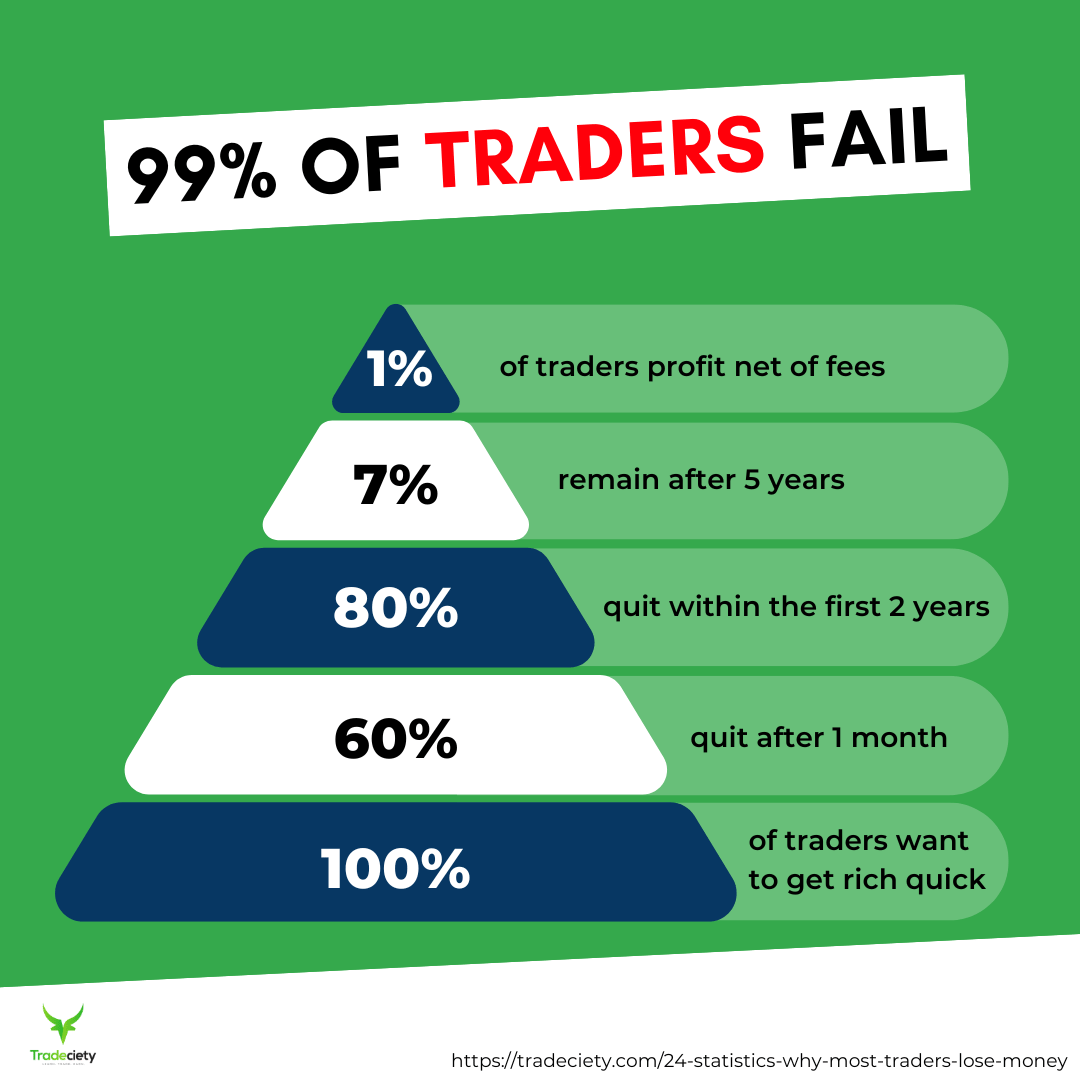

How do trading fees affect my overall profitability?

Trading fees directly reduce your overall profitability by decreasing your net gains from each trade. High fees can eat into profits, making it harder to achieve a positive return. For day traders, frequent buying and selling means these costs accumulate quickly. Choosing day trading platforms with the lowest fees can significantly enhance your profitability, allowing more of your gains to remain in your pocket. Look for platforms that offer low commissions, tight spreads, and minimal account fees to maximize your returns.

