Did you know that nearly 90% of day traders lose money? Yet, some traders consistently beat the odds through backtesting. In this article, we delve into the essentials of day trading backtesting, exploring its significance and how to select optimal historical data. Discover common pitfalls to avoid, effective indicators, and strategies that enhance the reliability of your results. We also highlight how to account for transaction costs, handle overfitting, and analyze drawdowns—key components that can make or break your trading success. With real-life examples and insights from successful traders, this guide equips you to fine-tune your approach and adapt strategies to live trading. Join DayTradingBusiness as we navigate the complex but rewarding world of day trading backtesting!

What is day trading backtesting and why is it important?

Day trading backtesting is testing a trading strategy on historical market data to see how it would have performed. It’s important because it helps traders identify effective strategies, avoid costly mistakes, and build confidence before risking real money. For example, a trader might backtest a momentum strategy on past stocks to verify its profitability before live trading.

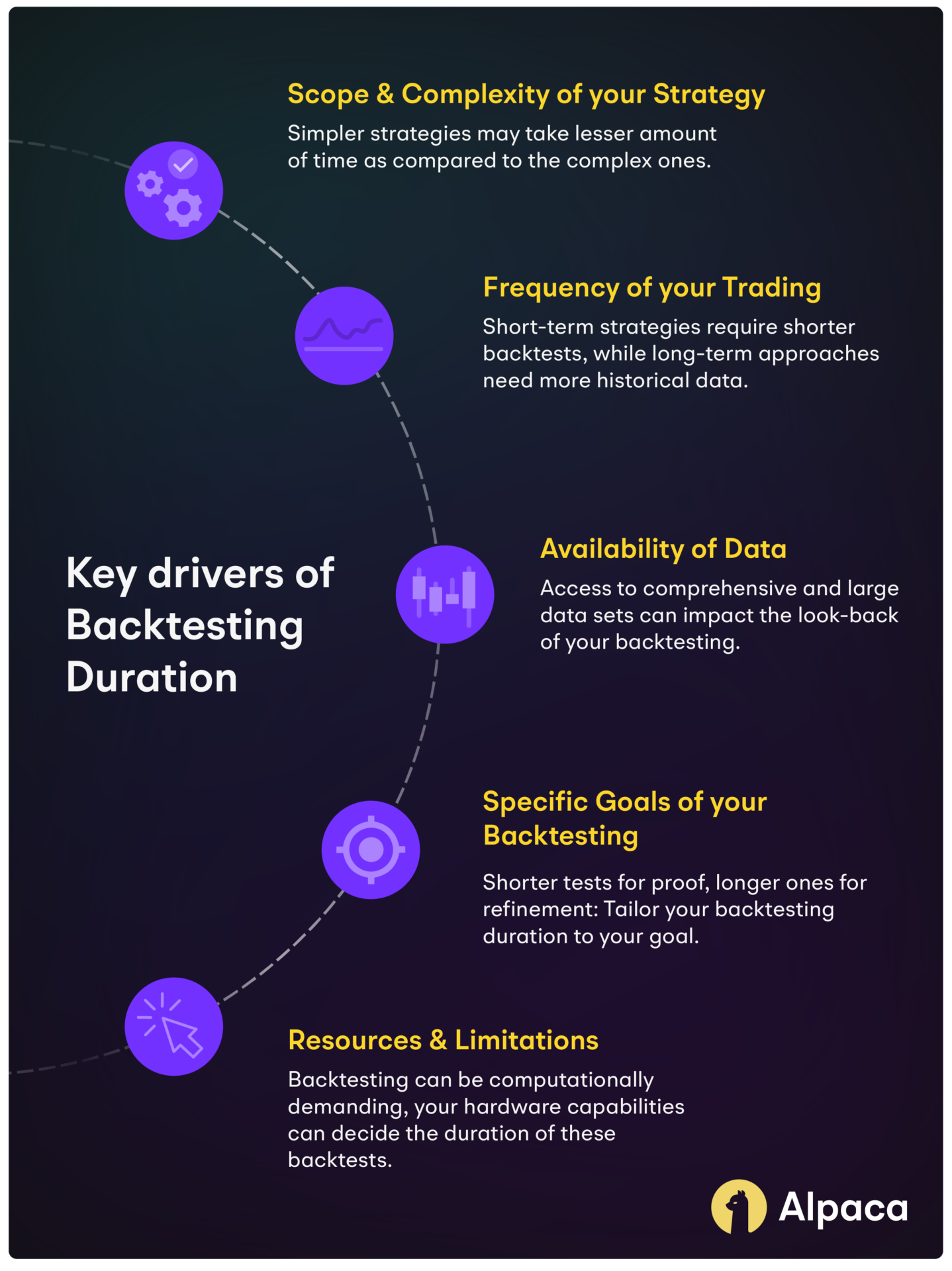

How do I select the best historical data for backtesting day trades?

Choose historical data that matches your trading style, timeframes, and assets. Use high-quality, clean data with minimal errors, preferably from reputable sources like exchanges or data providers. Focus on periods with market conditions similar to current trends, including volatility and liquidity. For example, if you trade stocks during volatile earnings seasons, include data from those times. Ensure data covers enough history to test your strategy across different market cycles. Use intraday data if your strategy relies on minute-by-minute price movements.

What are common mistakes to avoid in day trading backtests?

Avoid cherry-picking data that skews results. Don’t ignore transaction costs or slippage—they eat into profits. Use unrealistic assumptions, like perfect fills or instant order execution. Overfitting your model to past data makes it fail in real trading. Neglecting to test across different market conditions leads to false confidence. Relying solely on backtested results without forward testing can mislead. Failing to account for emotional impact and risk management skews real-world performance.

How can I evaluate the reliability of backtest results?

Check if the backtest uses realistic data, including slippage and transaction costs. Ensure it’s out-of-sample and forward-tested on unseen data. Look for consistent results over different periods and market conditions. Verify the strategy’s robustness with sensitivity analysis. Avoid overfitting by examining if the strategy performs well on multiple datasets. Consider the quality of data—clean, high-frequency data is crucial. Lastly, compare backtest results with live trading performance to identify discrepancies.

