Did you know that the average day trader makes more trades in a single day than some people make in a month? In the fast-paced world of high-frequency trading, choosing the right broker can make all the difference. This article dives into the best brokers for high-frequency day trading, focusing on critical aspects like order execution speed, low latency, and direct market access. We also explore essential features to look for, the impact of commissions and spreads, and how regulations can influence your trading experience. Whether you're interested in stocks or forex, understanding margin requirements and testing broker reliability is crucial for maximizing profitability. Join us as we uncover the top brokers and strategies tailored for high-frequency trading, brought to you by DayTradingBusiness.

What are the best brokers for high-frequency day trading?

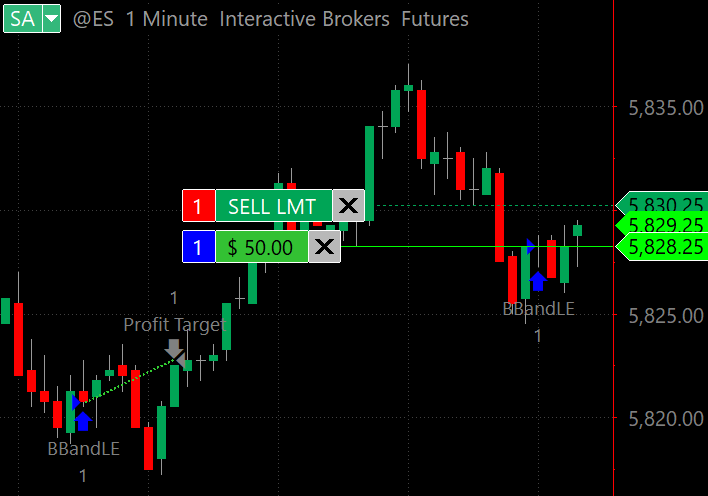

Interactive Brokers and TradeStation are top choices for high-frequency day trading due to their low latency, advanced order execution, and competitive commissions. Fidelity and Charles Schwab also offer reliable platforms with direct market access, suitable for high-speed trading. However, Interactive Brokers is often considered the best for its robust technology and low-cost structure.

Which brokers offer the fastest order execution for day traders?

Interactive Brokers and TD Ameritrade are among the fastest brokers for day traders, offering low latency order execution suitable for high-frequency trading.

How do I choose a broker with low latency for high-frequency trading?

Look for brokers with direct market access and low-latency infrastructure, like colocated servers close to exchange data centers. Check their execution speed and order processing times—aim for sub-millisecond latency. Read reviews from high-frequency traders about their connectivity and reliability. Ensure they offer fast, stable connections via Ethernet or fiber optics. Test their platform’s speed with demo accounts before committing.

What trading platforms are ideal for high-frequency day traders?

Interactive Brokers and TradeStation are top choices for high-frequency day traders due to their low latency, advanced APIs, and fast execution. TD Ameritrade’s thinkorswim offers robust tools and reliable execution but may be less optimized for ultra-fast trading. Lightspeed Trading provides ultra-low latency platforms specifically designed for high-frequency trading. Consider platforms with direct market access (DMA) and co-location options for the best performance.

Which brokers provide direct market access for quick trades?

Interactive Brokers, TD Ameritrade (Thinkorswim), and TradeZero offer direct market access suitable for quick, high-frequency trades.

What are the key features to look for in a high-frequency trading broker?

Look for ultra-low latency execution, reliable and fast order processing, advanced trading technology, tight bid-ask spreads, high leverage options, and robust risk management tools. Ensure they offer direct market access, minimal slippage, and strong security. Good infrastructure and support for algorithmic trading are also essential.

How important are commissions and spreads for high-frequency day trading?

Commissions and spreads are crucial for high-frequency day trading because they directly cut into profits. Low spreads mean less cost per trade, which matters when executing dozens or hundreds of quick trades daily. Similarly, tight commissions keep overall trading expenses minimal, allowing the trader to capitalize on small price movements. High spreads or high commissions can erode gains, making it harder to profit consistently in high-frequency trading.