What are the advantages of using low-fee trading platforms?

Low-fee trading platforms offer several advantages for day traders. First, they reduce overall trading costs, allowing you to keep more profit from each trade. Lower fees mean you can execute more trades without worrying about diminishing returns. These platforms often provide access to advanced tools and features without the burden of high commissions. Additionally, low-fee platforms can enhance your trading strategy by enabling quicker entry and exit points, which is crucial in day trading. Lastly, many of these platforms have user-friendly interfaces, making it easier for traders to navigate and execute trades efficiently.

Can I find commission-free day trading platforms?

Yes, you can find commission-free day trading platforms. Popular options include Robinhood, Webull, and Charles Schwab. These platforms offer commission-free trades on stocks and ETFs, making them ideal for day trading with low fees. Always check for other fees, like spreads or account minimums, before choosing a platform.

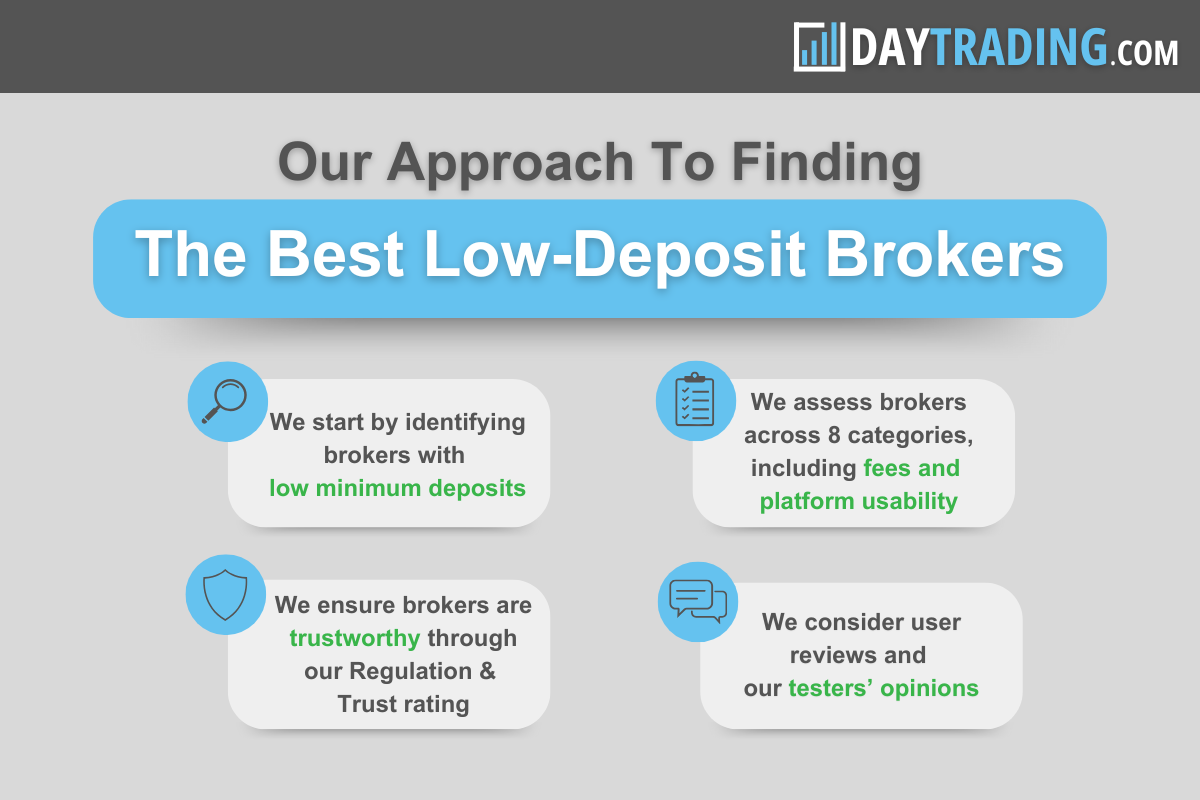

How do I choose a low-fee platform that suits my trading style?

To choose a low-fee platform for day trading, start by comparing commission structures. Look for platforms that offer zero-commission trades or low per-trade fees. Evaluate their margin rates and any hidden costs, like withdrawal fees. Check for fast execution speeds and reliable customer support, which are crucial for day trading. Make sure the platform provides advanced charting tools and real-time data that match your trading style. Finally, read user reviews and consider demo accounts to test the interface before committing.

