Did you know that even the most seasoned traders can get lost in a chart that looks like a toddler's finger painting? In the world of trading, mastering advanced charting techniques is crucial for navigating the complexities of the market. This article dives into the latest methods for experienced traders, including the use of multiple timeframes, identifying chart patterns, and incorporating volume analysis. We’ll explore effective trendline techniques, Fibonacci applications, and the significance of Elliott Wave theory. Additionally, learn how to combine technical indicators for precise signals, spot divergences, and improve your entry and exit points. Discover tools for detecting false breakouts, utilizing order flow data, and backtesting strategies while avoiding common pitfalls. Let DayTradingBusiness guide you through these essential techniques to elevate your trading skills.

What are the latest advanced charting techniques for traders?

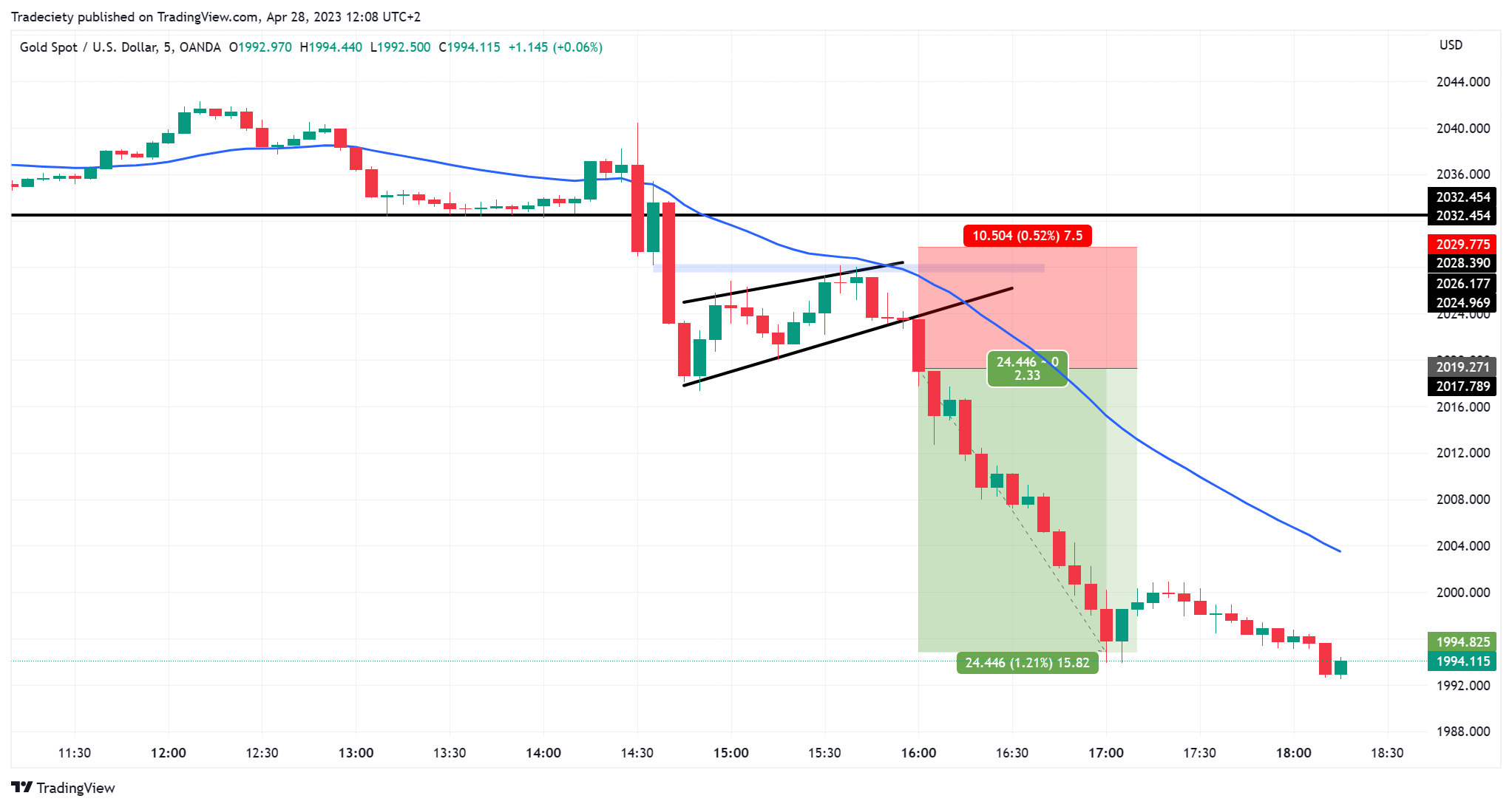

The latest advanced charting techniques for traders include Renko charts for noise reduction, Heikin-Ashi for trend clarity, Ichimoku Cloud for multi-layered support and resistance, and Market Profile for volume-based insights. Algorithmic overlays and custom indicators like Fibonacci retracements and Elliott Wave analysis also push analytical depth. Combining these methods helps experienced traders spot trend reversals, breakouts, and market momentum more precisely.

How can I use multiple timeframes in advanced chart analysis?

Use multiple timeframes by analyzing higher, lower, and current charts simultaneously to identify broader trends, entry points, and reversals. Switch between daily, hourly, and minute charts to confirm signals and spot divergences. Overlay or compare indicators across timeframes to validate patterns. This helps you see the bigger picture while fine-tuning your entries and exits.

What are the best ways to identify chart patterns for experienced traders?

Use multiple timeframes to confirm patterns like head and shoulders or double tops. Analyze volume alongside pattern formation to gauge strength. Recognize pattern breakouts with precise entry points and set stop-losses. Incorporate technical indicators such as RSI or MACD for additional confirmation. Practice pattern recognition through backtesting and real-time analysis to refine your skills. Stay aware of false signals and market context to avoid misinterpretation.

How do I incorporate volume analysis into advanced charting?