Which brokers support algorithmic and automated trading strategies?

Interactive Brokers, TD Ameritrade, TradeStation, NinjaTrader, and E*TRADE support algorithmic and automated trading strategies.

Are there brokers that specialize in high-speed data feeds?

Yes, some brokers specialize in high-speed data feeds for high-frequency trading, offering low-latency connections and direct market access. Examples include Interactive Brokers, Lightspeed, and TradeZero. These brokers provide advanced infrastructure tailored for fast, automated trading strategies.

How does broker regulation affect high-frequency day trading?

Broker regulation impacts high-frequency day trading by ensuring fair execution, preventing manipulation, and enforcing capital requirements. Regulated brokers must follow strict rules, reducing risks of fraud and order manipulation. They often provide better transparency, faster order execution, and access to reliable trading platforms. Without regulation, high-frequency traders face higher risks of unfair practices and unreliable service.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

What are the risks of using certain brokers for high-frequency trading?

Using certain brokers for high-frequency trading risks order execution delays, increased slippage, and limited access to advanced trading technology. Some brokers may have restrictions on order speed or impose higher fees, cutting into profits. Regulatory issues or lack of proper infrastructure can also cause sudden disconnections or unreliable data feeds, risking significant losses during rapid trades.

Which brokers offer the best leverage options for day traders?

Interactive Brokers and TD Ameritrade offer the best leverage options for day traders, with Interactive Brokers providing up to 90:1 leverage in some markets and TD Ameritrade offering around 30:1. Both are popular choices for high-frequency trading due to their flexible margin policies and fast execution.

Learn about Best Day Trading Brokers for Options Trading

How can I test a broker’s speed and reliability before trading?

Test a broker’s speed and reliability by running a demo account with low latency, monitoring order execution times, and checking for slippage during high-volume trades. Use tools like speed tests on their trading platform, review execution reports, and read user feedback on reliability during volatile markets. Consider executing small, rapid trades to see if orders fill promptly without errors.

What are the best brokers for trading stocks vs. forex in high-frequency strategies?

Interactive Brokers and TradeStation excel for high-frequency stock trading due to low latency and advanced APIs. For forex, IC Markets and MetaTrader 4/5 brokers like FXTM and Pepperstone offer fast execution and reliable order processing.

How do broker fees impact high-frequency trading profitability?

Broker fees cut into high-frequency trading profits by increasing transaction costs. Frequent trades mean even small fees add up quickly, eroding margins. Low or zero-commission brokers boost profitability by reducing these expenses. High-speed, low-latency brokers with competitive fees are essential for maximizing gains in day trading high-frequency strategies.

Learn about How Do Prop Firms Impact Day Trading Profitability?

What should I know about margin requirements for high-frequency day trading?

High-frequency day trading demands margin requirements that are typically higher than standard trading. Brokers often offer lower margin rates, but you need enough capital to meet their minimum equity requirements, which can range from $25,000 to $100,000. Leverage is usually high, sometimes up to 20:1 or more, increasing both profit potential and risk. Maintain strict risk management and be aware that sudden market moves can trigger margin calls. Choose brokers that support high-speed execution and have clear margin policies for day trading.

Learn about What should beginners know about legal compliance in day trading?

Conclusion about Day Trading Brokers for High-Frequency Trading

In conclusion, selecting the right broker for high-frequency day trading is crucial for success. Look for features such as low latency, fast order execution, and direct market access to enhance your trading experience. Consider factors like commissions, spreads, and regulatory standards to ensure profitability and security. With the right broker, you can effectively leverage high-frequency trading strategies, whether in stocks or forex. For comprehensive insights and guidance, DayTradingBusiness is here to assist you in making informed decisions.

Learn about What Is the Impact of High-Frequency Trading on Institutional Day Trading?