Did you know that some day traders treat their screens like a second spouse—constantly checking in for updates? In the world of day trading, choosing the right broker is crucial, and user reviews play a significant role in that decision. This article dives into what traders are saying about popular day trading brokers, evaluating the trustworthiness of these reviews, and highlighting which brokers stand out for their user ratings. We’ll explore common complaints, beginner impressions, and the fees that traders appreciate. Additionally, we’ll analyze the feedback from experienced traders regarding platform functionality and customer support. Finally, we’ll uncover recurring issues and how user experiences vary between free and paid brokers, providing valuable insights for anyone navigating the trading landscape. Trust the insights from DayTradingBusiness to guide you through this essential broker evaluation!

What do traders say about top day trading brokers?

Traders say top day trading brokers offer fast execution, reliable platforms, and tight spreads. They value good customer support and transparent fee structures. Many mention that reputable brokers provide advanced charting tools and strong order types. Some warn against brokers with high commissions or poor platform stability. Overall, traders look for brokers with high reliability, low latency, and solid regulatory standing.

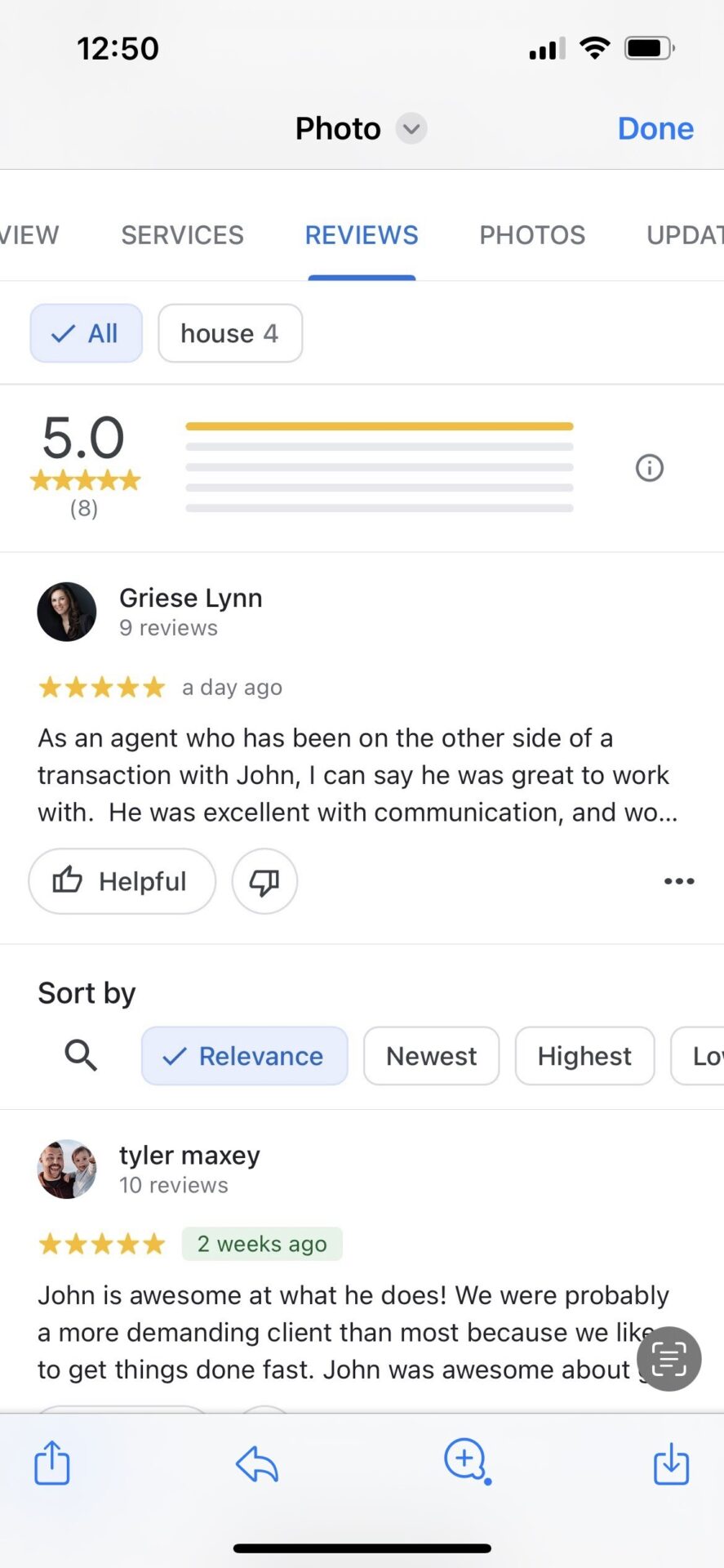

Are user reviews of day trading brokers trustworthy?

