Did you know that even the best traders sometimes treat backtesting like a game of darts—blindfolded? To boost your day trading success, optimizing your backtesting is crucial. In this article, we cover essential tips to enhance the accuracy of your results, including choosing the right historical data and tools. You'll learn how to avoid common pitfalls like overfitting and how to incorporate transaction costs effectively. We also discuss key metrics to analyze performance, the best timeframes for backtesting, and the importance of validating your models before going live. With insights from DayTradingBusiness, you'll be equipped to refine your strategies and tackle the markets with confidence.

How can I improve the accuracy of my backtesting results?

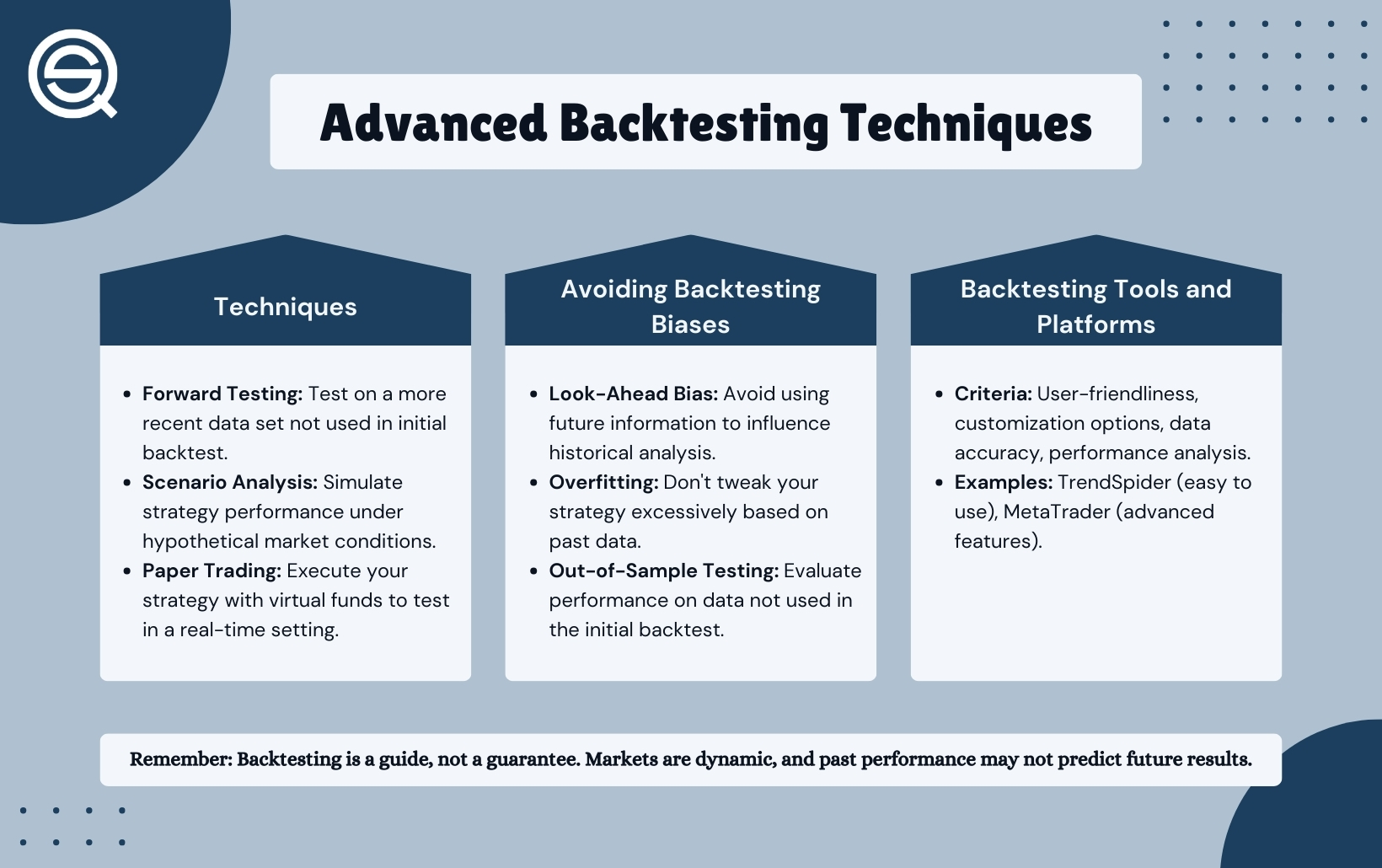

Use realistic data, including slippage and transaction costs. Avoid overfitting by testing on out-of-sample data. Incorporate variable market conditions to reflect real volatility. Validate your strategy with walk-forward testing. Keep your parameters simple and avoid curve-fitting. Regularly update your data to match current market behavior. Use multiple backtesting platforms to cross-verify results. Document your assumptions and ensure your model mimics actual trading conditions.

What are the best tools for day trading backtesting?

