Did you know that the only thing that might be more volatile than the stock market is your coffee on a Monday morning? In day trading, choosing the right broker with competitive margin rates can significantly impact your profitability. This article dives into the best day trading brokers with low margin rates, exploring how these rates affect your trading success. We’ll cover key factors like leverage options, commission fees, and minimum deposit requirements, as well as the importance of real-time margin updates and customer support. Discover the best platforms for day trading that not only meet your needs but also offer enticing deals for active traders. Join us at DayTradingBusiness as we unpack these essential aspects to help you make informed trading decisions.

What are the best day trading brokers with low margin rates?

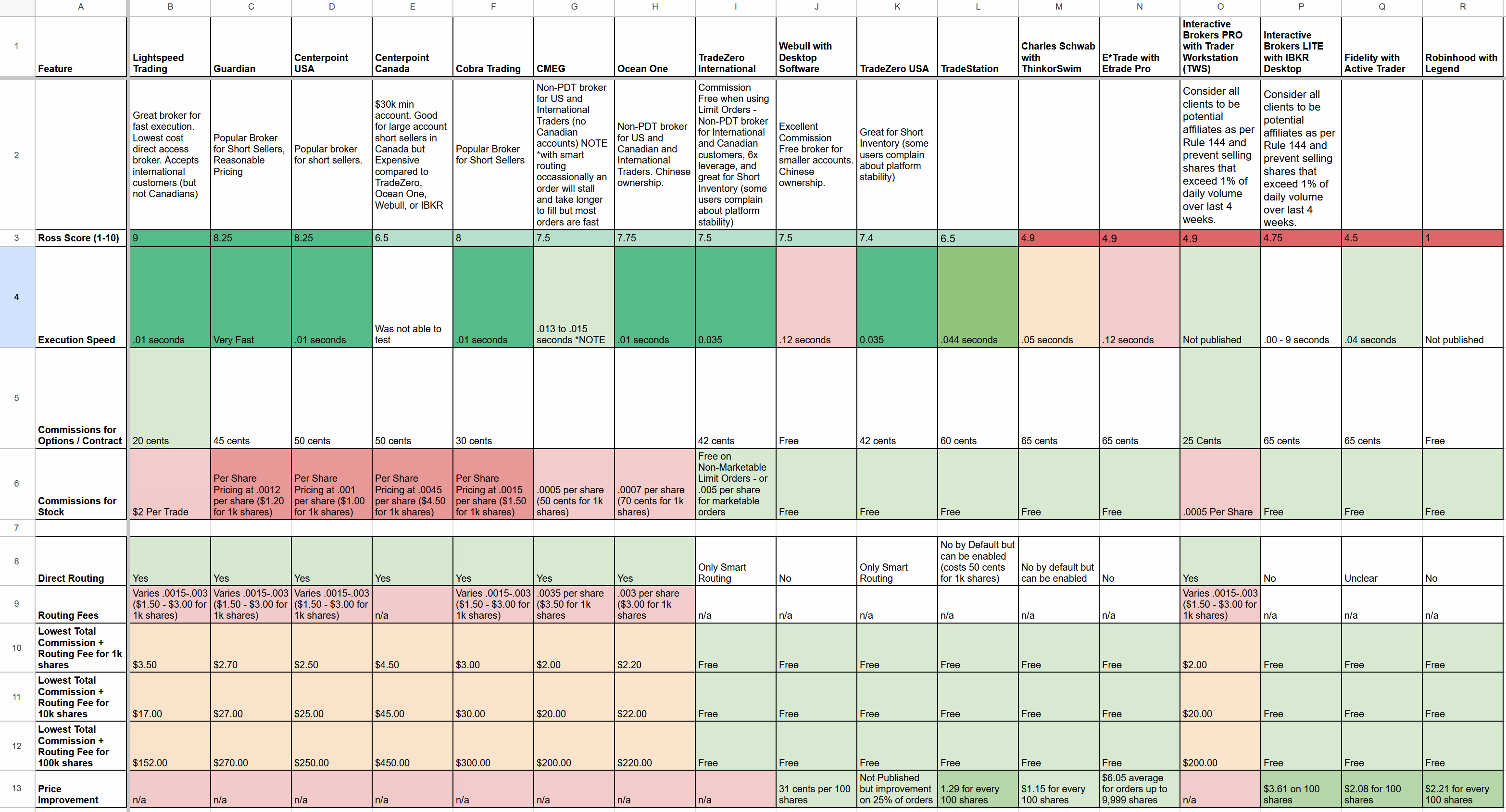

The best day trading brokers with low margin rates include Interactive Brokers, TD Ameritrade (thinkorswim), and Charles Schwab. Interactive Brokers offers some of the lowest margin rates, often below 1%, making it ideal for active traders. TD Ameritrade provides competitive margin rates around 7-8%, with excellent trading platforms. Charles Schwab also offers low margin rates, around 8%, with reliable service. These brokers combine low margin costs with strong tools and execution for day traders.

How do margin rates affect day trading profitability?

