Did you know that some day traders can execute a trade faster than you can say "buy low, sell high"? In the fast-paced world of day trading, selecting the right broker can make all the difference. This article delves into the top day trading brokers, highlighting essential features like execution speed, charting tools, and low fees. We’ll explore the importance of mobile trading apps, margin requirements, and advanced order types. Additionally, we’ll cover brokers that offer demo accounts for practice, automated trading support, and security features to protect your investments. With insights on customer support and a comparison of popular platforms like ThinkorSwim, MetaTrader, and TradingView, DayTradingBusiness equips you with everything you need to enhance your trading experience.

What are the top day trading brokers with the best platforms?

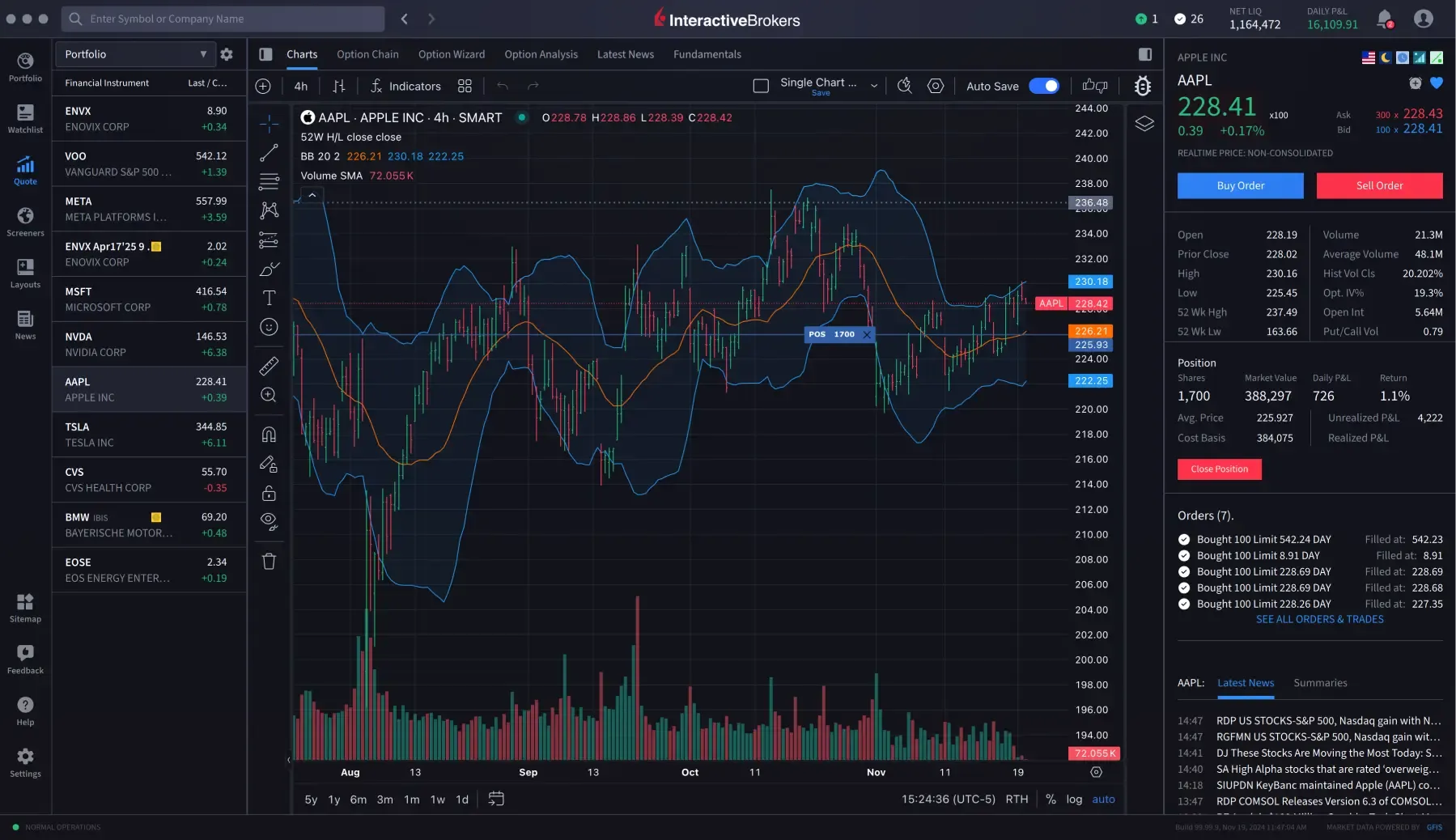

Interactive Brokers, TD Ameritrade (thinkorswim), and Charles Schwab are top day trading brokers with the best platforms. They offer advanced charting tools, fast execution, and customizable interfaces suitable for active traders. Each provides robust desktop applications and mobile apps optimized for quick trades and real-time data.

Which brokers offer the fastest execution for day trading?

Interactive Brokers, TD Ameritrade (thinkorswim), and Charles Schwab are known for the fastest execution speeds for day trading. Interactive Brokers offers ultra-low latency and direct market access, making it ideal for active traders. TD Ameritrade’s thinkorswim platform provides quick order execution with advanced tools. Charles Schwab’s StreetSmart Edge also delivers rapid trade execution, especially for high-volume traders.

How do I choose a day trading broker with reliable charting tools?