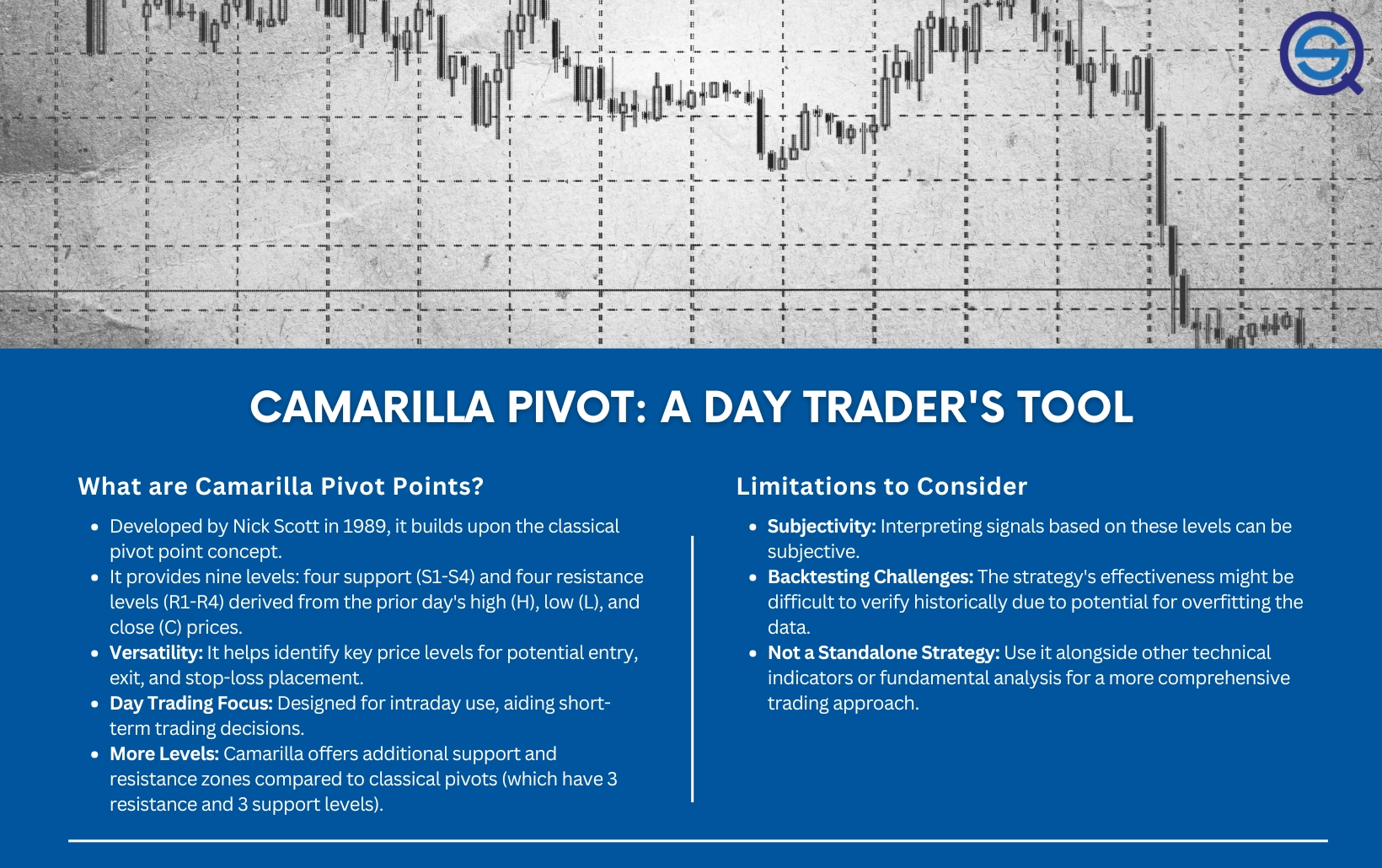

The best tools for day trading backtesting include TradingView, Thinkorswim, MetaTrader 4 and 5, NinjaTrader, and TradingSim. These platforms offer robust charting, real-time data, and customizable scripts to test strategies quickly. Use TradingView for its user-friendly interface and extensive indicator library. Thinkorswim by TD Ameritrade provides advanced analysis features. MetaTrader is popular for forex backtesting with its Expert Advisor tester. NinjaTrader offers detailed performance metrics and automation. TradingSim helps simulate real trading environments for strategy validation.

How do I choose the right historical data for backtesting?

Pick historical data that matches your trading style, including the same markets, timeframes, and conditions you plan to trade. Use clean, high-quality data with minimal gaps and errors. Focus on data covering different market environments—bullish, bearish, and sideways—to test robustness. Ensure the data’s resolution aligns with your trading strategy—tick data for scalping, daily data for longer-term trades. Avoid outdated or overly cherry-picked data; instead, choose a broad, representative sample to reflect real market behavior.

What metrics should I focus on when analyzing backtest performance?

Focus on profit factor, maximum drawdown, win rate, risk-reward ratio, and Sharpe ratio. Look at consistency over multiple periods, expectancy, and the number of trades to ensure reliability. Avoid metrics that can be skewed by small sample sizes, and prioritize those that reflect risk-adjusted returns and drawdown control.

