Did you know that even the best day traders sometimes flip a coin to make decisions? While that might sound amusing, there's a far more effective method to enhance your trading performance: backtesting. In this article, we dive into the essentials of backtesting in day trading, detailing its setup, strategies, and the metrics that matter. Learn how to choose the right historical data, avoid common pitfalls, and integrate backtesting results into your live trading. Discover the best software tools, the importance of updating your models, and how to optimize your strategies without falling into the trap of overfitting. With insights from DayTradingBusiness, you'll see how backtesting can reduce risks and improve your trading discipline, ultimately leading to more informed decisions and better trading outcomes.

What is backtesting in day trading?

Backtesting in day trading is testing a trading strategy using historical market data to see how it would have performed. It helps traders evaluate the effectiveness of their strategies before risking real money. By simulating trades based on past price movements, traders identify strengths, weaknesses, and tweak their approach. Backtesting reveals potential profitability, risk levels, and optimal entry or exit points. It’s a crucial step to refine your day trading plan and improve overall performance.

How do I set up a backtesting system?

Choose a reliable trading platform with backtesting features. Gather historical data relevant to your trading strategies. Define your trading rules clearly—entry, exit, stop-loss, and take-profit points. Input these rules into the backtesting software. Run the simulation on historical data to see how your strategy performs. Analyze the results—look for profitability, drawdowns, and consistency. Adjust your strategy based on findings and repeat the backtesting process. Validate with out-of-sample data before live trading.

Which trading strategies work best with backtesting?

Trend-following and momentum strategies work best with backtesting because they rely on historical price patterns to identify entry and exit points. Testing breakout strategies and mean reversion techniques also yield reliable results when backtested, as they depend on past price behavior. These strategies benefit from backtesting because it helps fine-tune parameters, assess risk, and improve timing before applying them live.

How do I choose the right historical data for backtesting?

Pick historical data that matches your trading style, timeframe, and market conditions. Use data from periods of high volatility if you trade actively, or calmer markets if you prefer steady gains. Ensure the data is clean, accurate, and free of gaps or errors. Focus on data that reflects the assets you trade, whether stocks, forex, or crypto. Avoid cherry-picking data; use diverse periods to test robustness. The goal is to simulate real trading conditions as closely as possible.

What metrics should I analyze during backtesting?

Focus on profit factor, win rate, risk-reward ratio, maximum drawdown, and Sharpe ratio. Track your total profit and loss, number of winning versus losing trades, and average gains per trade. Monitor the expectancy and consistency over different periods. Pay attention to drawdowns to understand potential losses and the strategy’s resilience. Analyze the number of trades, holding times, and entry/exit accuracy to refine timing and decision-making.

How can backtesting help reduce trading risks?

Backtesting helps reduce trading risks by showing how your strategy would have performed historically, identifying potential flaws before risking real money. It highlights profitable setups and warns against losing patterns, so you can refine entries and exits. By simulating trading conditions, it reveals drawdowns and volatility, allowing you to adjust risk management. Essentially, backtesting gives you confidence and clarity, helping avoid impulsive trades and minimizing losses in live trading.

What are common mistakes in backtesting?

Common mistakes in backtesting include using too short or biased data, overfitting strategies to past results, ignoring transaction costs, and not accounting for slippage. Relying on unrealistic assumptions, such as perfect order execution, skews results. Failing to test across different market conditions or overfitting parameters leads to poor real-world performance. Also, neglecting to validate results with out-of-sample data causes false confidence.

How accurate are backtest results?

Backtest results can be accurate if the data is reliable and the methodology is sound. However, they often overstate potential because they don't account for real-world issues like slippage, trading costs, or emotional reactions. Always treat backtest outcomes as rough estimates, not guarantees of future performance.

How do I incorporate backtesting results into live trading?

Use backtesting results to refine your trading strategy by identifying which setups and indicators work best. Implement your tested rules in a demo account first to see how they perform in real time. Adjust your entry, exit, and risk management based on backtested data before going live. Continuously compare live results with backtested expectations and tweak your approach as needed. Never rely solely on backtesting; combine it with real-time monitoring for optimal day trading performance.

What software tools are best for backtesting?

