Did you know that the first recorded stock trade took place in 1602 when the Dutch East India Company issued its shares? Fast forward to today, and options trading has become a thrilling way to capitalize on market movements. In this guide, we’ll dissect the best day trading platforms for options, highlighting key features like low fees, reliability, and advanced trading tools. Whether you’re a beginner or a seasoned trader, we’ll cover everything from mobile trading capabilities to security measures and customer support. With insights from DayTradingBusiness, you’ll be equipped to make informed decisions and maximize your trading potential.

What are the best day trading platforms for options?

The best day trading platforms for options include Thinkorswim by TD Ameritrade, Interactive Brokers, E*TRADE Pro, and TradeStation. They offer advanced charting, fast order execution, and real-time data crucial for options day trading. Thinkorswim is popular for its powerful tools and paper trading. Interactive Brokers provides low commissions and global access. E*TRADE Pro offers a user-friendly interface with robust options analytics. TradeStation excels in customizable platforms and quick trade execution.

How do I choose a reliable options trading platform?

Look for platforms with a strong reputation in options trading, low commissions, and fast execution. Ensure they offer advanced charting tools, real-time data, and a user-friendly interface. Check if they have robust security measures and responsive customer support. Read reviews from other options traders to confirm reliability and stability. Prioritize platforms that provide educational resources and demo accounts to test features before committing.

Which platforms offer the lowest fees for options trading?

Interactive Brokers and TD Ameritrade offer some of the lowest fees for options trading. Interactive Brokers charges per contract with no base fee, often making it cheaper for high-volume traders. TD Ameritrade’s thinkorswim platform has competitive per-contract fees and no account minimums. Both platforms are popular choices for cost-conscious options day traders.

What features should I look for in an options trading platform?

Look for real-time quotes, advanced charting tools, quick order execution, customizable options chains, risk management features, and options strategies. Ensure it offers reliable data, low latency, and user-friendly interface for fast decision-making. Integration with your brokerage account and educational resources are also key.

Are there platforms dedicated to day trading options?

Yes, platforms like Thinkorswim, Interactive Brokers, and E*TRADE Power E*TRADE are dedicated to day trading options.

How do I compare the trading tools on different options platforms?

Check each platform’s features like real-time data, charting tools, and order types. Look for user reviews about ease of use and reliability. Test their demo accounts if available to see how tools perform in actual trading. Compare costs such as commissions, spreads, and platform fees. Evaluate the variety of options contracts and advanced analytics offered. Consider platform stability during volatile market conditions.

What are the top platforms for real-time options data?

Top platforms for real-time options data include Thinkorswim by TD Ameritrade, Interactive Brokers, E*TRADE, Tradestation, and Tastyworks.

Which platforms provide the best options analytics and charts?

Thinkorswim by TD Ameritrade, Interactive Brokers, and E*TRADE offer the best options analytics and advanced charting tools for day trading options.

Can I day trade options on mobile platforms?

Yes, you can day trade options on mobile platforms. Many brokerages offer mobile apps with real-time data, fast order execution, and tools designed for active options trading. Platforms like TD Ameritrade's thinkorswim, E*TRADE, and Robinhood support day trading options on smartphones. Just ensure your chosen app provides the necessary features, and check if your broker allows pattern day trading rules on mobile.

What platforms support advanced options strategies?

Thinkorswim, Interactive Brokers, tastyworks, Tradestation, and E*TRADE support advanced options strategies.

Are demo accounts available for testing options platforms?

Yes, many options trading platforms offer demo accounts for testing their features and strategies before risking real money.

How secure are options trading platforms?

Options trading platforms vary in security; reputable ones use encryption, two-factor authentication, and regular security audits. Major platforms like TD Ameritrade or E*TRADE have strong security measures, but risks exist with online trading—protect your account with strong passwords and monitor for suspicious activity. Always choose regulated platforms to ensure compliance with financial authorities.

Which platforms offer the fastest order execution for options?

Thinkorswim by TD Ameritrade and Interactive Brokers offer the fastest order execution for options. They prioritize low latency and high-speed trading, making them ideal for day trading options.

What are the best platforms for beginner options traders?

