Did you know that even the best day traders sometimes feel like they’re just flipping a coin? In the world of trading, understanding the difference between day trading backtesting and forward testing is crucial for developing effective strategies. This article dives into the essence of backtesting—what it is, how it differs from forward testing, and why both are essential for day traders. We’ll explore the significance of accurate backtesting, common pitfalls to avoid, and practical tools to enhance your testing process. Additionally, we’ll discuss how market conditions impact results and when to transition from backtesting to forward testing. By the end, you’ll be equipped with the insights needed to assess your strategy’s performance and improve your trading success with DayTradingBusiness.

What is day trading backtesting?

Day trading backtesting is analyzing historical market data to evaluate how a trading strategy would have performed in the past. It involves applying your rules to past price movements to see if the strategy could be profitable.

How does forward testing differ from backtesting?

Forward testing evaluates a trading strategy in real-time or simulated live conditions, using current market data, to see how it performs going forward. Backtesting analyzes a strategy against historical price data to assess its past performance. While backtesting shows how a strategy might have worked historically, forward testing tests its viability under real market conditions, capturing factors like slippage and emotional responses.

Why is backtesting important for day traders?

Backtesting helps day traders evaluate their strategies using historical data, revealing what works before risking real money. It identifies profitable setups, tests risk management, and refines entries and exits. Without backtesting, traders gamble blindly, risking losses on unproven methods. It’s crucial for building confidence and understanding a strategy’s potential before live trading.

What are the main advantages of forward testing?

Forward testing proves a trading strategy in real market conditions, showing how it performs live. It reveals how strategies handle real-time data, slippage, and emotional factors. It helps traders identify flaws that backtesting might miss, ensuring the strategy works beyond historical data. Overall, forward testing builds confidence and improves the reliability of your day trading approach.

How accurate are backtests compared to real trading?

Backtests often overestimate accuracy because they use historical data without accounting for real-time market conditions like slippage, order delays, and emotional reactions. Real trading introduces variables that backtests can't fully simulate, making actual results often less favorable than backtested projections. While backtesting helps identify potential strategies, it can't guarantee performance in live trading.

What are common errors in day trading backtesting?

Common errors in day trading backtesting include overfitting the strategy to historical data, ignoring transaction costs and slippage, using unrealistic entry and exit assumptions, not accounting for market conditions like volatility, and neglecting to test across different time periods.

How do I set up a reliable backtest?

Set up a reliable backtest by using historical data that matches current market conditions, ensuring enough data to test various scenarios. Use realistic assumptions for order execution, slippage, and transaction costs. Keep your trading rules consistent with live trading. Validate your results with forward testing on a demo account before risking real money. Avoid overfitting by not tweaking your strategy to fit past data too precisely.

What tools can I use for backtesting day trading strategies?

Use TradingView, MetaTrader 4 or 5, ThinkorSwim, TradingSim, and QuantConnect for backtesting day trading strategies.

What should I look for in forward testing results?

Look for consistency in performance, low drawdowns, and stable profit ratios. Check if the strategy works across different market conditions. Watch for overfitting signs—results that look too perfect or don’t hold up in real-time. Ensure the strategy maintains its edge without excessive risk. Confirm that forward testing replicates your backtested results.

How do market conditions affect backtesting accuracy?

Market conditions directly impact backtesting accuracy by influencing how well past data reflects future trading environments. If market volatility, trends, or liquidity change over time, backtests based on historical data may not predict real-time performance. During stable periods, backtests tend to be more reliable, but during volatile or unpredictable markets, they can mislead. Sudden shifts, like economic news or geopolitical events, make past data less representative, reducing backtest accuracy for day trading strategies.

Learn about How Market Conditions Affect HFT Strategies

Can backtesting predict future day trading success?

Backtesting shows how a trading strategy would have performed on past data, but it doesn’t predict future day trading success. Market conditions change, and past performance doesn’t guarantee future results. While useful for strategy development, backtesting alone can’t reliably forecast day trading success.

What are the limitations of backtesting?

Backtesting can give false confidence because it’s based on historical data that may not reflect real-time market conditions. It often assumes perfect execution without slippage or emotional factors, which can skew results. Overfitting is common, making strategies look great on past data but fail in live trading. Additionally, data quality issues and limited sample periods can mislead traders. It doesn’t account for changing market dynamics or unexpected events.