MetaTrader 4 and 5 are top choices for backtesting in day trading, offering robust testing environments and detailed analytics. TradingView's backtesting tools are user-friendly and great for quick strategy testing with visual charts. NinjaTrader provides advanced backtesting with customizable strategies and performance metrics. Thinkorswim by TD Ameritrade features integrated backtesting for options and futures. Amibroker offers powerful scripting and detailed analytics for rigorous backtesting across multiple assets. Each tool helps refine strategies, identify weaknesses, and boost day trading performance.

How often should I update my backtesting models?

Update your backtesting models every 1 to 3 months or after major market shifts to keep them accurate and relevant.

Can backtesting identify false trading signals?

Backtesting can reveal false trading signals by showing which strategies produce profitable results historically and which do not. If a signal appears often in backtested data but doesn’t lead to real gains, it’s likely a false signal. It helps filter out unreliable signals by testing them against past market data before risking real money.

How do I optimize trading strategies through backtesting?

Use backtesting by applying your trading strategies to historical market data to see how they perform. Focus on key metrics like win rate, profit factor, and drawdowns. Adjust entry and exit rules based on the backtest results to refine your approach. Test different timeframes and market conditions to identify what works best. Avoid overfitting by ensuring your strategy performs well across various data sets. Continuously iterate, analyzing the reasons behind wins and losses, to improve your day trading performance.

