Did you know that the average trader spends over 10 hours a week analyzing charts, but only about 10% of that time actually results in profitable trades? To maximize your trading efficiency, setting up alerts for day trading chart signals is crucial. In this article, we’ll guide you through the essentials of creating effective alerts, from selecting the right tools and customizing them for specific chart patterns to automating alerts for price breakouts. We'll also cover common pitfalls to avoid, how to fine-tune sensitivity, and the advantages of alerts in streamlining your trading strategy. With insights from DayTradingBusiness, you’ll be well-equipped to enhance your trading game and seize opportunities as they arise.

How do I set up alerts for day trading chart signals?

Open your trading platform and find the chart you’re analyzing. Right-click on a key indicator or price level and select "Create Alert" or "Add Alert." Customize the alert by choosing conditions—like crossing a moving average or hitting a specific price. Set notification preferences—pop-up, sound, email, or push notifications. Save the alert, and it will notify you when the signal occurs.

What tools can I use to create real-time trading alerts?

Use TradingView's alert system, ThinkorSwim's alert features, MetaTrader 4/5's custom alerts, or TradingView's webhook alerts for real-time trading signals. These tools let you set alerts based on price levels, technical indicators, or chart patterns.

How do I customize alerts for specific chart patterns?

To customize alerts for specific chart patterns, identify the pattern in your trading platform’s alert system, then set the alert criteria based on pattern recognition (like head and shoulders or double bottoms). Use the platform’s tools to draw or select the pattern, then configure the alert to trigger when the pattern forms or hits a specific price level. Adjust notification settings to get alerts via pop-up, email, or SMS.

What are the best indicators for day trading alerts?

The best indicators for day trading alerts are moving averages (like the 9, 20, 50, or 200 EMA), RSI for overbought/oversold signals, MACD for trend shifts, Bollinger Bands for volatility, and volume spikes. These indicators help identify entry and exit points, trend changes, and market momentum, making them essential for creating effective chart alerts in day trading.

How can I automate alerts for price breakouts?

Use chart alert features on platforms like TradingView or ThinkorSwim. Set specific price levels or technical indicator thresholds for breakout signals. Enable notifications via email or mobile alerts when those levels are hit. Automate with scripts or alerts that trigger when a stock crosses a predefined support or resistance level. Consider using trading bots or APIs that monitor charts and send instant alerts for breakout signals.

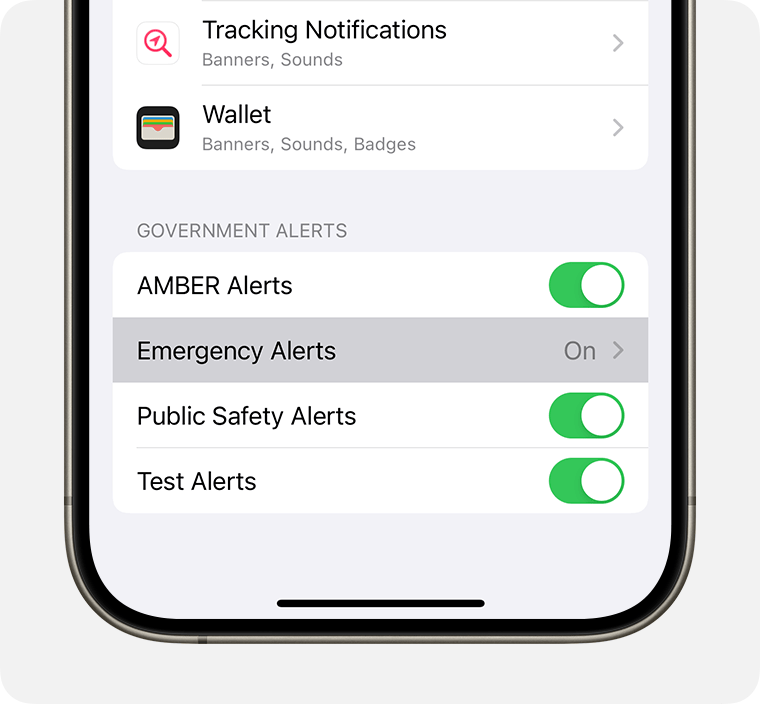

How do I receive alerts on different devices?