Lower margin rates increase day trading profitability by reducing borrowing costs on leveraged positions. When brokers offer competitive margin rates, traders pay less interest on borrowed funds, boosting net gains. High margin rates eat into profits, making trades less profitable, especially in frequent trading strategies. Choosing brokers with favorable margin rates allows traders to maximize returns on small price movements.

Which brokers offer the highest leverage for day traders?

Interactive Brokers and IC Markets offer the highest leverage for day traders, often up to 1:500 or 1:500+. Some brokers in forex and CFD trading also provide leverage up to 1:1000, but regulations limit these in many regions. Always check specific broker limits based on your location.

Are there brokers with no minimum deposit requirements?

Yes, some day trading brokers have no minimum deposit requirements, like Webull and Robinhood, making it easier to start trading without a large initial investment.

How do commission fees impact day trading costs?

Commission fees add to the overall cost of each trade, lowering profit margins for day traders. Even low commission rates can accumulate quickly with frequent trades, increasing total expenses. Competitive margin rates reduce borrowing costs, but commission fees still cut into gains. High commission fees can make day trading less profitable, especially for small or frequent trades. Choosing brokers with low commission fees and margin rates helps keep trading costs manageable.

What should I look for in a day trading broker’s margin policy?

Look for low margin requirements, clear leverage limits, and transparent rules on margin calls. Ensure the broker offers quick margin withdrawal, strict risk management policies, and no hidden fees. Check if they provide real-time margin monitoring and support for your trading style.

Which brokers provide real-time margin updates?

Interactive Brokers and TD Ameritrade offer real-time margin updates.

How do regulatory rules influence margin rates for day trading?

Regulatory rules cap leverage and require minimum margin deposits, which lower margin rates for day trading. They set maximum borrowing limits, preventing brokers from offering excessively high leverage that could inflate margin rates. These rules also enforce disclosure and transparency, ensuring traders understand margin costs. Overall, regulation keeps margin rates fair and limits risky borrowing, shaping the competitive landscape among day trading brokers.

Can I find brokers with flexible margin trading options?

Yes, many day trading brokers offer flexible margin trading options, allowing you to adjust margin levels based on your trading strategies. Look for brokers with competitive margin rates like Interactive Brokers or TD Ameritrade, which provide customizable margin limits and quick adjustments. Always check their margin policies to ensure they match your trading style.

What are the risks of high leverage in day trading?

High leverage in day trading amplifies both gains and losses, risking rapid account depletion if trades go against you. It can lead to margin calls, forcing you to deposit more funds or close positions at a loss. Sudden market swings become more damaging, increasing the chance of losing your entire investment quickly. Overleveraging also heightens emotional stress, potentially causing reckless decisions. Ultimately, it raises the risk of substantial financial loss and account liquidation.

Learn about What are the common leverage risks in day trading?

Which brokers have the fastest order execution for day traders?

Interactive Brokers and TD Ameritrade offer the fastest order execution for day traders.

How do broker margin rates compare across different markets?

Broker margin rates vary widely across markets. U.S. brokers often offer margin rates between 2% and 8%, with some discount brokers providing even lower rates for high-volume traders. In Europe, margin rates can range from 1% to 10%, depending on the broker and asset class. Asian brokers tend to have competitive rates, often around 1% to 5%, especially for forex and CFDs. Overall, discount brokers in developed markets usually offer the lowest margin rates, while full-service brokers charge more.

Are there brokers with special offers for active day traders?

Yes, many day trading brokers offer special promotions or lower margin rates for active traders. Look for brokers like Interactive Brokers, TD Ameritrade, or TradeZero that frequently provide reduced commissions, higher leverage, or exclusive deals for high-volume traders.

How important is customer support when choosing a day trading broker?

Customer support is crucial when choosing a day trading broker because quick, reliable help prevents costly mistakes during fast-paced trades. Good support ensures you can resolve issues like platform glitches or account problems immediately, minimizing risks and downtime. For day traders relying on tight margins and rapid decisions, responsive customer service can make the difference between profit and loss.

Learn about Day Trading Platforms with Customer Support and Resources

What are the best platforms for day trading with competitive margins?

Interactive Brokers and TD Ameritrade offer some of the best platforms for day trading with competitive margin rates. Interactive Brokers provides low margin rates and advanced trading tools, ideal for active traders. TD Ameritrade's thinkorswim platform combines robust features with competitive margins, especially for frequent traders. Both platforms are trusted, feature-rich, and designed for high-volume trading with tight spreads.

Learn about Day Trading Brokers with the Best Trading Platforms

Conclusion about Day Trading Brokers with Competitive Margin Rates

In conclusion, selecting the right day trading broker with competitive margin rates is crucial for maximizing profitability. Consider factors like margin policies, commission fees, and leverage options to make informed decisions. Brokers that offer real-time margin updates and strong customer support can significantly enhance your trading experience. For expert guidance and detailed insights, DayTradingBusiness is here to help you navigate the complexities of choosing the best broker for your day trading needs.