Learn about How to Optimize Algorithmic Strategies for Day Trading

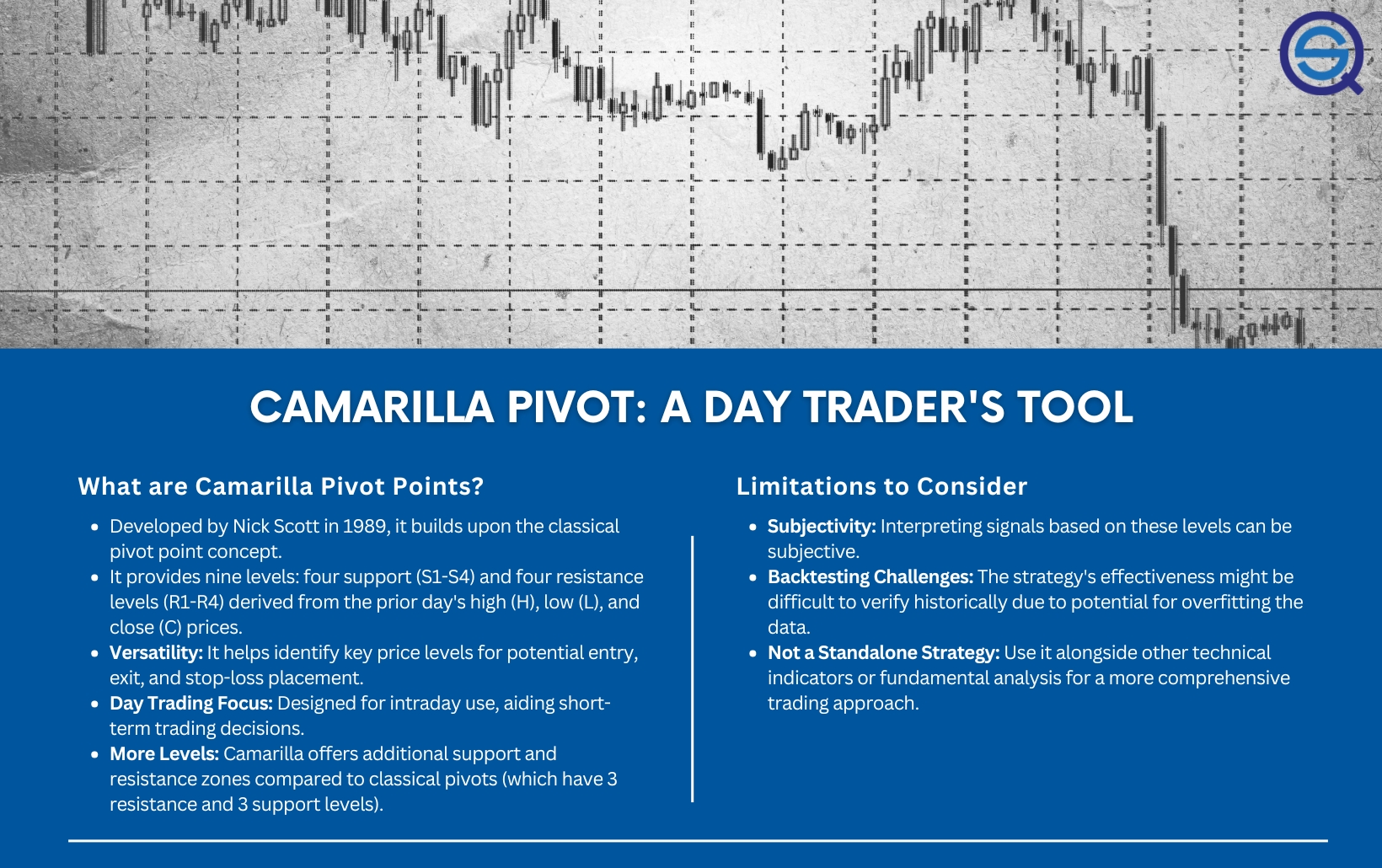

What are limitations of backtesting in day trading?

Backtesting in day trading can give false confidence if past data doesn’t match future market conditions. It often ignores slippage, transaction costs, and market impact, making results overly optimistic. Overfitting to historical data can lead to strategies that don’t work live. It may miss sudden news or volatility spikes that real-time trading faces. Limited historical data might not capture rare events or changing market dynamics. Relying solely on backtests can cause traders to overlook psychological and emotional factors in live trading.

How can I avoid overfitting in backtesting?

Use walk-forward testing, keep your data fresh, and limit the complexity of your strategy. Validate on out-of-sample data, avoid curve-fitting, and regularly update your model. Keep the backtest realistic by including transaction costs and slippage. Cross-validate with different timeframes and market conditions to ensure robustness.

How does backtesting improve my trading discipline?

Backtesting sharpens your trading discipline by forcing you to follow your strategy strictly, reducing impulsive decisions. It helps identify weaknesses and reinforces adherence to your rules, making you more consistent. When you see how your plan performs historically, you're more confident and less tempted to deviate in live trading. This process trains patience and discipline, turning good strategies into good habits.

What role does paper trading play alongside backtesting?

Paper trading lets you test strategies in real-time market conditions without risking money, complementing backtesting’s historical data analysis. It helps validate backtested ideas by exposing them to live market dynamics, like slippage and order execution issues. Combining both ensures your strategy isn't just theoretically sound but practically viable. Paper trading turns backtested concepts into actionable, real-world practice, building confidence before risking real capital.

How do I interpret backtest performance reports?

Look at the profit and loss figures to see if the strategy is profitable. Check the win rate to understand how often trades succeed. Review the drawdowns to see potential risks and worst-case losses. Analyze the profit factor—how much profit you make per dollar risked. Notice the consistency in returns over different periods. Compare the number of trades to ensure enough data supports the results. If the report shows strong, steady gains with manageable drawdowns, your strategy has potential; if not, revise your approach.

How can I backtest multiple strategies simultaneously?

Use a backtesting platform that supports multiple strategies at once. Set up each strategy with its parameters and run them together on historical data. Analyze the combined results to compare performance, drawdowns, and risk-reward ratios. Tools like TradingView, MetaTrader, or specialized backtesting software allow you to overlay strategies and see which performs best under different market conditions. Automate the process with scripts or APIs if possible, so you can efficiently test several ideas side by side.

What is walk-forward testing and how does it help?

Walk-forward testing is a method where you test your trading strategy on a recent data period, then update it with new data and repeat. It helps identify how well your strategy adapts to changing market conditions, reducing overfitting. By simulating real-time trading, it shows if your approach remains profitable and reliable over time. This process improves your day trading performance by ensuring your strategy is robust and responsive to market shifts.

Conclusion about How to Use Backtesting to Improve Your Day Trading Performance

Incorporating backtesting into your day trading strategy can significantly enhance your performance by providing data-driven insights and reducing risks. By carefully selecting historical data, analyzing key metrics, and utilizing the right software tools, traders can refine their strategies and improve decision-making. However, it's crucial to remain aware of common pitfalls and limitations to ensure the accuracy of your results. For those seeking to maximize their trading potential, leveraging backtesting is an essential step in developing a disciplined and effective trading approach. With the guidance of DayTradingBusiness, you can master these techniques and elevate your trading success.