Did you know that even your favorite sports teams rely on statistics to improve their game? Just like in sports, backtesting tools are crucial for day traders looking to enhance their trading strategies. This article dives into the essentials of backtesting tools, explaining what they are and how they can refine your trading approach. You'll learn about key features to consider, the data required for effective backtesting, and how these tools can help identify trading patterns and minimize risks. We’ll also explore common pitfalls, the differences between backtesting and paper trading, and the best tools available for day traders. By the end, you'll have a comprehensive understanding of how to leverage backtesting tools for better trading outcomes, courtesy of DayTradingBusiness.

What are backtesting tools for day trading?

Backtesting tools for day trading include platforms like TradingView, MetaTrader, and Thinkorswim. These tools allow traders to simulate trading strategies using historical data. You can analyze performance metrics, optimize parameters, and refine your approach before risking real capital. Key features to look for are customizable indicators, automated strategy testing, and detailed reporting. Using these tools helps identify successful patterns and improves your decision-making in live trading.

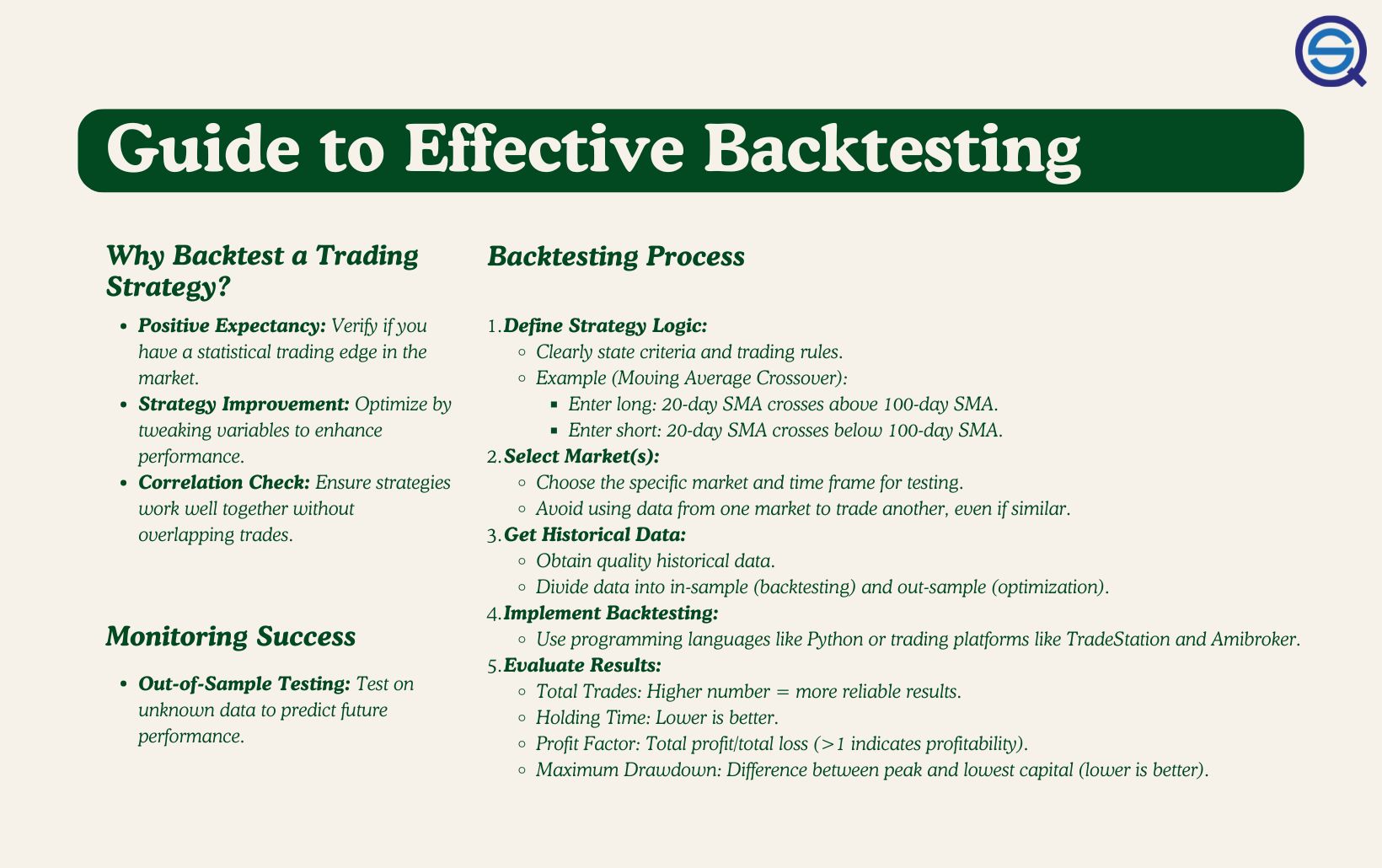

How do backtesting tools improve trading strategies?

