Did you know that even the best day traders can fall into the trap of treating backtesting like a magic crystal ball? In reality, backtesting is a critical process that can make or break your trading strategy, but it's fraught with common pitfalls. This article highlights key mistakes traders often make, such as overfitting and ignoring transaction costs, and explains how to avoid them. You'll learn about the importance of realistic assumptions, the impact of sample size, and the necessity of validating strategies with out-of-sample data. Additionally, we’ll explore psychological biases and the role of proper risk management in ensuring accurate backtesting. Join us at DayTradingBusiness to uncover how to effectively backtest your strategies and enhance your trading success.

What are the most common mistakes in day trading backtesting?

Common mistakes in day trading backtesting include:

1. Data Overfitting: Tailoring strategies too closely to historical data can lead to unrealistic performance expectations.

2. Ignoring Slippage and Commissions: Failing to account for transaction costs and market impact can skew results.

3. Using Incomplete Data: Relying on limited datasets or excluding significant market events can misrepresent a strategy's effectiveness.

4. Not Considering Market Conditions: Strategies may perform differently under varying market conditions, so ignoring this can lead to poor real-world results.

5. Overlooking Risk Management: Focusing solely on profit without adequate risk controls can result in devastating losses.

6. Inconsistent Timeframes: Testing strategies on different timeframes without consistency can produce misleading outcomes.

7. Lack of Realism: Assuming perfect execution and ignoring psychological factors can create an unrealistic view of trading performance.

How can overfitting affect my backtesting results?

Overfitting can lead to misleading backtesting results by creating a trading strategy that performs well on historical data but fails in real-time trading. This happens because the model may capture noise instead of underlying patterns, resulting in poor adaptability to new data. You might see impressive returns during backtesting, but when applied live, the strategy could underperform or incur significant losses. To avoid this, use techniques like cross-validation and ensure your model remains simple enough to generalize effectively.

Why is it important to use realistic assumptions in backtesting?

Using realistic assumptions in backtesting is crucial because it ensures that the results accurately reflect actual trading conditions. If assumptions are overly optimistic or ignore market realities, the backtest may show false profitability. This can lead to poor decision-making and significant losses when trading in real markets. For example, assuming perfect execution without slippage or commissions can skew results. Realistic assumptions help traders develop reliable strategies that account for risk, market volatility, and behavioral factors, leading to better preparedness and more successful trading outcomes.

What data issues should I watch out for in backtesting?

Watch for these data issues in backtesting:

1. Survivorship Bias: Ignoring stocks that have gone bankrupt or been delisted skews results.

2. Look-Ahead Bias: Using future data in the model that wouldn’t have been available at the time of trading.

3. Data Snooping: Overfitting your strategy to historical data can lead to poor future performance.

4. Incomplete Data: Missing data points can distort your analysis and lead to incorrect conclusions.

5. Incorrect Pricing: Using inaccurate or adjusted prices can affect performance metrics.

6. Overlooked Transaction Costs: Not factoring in commissions and slippage will inflate results.

7. Timeframe Mismatches: Using different timeframes for strategy development and backtesting can lead to misleading outcomes.

Be mindful of these pitfalls to ensure reliable backtesting results.

How does ignoring transaction costs impact backtesting accuracy?

Ignoring transaction costs in day trading backtesting leads to inflated performance results. Without accounting for these costs, profits appear higher than they actually are, skewing the strategy's effectiveness. This oversight can result in unrealistic expectations and poor decision-making in real trades. Accurate backtesting must include fees, slippage, and spreads to reflect true profitability and risk. Failing to do so can misguide traders into believing their strategies are more viable than they truly are.

What role does sample size play in day trading backtesting?

Sample size is crucial in day trading backtesting because it directly affects the reliability of your results. A small sample size can lead to misleading conclusions, as it may not capture different market conditions or trading scenarios. Larger sample sizes provide more data points, enhancing the statistical significance of your findings and reducing the impact of randomness. This helps in identifying consistent patterns and validating your trading strategy. Inadequate sample sizes can result in overfitting, where a strategy seems profitable in backtests but fails in live trading. Therefore, ensure your backtesting includes a sufficiently large sample size to improve accuracy and reduce the risk of errors.

How can I avoid data snooping in my backtesting?

To avoid data snooping in your backtesting, follow these steps:

1. Use Out-of-Sample Data: Split your data into training and testing sets. Only optimize your strategy on the training set and validate it on the out-of-sample data.

2. Limit Parameter Optimization: Avoid excessive tweaking of parameters based on historical data. Stick to a few key metrics that are justifiable.

3. Implement Walk-Forward Analysis: Regularly update your model with new data while testing it on the most recent data to ensure its robustness.

4. Keep It Simple: Use straightforward strategies that don’t rely on complex patterns or overly specific conditions.

5. Beware of Overfitting: Ensure your strategy performs well across different time periods and market conditions, not just the data you used for testing.