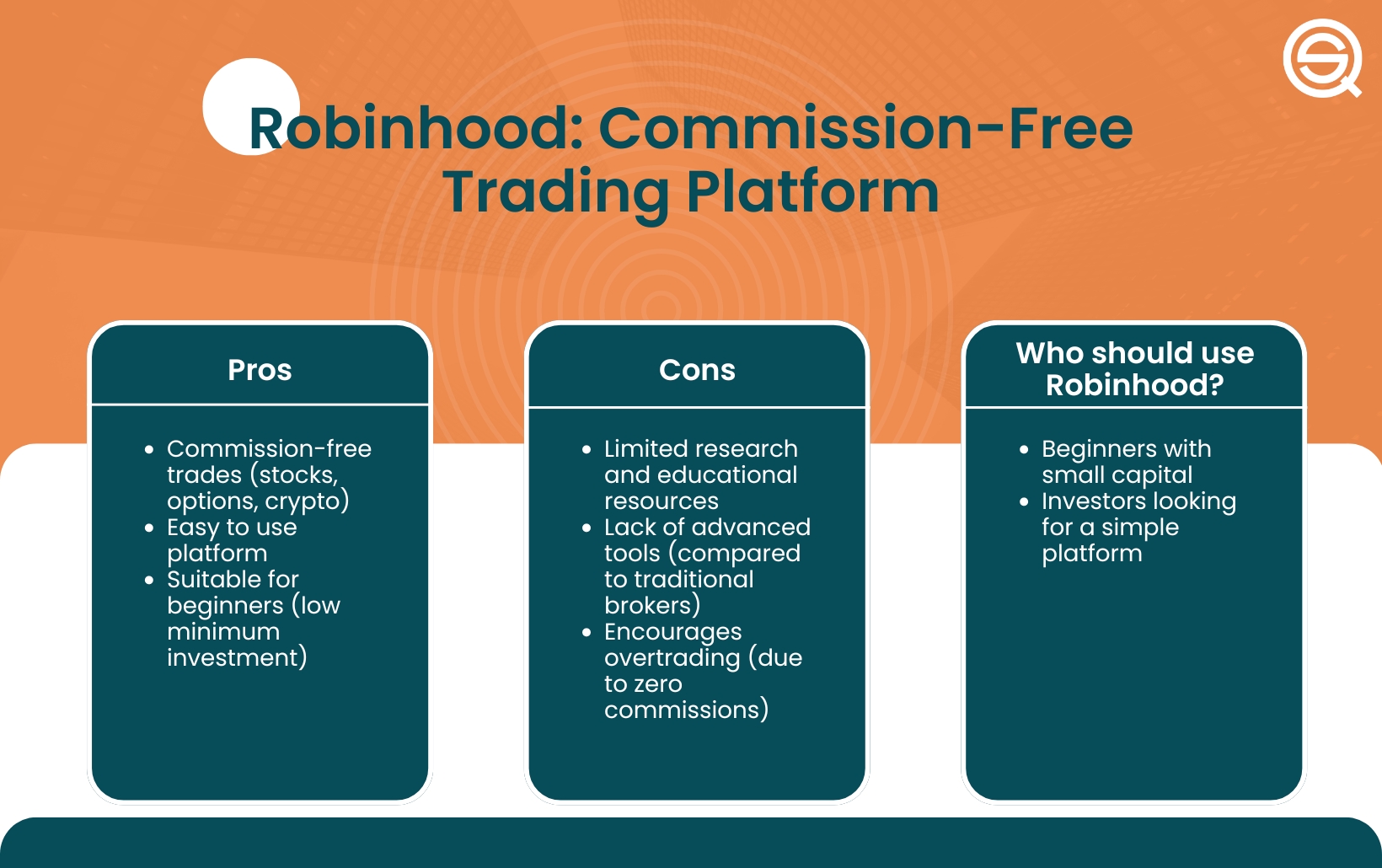

Thinkorswim by TD Ameritrade, E*TRADE, and Robinhood are top platforms for beginner options traders. They offer user-friendly interfaces, educational resources, and simple order execution. Thinkorswim provides advanced tools but is still accessible for learners. Robinhood has a straightforward app perfect for starting out. E*TRADE balances ease of use with solid options trading features.

Do different platforms support various options expiry types?

Yes, different platforms support various options expiry types, including standard monthly, weekly, and even custom expiration dates, catering to diverse day trading strategies.

How do I evaluate customer support on options trading platforms?

Test their responsiveness with quick questions, see how clear their explanations are, and check for knowledgeable support during market hours. Read reviews to find recurring issues or praise about their help. Try reaching out via chat or email to gauge response time and quality. Look for platforms with support teams experienced in options trading, not just general customer service. Good customer support should guide you through complex options strategies and resolve issues promptly.

Conclusion about Day Trading Platforms for Options Trading

In conclusion, selecting the right day trading platform for options trading hinges on several key factors, including fees, features, reliability, and customer support. It's crucial to compare platforms based on their tools, analytics, and security measures to find the best fit for your trading style. Platforms that offer demo accounts can be particularly beneficial for testing before committing. For comprehensive guidance and insights into these platforms, exploring resources from DayTradingBusiness will enhance your decision-making and trading success.

Learn about FAQs About Day Trading Platforms

Sources:

- The Obligations and Regulatory Challenges of Online Broker ...

- Does information drive trading in option strategies? - ScienceDirect

- A Case for Broadening Retail Access to Private Markets | CFA ...

- Securing passive liquidity: The impact of Europe's first asymmetric ...

- Competition, interlisting and market structure in options trading ...

- Investors with too many options?