Did you know that some AI trading systems can analyze market data faster than you can say "buy low, sell high"? In this article, we dive deep into the world of Day Trading AI, exploring its benefits and drawbacks for both novice and seasoned traders. We'll clarify what Day Trading AI is and how it enhances trading strategies, while also addressing common errors and limitations. Discover how effective AI tools are for beginners, their accuracy in predictions, and their ability to reduce trading risks. We’ll also review top AI platforms, legal considerations, costs, and what features to prioritize. Plus, find out how AI compares to human traders and what real users are saying about their experiences. Join us as we uncover the truth behind AI-driven day trading and the ethical concerns surrounding it—all brought to you by DayTradingBusiness.

What is Day Trading AI?

User experiences with Day Trading AI vary. Some traders find it helpful for quick analysis and automated trades, boosting efficiency. Others report it’s not foolproof, especially in volatile markets, and still need human oversight. Many users appreciate real-time insights and data-driven decisions, but some struggle with false signals or over-reliance on AI predictions. Overall, experiences depend on the AI’s sophistication and the trader’s skills.

How does AI improve day trading strategies?

AI enhances day trading strategies by analyzing vast market data quickly, identifying patterns, and executing trades faster than humans. Users report that AI tools help them spot opportunities they might miss and reduce emotional trading errors. Many find that AI-driven algorithms improve accuracy in predicting short-term market movements. Traders also praise AI for automating routine tasks, freeing them to focus on strategy adjustments. Overall, user experiences show AI boosts confidence and efficiency in day trading.

Are AI tools effective for beginner traders?

Many beginner traders find AI tools helpful for day trading because they automate analysis and identify patterns faster than humans. Users report that AI can improve decision-making and reduce emotional mistakes, but it’s not foolproof—market volatility still affects outcomes. Some beginners see AI as a valuable learning aid, while others rely on it for quick trades. Overall, AI tools can boost a beginner’s trading efficiency, but success depends on understanding their limits and integrating human judgment.

What are common AI errors in day trading?

Common AI errors in day trading include misinterpreting market signals, overfitting to past data, generating false buy or sell signals, and failing to adapt to sudden market shifts. These errors can lead to significant losses, especially when the AI relies on outdated or incomplete information, causing traders to make poor decisions based on inaccurate predictions.

How accurate are AI predictions in day trading?

User experiences with day trading AI vary; some find it helpful for identifying trends and making quick decisions, boosting confidence and speed. Others report mixed results, noting that AI predictions aren't foolproof and can lead to losses if relied on solely. Many traders use AI as a tool alongside their own analysis, not a guaranteed winner. Overall, AI predictions in day trading are moderately accurate but not infallible—best used to support, not replace, human judgment.

Can AI help reduce trading risks?

Yes, many traders find that AI helps reduce risks by analyzing market data faster and more accurately than humans, identifying patterns, and automating trades to avoid emotional mistakes. Users report that AI tools improve decision-making, highlight potential pitfalls, and enable more disciplined trading strategies. However, some warn that relying solely on AI isn't foolproof, and market volatility can still cause losses. Overall, user experiences suggest AI can be a valuable risk management tool in day trading.

What are the best AI platforms for day trading?

Users find platforms like Trade Ideas, MetaTrader with AI plugins, and eToro’s AI tools most helpful for day trading. They praise real-time data analysis, predictive insights, and automated trading features. Many report increased efficiency and better decision-making with these AI platforms.