How can I avoid overfitting in my backtesting models?

Use out-of-sample data to test your model, avoid excessive parameter tuning, and keep your backtests simple. Incorporate walk-forward analysis to validate stability over time. Limit the number of parameters and avoid fitting to noise. Regularly cross-validate your models across different market conditions. Be cautious with curve-fitting; prioritize robustness over perfect past performance.

What are common mistakes to watch out for in backtesting?

Common mistakes in backtesting include overfitting to historical data, ignoring transaction costs, using unrealistic assumptions like perfect fills, not accounting for slippage, and failing to test across different market conditions. Also, relying on too small sample sizes or cherry-picking data can give misleading results. Avoid adjusting parameters after seeing the results, and don't assume past performance guarantees future success.

How do I incorporate transaction costs into my backtest?

Include transaction costs as fixed per trade or percentage of trade value in your backtest. Adjust your trading algorithm to subtract these costs from profits or add them to losses each time you enter or exit a position. Use realistic estimates—broker fees, spreads, slippage—and apply them consistently across all trades. This ensures your backtest accurately reflects real trading conditions.

How can I optimize trading strategies based on backtesting results?

Use backtesting results to identify robust strategies that perform well across different market conditions. Focus on optimizing parameters like entry and exit points, stop-loss levels, and position sizing. Avoid overfitting by testing on unseen data or out-of-sample periods. Incorporate risk management rules to improve strategy resilience. Continuously refine based on performance metrics like drawdown, win rate, and profit factor. Adjust your strategy to adapt to changing market dynamics, and validate improvements with forward testing.

What timeframes are best for effective day trading backtests?

Use timeframes of 1-minute to 15-minute charts for effective day trading backtests. These capture intraday price movements and volatility essential for accurate strategy evaluation. Avoid longer timeframes like daily or weekly, as they miss the quick price swings crucial for day trading. Focus on data covering several weeks to months to test performance across different market conditions.

How do I test multiple strategies simultaneously?

Use a backtesting platform that supports multi-strategy testing, like TradingView or MetaTrader. Set up each strategy with different parameters or indicators. Run a combined backtest to see how each performs over the same data set. Analyze the results side-by-side, focusing on metrics like profit, drawdown, and win rate. Adjust strategies based on performance, then retest to compare outcomes. This helps identify the best approach without running separate tests.

How can I ensure my backtest reflects real market conditions?

Use realistic data, including bid-ask spreads, commissions, and slippage. Simulate trading hours accurately and avoid future data lookahead. Include transaction costs and account for market volatility. Test on out-of-sample data to validate robustness. Keep your backtest environment as close to live trading as possible.

What role does leverage play in backtesting accuracy?

Leverage skews backtesting accuracy by amplifying gains and losses, making results look more profitable than realistic. It can hide risks or overstate potential returns if not properly accounted for. Using realistic leverage levels in your backtest ensures more reliable insights into how your trading strategy performs under actual market conditions.

How do I handle data gaps and anomalies in backtesting?

Identify data gaps and anomalies early by comparing your data with reliable sources. Fill gaps with adjusted or interpolated data, but note limitations. For anomalies, verify if they’re real market events or data errors; exclude or correct errors. Use robust data cleaning tools and set alerts for irregularities. Document all adjustments to ensure transparency. Regularly update your data set to prevent future gaps and anomalies.

How often should I update my backtesting models?

Update your backtesting models every 1 to 3 months to reflect recent market changes and data. If markets are volatile or your trading strategies evolve, update more frequently—every few weeks. Regular updates ensure your models stay accurate and relevant for day trading.

What are the limitations of backtesting in day trading?

Backtesting in day trading can be limited by unrealistic assumptions about market conditions, overfitting to past data, and ignoring slippage and transaction costs. It may give a false sense of profitability if it doesn't account for real-time execution delays or market impact. Historical data might lack the volatility and surprises of live trading, leading to overly optimistic results. Also, backtests often neglect psychological factors traders face in real markets, making them less reliable for predicting future performance.

How can I validate my backtest before live trading?

To validate your backtest before live trading, compare its results with a forward test on a different data set, ensuring consistency. Check for overfitting by testing on out-of-sample data and confirm that your strategy performs well across multiple market conditions. Use realistic assumptions for slippage, commissions, and spreads to mirror live trading. Run walk-forward analysis to see if your strategy adapts over time. Finally, review trade logs for logical entry/exit reasons and verify that your backtest code accurately reflects your trading rules.

Conclusion about Tips for Optimizing Your Day Trading Backtesting

In summary, optimizing your day trading backtesting involves a multi-faceted approach that includes selecting reliable historical data, using the right tools, and focusing on key performance metrics. Avoiding common pitfalls like overfitting and incorporating transaction costs are crucial for realistic results. Regularly updating your models and validating them against live market conditions will enhance their accuracy. By following these strategies, traders can refine their techniques and improve their chances of success in the fast-paced world of day trading. For deeper insights and support, DayTradingBusiness is here to help you navigate your trading journey.

Learn about Frequently Asked Questions About Day Trading Backtesting