Did you know that even a goldfish has a longer attention span than most day traders? In the fast-paced world of day trading, having a solid backtesting plan is crucial for success. This article dives into the essentials of backtesting, from defining what it is to the importance of selecting the right trading strategies. You’ll discover the best tools for gathering historical data, key metrics to track, and tips for avoiding common pitfalls like overfitting. With insights on how to set realistic performance goals and account for market volatility, this guide will equip you with the knowledge to transition smoothly from backtesting to live trading. Plus, learn how to document and continuously improve your backtesting plan with DayTradingBusiness.

What is a backtesting plan for day trading?

A backtesting plan for day trading involves selecting a specific trading strategy, choosing historical market data, and simulating trades based on that data to evaluate performance. Define clear entry and exit rules, set risk management parameters, and decide on the timeframe and assets to test. Use reliable backtesting software to run these simulations, analyze results for profitability, drawdowns, and consistency, then refine your strategy accordingly. The goal is to ensure your approach works before risking real money.

Why is backtesting important for day traders?

Backtesting shows if your day trading strategy works before risking real money. It helps identify profitable setups and avoid costly mistakes. By testing historical data, you refine your entry and exit points, improving consistency. Backtesting also boosts confidence and helps manage risk by revealing potential drawdowns.

How do I choose the right trading strategy to backtest?

Pick a strategy that matches your trading style and risk tolerance—whether it’s scalping, momentum, or swing trading. Focus on strategies with clear entry and exit rules, so backtesting yields meaningful results. Consider your available data—use historical price, volume, and news data relevant to your chosen approach. Test on different market conditions to see how the strategy performs in trending versus sideways markets. Use forward testing with a small live account to validate results before full-scale backtesting.

What tools or software can I use for backtesting?

Use TradingView, MetaTrader 4 or 5, NinjaTrader, ThinkorSwim, and AmiBroker for backtesting. These platforms allow you to test trading strategies with historical data efficiently.

How do I gather historical data for backtesting?

Download historical price data from sources like Yahoo Finance, Alpha Vantage, or Quandl. Use APIs or data export options to get daily, hourly, or minute-by-minute records. Ensure the data covers your trading period and includes open, high, low, close, and volume. Clean the data by removing gaps and adjusting for splits or dividends. Store it in a spreadsheet or database for easy access during backtesting.

What metrics should I track during backtesting?

Track metrics like win rate, profit factor, drawdown, Sharpe ratio, and expectancy. Monitor total profit and loss, average trade gain/loss, and the number of trades. Keep an eye on risk-reward ratio, maximum consecutive wins/losses, and trade duration. These metrics reveal strategy robustness, risk levels, and overall performance.

How do I set realistic performance goals for backtesting?

Set performance goals based on your trading experience, starting with achievable profit targets and risk levels. Use historical data to estimate realistic returns and drawdown limits. Align goals with your trading style—scalping, swing trading, or long-term. Ensure goals are specific, measurable, and time-bound, like aiming for a 5% monthly return or limiting drawdowns to 2%. Regularly review and adjust based on backtest results to stay realistic and avoid overestimating your capabilities.

How can I avoid overfitting in my backtesting plan?

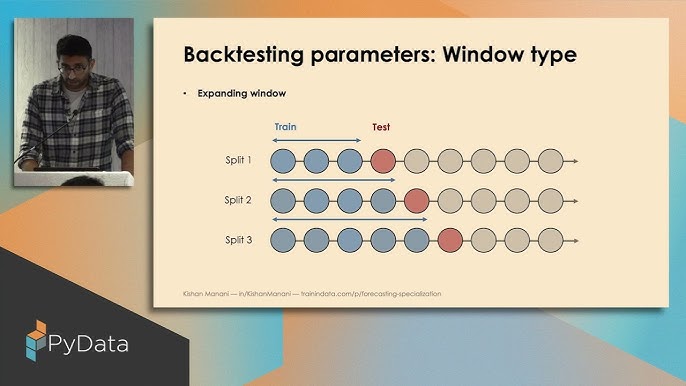

Use out-of-sample data to test your strategy, limit the number of parameters to avoid overly complex models, and incorporate walk-forward testing. Regularly validate with fresh data, keep the trading period realistic, and avoid tweaking your plan based on past performance to prevent curve-fitting.

