Did you know that even the smartest AI can struggle to make sense of a market that reacts faster than a cat chasing a laser pointer? In our exploration of day trading AI, we’ll uncover the key limitations that traders must be aware of. From the technical constraints that hinder prediction accuracy to the impact of data quality on performance, we'll discuss how market volatility, algorithmic bias, and human oversight play critical roles in AI trading strategies. Additionally, we will address the challenges of real-time data processing, liquidity issues, and the ethical considerations surrounding AI in day trading. Join DayTradingBusiness as we delve into how these factors can influence your trading outcomes and the potential risks that come with relying on AI in a fast-paced market.

What are the main technical limitations of day trading AI?

Day trading AI struggles with unpredictable market swings and sudden news events that can't be modeled accurately. It relies on historical data, which limits its ability to foresee black swan events or drastic volatility. Latency and data processing speeds can cause delays in executing trades, leading to missed opportunities or losses. Overfitting to past patterns makes AI vulnerable to changing market conditions. Additionally, market manipulation and human trader behavior can distort AI predictions, reducing effectiveness. Technical glitches or server outages can also disrupt trading, exposing AI systems to risks.

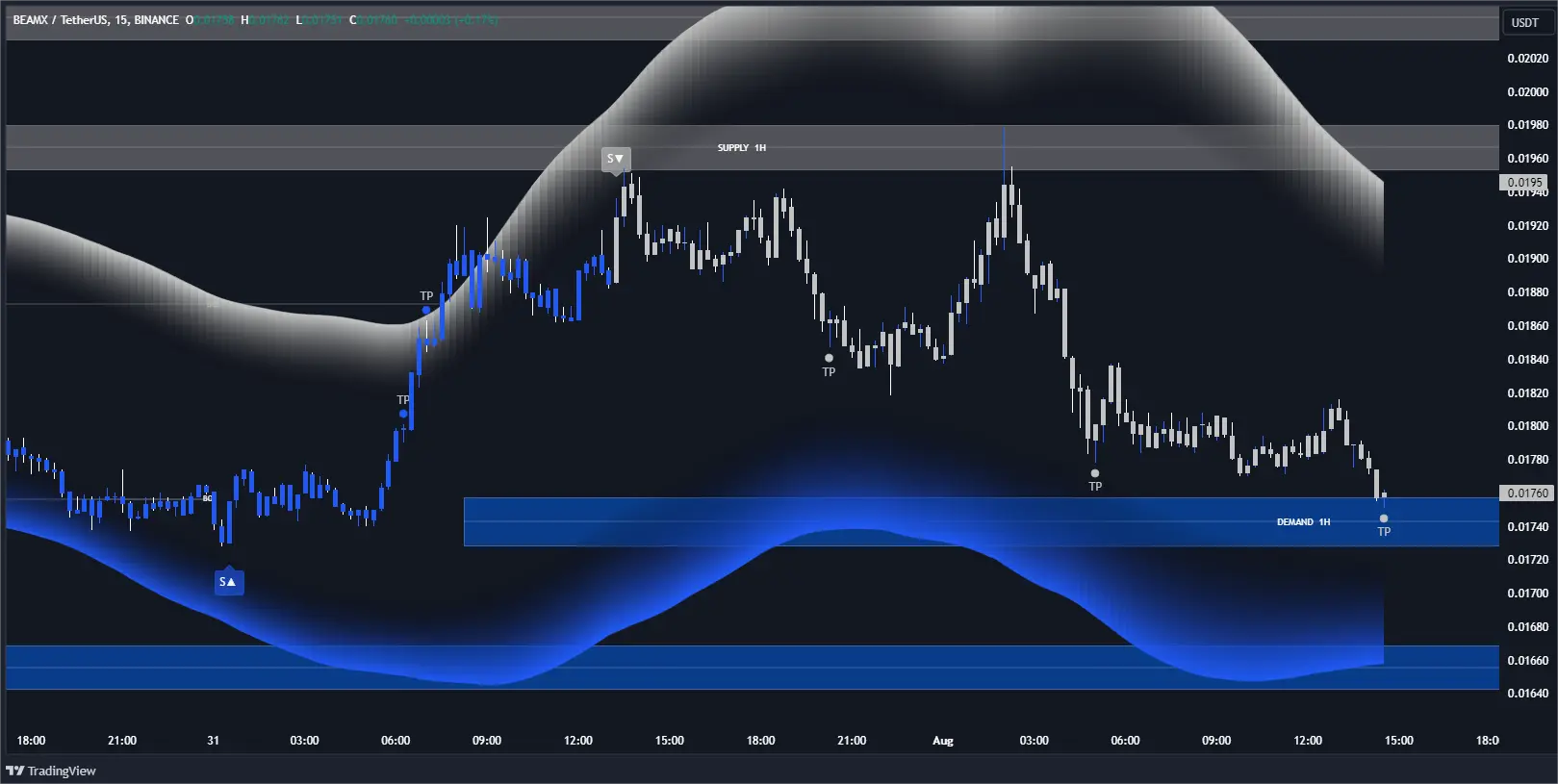

Can day trading AI accurately predict market movements?

Day trading AI can't always accurately predict market movements due to unpredictable news, sudden volatility, and market sentiment shifts. It relies on historical data and algorithms that may miss black swan events or rapid changes. Market noise and complex human behavior limit its precision. While AI can identify patterns and improve decision speed, it can't guarantee perfect predictions in real-time trading.

How does data quality affect day trading AI performance?

Poor data quality leads to inaccurate predictions, causing costly errors in day trading AI. If data is incomplete or outdated, the AI can't recognize real-time market shifts, reducing its effectiveness. Noisy or mislabeled data skews decision-making, increasing the risk of losses. Reliable, high-quality data is essential for the AI to identify profitable trades and adapt quickly to market volatility.

Are there risks of overfitting in day trading AI models?