Learn about How to Choose the Right Day Trading Platform

What platforms offer the lowest spreads for day trading?

Platforms that offer the lowest spreads for day trading include:

1. TD Ameritrade: Known for competitive spreads on major stocks and ETFs.

2. Interactive Brokers: Offers low spreads, especially for high-volume traders.

3. Charles Schwab: Provides tight spreads with no commission on many trades.

4. eToro: Features low spreads on cryptocurrencies and forex.

5. Robinhood: Offers commission-free trading with tight spreads on stocks.

Check each platform for current rates, as spreads can vary by asset and market conditions.

Are there any low-fee platforms for mobile day trading?

Yes, several low-fee platforms for mobile day trading include Robinhood, Webull, and TD Ameritrade's thinkorswim. Robinhood offers commission-free trades on stocks and ETFs, while Webull provides no commissions and a robust mobile app. TD Ameritrade has low fees and advanced trading tools. Consider checking their fee structures for specific details.

How do trading fees vary between different asset classes?

Trading fees vary by asset class due to differences in market structure and liquidity. For stocks, fees are generally lower, often a fixed commission or zero commission on many platforms. Options typically have a per-contract fee, which can add up. Forex trading usually involves spreads rather than commissions, making it cost-effective for high-frequency trading. Futures often have lower fees due to standardized contracts, but exchange fees can apply. Cryptocurrencies may have varying fees depending on the platform, including trading fees and withdrawal fees. Check each platform’s fee structure for specifics related to the asset class you're interested in.

What are the most common fees associated with day trading platforms?

The most common fees associated with day trading platforms include:

1. Commission Fees: Charged per trade, these can vary widely among platforms.

2. Spread: The difference between the buying and selling price of a security, which can affect your profits.

3. Inactivity Fees: Some platforms charge if you don’t trade for a certain period.

4. Withdrawal Fees: Fees that may apply when you transfer funds out of your trading account.

5. Data Fees: Charges for real-time market data, which can be essential for day trading.

6. Margin Fees: Costs associated with borrowing funds to trade on margin.

Choosing a platform with low or no commissions, minimal spreads, and no inactivity fees can significantly reduce your overall trading costs.

Learn about What Are the Most Common Myths About Day Trading Bots?

How do promotions and offers affect trading fees on platforms?

Promotions and offers can significantly reduce trading fees on platforms. Many brokers provide limited-time promotions that offer zero-commission trades or reduced fees for specific assets. These incentives can lower your overall trading costs, making it cheaper to execute multiple trades. Additionally, some platforms reward loyal customers with fee discounts based on trading volume or account balance. Always check the terms of these offers, as they can vary widely and impact your day trading profitability.

What user reviews say about low-fee day trading platforms?

User reviews of low-fee day trading platforms highlight several key points. Many traders appreciate the cost savings, noting that lower fees enhance their profitability. Users often mention the ease of use and intuitive interfaces of these platforms, making trading more accessible. Speed and reliability in executing trades are frequently praised, with users emphasizing the importance of quick transactions in day trading. However, some reviews caution about limited customer support and fewer advanced tools compared to higher-fee platforms. Overall, traders enjoy the balance of affordability and functionality but stress the need for robust support and features.

Learn about User Reviews of Popular Day Trading Brokers

Conclusion about Day Trading Platforms with the Lowest Fees

In summary, choosing a day trading platform with low fees is crucial for maximizing your profitability. By comparing features, understanding potential hidden costs, and selecting a platform that aligns with your trading style, you can significantly reduce your expenses. Commission-free and low-spread options are available, particularly for mobile traders. Always consider user reviews and promotions to make an informed decision. For ongoing insights and support on navigating these platforms, DayTradingBusiness is here to help you optimize your trading experience.

Learn about FAQs About Day Trading Platforms

Sources:

- Gambling and online trading: emerging risks of real-time stock and ...

- The cross-section of speculator skill: Evidence from day trading ...

- All-to-All Trading in the U.S. Treasury Market

- Institutional trading and alternative trading systems - ScienceDirect

- The anatomy of a fee change — evidence from cryptocurrency markets