Did you know that some day traders are so fast they could give a cheetah a run for its money? In the high-stakes world of day trading, selecting the right broker is crucial for success. This article covers essential features day traders should prioritize, such as commission fees, platform types, and the importance of reliable customer support. We’ll also explore the impact of regulations, margin trading, and execution speeds, as well as the tools and resources brokers offer. Additionally, we’ll discuss how to evaluate a broker’s reputation and the significance of demo accounts. By understanding these key factors, day traders can make informed decisions to enhance their trading experience. Let’s dive into the details with DayTradingBusiness!

What key features should day traders look for in a broker?

Day traders should look for the following key features in a broker:

1. Low Commissions: Choose brokers with low trading fees to maximize profits.

2. Fast Execution: Ensure quick trade execution speeds to capitalize on market movements.

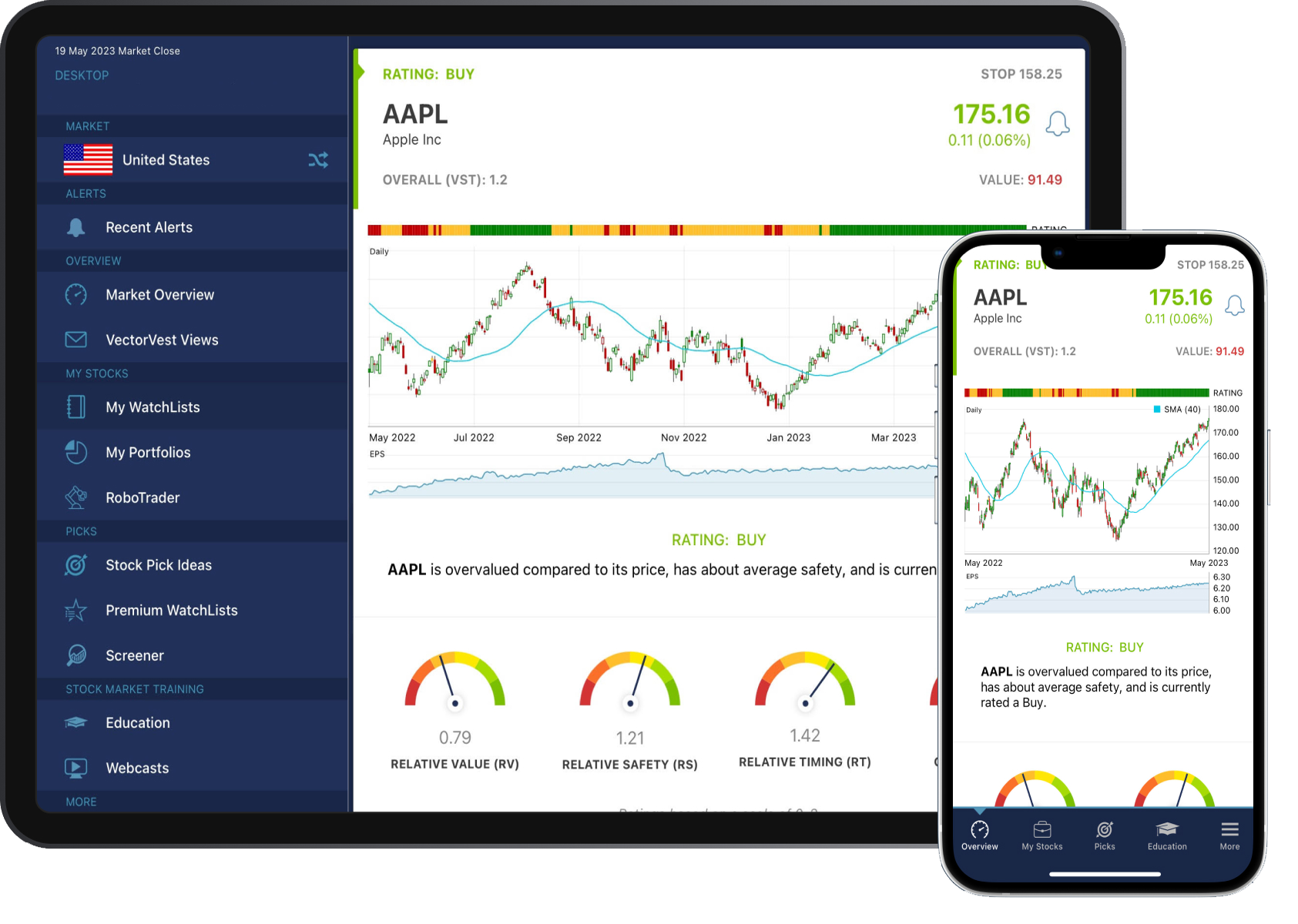

3. Advanced Trading Platform: A user-friendly platform with real-time data and advanced charting tools is essential.

4. Leverage Options: Look for brokers that offer competitive margin rates to enhance trading capacity.

5. Robust Customer Support: Reliable support is crucial for resolving issues quickly during trading hours.

6. Variety of Assets: Access to diverse instruments like stocks, ETFs, and options helps in strategy diversification.

7. Research and Tools: Quality research resources and analytical tools can aid in informed decision-making.

8. Regulatory Compliance: Ensure the broker is regulated to protect your funds and ensure fair trading practices.

How do commission fees impact day trading profitability?