Which indicators are most effective in day trading backtests?

Effective indicators for day trading backtests include the Relative Strength Index (RSI), Moving Averages (like the 20- and 50-period), Bollinger Bands, the Moving Average Convergence Divergence (MACD), and volume indicators. These tools help identify momentum, trend direction, and overbought or oversold conditions, enabling precise entry and exit points. Real-life successful backtests often combine these indicators, like using RSI with Moving Averages to confirm signals, leading to better trade accuracy.

How do I incorporate transaction costs into my backtest?

Include transaction costs as a fixed fee or percentage per trade in your backtest. Deduct these costs from each trade’s profit or add them to the loss before calculating net results. Use realistic estimates based on broker fees, spreads, and slippage. For example, if your broker charges $5 per trade, subtract $5 from each completed trade’s profit. Adjust your strategy parameters to account for these costs, ensuring your backtest reflects real-world trading conditions accurately.

What strategies work best for day trading backtesting?

Use historical market data to simulate your trades, focusing on timeframes relevant to your strategy. Incorporate realistic assumptions about order execution, slippage, and commissions. Test multiple setups—like moving averages or breakout patterns—to see which yield consistent profitability. Keep your backtests simple—avoid overfitting—by validating results across different market conditions. Use software like TradingView or MetaTrader to automate and analyze trades. For example, a trader testing a momentum strategy might backtest on volatile stocks during specific hours, adjusting parameters until they find a reliably profitable setup.

How can I improve the accuracy of my backtesting models?

Use realistic data, including slippage and commissions, to mirror live trading conditions. Incorporate multiple market scenarios and different timeframes for robustness. Validate your strategies on out-of-sample data. Avoid overfitting by keeping models simple and testing with walk-forward analysis. Regularly update your data and refine your parameters based on recent market behavior.

What software tools are recommended for day trading backtesting?

MetaTrader 4 and 5 are popular for day trading backtesting, offering robust charting and automated strategy testing. TradingView provides easy-to-use backtesting with its scripting language Pine Script, ideal for quick strategy checks. NinjaTrader delivers advanced backtesting features with real-time data, perfect for testing day trading setups. Thinkorswim by TD Ameritrade has built-in backtesting tools tailored for active traders. Amibroker offers powerful custom backtesting and optimization, suitable for detailed strategy analysis.