Set up alerts in your trading platform for specific chart signals. Use device-specific notification settings—enable push notifications on your phone, browser alerts on your computer, and app notifications on tablets. Sync your trading app across devices to get real-time alerts wherever you are. Customize alert types—sound, vibration, or pop-up—to match each device. Test alerts on each device to ensure they come through instantly during trading.

What are the common mistakes when creating trading alerts?

Common mistakes when creating trading alerts include setting them too far from current price, which causes missed signals; using vague or generic alert conditions instead of specific, actionable ones; ignoring market volatility, leading to false triggers; not testing alerts beforehand; and failing to update alerts as market conditions change.

How do I set alerts for volume spikes?

Use your trading platform’s alert feature. Right-click on the volume indicator or chart area, select “Create Alert,” then set the condition for a volume spike—like a specific volume threshold or percentage increase. Save the alert, and it’ll notify you when volume exceeds your set level during trading.

Can I create alerts for multiple stocks at once?

Yes, most trading platforms let you set alerts for multiple stocks simultaneously. You can usually customize alerts by price, indicator signals, or volume across several stocks at once. Use the platform’s alert management feature or batch create alerts to streamline the process.

How do I adjust alert sensitivity for minor price movements?

To adjust alert sensitivity for minor price movements, go to your trading platform’s alert settings, find the sensitivity or threshold option, and lower the trigger level so small price changes activate the alert. Some platforms let you customize alerts with percentage or pip-based thresholds; set these to a smaller value to catch minor moves. Make sure to select "minor" or "small" movement options if available, or manually adjust the alert parameters to be more responsive to tiny price shifts.

What is the best way to test my alert setup?

Use a demo trading account to set up your alerts and monitor real-time chart signals without risking money. Verify alerts trigger correctly by simulating market conditions or manually triggering them. Cross-check alerts with actual price movements and chart patterns to ensure accuracy. Review alert logs periodically to confirm they activate as expected during different market scenarios.

How do I get alerts for trend reversals?

Set alerts on your trading platform for key technical signals like moving average crossovers, RSI divergence, or candlestick patterns. Use tools like TradingView or ThinkorSwim to customize notifications for specific price levels or indicator changes. Enable SMS or email alerts to get immediate updates when a trend reversal signal appears. Consider using third-party alert services that monitor chart patterns and send real-time alerts.

How can I filter false signals in my alerts?

Use multiple indicators together to confirm signals—combine moving averages, RSI, and volume. Set strict criteria for alerts, like requiring two or three indicators to align before triggering. Incorporate filters for low-volume periods or choppy markets to avoid false signals. Backtest your alert conditions to see how often they produce false positives. Adjust sensitivity settings to reduce noise, and consider adding a time filter to avoid reacting to quick, unreliable spikes.

What are the advantages of using alerts in day trading?

Using alerts in day trading helps you catch trade setups instantly, avoid missing key signals, and manage risk more effectively. They notify you immediately when a chart hits a specific price, indicator level, or pattern, so you can act fast. Alerts reduce the need for constant screen watching, freeing you to focus on analysis and decision-making. They also help you stick to your trading plan by reminding you of entry or exit points, improving discipline. Overall, alerts make your trading more responsive, timely, and less stressful.

How do I sync alerts with trading platforms?

To sync alerts with trading platforms, connect your alert app or software to the platform via APIs or built-in integrations. Use platform-specific notification settings or third-party tools like TradingView or MetaTrader to link alert triggers directly to your trading account. Ensure your alert conditions match your chart signals, then enable real-time notifications through email, SMS, or app alerts. Test the setup by triggering a sample alert to verify it syncs properly.

How can I create alerts based on moving average crossovers?

Set up your chart with two moving averages, like the 50-period and 200-period. When the shorter MA crosses above the longer MA, create an alert for a bullish signal. When it crosses below, set an alert for a bearish signal. Use your trading platform’s alert feature to specify these crossover points, so you get notified instantly when they happen. Some platforms allow you to automate these alerts with custom scripts or indicator alerts.

Conclusion about How to Create Alerts for Day Trading Chart Signals

Incorporating alerts into your day trading strategy enhances your ability to respond to market movements efficiently. By utilizing the right tools and customizing alerts for specific patterns and indicators, you can stay ahead of potential trades. Avoid common pitfalls, test your setups, and ensure your alerts sync seamlessly with your trading platform. For further insights and support on effectively using alerts in day trading, explore the resources available at DayTradingBusiness.

Learn about How to Spot Reversal Signals on Day Trading Charts