Look for brokers with highly rated, intuitive charting tools like TradingView integration or advanced technical analysis features. Check user reviews for reliability and real-time data accuracy. Test demo accounts to see if their charting platform matches your trading style. Prioritize brokers with a reputation for seamless platform performance during high-volatility periods. Ensure their charting tools offer customizable indicators, drawing tools, and multiple timeframes.

What features should I look for in a day trading platform?

Look for fast execution speed, reliable charting tools, real-time data, easy order placement, low spreads, and strong security. A user-friendly interface and customizable features help manage trades efficiently. Check for educational resources and customer support. Compatibility with your devices and integrations with analysis tools are also key.

Are there brokers with low fees for active traders?

Yes, brokers like Interactive Brokers, TD Ameritrade, and Webull offer low fees for active traders, with competitive commissions, tight spreads, and low or zero account minimums.

Which brokers provide paper trading or demo accounts for day traders?

Many brokers offer paper trading or demo accounts for day traders, including Thinkorswim by TD Ameritrade, Interactive Brokers, TradingView, NinjaTrader, Webull, and eToro.

What are the best mobile trading apps for day trading?

The best mobile trading apps for day trading are MetaTrader 4 and 5, Thinkorswim, TD Ameritrade Mobile, Interactive Brokers IBKR Mobile, and eToro. They offer real-time data, fast execution, and advanced charting tools suited for active traders.

How important are margin requirements in choosing a broker?

Margin requirements are crucial because they determine how much leverage you can use and how much capital you need to open positions. Lower margin requirements let you control larger trades with less money, increasing potential gains but also risk. High margin requirements limit leverage, offering more safety but less flexibility for aggressive day trading. Choosing a broker with suitable margin policies ensures you can execute your trading strategy effectively while managing risk.

Which brokers offer advanced order types for day trading?

Interactive Brokers, TD Ameritrade (Thinkorswim), TradeStation, and NinjaTrader offer advanced order types like bracket orders, OCO (One-Cancels-Other), trailing stops, and conditional orders suitable for day trading.

What security features should I check in a day trading platform?

Look for two-factor authentication, secure login protocols, and data encryption. Check if the platform offers real-time risk management tools like stop-loss orders. Ensure there are strict account verification processes and fraud protection measures. Review the platform’s history for past security breaches. Confirm regular security audits and compliance with industry standards like GDPR or SOC 2. Also, consider secure API access and multi-layered security controls for connected devices.

Learn about Security Features in Day Trading Software

How do trading platform interfaces impact day trading success?

Trading platform interfaces directly affect day trading success by enabling quick decision-making and seamless execution. User-friendly, fast, and reliable interfaces reduce errors and slippage, critical for intraday trades. Advanced charting tools, real-time data, and customizable layouts improve analysis and timing. A cluttered or slow platform hampers reaction speed, leading to missed opportunities. The best day trading brokers offer intuitive platforms that balance complexity with accessibility, boosting confidence and efficiency.

Learn about How Do Prop Firms Impact Day Trading Profitability?

Which brokers support automated trading for day traders?

Interactive Brokers and TD Ameritrade support automated trading for day traders. Both offer robust APIs, advanced trading platforms, and reliable execution. They allow custom algorithms and automated strategies to run seamlessly during trading sessions.

Learn about Day Trading Brokers for Automated Trading Systems

Are there brokers specializing in certain markets (stocks, forex, crypto)?

Yes, many brokers specialize in specific markets. Some focus on stocks, offering platforms optimized for equity trading. Others, like forex brokers, cater to currency trading with tools tailored for high leverage and fast execution. Crypto brokers target digital asset trading, providing features suited for cryptocurrencies. Each broker's platform is designed to meet the needs of traders in that specific market.

How do customer support and educational resources vary across brokers?

Customer support at top day trading brokers varies in availability and quality; some offer 24/7 live chat and phone support, while others rely on email or limited hours. Educational resources differ too—leading brokers provide comprehensive tutorials, webinars, and real-time market analysis, whereas smaller brokers may only offer basic guides. The best trading platforms often come with integrated support tools, but the depth of educational content and support responsiveness can influence your trading experience.

What are the pros and cons of popular trading platforms like ThinkorSwim, MetaTrader, and TradingView?

ThinkorSwim offers advanced charting, paper trading, and strong research tools, ideal for active traders. Its cons include a steep learning curve and occasional platform bugs. MetaTrader is popular for automated trading, custom indicators, and broad broker compatibility, but it can be clunky and lacks integrated news feeds. TradingView shines with its user-friendly interface, social trading features, and excellent charting, though it doesn’t support direct order execution on all brokers and is limited in back-end automation. Each platform suits different trading styles—ThinkorSwim for in-depth analysis, MetaTrader for automation, and TradingView for social and visual insights.

Learn about Pros and Cons of Popular Day Trading Platforms

Conclusion about Day Trading Brokers with the Best Trading Platforms

In summary, selecting the right day trading broker hinges on various critical factors, including platform reliability, execution speed, and available tools. Look for brokers that cater to active traders with low fees, robust charting capabilities, and strong customer support. Platforms like ThinkorSwim and MetaTrader offer unique advantages, but it’s essential to evaluate your specific trading needs. For comprehensive insights and guidance on choosing the best day trading brokers and platforms, DayTradingBusiness is here to help you navigate the complexities of the trading landscape.

Learn about FAQs About Day Trading Platforms

Sources:

- Institutional trading and alternative trading systems - ScienceDirect

- How free is free? Retail trading costs with zero commissions ...

- All-to-All Trading in the U.S. Treasury Market

- Comments on “the role of information in a continuous double auction ...

- fun and games - investment gamification and implications for capital ...