6. Use Robust Metrics: Focus on metrics that reflect real-world performance, like Sharpe ratio or maximum drawdown, rather than just profitability.

By applying these practices, you can minimize the risk of data snooping in your backtesting.

Why is it crucial to validate backtested strategies with out-of-sample data?

Validating backtested strategies with out-of-sample data is crucial because it helps confirm that the strategy performs well in different market conditions, reducing the risk of overfitting to historical data. Out-of-sample testing ensures that the strategy has real-world applicability and can withstand unforeseen market changes. It also increases confidence in the strategy's robustness and reliability, which is essential for making informed trading decisions. Without this validation, traders may face unexpected losses due to strategies that only worked in the specific conditions of the backtest period.

What common biases should I be aware of in backtesting?

In backtesting, be aware of these common biases:

1. Look-Ahead Bias: Using future data that wouldn't have been available during the trading period.

2. Survivorship Bias: Ignoring assets that have failed or been removed from the dataset, skewing results.

3. Data Snooping: Overfitting a strategy to historical data, leading to unrealistic expectations in live trading.

4. Selection Bias: Choosing only favorable data or time frames that distort performance results.

5. Confirmation Bias: Favoring information that supports your pre-existing beliefs about a strategy.

Avoiding these biases will lead to more reliable backtesting results.

How can psychological factors influence backtesting outcomes?