Add volume indicators like OBV, VWAP, or volume profile to your chart. Use volume overlays to identify buying or selling pressure during price moves. Combine volume analysis with price patterns, such as breakouts or reversals, to confirm trends. Adjust volume settings for timeframes that match your trading style. Use volume divergence to spot potential reversals or continuation signals. Integrate volume analysis into your existing technical setup for clearer entry and exit points.

What are the most effective trendline and channel techniques?

Use logarithmic trendlines for long-term, exponential growth patterns. Combine multiple trendlines to identify support and resistance zones. Apply Fibonacci channels to pinpoint potential reversal points. Use regression channels for statistically significant trend boundaries. Incorporate Andrews’ pitchfork for dynamic trend support. Overlay volume-based channels like VWAP for confirmation. Always validate trendlines with price action and volume for accuracy.

How can I apply Fibonacci retracements and extensions accurately?

Identify key swing highs and lows on your chart. Use Fibonacci retracement tools to draw from recent swing lows to highs (or vice versa), ensuring the lines align with significant support or resistance levels. For extensions, place the tool from the initial swing low to high and then to the retracement low to project potential target zones. Confirm retracement levels with other technical indicators like candlestick patterns or volume. Adjust the Fibonacci lines to match price action precisely, avoiding arbitrary placements. Practice drawing these levels on various timeframes to improve accuracy.

What is the role of Elliott Wave theory in advanced charting?

Elliott Wave theory helps experienced traders identify market cycles and predict future price movements by analyzing recurring wave patterns and investor psychology. It provides a framework for timing entries and exits, improving precision in advanced charting. Traders use it to confirm trends, spot reversals, and refine their technical analysis with wave counts that reveal market structure.

How do I combine technical indicators for more precise signals?

Combine technical indicators by using one as a trend filter—like moving averages—and another for entry signals, such as RSI or MACD. Look for confluence: when multiple indicators align, like a moving average crossover while RSI hits oversold or overbought levels. Use divergence between indicators for early warnings. Avoid conflicting signals; for example, don’t buy if MACD shows bullish momentum but RSI is in extreme overbought territory. Backtest your combinations to refine timing and reduce false signals.

