Did you know that the average day trader spends about 6 hours a day staring at charts, which is longer than most cats sleep in a day? In this article, we’ll explore the essential tools that can make or break your day trading experience. From must-have trading software to the best mobile apps for trading on the go, we’ll delve into the features that enhance your strategy and improve your success rate. Discover how charting tools, stock scanners, and risk management software can elevate your trading game. We’ll also highlight the importance of real-time market data, trading journals, and social trading networks. Plus, find out how to choose the right broker and leverage automated trading systems to your advantage. Let’s dive into the world of day trading tools and see how DayTradingBusiness can help you make informed trading decisions!

What are the must-have tools for day trading?

The must-have tools for day trading include a reliable trading platform, real-time market data feeds, a quality charting software, and a robust internet connection. Additionally, consider using a stock screener, a news aggregator for market updates, and a broker with low commissions. Risk management tools, like stop-loss orders, are essential too. Finally, having a good calculator for quick calculations can streamline your trading decisions.

How does trading software improve day trading success?

Trading software improves day trading success by providing real-time data, advanced charting tools, and automated trading features. It enables quick execution of trades, minimizes human error, and offers analytical tools for better market insights. With customizable alerts and risk management features, traders can react swiftly to market changes, enhancing their overall performance. Additionally, these platforms often include backtesting capabilities, allowing traders to refine their strategies based on historical data.

What features should I look for in day trading platforms?

Look for these key features in day trading platforms:

1. Real-time Data: Ensure access to live market data with minimal lag.

2. Advanced Charting Tools: Check for customizable charts and technical indicators.

3. Order Execution Speed: Prioritize platforms with fast order processing to capitalize on market movements.

4. Risk Management Tools: Look for stop-loss and take-profit orders to manage risk effectively.

5. User-Friendly Interface: Choose a platform that is intuitive and easy to navigate.

6. Mobile Access: Ensure the platform has a reliable mobile app for trading on the go.

7. Research and Analysis: Find platforms that offer market research, news feeds, and analysis tools.

8. Commission Structure: Compare fees to ensure you're getting value without excessive costs.

9. Customer Support: Opt for platforms with responsive support for troubleshooting.

These features will enhance your day trading experience and improve your chances of success.

How can charting tools enhance my trading strategy?

Charting tools enhance your trading strategy by providing visual insights into price movements and trends. They help you identify key support and resistance levels, allowing for better entry and exit points. With indicators like moving averages and RSI, you can gauge market momentum and make informed decisions. Customizable charts let you analyze different time frames, improving your adaptability to market changes. Overall, they facilitate quicker analysis and increase your confidence in executing trades.

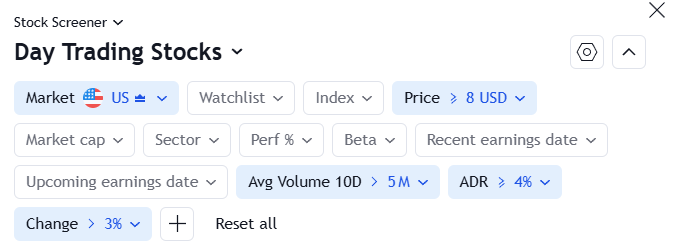

What role do stock scanners play in day trading?

Stock scanners identify stocks that meet specific criteria for day trading, such as price movement, volume, and technical indicators. They help traders quickly spot potential buying or selling opportunities, enabling faster decision-making and execution. By filtering through thousands of stocks, scanners save time and highlight stocks that are more likely to be profitable in a short timeframe. This can lead to better entries, exits, and overall trading efficiency.

How important is risk management software for day traders?

Risk management software is crucial for day traders. It helps protect capital by setting stop-loss orders, managing position sizes, and analyzing potential losses. Without it, traders may expose themselves to significant financial risks. Effective risk management tools also provide real-time analytics, enabling quick decision-making and minimizing emotional trading. Overall, using risk management software enhances trading discipline and increases the chances of long-term profitability.

Which mobile apps are best for day trading on the go?

The best mobile apps for day trading on the go include:

1. TD Ameritrade Mobile – Offers comprehensive tools and real-time data.

2. E*TRADE Mobile – User-friendly interface with advanced charting features.

3. Webull – Commission-free trading and robust analytics.

4. Robinhood – Simple interface for commission-free trades, ideal for beginners.

5. Fidelity Mobile – Strong research tools and reliable performance tracking.

6. Charles Schwab – Great for access to research and educational resources.

7. Thinkorswim by TD Ameritrade – Advanced trading tools for serious traders.

Choose based on your trading style and the features you value most.

How can news feeds impact my day trading decisions?

News feeds can significantly impact your day trading decisions by providing real-time updates on market trends, economic indicators, and company news. They help you react quickly to relevant events, such as earnings reports or geopolitical developments, which can cause stock price fluctuations. By staying informed, you can identify trading opportunities and avoid potential losses. Integrating a reliable news feed into your trading strategy allows you to make well-informed decisions and adjust your positions based on the latest information.

What is the significance of real-time market data in day trading?