How do I handle overfitting in my backtesting process?

Use walk-forward analysis, validate your model on unseen data, and incorporate out-of-sample testing. Limit over-optimization by simplifying your strategy parameters. Regularly cross-verify with different market conditions and avoid curve-fitting to past data.

What are real-life examples of profitable day trading backtests?

One example is a trader who backtested a scalping strategy on 5-minute EUR/USD charts, showing a 20% annualized return with a 1.5 risk/reward ratio. Another is a day trader testing a breakout system on Tesla stock, achieving a 25% profit over six months with a 60% win rate. A third case involves backtesting a moving average crossover on Bitcoin, which delivered consistent gains during volatile periods, boosting confidence before live trading. These real-life backtests helped traders refine entries, exits, and risk management, leading to profitable day trading strategies.

Learn about Real-Life Examples of Day Trading Arbitrage

How do I analyze drawdowns in my backtest results?

Check the maximum peak-to-trough decline in your equity curve during the backtest. Look for the largest percentage or dollar loss from a high point before recovery. Use equity charts to visually spot drawdowns, noting their duration and severity. Calculate the average drawdown and the worst-case drawdown to understand risk. Compare drawdowns across different periods or strategies to identify patterns. Use tools like trading software or Excel to automate these calculations for precision.

What role does market volatility play in backtesting success?

Market volatility affects backtesting success by providing realistic price movements that test a strategy’s robustness. High volatility creates diverse scenarios, revealing how well a trading plan handles sudden swings. Low volatility offers stability, but may not reflect real trading conditions, risking over-optimization. Successful backtests often incorporate periods of both high and low volatility, mimicking real market behavior. For example, a day trader’s backtest during volatile times like earnings reports shows how their strategy manages rapid price changes, increasing confidence in real trades.

How can I adapt backtested strategies to live trading?

To adapt backtested strategies to live trading, start by paper trading the strategy in real-time to spot issues. Adjust parameters based on live market conditions, not just historical data. Incorporate real-time data feeds and consider slippage, transaction costs, and order execution delays. Monitor performance closely and refine your approach as market dynamics change. For example, if your backtest shows a breakout strategy working well, test it live with small size, then gradually increase as confidence grows.

What lessons can be learned from failed backtests?

Failed backtests teach traders to refine entry and exit strategies, avoid overfitting to past data, and recognize market conditions that don’t repeat. They highlight the importance of realistic assumptions, proper risk management, and testing across diverse market environments. Failures also remind traders to stay adaptable and question whether their strategies have genuine predictive power or just fit historical noise.

How often should I update my backtesting data and strategies?

Update your backtesting data every 1 to 3 months to ensure it reflects current market conditions. Refresh your strategies whenever you notice significant changes in market behavior or after testing new ideas. Regular updates help keep your trading edge sharp and relevant.

How do successful traders use backtesting to refine their approach?

Successful traders use backtesting to simulate their strategies on historical data, identify what worked, and eliminate what didn’t. They analyze past market conditions to refine entry and exit points, improve risk management, and optimize trade size. For instance, a day trader might backtest a moving average crossover system to see how it performs during volatile versus trending markets, tweaking parameters accordingly. This process helps them build confidence, reduce emotional trading, and develop a data-driven approach that increases their chances of consistent profits.

Conclusion about Real-Life Examples of Successful Day Trading Backtesting

In conclusion, effective day trading backtesting requires careful consideration of historical data, strategy evaluation, and a thorough understanding of market dynamics. By avoiding common pitfalls and incorporating transaction costs, traders can enhance the reliability of their results. Successful backtesting not only identifies profitable strategies but also allows for continuous improvement and adaptation to live trading conditions. For those looking to deepen their trading expertise, DayTradingBusiness offers invaluable insights and resources to navigate the complexities of backtesting and achieve trading success.

Learn about Frequently Asked Questions About Day Trading Backtesting

Sources:

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Interagency Supervisory Guidance on Counterparty Credit Risk ...

- The Fed - Banks' Backtesting Exceptions during the COVID-19 ...

- Large Language Model Agent in Financial Trading: A Survey

- The Fed - Supervisory Letter SR 11-7 on guidance on Model Risk ...

- How to Evaluate Trading Strategies: Single Agent Market Replay or ...