User reviews of day trading brokers can be helpful but aren't always trustworthy. They reflect individual experiences, which vary widely. Some reviews may be biased, fake, or influenced by personal agendas. Cross-check multiple sources and look for patterns rather than relying on single reviews. Trustworthy reviews often come from reputable platforms or verified users.

Which day trading brokers have the best user ratings?

Interactive Brokers, TD Ameritrade, and Charles Schwab top user ratings for day trading brokers.

What common complaints do users have about day trading brokers?

Users often complain about high commissions and hidden fees from day trading brokers. They cite poor customer service, slow trade execution, and technical glitches. Many dislike confusing platform interfaces and lack of educational support. Some mention unexpected margin calls or restrictive trading limits. Overall, frustrations stem from unreliable trading experiences and opaque fee structures.

How do beginner traders rate popular brokers?

Beginner traders often rate popular brokers based on ease of use, customer support, and transparency. They look for intuitive platforms, quick deposit and withdrawal options, and helpful educational resources. Many favor brokers with low fees, demo accounts, and reliable order execution. Overall, positive reviews highlight user-friendly interfaces and responsive service, while negative feedback points to hidden costs or confusing interfaces.

Which brokers are most praised for low fees?

Interactive Brokers and TD Ameritrade are most praised for low fees in day trading. Interactive Brokers offers low commissions and tight spreads, ideal for active traders. TD Ameritrade is known for no account minimums and competitive trading fees. Charles Schwab also gets positive reviews for low-cost trading options.