Backtesting tools improve trading strategies by allowing traders to simulate their strategies against historical market data. This process reveals how a strategy would have performed in the past, helping identify strengths and weaknesses. By analyzing metrics like win rates and drawdowns, traders can refine their strategies before risking real capital. Additionally, backtesting helps traders understand market conditions and optimize entry and exit points, ultimately increasing the likelihood of success in day trading.

What features should I look for in a backtesting tool?

Look for these key features in a backtesting tool for day trading:

1. Data Access: Ensure it provides historical data for various assets.

2. Strategy Testing: It should allow you to test multiple strategies simultaneously.

3. Customizability: Look for tools that let you define your own indicators and parameters.

4. Performance Metrics: Check for detailed reports on returns, drawdowns, and win rates.

5. User Interface: A clean, intuitive interface makes it easier to analyze results.

6. Real-time Simulation: Ability to simulate trades in real-time conditions.

7. Integration: Ensure it can connect with your trading platform for seamless execution.

8. Community Support: Access to forums or user communities can help solve issues quickly.

These features will enhance your backtesting experience and improve your day trading strategies.

How can I set up a backtesting tool for day trading?

To set up a backtesting tool for day trading, follow these steps:

1. Choose a Platform: Select a trading platform that offers backtesting features, such as TradingView, MetaTrader, or Thinkorswim.

2. Define Your Strategy: Clearly your trading strategy, including entry and exit points, risk management, and the specific indicators you'll use.

3. Gather Historical Data: Ensure you have access to historical price data for the assets you want to test. Most platforms provide this data.

4. Input Your Strategy: Use the platform’s interface to input your trading rules, specifying conditions for buys and sells based on your defined strategy.

5. Run the Backtest: Execute the backtest over your chosen time frame, allowing the tool to simulate trades based on historical data.

6. Analyze Results: Review the performance metrics provided, such as win rate, profit factor, and drawdown. Adjust your strategy based on the insights gained.

7. Refine and Repeat: Make necessary adjustments to your strategy and backtest again to ensure consistent results.

By following these steps, you can effectively set up and utilize a backtesting tool to refine your day trading strategy.

What data do I need for effective backtesting?

For effective backtesting in day trading, you need historical price data, including open, high, low, and close prices. Additionally, volume data is crucial. Ensure you have a well-defined trading strategy with entry and exit rules. Incorporate risk management parameters like stop-loss and take-profit levels. Finally, make sure your data covers a relevant time frame to capture various market conditions.

How does backtesting help identify trading patterns?

Backtesting helps identify trading patterns by analyzing historical data to see how a specific strategy would have performed in the past. It allows traders to test various parameters and optimize their approach, revealing which patterns consistently yield profitable results. By examining past trades, traders can spot recurring trends, validate their strategies, and adjust their risk management. This process enhances confidence in their trading decisions and improves overall strategy effectiveness.

Can backtesting tools predict future market movements?

Backtesting tools cannot predict future market movements with certainty, but they can help identify patterns and strategies that have worked historically. By analyzing past price data, you can assess how a trading strategy might perform under similar conditions. This insight can guide your decision-making in day trading, but always remember that market conditions can change. Use backtesting as a way to refine your approach, not as a guarantee of future success.

What are the limitations of using backtesting tools?

Backtesting tools have several limitations for day trading. First, they rely on historical data, which may not accurately predict future performance due to market changes. Second, they often assume perfect execution and ignore slippage, commissions, and fees, leading to overly optimistic results. Third, they can be influenced by curve fitting, where strategies are tailored too closely to past data, reducing effectiveness in real market conditions. Additionally, backtesting doesn't account for psychological factors that affect trading decisions. Lastly, it may not incorporate sudden market events or news that can drastically impact prices.

How do I interpret backtesting results?

To interpret backtesting results for day trading, focus on these key metrics:

1. Net Profit: Check total gains minus losses to assess overall strategy effectiveness.

2. Win Rate: Calculate the percentage of profitable trades; a higher win rate suggests a more reliable strategy.

3. Risk-Reward Ratio: Examine the ratio of average profit per trade to average loss; aim for at least 2:1.

4. Maximum Drawdown: Look at the largest peak-to-trough decline; lower drawdowns indicate better risk management.

5. Sharpe Ratio: Evaluate return relative to risk; a higher Sharpe ratio means better risk-adjusted performance.

Analyze these metrics together to gauge your strategy's viability in real market conditions. Adjust your approach based on what the data reveals.

What are the best backtesting tools for day traders?

The best backtesting tools for day traders include:

1. TradingView – Offers powerful charting tools, extensive historical data, and a user-friendly interface for creating and testing strategies.