Commission fees directly reduce day trading profitability by increasing the cost of each trade. High fees can erode gains from small price movements, making it harder to achieve a net profit. For day traders, finding brokers with low or zero commissions is crucial to maximize returns. Additionally, some brokers offer tiered pricing based on trading volume, which can further impact profitability. Therefore, choosing the right broker with favorable commission structures is essential for successful day trading.

What types of trading platforms are best for day traders?

The best trading platforms for day traders should offer low commissions, fast execution speeds, and reliable uptime. Look for features like advanced charting tools, real-time market data, and customizable dashboards. Platforms like TD Ameritrade’s thinkorswim, Interactive Brokers, and E*TRADE are popular choices due to their robust features and user-friendly interfaces. Additionally, ensure the platform provides good customer support and mobile trading capabilities for flexibility.

How important is customer support for day trading brokers?

Customer support is crucial for day trading brokers. It ensures timely assistance during market hours when quick decisions are vital. Effective support helps resolve technical issues, clarify platform functionalities, and address account inquiries. Traders benefit from 24/7 availability, live chat options, and knowledgeable representatives. Strong customer support can enhance a trader's experience and confidence in executing trades.

What regulations should day traders consider when choosing a broker?

Day traders should consider the following regulations when choosing a broker:

1. FINRA Registration: Ensure the broker is registered with the Financial Industry Regulatory Authority (FINRA) for oversight and compliance.

2. SEC Compliance: The broker should adhere to Securities and Exchange Commission (SEC) regulations to protect investors.

3. Capital Requirements: Check if the broker meets the minimum capital requirements set for day trading.

4. Pattern Day Trader Rule: Understand the implications of the FINRA rule requiring a minimum balance of $25,000 for those who execute four or more day trades in five business days.

5. Margin Regulations: Verify the broker’s margin policies, including rates and requirements, to manage leverage effectively.

6. Reporting Standards: Ensure the broker complies with reporting standards to provide transparency in transactions.

These regulations help ensure a safe trading environment and protect your investments.

How does margin trading work with different brokers?

Margin trading allows you to borrow funds from a broker to trade larger positions than your account balance. Different brokers have varying margin requirements, interest rates, and leverage ratios.

When choosing a broker, look for:

1. Margin Requirements: Understand how much capital you need to maintain a position and the initial margin needed to open a trade.

2. Leverage Offered: Some brokers offer higher leverage, which can amplify gains but also losses.

3. Interest Rates: Check the cost of borrowing on margin, as this impacts your profits.

4. Platform Features: A good trading platform should provide real-time data and risk management tools.

5. Regulation and Safety: Ensure the broker is regulated to protect your funds.

Compare these factors across brokers to find the best fit for your trading strategy.

What are the best tools for day traders offered by brokers?

The best tools for day traders offered by brokers include:

1. Real-Time Market Data: Look for platforms that provide up-to-the-second quotes and market news.

2. Advanced Charting Tools: Brokers should offer customizable charts with technical indicators and drawing tools.

3. Mobile Trading Apps: Ensure the broker has a robust mobile platform for trading on the go.

4. Risk Management Features: Tools for setting stop losses, alerts, and position sizing calculators are essential.

5. Level II Quotes: Access to order book data allows traders to see market depth and better gauge buying/selling pressure.

6. Backtesting Capabilities: Some brokers provide tools to test trading strategies against historical data.

7. Analytical Tools: Look for sentiment analysis, news feeds, and economic calendars integrated into the trading platform.

8. Direct Market Access (DMA): This allows for faster execution speeds, crucial for day trading.

Choose a broker that excels in these areas to enhance your day trading experience.

How do trading commissions compare among top brokers?

Trading commissions vary significantly among top brokers. Discount brokers like Robinhood and Webull often offer commission-free trading, making them attractive for day traders. In contrast, traditional brokers like Charles Schwab or Fidelity may charge around $4.95 to $6.95 per trade but might provide additional services or tools. Interactive Brokers is known for low commissions, often starting at $0.005 per share. When choosing a broker, consider not just the commission rates but also the overall trading platform, tools, and support offered.

What should day traders know about broker execution speeds?

Day traders should prioritize broker execution speeds because they directly impact trade profitability. Fast execution reduces slippage, ensuring trades are filled at desired prices. Look for brokers that offer low latency and reliable infrastructure. Check for reviews and performance metrics to gauge execution times. Consider features like direct market access and advanced order types, which can enhance speed. Lastly, test the broker's platform with a demo account to assess real-time performance before committing.

How can day traders assess a broker's reliability?

Day traders can assess a broker's reliability by checking the following key factors:

1. Regulation: Ensure the broker is regulated by a reputable authority, like the SEC or FCA.

2. Reviews: Look for user reviews and ratings on trusted financial websites.

3. Execution Speed: Test the broker’s execution speed with a demo account.

4. Fees: Compare trading fees, commissions, and spreads to ensure they are competitive.

5. Customer Support: Evaluate the availability and responsiveness of customer support.

6. Platform Stability: Use the trading platform to assess stability and user experience.

7. Account Security: Review the security features, including encryption and two-factor authentication.

These factors provide a solid basis for determining a broker's reliability for day trading.