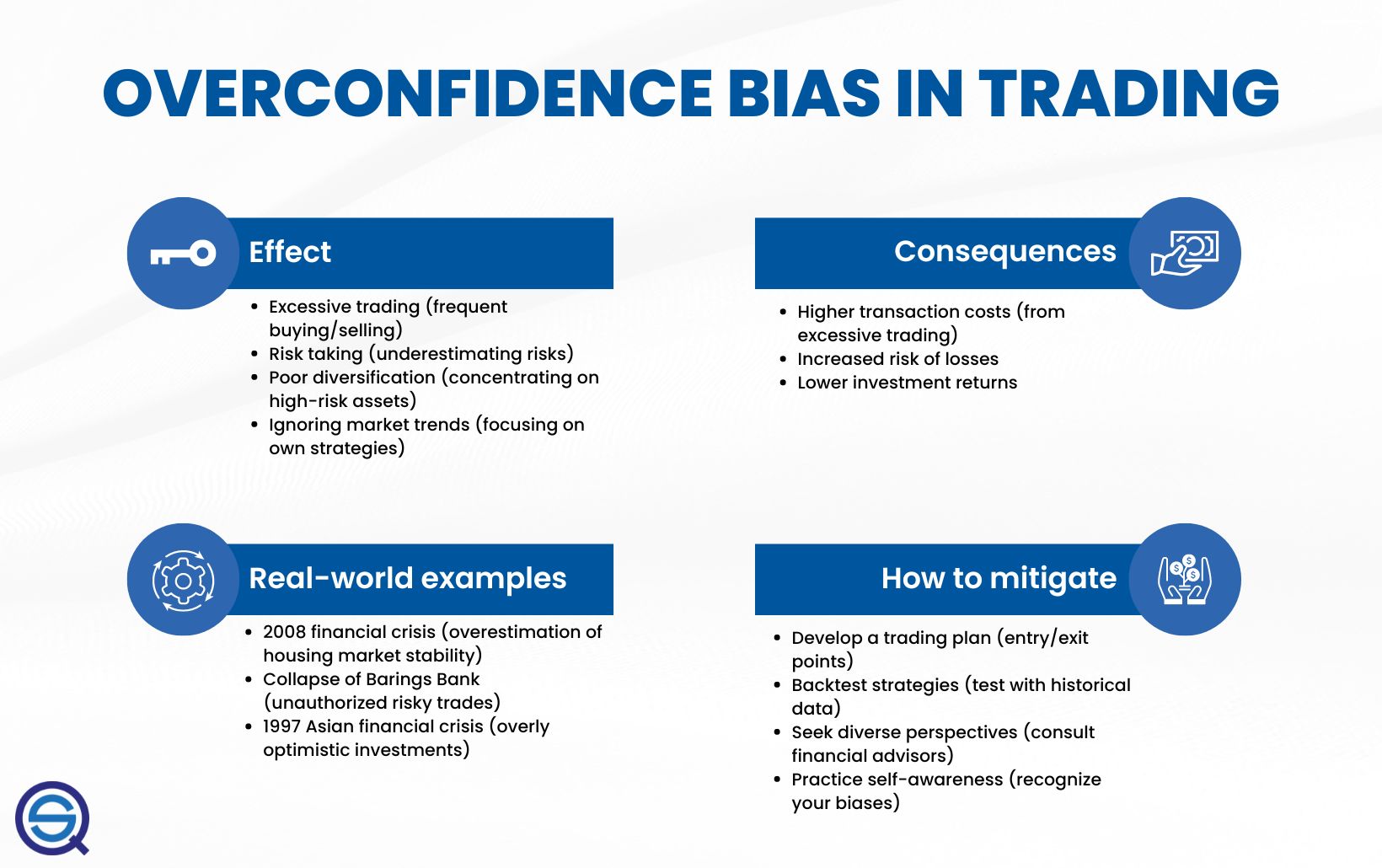

Psychological factors can significantly skew backtesting outcomes by introducing biases. For example, over-optimism may lead traders to overfit their models, resulting in strategies that perform well on historical data but fail in real markets. Fear of loss can cause traders to prematurely exit winning trades, impacting the perceived effectiveness of backtested strategies. Additionally, confirmation bias may lead traders to focus only on data that supports their beliefs while ignoring contrary evidence. These psychological traps can distort the interpretation of backtesting results, leading to flawed decision-making in day trading.

What are the pitfalls of using untested strategies in backtesting?

Using untested strategies in backtesting can lead to several pitfalls. First, you risk overfitting, where the strategy performs well on historical data but fails in real markets. Second, inadequate sample size may not reflect market conditions accurately, skewing results. Third, ignoring transaction costs can create unrealistic expectations of profitability. Lastly, psychological factors are often overlooked; what works in theory may not hold up under emotional pressure during live trading. Always validate strategies with robust testing before implementation.

How does the choice of time frame affect backtesting results?

The choice of time frame significantly impacts backtesting results by affecting trade frequency, signal reliability, and overall strategy performance. Shorter time frames may produce more signals and highlight market noise, leading to misleading results. Conversely, longer time frames can smooth out volatility, offering a clearer picture of a strategy's effectiveness over time. Additionally, the chosen time frame can influence risk management and drawdown assessments, potentially skewing the perception of a strategy's robustness. Always align your time frame with your trading style for accurate backtesting.

What tools can help me conduct effective day trading backtesting?

To conduct effective day trading backtesting, consider these tools:

1. TradingView: Offers powerful charting tools and historical data for backtesting strategies.

2. MetaTrader 4/5: Popular platform with built-in backtesting capabilities for Forex and CFDs.

3. Amibroker: Advanced software for backtesting and optimizing trading strategies with comprehensive analytics.

4. NinjaTrader: Provides robust backtesting features and data analysis for futures and Forex trading.

5. QuantConnect: A cloud-based platform for algorithmic trading that supports backtesting in multiple markets.

6. Thinkorswim by TD Ameritrade: Includes a paper trading feature that allows for simulation and backtesting of strategies.

Choose tools based on your specific trading needs and the markets you are targeting.

Learn about Tools for Effective Fundamental Analysis in Day Trading

How can improper risk management lead to backtesting errors?

Improper risk management can lead to backtesting errors by skewing results and creating unrealistic expectations. For example, if a trader uses excessive leverage without accounting for potential losses, the backtest may show inflated profits that won't occur in real trading. Additionally, neglecting to set proper stop-loss orders can result in backtests that fail to reflect actual risk exposure. This can mislead traders into believing a strategy is more robust than it truly is, ultimately leading to poor live trading performance.

Learn about How can poor risk management lead to losses in day trading?

Why is it essential to document my backtesting process?

Documenting your backtesting process is essential because it allows you to track your strategies' effectiveness, identify strengths and weaknesses, and avoid repeating mistakes. It provides a clear reference for future trading decisions and helps refine your approach based on past performance. Detailed records also enhance accountability and make it easier to share insights with others or revisit strategies later. Ultimately, thorough documentation leads to better decision-making and improved trading outcomes.

How can I learn from backtesting mistakes to improve my trading strategies?

To learn from backtesting mistakes in day trading, start by reviewing your backtest results critically. Identify specific errors, such as using insufficient data, failing to account for slippage, or ignoring transaction costs. Analyze why these mistakes occurred—was it due to a lack of knowledge or oversight?

Next, refine your strategy based on these insights. Adjust your parameters or incorporate risk management techniques that you overlooked. Keep detailed records of each backtest, noting what worked and what didn’t.

Finally, continuously iterate on your strategy. Test new ideas and learn from both successes and failures. Engage with trading communities to gain different perspectives and insights. This proactive approach will help you avoid repeating mistakes and enhance your trading strategies over time.

Learn about How to Learn from Day Trading Mistakes

Conclusion about Common Mistakes in Day Trading Backtesting

In summary, avoiding common mistakes in day trading backtesting is crucial for developing effective trading strategies. By being aware of issues such as overfitting, unrealistic assumptions, and data quality, you can enhance the accuracy of your backtesting results. It’s essential to consider transaction costs, sample size, and potential biases while validating strategies with out-of-sample data. Documenting your process and learning from past errors will help refine your approach. For comprehensive insights and guidance, DayTradingBusiness is here to support your trading journey.

Learn about Common mistakes that increase stop-loss risk in day trading