What are the best methods for spotting divergence in price and indicator charts?

Look for price making new highs or lows while the indicator moves in the opposite direction. Use multiple timeframes to confirm divergence signals. Watch for hidden divergences where price retraces but the indicator shows a different trend. Pay attention to the strength of the divergence—stronger discrepancies signal higher reliability. Combine divergence with volume and momentum indicators for confirmation. Practice spotting divergence during key trend points, like pullbacks or breakouts, to improve accuracy.

How can I improve entry and exit points with advanced chart setups?

Use multiple timeframes to confirm entries and exits, aligning short-term signals with longer-term trends. Apply technical indicators like Fibonacci retracements, Elliott Wave analysis, or volume profile to identify precise entry/exit zones. Incorporate pattern recognition—like head and shoulders or double bottoms—to time moves better. Use price action and candlestick signals for more accurate timing. Experiment with custom indicators or overlays that suit your trading style to refine entry and exit points.

Learn about How to Set Entry and Exit Points in Breakout Trades

What are the key tools for detecting false breakouts?

Key tools for detecting false breakouts include volume analysis, ATR (Average True Range), and price momentum indicators like RSI or MACD. Watch for volume spikes that lack follow-through, indicating a false move. Use ATR to gauge volatility—low volatility during a breakout can signal a false signal. Check momentum indicators; divergence or weak momentum during a breakout suggests it might be false. Price action patterns like whipsaws or quick reversals also signal false breakouts. Combining these tools helps confirm whether a breakout is genuine or false.

How do I use order flow and level II data in chart analysis?

Use order flow and Level II data to identify real-time supply and demand shifts. Watch for large bid-ask spreads, iceberg orders, and aggressive buying or selling to spot potential reversals or breakouts. Incorporate time and sales data to see how big orders execute, confirming support or resistance levels. Use Level II to gauge market interest at specific price points, guiding entries and exits with more precision. Combine these insights with your chart patterns to improve timing and anticipate institutional moves.

Learn about How Do Institutional Traders Use Volume and Order Flow Data?

What are the techniques for customizing and optimizing chart layouts?

Use custom gridlines, adjust axis scales, and modify data labels to tailor chart layouts. Incorporate overlays like trendlines and annotations to highlight key points. Leverage multiple axes for complex data comparison. Apply formatting options such as colors, fonts, and marker styles to improve clarity. Resize and reposition chart elements for better visual flow. Use templates to maintain consistency across charts. Experiment with logarithmic scales and dynamic updates to optimize readability.

How can I backtest complex charting strategies effectively?

Use trading platforms with robust backtesting tools like TradingView or MetaTrader. Script your strategies in Pine Script or MQL4/5 to automate testing. Incorporate historical data that matches your trading timeframe and instrument. Validate your strategies across different market conditions to spot weaknesses. Optimize parameters without overfitting. Analyze performance metrics like drawdown, profit factor, and win rate. Keep a detailed record of your backtests to refine your approach.

What are the common pitfalls in advanced charting and how to avoid them?

Common pitfalls in advanced charting include overcomplicating visuals, relying too heavily on indicators, and ignoring context like volume or news. To avoid these, simplify charts by focusing on key patterns, combine indicators with price action, and always consider broader market factors. Avoid false signals by confirming patterns with multiple tools and maintaining discipline to prevent impulsive trades based on confusing signals. Regularly backtest your setups to ensure they work across different market conditions.

Conclusion about Advanced Charting Techniques for Experienced Traders

Mastering advanced charting techniques can significantly enhance your trading performance. By effectively utilizing multiple timeframes, identifying chart patterns, and incorporating volume analysis, traders can make more informed decisions. Additionally, integrating tools like Fibonacci retracements, Elliott Wave theory, and order flow data allows for precise entry and exit points. To avoid common pitfalls, continuous backtesting and customization of chart layouts are essential. For further insights and support in navigating these strategies, DayTradingBusiness is here to help you elevate your trading skills.