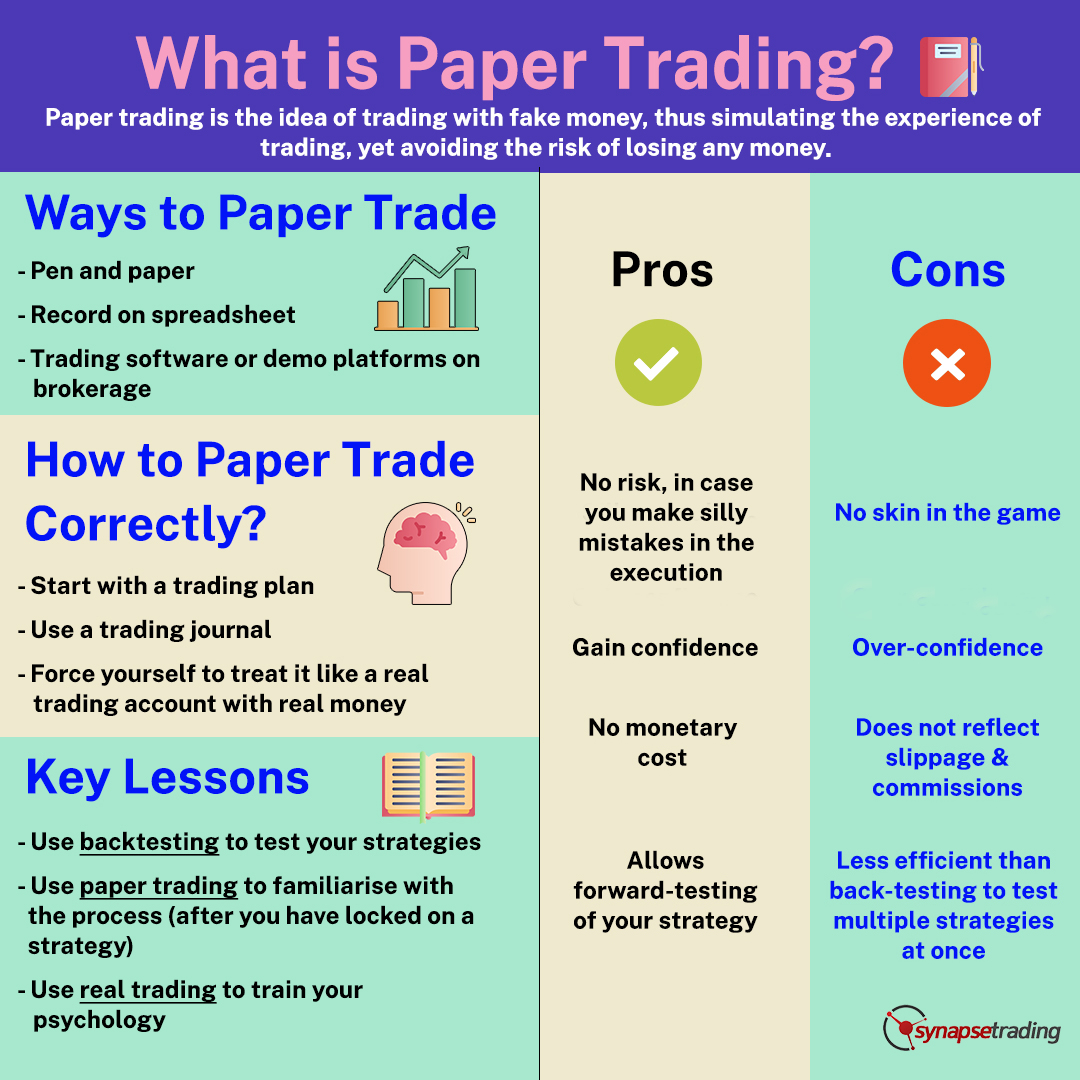

How does paper trading relate to forward testing?

Paper trading is a form of forward testing where you simulate real trading without risking money. It lets you practice strategies in current market conditions, mimicking live trading. Forward testing, including paper trading, validates your trading plan by observing how it performs in real-time before risking actual capital.

When should I switch from backtesting to forward testing?

Switch from backtesting to forward testing once your trading strategy shows consistent, reliable results over multiple backtest periods and market conditions. Typically, after you’ve optimized and validated your system in backtesting, move to forward testing to see how it performs in real-time or simulated live environments before risking real money.

How do I evaluate a strategy’s real-world performance?

Evaluate a strategy’s real-world performance by comparing backtested results with forward testing in live markets. Check if the strategy maintains consistent profitability, manages risk well, and adapts to changing conditions. Use metrics like drawdown, win rate, and profit factor. Confirm that forward testing results match backtest expectations before trusting the strategy in actual trading.

Is combining backtesting and forward testing better?

Yes, combining backtesting and forward testing is better. Backtesting shows how your strategy would have performed historically, while forward testing assesses its real-time viability. Using both helps identify weaknesses, validate results, and build confidence before risking actual money.

Conclusion about Day Trading Backtesting vs. Forward Testing: What’s the Difference?

In summary, both day trading backtesting and forward testing are crucial for developing effective trading strategies. While backtesting allows traders to analyze historical data and refine their tactics, forward testing provides real-time insights into strategy performance in current market conditions. Understanding the strengths and limitations of each method can enhance your trading approach. For comprehensive guidance on mastering these techniques and improving your trading success, explore the resources offered by DayTradingBusiness.

Learn about Frequently Asked Questions About Day Trading Backtesting