Yes, overfitting is a major risk in day trading AI models. It causes the model to perform well on historical data but fail in real-time trading. Overfitted models can't adapt to market changes or unexpected events, leading to losses. They tend to memorize past patterns rather than generalize to new situations. This limits their effectiveness and increases the risk of significant errors during live trading.

What are the common errors made by day trading AI systems?

Day trading AI systems often make errors like overfitting to past market data, leading to poor real-time performance. They can misinterpret sudden market shifts or news events as predictable patterns. Many struggle with high volatility, causing false signals and whipsaws. Additionally, AI might rely too heavily on historical trends, missing new market conditions. Poor risk management and lack of adaptability to rapid changes also cause significant trading losses.

How does market volatility impact AI trading strategies?

Market volatility makes AI trading strategies less reliable because sudden price swings can trigger false signals or cause losses. AI models struggle to adapt quickly to rapid changes, leading to increased risk and potential mispredictions. During volatile periods, AI's reliance on historical data hampers its ability to forecast short-term price movements accurately. This unpredictability can cause AI-driven day trading systems to underperform or incur substantial losses.

Can AI adapt to sudden market news or events?

AI struggles to adapt instantly to sudden market news or events because it relies on historical data and predefined algorithms. It can’t interpret breaking news or geopolitical shifts in real-time like human traders can. Rapid market changes often cause AI models to lag or make incorrect predictions until they are retrained or updated. This limits its effectiveness in volatile situations where quick, nuanced judgment is critical.

What are the limitations of AI in managing risk?

AI in day trading struggles with unpredictable market swings and sudden news events, which it can't always interpret accurately. It lacks human intuition and emotional judgment, leading to potential overconfidence or panic. AI models rely on historical data, so they can miss novel patterns or black swan events. They may also misinterpret market sentiment or social media trends, causing false signals. Additionally, technical limitations like data quality and processing speed restrict real-time decision-making.

How does algorithmic bias influence day trading AI outcomes?

