Did you know that even the most seasoned traders can get lost in a sea of brokers faster than a cat in a room full of laser pointers? For new investors stepping into the world of day trading, choosing a safe broker is paramount. This article dives into the safest day trading brokers, identifying trustworthy platforms, and the regulatory bodies that ensure your investment is protected. We’ll discuss essential features to look for, the safety of commission-free options, and the importance of robust account security measures. Additionally, learn how to gauge broker credibility, the benefits of paper trading accounts, and how to spot potential scams. With insights from DayTradingBusiness, you’ll be well-equipped to navigate the broker landscape confidently and securely.

What are the safest brokers for new day traders?

Interactive Brokers, TD Ameritrade, and Charles Schwab are among the safest brokers for new day traders. They offer strong regulatory oversight, robust customer support, and transparent fee structures. These brokers have user-friendly platforms, educational resources, and good security measures, making them reliable choices for beginners.

How to identify trustworthy day trading platforms for beginners?

Look for platforms regulated by reputable authorities like the SEC or FCA. Check user reviews for consistent positive feedback and minimal complaints. Ensure they offer transparent fee structures and clear account security measures. Test their demo accounts to see if they provide real-time data and easy-to-use tools. Trustworthy brokers have strong customer support and educational resources tailored for beginners.

Which regulatory bodies oversee safe day trading brokers?

The SEC (Securities and Exchange Commission) and FINRA (Financial Industry Regulatory Authority) oversee safe day trading brokers, ensuring they follow strict rules to protect investors.

What features should a safe broker offer to new traders?

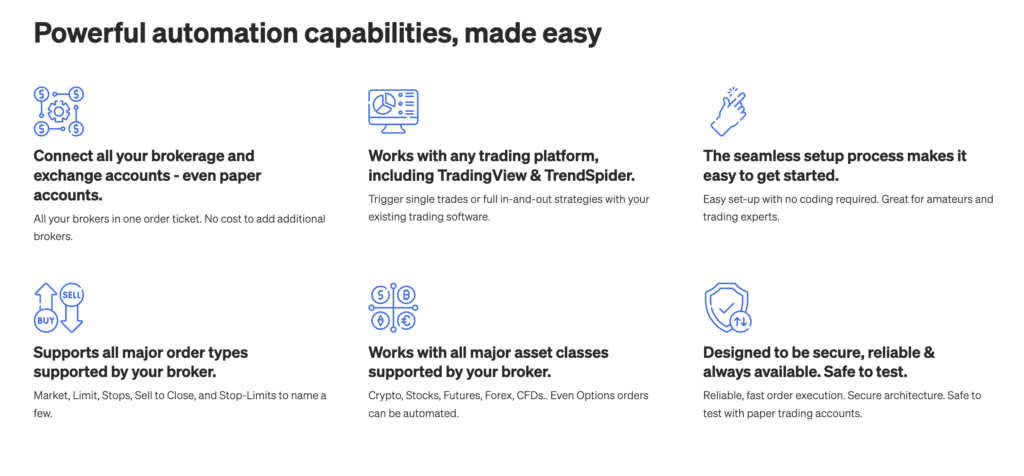

A safe broker for new day traders should offer robust security measures, like two-factor authentication and segregated accounts. It must have transparent fee structures and clear trading conditions. User-friendly platforms with educational resources and demo accounts help beginners learn risk management. Reliable customer support and fast, secure order execution prevent costly mistakes. Regulatory compliance from authorities like the SEC or FCA ensures trustworthiness. Access to real-time data, risk controls, and clear withdrawal procedures are essential for safe trading.

Are commission-free brokers safe for day trading beginners?

Yes, commission-free brokers can be safe for day trading beginners if they are reputable, regulated, and offer robust trading platforms. Look for brokers with transparent fee structures, strong customer support, and good educational resources. Always verify their licensing with authorities like the SEC or FINRA. Avoid brokers with a history of complaints or poor security measures.

How important are account security measures in day trading brokers?

Account security measures are crucial in day trading brokers because they protect your funds and sensitive information from theft or hacking. With real money at stake, strong encryption, two-factor authentication, and secure login processes prevent unauthorized access. They ensure your trading activities and personal data stay safe, reducing the risk of fraud. For new investors, choosing brokers with solid security builds trust and peace of mind in a high-stakes environment.

