Did you know that the average day trader spends more time analyzing charts than a barista perfecting their latte art? Understanding how to use charts effectively is crucial for managing day trading risk. In this article, we dive into the best types of charts for risk management, including the advantages of candlestick and volume charts. You'll learn how indicators, trend lines, and support and resistance levels can enhance your risk control. We also cover common chart mistakes to avoid and how to set effective stop-loss levels. Discover how chart analysis can prevent emotional trading decisions and improve your overall strategy with tools for real-time monitoring and backtesting. With insights from DayTradingBusiness, you'll be well-equipped to navigate the complexities of day trading risk.

What are the best types of charts for day trading risk management?

The best charts for day trading risk management are candlestick charts, volume charts, and heat maps. Candlestick charts show real-time price action and reversals, helping you spot entry and exit points quickly. Volume charts indicate trading activity, revealing the strength behind price moves and potential reversals. Heat maps visualize market activity across multiple assets, helping you assess risk exposure efficiently. Use these charts together to monitor volatility, confirm signals, and control your trades actively.

How can candlestick charts help identify trading risks?

Candlestick charts reveal market sentiment and potential reversals, helping traders spot risky setups early. They show patterns like doji, hammer, or engulfing candles that warn of trend reversals or indecision, reducing the chance of entering bad trades. By analyzing candlestick formations, traders can set tighter stop-loss levels and avoid holding onto losing positions. Overall, they provide visual cues about market volatility and potential price swings, helping manage day trading risk effectively.

What indicators should I use with charts to manage risk?

Use support and resistance levels, trend lines, and volatility indicators like ATR (Average True Range). Add moving averages to identify trend direction. Incorporate volume to confirm price moves. Use RSI or Stochastic to spot overbought or oversold conditions. These help set stop-loss and take-profit points and gauge potential risk.

How do volume charts assist in risk assessment?

Volume charts show how much of a stock is traded at specific prices, helping identify strong buying or selling activity. They reveal market interest and potential reversals, indicating when a trend may weaken or strengthen. High volume during a price move confirms momentum, while low volume suggests hesitation or potential reversal. Using volume charts, traders spot entry and exit points, manage stop-loss placement, and avoid false signals, reducing overall risk in day trading.

How can trend lines improve risk control in day trading?

Trend lines help identify market direction, signaling when to enter or exit trades. They highlight support and resistance levels, showing potential reversal points. Using trend lines, traders can set stop-loss orders just beyond these lines, reducing losses. They also confirm breakout or breakdown signals, allowing for timely adjustments. Overall, trend lines provide visual cues to avoid false moves and manage risk more effectively.

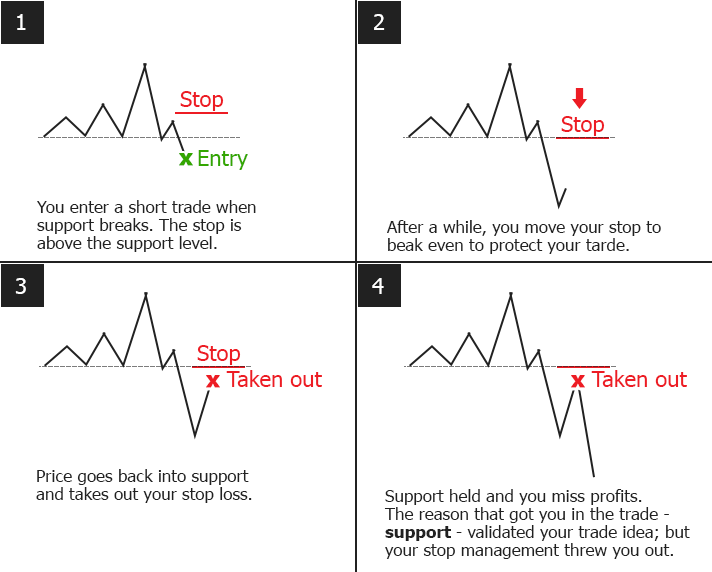

What role do support and resistance levels play in risk management?

Support and resistance levels help identify where price may reverse or pause, allowing traders to set stop-loss and take-profit points. They define key zones to limit losses and lock in gains, reducing risk exposure. Using these levels ensures trades are entered and exited at strategic points, improving overall risk management in day trading.