Algorithmic bias skews day trading AI outcomes by favoring certain market patterns or assets, leading to inaccurate predictions and poor decision-making. It can cause the AI to overlook emerging trends, overemphasize familiar data, or reinforce existing market stereotypes. This bias results in inconsistent profits, increased risk, and reduced adaptability to real-time market changes. Ultimately, bias limits the AI’s effectiveness, making it less reliable for successful day trading.

Is real-time data processing a challenge for trading AI?

Yes, real-time data processing is a challenge for trading AI because it requires massive computational power and low-latency systems to analyze market fluctuations instantly. Delays or inaccuracies in processing can lead to missed opportunities or losses. Handling the volume and speed of live data streams while maintaining accuracy and speed remains a key limitation for effective day trading AI.

How does liquidity affect the effectiveness of trading AI?

Liquidity is crucial for trading AI because it determines how easily the AI can execute trades without affecting the market price. Low liquidity causes slippage, making it hard for the AI to buy or sell at desired prices, reducing profit potential. High liquidity allows the AI to enter and exit positions quickly and accurately, improving trade execution and overall effectiveness. Without sufficient liquidity, even sophisticated AI algorithms struggle to perform reliably, limiting their profitability in volatile or thin markets.

Can AI trading systems handle unexpected market crashes?

AI trading systems struggle with unexpected market crashes because they rely on historical data and patterns. Sudden crashes, like black swan events, are unpredictable and outside normal training data, causing AI to misjudge risks or continue flawed strategies. They lack the intuition and real-time human judgment needed to react swiftly to extreme, unforeseen market moves.

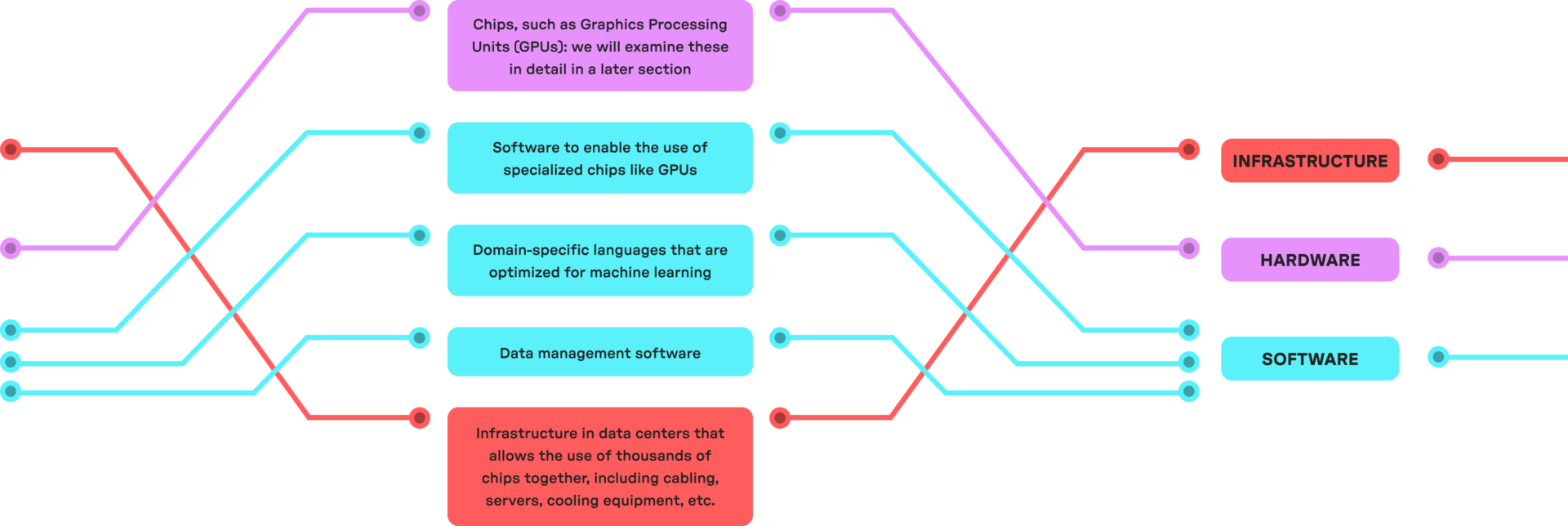

What are the limitations of AI in different asset classes?