What are common mistakes to watch for in backtesting?

Common mistakes in backtesting include overfitting to past data, ignoring transaction costs, using unrealistic entry and exit rules, not accounting for slippage, cherry-picking data, and failing to test across different market conditions.

How do I account for market volatility in backtests?

Use multiple market scenarios, including volatile periods, to test your strategy. Incorporate stress tests by simulating sudden price swings and gaps. Adjust your risk parameters to reflect real-world volatility, like wider stop-losses during turbulent times. Analyze performance metrics across different volatility levels to ensure robustness. Regularly update your backtest with recent volatile data for accuracy.

How do I test multiple strategies effectively?

Test multiple strategies by running each on historical data, comparing their performance metrics like win rate and profit factor. Use a consistent timeframe and market conditions for fair comparison. Apply forward testing in demo accounts to see how strategies perform in real-time. Keep detailed records of results, tweak parameters, and identify which strategies show steady, reliable performance. Avoid overfitting by testing across different market scenarios.

How often should I update my backtesting plan?

Update your backtesting plan whenever your trading strategy changes or new data suggests adjustments, typically every few months or after significant market shifts. Regular updates ensure your plan stays relevant and accurate.

How can I interpret backtest results accurately?

To interpret backtest results accurately, focus on key metrics like profit factor, win rate, and drawdowns. Look for consistent performance over multiple periods, not just a few winning trades. Check for overfitting—make sure the strategy works in different market conditions. Compare simulated results to real trading to spot unrealistic assumptions. Identify if the strategy’s edge remains after transaction costs and slippage. Use forward testing to verify that historical success translates to live trading.

What are the limitations of backtesting in day trading?

Backtesting in day trading can give false confidence because it doesn’t account for real-time market conditions, slippage, or execution delays. It often relies on historical data that may not reflect future volatility or liquidity issues. Overfitting to past data can make a strategy seem perfect but fail in live trading. It also ignores emotional factors and the psychological pressure traders face in real-time. Lastly, backtests can't predict unexpected news or sudden market shifts that drastically impact day trading strategies.

How do I transition from backtesting to live trading?

To transition from backtesting to live trading, start by gradually scaling up your trading size after consistent backtest results. Use a demo account to practice your strategy in real market conditions before risking real money. Set strict risk management rules, like stop-losses and position sizes, to protect capital. Monitor your trades closely, log every trade, and review performance regularly to ensure your strategy holds up in live markets. Adjust your plan as needed based on live trading experience.

Learn about How to Transition from Pattern Day Trader to Longer-Term Trading?

How do I document and review my backtesting results?

To document your backtesting results, record each trade’s entry and exit points, reasons, and outcomes in a spreadsheet or trading journal. Include key metrics like profit/loss, drawdown, win rate, and risk-reward ratio. Review results by analyzing overall performance, identifying patterns, and pinpointing strengths and weaknesses. Look for consistent profit zones and risky setups. Use visual tools like charts to compare simulated trades against your strategy. Regularly update your documentation after each backtest session to track progress and refine your plan.

How can I improve my backtesting plan over time?

Regularly review and refine your backtesting plan by analyzing recent trade data, adjusting parameters based on performance, and incorporating new market conditions. Keep your data set updated with the latest market swings, and test different strategies to find what works best. Document your results, learn from mistakes, and avoid overfitting by validating your plan on unseen data. Continuously educate yourself on new indicators and trading techniques to keep your backtest relevant.

Conclusion about How to Create a Backtesting Plan for Day Trading

In summary, a well-structured backtesting plan is essential for any day trader aiming to refine their strategies and improve performance. By selecting the right tools, gathering accurate historical data, and tracking relevant metrics, traders can gain valuable insights into their methods. It's crucial to remain aware of common pitfalls and limitations of backtesting while continuously updating and documenting results. Incorporating these practices will lead to more informed trading decisions. For further guidance and support, DayTradingBusiness is here to help you navigate the complexities of day trading effectively.

Learn about How to Create a Day Trading Options Plan