Real-time market data is crucial in day trading because it provides instant access to price movements, volume changes, and market trends. This information enables traders to make quick decisions, capitalize on short-term opportunities, and manage risks effectively. Accurate, up-to-the-second data helps identify entry and exit points, ensuring trades align with current market conditions. Without real-time data, traders are at a disadvantage, as delays can lead to missed opportunities or increased losses.

How do trading journals help improve day trading performance?

Trading journals help improve day trading performance by providing a structured way to analyze your trades. They allow you to track entries, exits, and strategies, helping identify patterns in your successes and mistakes. By reviewing your emotional responses and decision-making processes, you can pinpoint areas for improvement. This reflection fosters discipline and enhances strategy adjustments, ultimately leading to more informed trading decisions.

Learn about How Market Microstructure Insights Improve Day Trading Accuracy

What tools can assist in technical analysis for day trading?

Key tools for technical analysis in day trading include:

1. Charting Software: Platforms like TradingView and MetaTrader offer advanced charting capabilities, allowing for real-time analysis of price movements.

2. Technical Indicators: Use indicators such as Moving Averages, RSI, and MACD to identify trends and potential reversal points.

3. Stock Screeners: Tools like Finviz and Screener.co help filter stocks based on specific criteria, making it easier to find trading opportunities.

4. News Aggregators: Services like Benzinga and MarketWatch provide up-to-date news that can impact stock prices, essential for making informed decisions.

5. Backtesting Software: Tools like Amibroker allow you to test trading strategies against historical data to see how they would have performed.

6. Trading Journals: Keeping a journal using software like Edgewonk helps track trades, analyze performance, and improve strategies over time.

7. Social Trading Platforms: Websites like eToro allow you to follow and replicate the trades of successful traders, providing insights into effective strategies.

Learn about Best Technical Analysis Tools for Day Traders

How can I use social trading networks effectively?

To use social trading networks effectively, start by choosing platforms with strong communities and user activity. Follow experienced traders and analyze their strategies, focusing on their performance metrics. Engage with the community by asking questions and sharing insights to build your network. Use the platform's tools to track trends and sentiment, and consider copying trades from top performers while managing your risk. Regularly review your own trades and adapt your strategy based on feedback and market changes.

What are the best brokers for day trading tools?

The best brokers for day trading tools include:

1. TD Ameritrade – Offers thinkorswim platform with advanced charting, research tools, and real-time data.

2. Interactive Brokers – Known for low fees and a powerful Trader Workstation with extensive features for analysis.

3. E*TRADE – Provides a user-friendly platform with solid mobile access and educational resources.

4. Charles Schwab – Features StreetSmart Edge, which has customizable tools and robust analytics.

5. Fidelity – Offers comprehensive research and a solid trading platform suitable for various strategies.

Choose based on your specific needs, like fees, tools, and support.

Learn about Day Trading Brokers with the Best Trading Platforms

How do automated trading systems work for day traders?

Automated trading systems for day traders use algorithms to execute trades based on predefined criteria. These systems analyze market data, identify trading opportunities, and enter or exit positions without human intervention. Traders set parameters like entry/exit points, risk levels, and trade size. The software monitors the market in real-time, ensuring fast execution and minimizing emotional decision-making. Popular tools include trading platforms like MetaTrader and Thinkorswim, which integrate these systems for strategy testing and execution.

Learn about How Does Insider Trading Affect Day Traders?

What are the key indicators to include in my trading toolkit?

Key indicators to include in your day trading toolkit are:

1. Moving Averages: Use the 50-day and 200-day for trend direction.

2. Relative Strength Index (RSI): Identify overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Spot momentum shifts.

4. Bollinger Bands: Gauge volatility and potential price reversals.

5. Volume: Confirm trends and breakout strength.

6. Fibonacci Retracement Levels: Identify potential support and resistance levels.

7. Stochastic Oscillator: Assess momentum and potential reversal points.

Incorporate these indicators to enhance your trading decisions and strategy.

How can I select the right broker based on my trading tools?

To select the right broker based on your trading tools, first identify the specific tools you need, such as charting software, real-time data feeds, or technical analysis tools. Then, evaluate brokers based on their platform capabilities, fees, and available features. Look for brokers that offer customizable interfaces, advanced order types, and integration with third-party trading tools. Check for user reviews and demo accounts to test the platform before committing. Ensure the broker provides adequate customer support for your trading tools.

Learn about How to Select a Day Trading Broker

Conclusion about Essential Day Trading Tools You Need

Incorporating the right tools is essential for successful day trading. From advanced trading software and charting tools to stock scanners and risk management systems, each component plays a critical role in enhancing your trading strategy and performance. To maximize your potential, consider integrating mobile apps for trading on the go, leveraging real-time market data, and utilizing trading journals for ongoing improvement. By selecting the best brokers and tools tailored to your needs, you can position yourself for success in the dynamic world of day trading. DayTradingBusiness is here to provide the insights and support you need to navigate these tools effectively.

Learn about Essential Tools for Order Flow Analysis in Day Trading