Did you know that the average person spends about 6 months of their life waiting for red lights to turn green? While waiting may not be ideal, finding the right day trading broker shouldn’t take as long! In this article, we dive into the world of day trading brokers with low commissions, exploring the best options available in 2023. We’ll discuss how these brokers can significantly impact your trading profits, the essential features to consider, and any hidden fees to watch out for. Additionally, we’ll help you understand how to select the right broker for your trading style and compare your options effectively. Finally, we’ll highlight the advantages low commission brokers offer, including trading tools and customer support, ensuring you have the knowledge to make informed decisions. With insights from DayTradingBusiness, let's get started on maximizing your trading potential!

What are the best day trading brokers with low commissions?

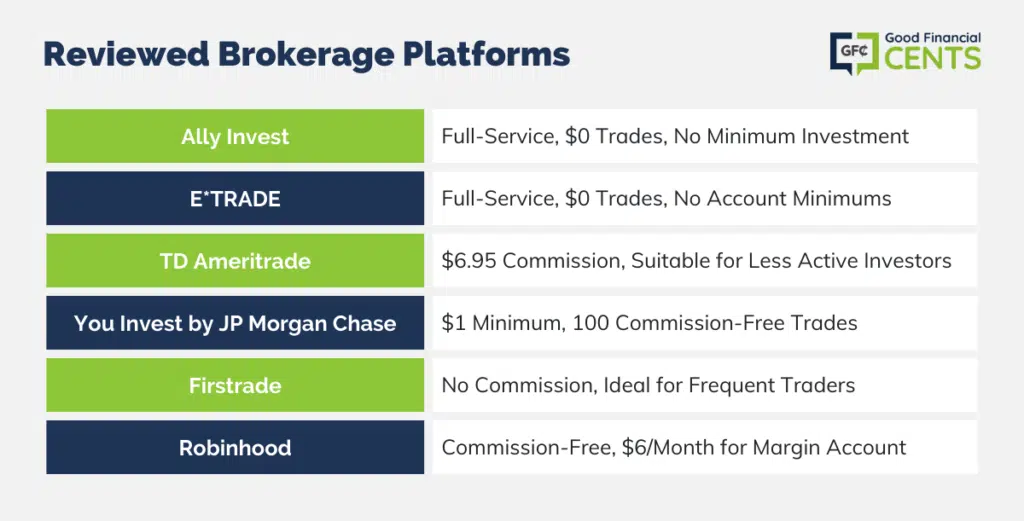

The best day trading brokers with low commissions include:

1. Robinhood – Zero commission trades on stocks and options.

2. Webull – No commission on stocks, ETFs, and options; offers advanced trading tools.

3. TD Ameritrade – Commission-free trades on stocks and ETFs, plus powerful trading platforms.

4. Fidelity – No commission on stocks and ETFs, with strong research and resources.

5. Charles Schwab – Commission-free trades for stocks and ETFs, with solid customer support.

Choose based on your trading needs and platform preferences.

How do low commission brokers affect day trading profits?

Low commission brokers can significantly boost day trading profits by reducing the costs associated with each trade. With lower fees, traders can execute more transactions without eating into their profits. This is crucial for day trading, where frequent buying and selling is common. Additionally, lower commissions mean that even small price movements can become profitable, allowing traders to capitalize on more opportunities. Overall, choosing a low commission broker directly enhances a trader's ability to maximize returns.

What features should I look for in a low commission day trading broker?

Look for a low commission day trading broker that offers low trading fees, a user-friendly trading platform, fast execution speeds, advanced charting tools, and reliable customer support. Ensure they provide access to a wide range of assets, including stocks, ETFs, and options. Consider the availability of educational resources, research tools, and risk management features like stop-loss orders. A good mobile app is also a plus for trading on the go.

Are there any hidden fees with low commission day trading brokers?

Yes, low commission day trading brokers can have hidden fees. These may include charges for withdrawal, account maintenance, data feeds, or margin trading. Always read the fine print and check for fees related to inactivity or trading platforms.

How do I choose the right low commission broker for my trading style?

To choose the right low commission broker for day trading, consider these key factors:

1. Commission Rates: Look for brokers that offer low or zero commissions on trades. Compare different platforms to find the best rates.

2. Execution Speed: Ensure the broker provides fast order execution, as this is crucial for day trading success.

3. Trading Tools: Evaluate the tools and features offered, like advanced charting, technical indicators, and real-time data.

4. Margin Rates: Check the margin rates, as they can significantly impact your trading costs.

5. Platform Usability: Test the trading platform for user-friendliness. A smooth interface can enhance your trading experience.

6. Customer Support: Look for responsive customer service to address any issues quickly while you trade.

7. Regulation and Safety: Ensure the broker is regulated by a reputable authority to protect your funds.

Compare these elements across various brokers to find the best fit for your day trading style.

What are the top-rated low commission brokers for day trading in 2023?

The top-rated low commission brokers for day trading in 2023 include:

1. Webull – Zero commissions on trades, excellent mobile platform.

2. Robinhood – No commission trading, user-friendly interface.

3. TD Ameritrade – $0 commissions, advanced trading tools with thinkorswim.

4. Charles Schwab – No commission on online stock trades, robust research tools.

5. Fidelity – $0 commission, strong customer service and educational resources.

These brokers are popular for their low fees and trading features suited for day traders.

How can I compare day trading brokers with low commissions?