Can a new trader trust low-cost brokers for safety?

Low-cost brokers can be safe if they’re regulated by reputable authorities like the SEC or FCA. Look for brokers with solid security measures, good reviews, and transparent fee structures. Cheaper doesn’t mean riskier if they follow strict industry standards. Do your homework on their licensing, customer support, and trading platform reliability.

What should I look for in customer support from a safe broker?

Look for quick, responsive support that clearly explains safety features like segregated accounts and regulatory compliance. They should offer multiple contact options—chat, email, phone—and respond promptly. Support staff must be knowledgeable about security measures and able to address concerns about fund safety, fraud prevention, and account protection. Reliable customer support shows the broker prioritizes your security and is transparent about their safety protocols.

How do I verify a broker’s credibility before opening an account?

Check if the broker is registered with regulatory authorities like the SEC, FINRA, or FCA. Look for reviews and ratings from trusted sources to spot any red flags. Verify their licensing and licensing status on official regulatory websites. Examine their trading platform for transparency and ease of use. Confirm their customer support responsiveness and availability. Research their fee structure to ensure no hidden charges. Read user testimonials and experiences for real-world insights.

Are paper trading accounts useful for testing safe brokers?

Yes, paper trading accounts are useful for testing safe brokers. They let you evaluate the broker’s platform, execution speed, and reliability without risking real money, helping you find trustworthy, secure brokers suited for day trading.

Which brokers have the best reviews for beginner day traders?

Interactive Brokers and TD Ameritrade are top-rated for beginner day traders. They offer user-friendly platforms, educational resources, and strong customer support. E*TRADE also gets good reviews for ease of use and helpful tools. These brokers are considered safe choices for new investors starting day trading.

How do I avoid scams when choosing a day trading broker?

Research broker licensing and regulation from reputable authorities like the SEC or FCA. Check reviews and user feedback on platforms like Trustpilot. Avoid brokers with unprofessional websites, unclear fees, or pressure tactics. Use demo accounts to test their platform before depositing real money. Confirm transparent fee structures and secure payment options. Stay away from brokers promising guaranteed profits or high leverage without proper regulation.

Learn about How to avoid unnecessary stop-loss risk in day trading

What are the risks of choosing an unregulated broker?

Choosing an unregulated broker risks fraud, fund theft, and poor trade execution. They might manipulate prices or delay withdrawals. Without regulation, there's no authority to protect your investments or resolve disputes. You could face hidden fees, unfair practices, or even complete loss of your money. Always pick regulated brokers to ensure transparency and security in your day trading.

How do demo accounts help in selecting a safe broker?

Demo accounts let you test a broker’s platform, execution speed, and customer support without risking real money. They reveal if the broker’s trading environment is reliable and user-friendly, helping you spot red flags like delayed orders or poor interface. Using a demo, you can evaluate security features, account management, and the transparency of fees. This hands-on experience ensures you choose a broker with solid technology and trustworthy practices, making your day trading safer.

What are common red flags indicating a broker might be unsafe?

Common red flags include unregulated brokers, high-pressure sales tactics, vague or hidden fees, poor customer reviews, delayed withdrawals, and lack of transparent licensing. If a broker refuses to provide clear licensing info or insists on risky trading practices, steer clear. Unresponsive support and frequent technical issues also signal trouble.

Conclusion about Safe Day Trading Brokers for New Investors

In conclusion, selecting a safe day trading broker is crucial for new investors to mitigate risks and enhance their trading experience. Look for brokers regulated by credible authorities, offer robust security measures, and provide reliable customer support. Utilize features like paper trading accounts to test platforms before committing. By prioritizing these factors, you can confidently navigate the trading landscape. For more comprehensive insights and assistance in your trading journey, consider leveraging the expertise of DayTradingBusiness.

Sources:

- Finance & Development, June 2012 - Back to Basics: What Are ...

- A Brief History of the 1987 Stock Market Crash with a Discussion of ...

- Futures Brokerage Activities and Futures Commission Merchants ...

- Speech by Governor Brainard on the structure of the Treasury market

- The Treasury Securities Market: Overview and Recent Developments

- Appendix Comprehensive Review of Regulation W Overview of the ...