How can chart patterns signal potential trading risks?

Chart patterns like head and shoulders or double tops signal potential reversals, warning of trend changes that can lead to losses. Breakouts or breakdowns from patterns such as triangles or flags suggest increased volatility and false signals, risking quick reversals. Recognizing pattern failure points helps traders avoid entering risky trades. Volume confirmation during pattern formation indicates strength or weakness, guiding risk decisions. Spotting pattern exhaustion signals, like a rounded top, warns of a trend losing momentum, preventing costly trades.

How do moving averages help reduce day trading losses?

Moving averages help reduce day trading losses by smoothing out price fluctuations, making trend directions clearer. They act as dynamic support and resistance levels, guiding entry and exit points. When prices stay above a moving average, it signals a potential uptrend; below suggests a downtrend. Using moving averages as part of a trading strategy helps avoid false signals and market noise, reducing impulsive trades. This disciplined approach minimizes losses by sticking to the trend and avoiding trades against it.

What are the common chart mistakes that increase risk?

Common chart mistakes that increase day trading risk include ignoring support and resistance levels, overtrading based on impulse instead of analysis, relying on lagging indicators instead of real-time data, misinterpreting chart patterns, and neglecting volume confirmation. Using charts without proper context or failing to set stop-loss levels also heightens risk.

How to set stop-loss levels using charts?

Identify key support and resistance levels on the chart. Place your stop-loss just below support for long trades or above resistance for short trades. Use technical indicators like ATR or moving averages to set dynamic stop-loss levels that adapt to market volatility. Adjust stops as the chart forms new highs or lows to lock in profits and limit losses.

How can chart analysis prevent emotional trading decisions?

Chart analysis helps prevent emotional trading by providing objective data on price trends and patterns. It removes guesswork, so traders base decisions on visual evidence rather than impulses. Recognizing setups like support and resistance levels keeps emotions in check, avoiding impulsive entries or exits. Consistent chart review builds discipline, reducing fear and greed-driven mistakes. Ultimately, using charts to identify clear signals keeps trading rational and focused, preventing emotional reactions.

Learn about How to Use Chart Patterns for Day Trading Analysis

What are the best chart tools for real-time risk monitoring?

Best chart tools for real-time risk monitoring include TradingView, Thinkorswim, MetaTrader 5, and NinjaTrader. These platforms offer live data, customizable indicators, and alert systems to track market volatility and manage day trading risk effectively.

How do oscillators and momentum indicators help manage risk?

Oscillators and momentum indicators help manage day trading risk by signaling overbought or oversold conditions, alerting traders to potential reversals. They identify when an asset's price might change direction, allowing timely exits or entries. For example, if an oscillator shows overbought levels, you might tighten stops or avoid new positions. Momentum indicators reveal the strength of a trend, helping you avoid trading against weak or fading moves. Using these tools together improves decision-making, reducing the chance of holding losing trades or entering at risky points.

How can backtesting charts improve risk strategies?

Backtesting charts helps identify which risk strategies work by showing past performance of trade setups. It reveals patterns, like how stop-losses or position sizes affect outcomes. Using historical data, traders can refine risk management rules, avoid repeating mistakes, and develop more reliable exit points. Ultimately, backtesting makes risk strategies more data-driven and less guesswork, boosting confidence in live trading.

What are the risks of relying solely on chart patterns?

Relying only on chart patterns risks false signals, leading to bad trades. Patterns can be misleading in volatile markets, causing losses. They don’t account for news or sudden price swings. Overconfidence in patterns may cause ignoring other risk factors like stop-loss placement. This approach can lead to missed opportunities or unnecessary losses if patterns fail.

Conclusion about How to Use Charts to Manage Day Trading Risk

Incorporating effective chart analysis into your day trading strategy is crucial for managing risk. By leveraging tools like candlestick charts, volume indicators, and moving averages, traders can better assess potential pitfalls and make informed decisions. Additionally, understanding support and resistance levels and avoiding common chart mistakes can further enhance your risk management approach. Ultimately, utilizing these techniques not only aids in minimizing losses but also fosters disciplined trading practices, ensuring a more successful trading journey. For comprehensive insights and guidance, explore the resources offered by DayTradingBusiness.

Learn about How to Use Trend Lines in Day Trading Charts