AI in day trading struggles with unpredictable market swings, sudden news events, and black swan incidents. It often fails to interpret human emotions, leading to missed cues during volatile periods. Overfitting to historical data limits adaptability in changing market conditions. AI can also misjudge the impact of macroeconomic shifts or geopolitical news. In fast-moving markets, latency and data inaccuracies can cause costly errors. Additionally, AI models lack intuition and can't replace human judgment in complex, nuanced trading scenarios.

How do computational constraints limit AI trading speed?

Computational constraints slow down AI trading speed by limiting processing power and data handling. They create delays in analyzing market data, executing trades, and updating models in real-time. This lag can cause missed opportunities during fast market moves. Hardware limitations, network latency, and algorithm complexity all restrict how quickly an AI can respond to changing conditions.

Are there ethical or regulatory issues restricting AI in day trading?

Yes, ethical and regulatory issues limit AI in day trading. Regulators scrutinize AI for potential market manipulation, unfair advantages, and transparency concerns. Ethical worries include algorithmic bias and the risk of causing market instability. Some jurisdictions restrict or heavily regulate AI-driven trading to ensure fair, transparent markets.

How does human oversight complement AI trading systems?

Human oversight ensures AI trading systems catch errors, adapt to unexpected market shifts, and prevent costly mistakes. It provides strategic judgment AI lacks, like understanding news or sentiment that algorithms might miss. Traders can adjust AI models based on real-world events, keeping trading more aligned with current conditions. Without human oversight, AI might follow faulty signals or fail to recognize nuanced market signals. Combining AI's speed with human intuition creates a balanced approach, reducing risks and improving decision accuracy.

Can AI consistently outperform human traders?

AI can outperform human traders in speed and data analysis, but it struggles with unpredictable market shifts and emotional factors. It may misinterpret rare events or sudden news, leading to losses. Human intuition and experience still outperform AI in complex, volatile situations. AI's performance depends on quality data and algorithm design, but it can't fully grasp market sentiment or adapt instantly like a skilled trader.

What are the scalability issues of AI in day trading?

AI in day trading faces scalability issues like data overload, which slows decision-making as market complexity grows. High computational costs limit real-time analysis during volatile trading hours. As markets evolve, retraining models becomes resource-intensive, reducing responsiveness. Limited ability to adapt quickly to sudden market shifts causes missed opportunities. Infrastructure bottlenecks can cause delays, impacting execution speed. Overall, growing data volumes and market unpredictability challenge AI’s scalability in day trading.

How do model updates impact AI trading performance?

Model updates can improve AI trading performance by refining algorithms, correcting errors, and adapting to new market data. However, they can also introduce instability if updates are poorly implemented or overfit recent trends. Frequent updates may cause inconsistency, making it hard for the AI to maintain steady performance. Relying heavily on updates without thorough testing can lead to unpredictable results in volatile markets.

What are the cybersecurity risks for AI trading platforms?

Cybersecurity risks for AI trading platforms include hacking, data breaches, and manipulation of algorithms. Hackers can access sensitive trading data or disrupt system operations, causing financial losses. Data breaches expose client information and proprietary models. Malicious actors might manipulate AI algorithms to cause false trades or market distortion. These risks threaten platform integrity, investor trust, and overall market stability.

Conclusion about What Are the Limitations of Day Trading AI?

In conclusion, while day trading AI offers innovative approaches to market analysis and decision-making, it faces several limitations that traders should be aware of. Challenges such as data quality, algorithmic bias, and the inherent unpredictability of markets can hinder performance. Additionally, human oversight remains crucial for navigating risks and ensuring ethical compliance. Understanding these limitations is essential for any trader looking to incorporate AI into their strategy effectively. For more insights and guidance on trading, consider exploring the resources offered by DayTradingBusiness.