2. MetaTrader 4/5 – Widely used platforms with built-in testing capabilities, allowing for automated strategy testing with expert advisors.

3. NinjaTrader – Provides advanced backtesting features and real-time simulation, ideal for active day trading.

4. Amibroker – Known for its flexibility and speed, it allows for complex strategies and comprehensive performance analytics.

5. ThinkOrSwim – Offers a robust thinkScript language for custom strategy development and backtesting.

Choose a tool that aligns with your trading style and technical needs for optimal results.

Learn about Best Tools for Day Trading Backtesting

How can I use backtesting to minimize risk?

Use backtesting to minimize risk in day trading by analyzing historical price data and testing your trading strategy under various market conditions. Start by selecting a backtesting tool that allows you to input your strategy parameters. Run simulations to see how your strategy would have performed in the past, focusing on metrics like drawdown and win rate. Identify patterns and adjust your strategy based on the results to improve performance. Use stop-loss orders and position sizing based on the backtest outcomes to further limit risk. Regularly update your backtesting as market conditions change to ensure ongoing effectiveness.

How often should I backtest my trading strategies?

Backtest your trading strategies regularly, ideally after every significant market change or strategy adjustment. If you’re day trading, consider backtesting weekly or monthly to ensure your strategies remain effective. Frequent backtesting helps you adapt to market conditions and refine your approach.

What common mistakes should I avoid in backtesting?

1. Ignoring slippage: Always account for slippage in your trades, as it affects real-world execution.

2. Overfitting the strategy: Don't tailor your strategy too closely to past data; it may not perform well in the future.

3. Lack of proper risk management: Ensure you include stop-loss orders and position sizing in your backtesting.

4. Using unrealistic assumptions: Avoid assuming perfect market conditions; include factors like commissions and spreads.

5. Testing on limited data: Use a diverse dataset that covers various market conditions for a comprehensive analysis.

6. Neglecting to validate: Always validate your strategy with out-of-sample data to check its robustness.

7. Focusing solely on profits: Look at other metrics like drawdown and win-loss ratio to evaluate your strategy's overall performance.

How does backtesting differ from paper trading?

Backtesting involves testing a trading strategy against historical data to see how it would have performed, while paper trading simulates trading in real-time without using actual money. Backtesting analyzes past market conditions, whereas paper trading allows you to practice executing trades in current markets without financial risk. Backtesting helps refine strategies based on historical outcomes, while paper trading tests execution and decision-making skills in live scenarios.

Learn about How Do Institutional Trading Strategies Differ from Individual Trading?

Can I automate my day trading strategies using backtesting tools?

Yes, you can automate your day trading strategies using backtesting tools. These tools allow you to test your trading strategies on historical data to evaluate their performance. You can set parameters for entry and exit points, risk management, and other factors. Once you identify a successful strategy, you can automate the execution through trading platforms that support algorithmic trading. Popular backtesting tools include MetaTrader, TradingView, and Amibroker.

Learn about How to Automate Your Day Trading Backtesting Process

How do I validate my backtesting results for accuracy?

To validate your backtesting results for accuracy, follow these steps:

1. Use Multiple Data Sources: Compare results using different data providers to check for consistency.

2. Check for Overfitting: Ensure your strategy is not tailored too closely to historical data. Use out-of-sample testing to confirm performance.

3. Run Monte Carlo Simulations: Test your strategy under various market conditions to assess robustness.

4. Analyze Performance Metrics: Look at key metrics like Sharpe ratio, drawdown, and win/loss ratio to gauge reliability.

5. Paper Trade: Implement your strategy in a live market environment without real capital to see if results hold up.

6. Seek Peer Review: Share your methodology with experienced traders for feedback and insights.

These steps help ensure your backtesting results are valid and can be trusted for day trading decisions.

Conclusion about How to Use Backtesting Tools for Day Trading

Incorporating backtesting tools into your day trading routine can significantly enhance your trading strategies and decision-making process. By analyzing historical data, you can identify effective patterns, minimize risks, and optimize your approach for future trades. However, it’s essential to understand the limitations and common pitfalls of backtesting to ensure accurate results. Regularly validating and refining your strategies with reliable backtesting tools will ultimately lead to more informed trading decisions. Leverage the insights offered by DayTradingBusiness to master these tools and elevate your trading game.

Learn about How to Use Backtesting to Improve Your Day Trading Performance

Sources:

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- The Fed - Banks' Backtesting Exceptions during the COVID-19 ...

- Forecasting value at risk with intra-day return curves - ScienceDirect

- Trading with Time Series Causal Discovery: An Empirical Study

- TradingAgents: Multi-Agents LLM Financial Trading Framework

- Statistical Overfitting and Backtest Performance by David H. Bailey ...