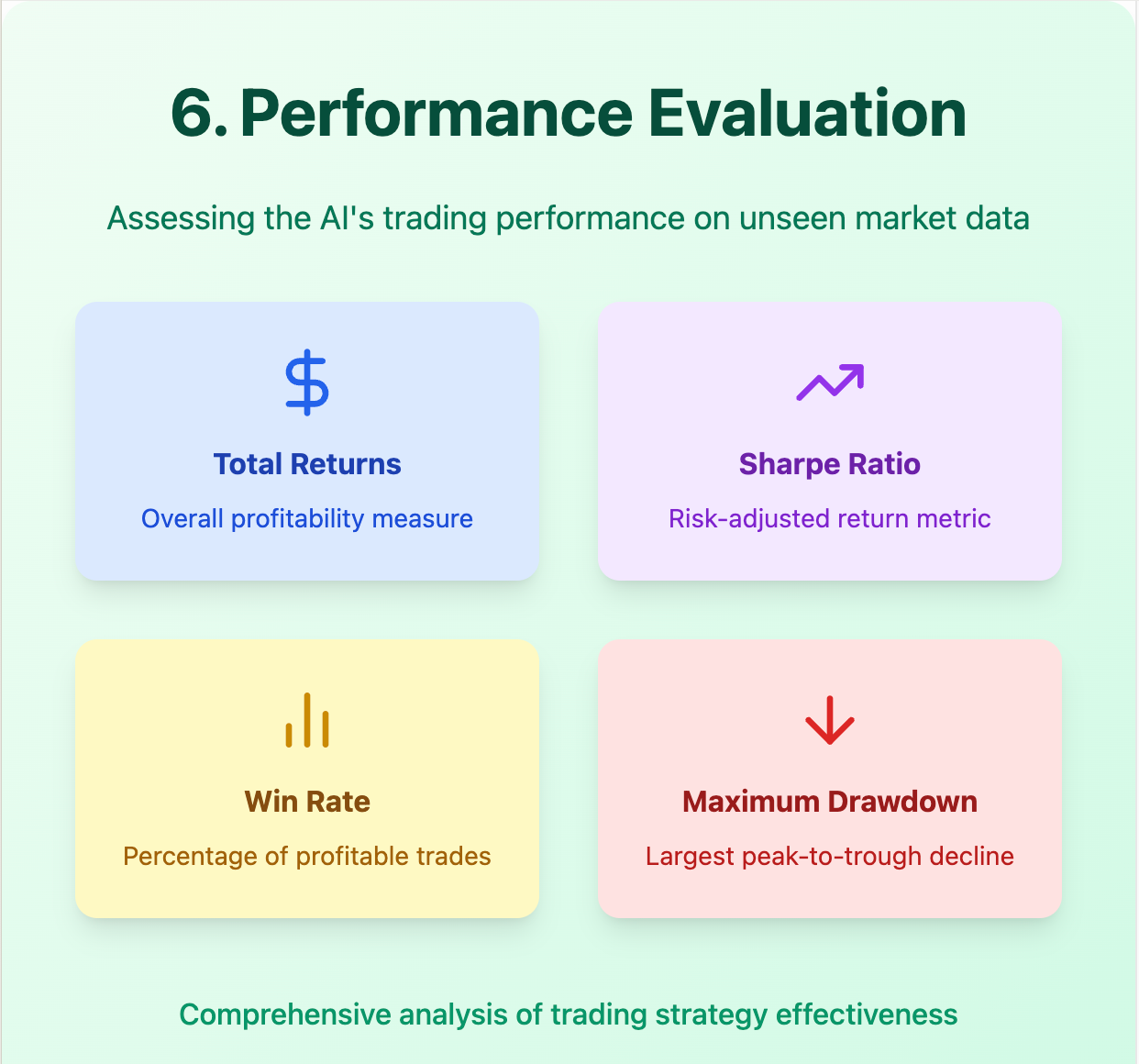

How do traders evaluate AI trading performance?

Traders evaluate AI trading performance by analyzing accuracy in predicting market moves, consistency of profits, and risk management effectiveness. They look at metrics like win rate, profit factor, drawdowns, and return on investment. User experiences often mention tracking AI's historical performance, testing it in simulated environments, and monitoring real-time results to gauge reliability. Traders also consider how well the AI adapts to market changes and its transparency in decision-making.

Is using AI in day trading legal and regulated?

Using AI in day trading is legal in most countries, but it must comply with local financial regulations. Regulatory bodies like the SEC in the U.S. oversee trading practices, including AI use, to prevent market manipulation. Traders should ensure their AI tools follow rules on disclosure, transparency, and fair trading. Failure to adhere can lead to legal penalties. User experiences vary: some find AI helpful and compliant, while others worry about regulatory gray areas and potential risks.

What are the costs of AI-based trading tools?

AI-based trading tools typically cost between $50 to $500 monthly, depending on features and complexity. Some platforms charge one-time setup fees or offer tiered subscriptions with higher prices for advanced analytics. User experiences vary: beginners often find affordable tools helpful for learning, while experienced traders may invest more in premium AI systems that offer deeper insights. Overall, costs reflect the sophistication and data integration level of the AI trading tools.

How quickly can AI adapt to market changes?