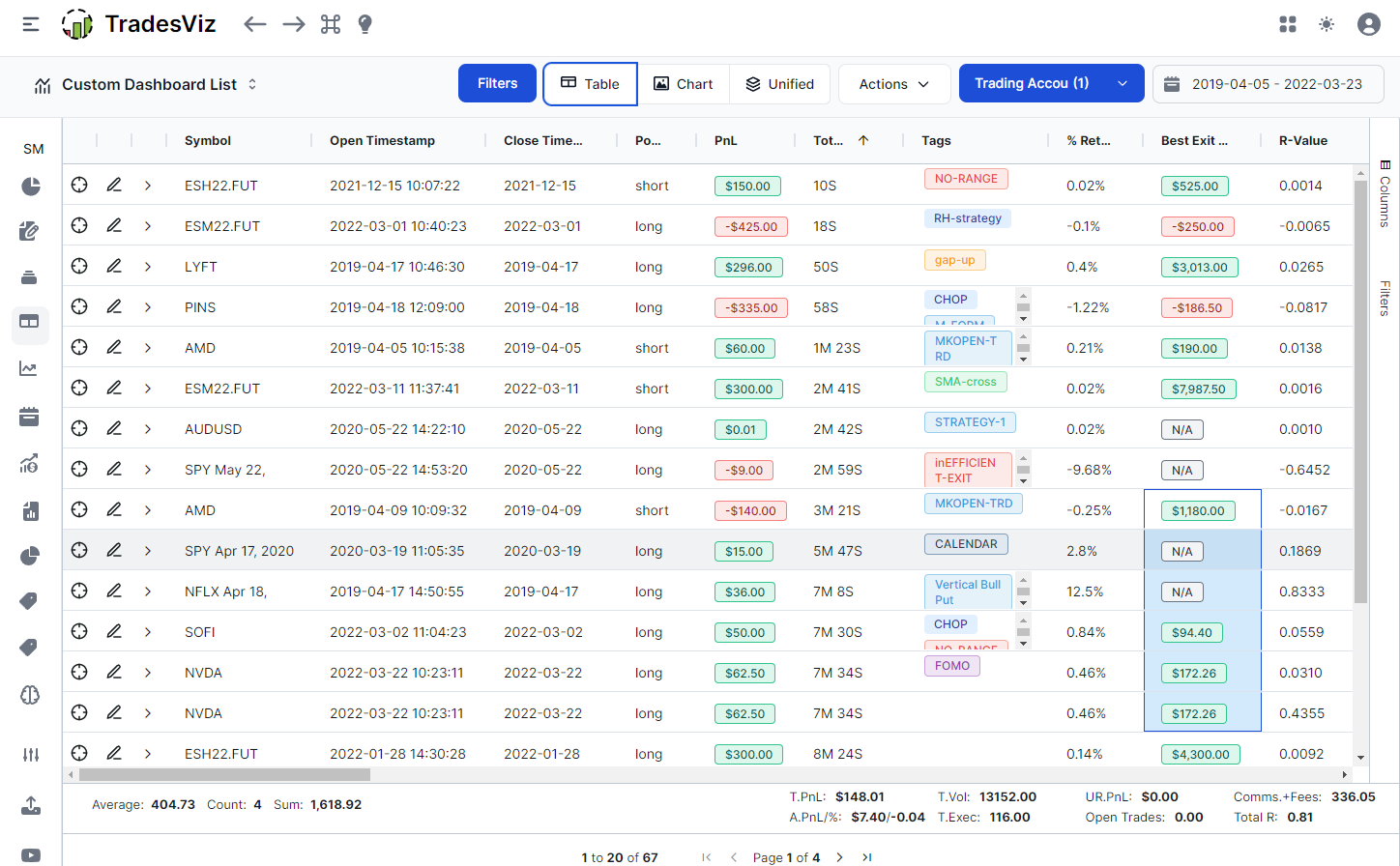

What do experienced traders say about broker platforms?

Experienced traders say broker platforms should be fast, reliable, and user-friendly. They value platforms with real-time data, low spreads, and solid charting tools. Many warn against platforms with frequent outages or confusing interfaces. Trustworthiness and good customer support are also top priorities. Overall, they look for platforms that support quick decision-making and smooth execution.

Are there any recurring issues in user reviews?

Yes, common recurring issues include high trading fees, slow customer support, platform crashes during high volatility, and confusing fee structures.

Which brokers get high marks for customer support?

Interactive Brokers and TD Ameritrade get high marks for customer support. Customers praise their quick response times, knowledgeable agents, and helpful online resources. Fidelity and Charles Schwab also receive strong reviews for attentive service and accessible support channels.

How do user reviews compare across different trading platforms?

User reviews of popular day trading brokers vary widely; some praise platforms like Interactive Brokers for reliability, while others criticize them for high fees. E*TRADE users often highlight ease of use, but complain about customer service, whereas TD Ameritrade is praised for research tools but noted for occasional platform glitches. Reviewers on Robinhood appreciate its simplicity but flag limited features for active traders. Overall, reviews depend on individual experience, trading style, and platform expectations, with common themes of platform stability, fees, research tools, and customer support.

What features do users value most in day trading brokers?

Users value fast order execution, low spreads, and reliable platform stability in day trading brokers. They also prioritize responsive customer support, advanced charting tools, and real-time market data. Easy account setup, flexible leverage options, and transparent fee structures matter too. Ultimately, smooth trading experience and minimal delays are top priorities.

Are user reviews biased or genuinely helpful?

User reviews of popular day trading brokers can be biased or genuinely helpful. Some reviews reflect real experiences, offering useful insights into platform features and customer service. Others may be biased, either overly positive from affiliates or negative due to bad experiences. Check multiple sources and look for detailed, specific feedback to determine their helpfulness.

Which brokers are recommended by the trading community?

Popular day trading brokers recommended by the trading community include Interactive Brokers, TD Ameritrade (thinkorswim), E*TRADE, and Charles Schwab. Traders praise Interactive Brokers for low fees and advanced tools, while TD Ameritrade’s thinkorswim platform is favored for educational resources and user-friendly interface. E*TRADE is known for reliable execution and good research tools, and Charles Schwab offers strong customer service and solid trading platforms.

What do reviews reveal about broker reliability?

Reviews reveal that broker reliability varies; positive reviews highlight consistent execution, good customer support, and transparent fees, while negative ones point to delays, hidden charges, or poor service. They show which brokers are trusted by traders and expose issues like platform crashes or withdrawal problems. Overall, user reviews are a real-world gauge of a broker’s dependability.

How do user experiences differ between free and paid brokers?

User experiences with free brokers often involve limited tools and slower customer support, but they offer cost savings. Paid brokers typically provide advanced trading platforms, better research tools, and quicker support, enhancing the trading experience. Users tend to feel more confident and supported with paid brokers, especially for active day trading, while free brokers suit beginners or casual traders. Cost, platform features, and customer service shape how traders perceive their experience with each type.

Conclusion about User Reviews of Popular Day Trading Brokers

In summary, user reviews provide valuable insights into the performance and reliability of day trading brokers. Traders consistently highlight factors such as fees, platform usability, and customer support as critical determinants of their satisfaction. While some reviews may exhibit bias, they often reveal common experiences and concerns that can guide both beginners and seasoned traders in their choices. For those seeking further assistance in navigating the trading landscape, DayTradingBusiness offers comprehensive resources to enhance your trading journey.

Learn about Popular Day Trading Brokers in 2023

Sources:

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- Retail trader sophistication and stock market quality: Evidence from ...

- fun and games - investment gamification and implications for capital ...

- Setting the future of digital and social media marketing research ...

- FRB: Supervisory Letter SR 93-13 (FIS) on violations of Federal ...