To compare day trading brokers with low commissions, focus on these key factors:

1. Commission Rates: Look for brokers that offer the lowest per-trade commissions or commission-free trading.

2. Account Minimums: Check if there are minimum balance requirements to avoid fees.

3. Trading Platforms: Evaluate the usability and features of their trading platforms. A good platform enhances your trading experience.

4. Execution Speed: Research broker reviews to gauge their order execution speed, which is crucial for day trading.

5. Margin Rates: Compare margin rates if you plan to trade on margin, as these can affect your profitability.

6. Research and Tools: Consider the research resources and analytical tools available for making informed trading decisions.

7. Customer Support: Assess the quality of customer service for assistance when needed.

Use these criteria to narrow down your options and find the best fit for your day trading needs.

What advantages do low commission brokers offer for day traders?

Low commission brokers offer day traders several key advantages:

1. Cost Efficiency: Lower fees mean more of your profits stay in your pocket, essential for the frequent trading day traders engage in.

2. Increased Trade Frequency: Reduced costs allow traders to execute more trades without worrying about high commissions eating into their gains.

3. Better Profit Margins: With lower commissions, even small price movements can be profitable, which is crucial for day trading strategies.

4. Access to Advanced Tools: Many low commission brokers provide robust trading platforms and tools, enhancing decision-making and trade execution.

5. Flexibility: Lower costs enable traders to experiment with different strategies without the fear of significant losses from commissions.

These advantages make low commission brokers attractive for day traders seeking to maximize their returns.

Do low commission brokers provide adequate trading tools and resources?

Low commission brokers often offer basic trading tools and resources, but they may lack the advanced features found with higher-cost platforms. You can typically access essential charting, market data, and order types, but premium tools like advanced analytics or in-depth research might be limited. Always check specific broker offerings to ensure they meet your day trading needs.

How do low commission rates impact trading frequency?

Low commission rates lead to increased trading frequency among day traders. When brokers charge less per trade, traders can execute more transactions without worrying about high costs eating into their profits. This encourages them to take advantage of small price movements throughout the day. As a result, low commission structures can significantly enhance day trading strategies and overall profitability.

Are there low commission brokers that cater to beginner day traders?

Yes, several low commission brokers cater to beginner day traders. Popular options include:

1. Robinhood – No commission on trades, user-friendly interface.

2. Webull – Zero commissions, advanced charting tools, and a paper trading feature.

3. TD Ameritrade – No commissions for online stock trades, robust educational resources.

4. E*TRADE – Commission-free trades, excellent trading platforms for beginners.

5. Fidelity – No commission on stocks and ETFs, strong research tools.

These brokers provide accessible platforms and resources ideal for novice day traders.

What are the risks of using low commission day trading brokers?

Using low commission day trading brokers can pose several risks. First, they may offer inferior execution speeds, leading to slippage and missed opportunities. Second, such brokers might have limited customer support, making it hard to resolve issues quickly. Third, they could provide fewer trading tools and research resources, hindering informed decision-making. Lastly, some low-cost brokers might engage in questionable practices, like payment for order flow, which could compromise trade quality. Always assess the broker’s reputation and services beyond just commission rates.

Learn about What Are the Risks of Using Non-Compliant Day Trading Brokers?

How can I find promotional offers from low commission brokers?

To find promotional offers from low commission brokers, start by visiting their websites directly. Look for sections labeled "Promotions" or "Offers." Sign up for newsletters to receive updates on current deals. Follow brokers on social media for exclusive promotions. Use comparison sites that list brokers and their offers. Engage in trading forums or communities where users share current promotions. Lastly, check financial news websites for announcements about broker deals.

Do low commission brokers offer margin trading options?

Yes, many low commission brokers do offer margin trading options. These brokers provide access to leverage, allowing traders to borrow funds against their investments. Check the specific broker's terms to understand their margin requirements and interest rates.

What account types do low commission day trading brokers provide?

Low commission day trading brokers typically offer the following account types:

1. Individual Cash Account: Ideal for casual traders, allowing you to trade with the cash you deposit.

2. Individual Margin Account: Enables you to borrow funds to trade, increasing your buying power.

3. Retirement Accounts (e.g., IRA): Tax-advantaged accounts for long-term investing, with restrictions on withdrawals.

4. Joint Accounts: Shared accounts for multiple individuals, useful for couples or partners trading together.

5. Corporate Accounts: Designed for businesses to trade in the market.

Each account type comes with different features and benefits, so choose one that fits your trading strategy.

Learn about Day Trading Brokers with Low Minimum Deposits

How do low commission brokers handle customer support for day traders?

Low commission brokers typically offer customer support for day traders through multiple channels, including live chat, email, and phone support. They often provide dedicated support teams knowledgeable about day trading strategies, market conditions, and platform issues. Many also include educational resources like webinars and FAQs tailored to day trading needs. Some brokers may offer 24/7 support to assist with urgent trading issues, ensuring traders have access to help when needed.

Learn about What Are Prop Firms and How Do They Support Advanced Day Traders?

Conclusion about Day Trading Brokers with Low Commissions

In summary, selecting a low commission day trading broker can significantly enhance your trading experience and profitability. It's crucial to evaluate each broker's features, potential hidden fees, and suitability for your trading style. By making informed comparisons and considering the advantages these brokers offer, you can optimize your trading strategy. For comprehensive insights and tailored support in navigating these options, DayTradingBusiness is here to assist you in achieving your trading goals.

Learn about Day Trading Brokers with Low Minimum Deposits