What are the advantages of using an online broker for day trading?

Using an online broker for day trading offers several advantages:

1. Lower Fees: Online brokers typically have lower commissions and fees compared to traditional brokers, maximizing your profit on trades.

2. Real-Time Access: They provide real-time market data and trading platforms, essential for making quick decisions.

3. User-Friendly Interfaces: Many online brokers offer intuitive platforms that simplify order placement and tracking.

4. Advanced Tools: Access to charting tools, technical analysis, and research resources helps traders make informed decisions.

5. Flexible Trading Hours: Online brokers allow trading outside regular market hours, giving you more opportunities to capitalize on market movements.

6. Variety of Assets: You can trade various assets, including stocks, ETFs, options, and cryptocurrencies, all in one place.

7. Educational Resources: Many brokers provide educational materials, webinars, and tutorials to enhance your trading skills.

8. Customizable Alerts: Set up alerts for price movements or news changes, keeping you informed without constantly monitoring the market.

Choosing the right online broker can significantly enhance your day trading experience.

How does a broker's account minimum affect day traders?

A broker's account minimum affects day traders by determining the initial capital they need to start trading. Higher minimums can limit access for new traders or those with less capital. This can hinder their ability to execute multiple trades, diversify their strategies, or manage risk effectively. Conversely, lower minimums allow more flexibility, enabling traders to enter the market with less financial commitment. Ultimately, the account minimum influences a trader's ability to engage in day trading strategies and achieve their financial goals.

Learn about How Does Insider Trading Affect Day Traders?

What research and analysis resources do brokers provide for day traders?

Brokers typically provide a range of research and analysis resources for day traders, including:

1. Market Reports: Daily or weekly reports that summarize market trends and economic indicators.

2. Technical Analysis Tools: Charting software, indicators, and technical patterns to help identify trading opportunities.

3. News Feeds: Real-time news updates that impact market movements, essential for quick decision-making.

4. Economic Calendars: Schedules of upcoming economic events and data releases that may affect trading.

5. Research Articles: In-depth analyses and insights on specific stocks, sectors, or market conditions.

6. Webinars and Educational Content: Sessions on trading strategies, risk management, and market analysis techniques.

7. Social Sentiment Analysis: Insights from social media or trading forums to gauge market sentiment.

8. Trading Simulators: Platforms for practicing trades without risking real money, allowing day traders to refine their skills.

Choose a broker that offers a comprehensive suite of these resources to enhance your trading strategy.

Learn about Day Trading Brokers with Research and Analysis Tools

How can day traders evaluate a broker's reputation?

Day traders can evaluate a broker's reputation by checking reviews on financial forums, looking for regulatory compliance with organizations like the SEC or FCA, and assessing the broker’s execution speed and reliability. They should also consider the broker's customer service quality, available trading platforms, and fee structures. Analyzing the broker's history, including any regulatory issues or complaints, is crucial. Finally, seeking recommendations from other traders can provide valuable insights into a broker's trustworthiness.

What is the significance of demo accounts for day traders?

Demo accounts are crucial for day traders as they allow practice without financial risk, helping traders refine strategies and improve skills. They provide a realistic trading experience using live market conditions, which builds confidence before trading with real money. Additionally, demo accounts help traders evaluate brokers' platforms and tools, ensuring they choose the right one that meets their trading needs.

How do brokers handle order types for day trading?

Brokers handle order types for day trading by offering a range of options, including market orders, limit orders, stop orders, and stop-limit orders. Day traders typically prefer brokers that provide quick execution speeds and minimal slippage. They should look for platforms with advanced order types like trailing stops and one-cancels-other (OCO) orders. Additionally, features like direct market access (DMA) and customizable order routing can enhance trading efficiency. Transparent commission structures and low fees are also crucial for maximizing profit on frequent trades.

Learn about How Do Prop Firms Handle Losses in Day Trading?

Conclusion about Analyzing Brokers: What Day Traders Should Look For

In conclusion, selecting the right broker is crucial for day traders aiming to maximize their profitability and efficiency. Key features such as low commission fees, reliable trading platforms, and robust customer support significantly influence trading success. Additionally, understanding regulations, margin trading, and execution speeds can further enhance a trader's experience. By considering these factors and utilizing available tools and resources, day traders can make informed decisions that align with their strategies. Ultimately, partnering with a reputable broker like DayTradingBusiness can provide the insights and support necessary for navigating the fast-paced trading environment effectively.

Sources:

- The cross-section of speculator skill: Evidence from day trading ...

- How free is free? Retail trading costs with zero commissions ...

- Are individual investors tax savvy? Evidence from retail and discount ...

- Should retail investors' leverage be limited? - ScienceDirect

- Well-connected short-sellers pay lower loan fees: A market-wide ...

- A Practical Guide to Trade Policy Analysis