AI can adapt to market changes within seconds to minutes, using real-time data and machine learning algorithms. User experiences with day trading AI show it reacts swiftly to market shifts, often outperforming humans in speed. However, its effectiveness depends on data quality and algorithm design, with some users noting rapid adjustments during volatile periods.

Do traders trust AI recommendations?

Some traders trust AI recommendations in day trading, especially those who see consistent gains or find AI insights helpful for quick decisions. Others remain skeptical due to AI's occasional errors or unpredictable market shifts. Trust varies based on individual experience, risk tolerance, and how well the AI aligns with their trading style. Many traders test AI tools cautiously before relying heavily on them.

What are the limitations of AI in day trading?

AI in day trading struggles with unpredictable market swings and sudden news events that cause volatile price movements. It often relies on historical data, making it less effective during unexpected market shifts. AI algorithms can misinterpret complex human behaviors and sentiment, leading to false signals. Overfitting to past patterns reduces adaptability in real-time trading. Additionally, AI lacks intuition and the ability to understand nuanced geopolitical or economic developments impacting markets. Users report that AI sometimes makes rapid decisions that don’t account for context, causing losses.

How does AI analyze market data?

AI analyzes market data by processing real-time price movements, volume, and news feeds using machine learning algorithms. It identifies patterns, trends, and anomalies faster than humans, providing insights for day trading. Users report that AI-driven tools help spot entry and exit points, reducing emotional bias. Many experience quicker decision-making and improved trade accuracy, but some note limitations during unexpected market swings.

Can AI outperform human traders consistently?

Some users report that AI can outperform human traders in specific markets and short-term trades, but consistent success is rare. Many find AI helpful for analyzing data quickly and executing trades faster. However, others warn that AI struggles with unpredictable market shifts and emotional factors humans handle better. Overall, user experiences vary; AI can boost trading efficiency but rarely guarantees consistent outperforming of experienced traders.

What are user experiences with AI trading bots?

Users report mixed experiences with AI trading bots for day trading. Some praise their ability to execute trades quickly and remove emotional bias, leading to consistent gains. Others highlight inaccuracies during volatile market swings, causing unexpected losses. Many appreciate the convenience and 24/7 operation but warn that bots require careful setup and monitoring. Overall, user experiences depend heavily on the bot’s sophistication and the trader’s understanding of market dynamics.

How safe is investing with AI-driven day trading?

User experiences with AI-driven day trading vary. Some traders see quick gains and efficiency, feeling confident using algorithms. Others face unpredictable losses when markets shift suddenly or AI makes errors. Overall, investing with AI in day trading carries significant risk, and many users advise caution, testing algorithms thoroughly before committing large amounts.

What features should I look for in AI trading software?

Look for user-friendly interfaces, real-time data analysis, customizable strategies, backtesting capabilities, and reliable risk management tools. Ensure it offers transparent algorithms, good customer support, and positive user reviews on performance and accuracy. Compatibility with your trading platforms and strong security features are also key.

How do AI trading systems handle volatile markets?

AI trading systems handle volatile markets by quickly analyzing real-time data, adjusting strategies instantly, and executing trades faster than humans. They rely on algorithms that detect sudden price swings and adapt without emotional bias, often reducing losses during market turbulence. Users report that AI tools can capitalize on quick moves, but in extreme volatility, they sometimes struggle with false signals or lag. Overall, AI trading systems are designed to manage unpredictability better than manual trading but aren’t foolproof in chaos.

What are the ethical concerns with AI in trading?

Ethical concerns with AI in trading include potential market manipulation, lack of transparency in algorithms, and unfair advantages for those with advanced AI tools. Users worry about AI making decisions that could manipulate prices or exploit market loopholes without accountability. Additionally, AI-driven trading may increase systemic risks, causing sudden crashes. There's also concern over data privacy and the moral implications of algorithms that prioritize profit over investor well-being.

Conclusion about What Are User Experiences with Day Trading AI?

In summary, user experiences with day trading AI highlight its potential to enhance trading strategies, particularly for beginners. While AI tools can analyze vast amounts of market data and adapt quickly to changes, they are not without limitations and inaccuracies. Traders must weigh the benefits against the costs and ethical concerns associated with AI in trading. Ultimately, leveraging AI can complement human decision-making, making it a valuable asset in the ever-evolving landscape of day trading. For further insights and guidance on effectively utilizing AI in your trading journey, consider exploring resources from DayTradingBusiness.