Did you know that some traders believe their coffee can predict market trends better than their intuition? While caffeine might give you a kick, it's AI that's truly revolutionizing day trading. This article dives into the best AI strategies for day trading, highlighting top tools, algorithms for predicting stock movements, and how machine learning can enhance accuracy. We’ll explore how AI trading systems utilize various data sources, reduce risks, and operate through trading bots. Whether you’re a beginner or an experienced trader, discover the advantages of AI and learn how to seamlessly integrate it into your workflow. Plus, we’ll address common challenges and ethical considerations, ensuring you're well-equipped for the future of trading with insights from DayTradingBusiness.

What are the top AI tools for day trading?

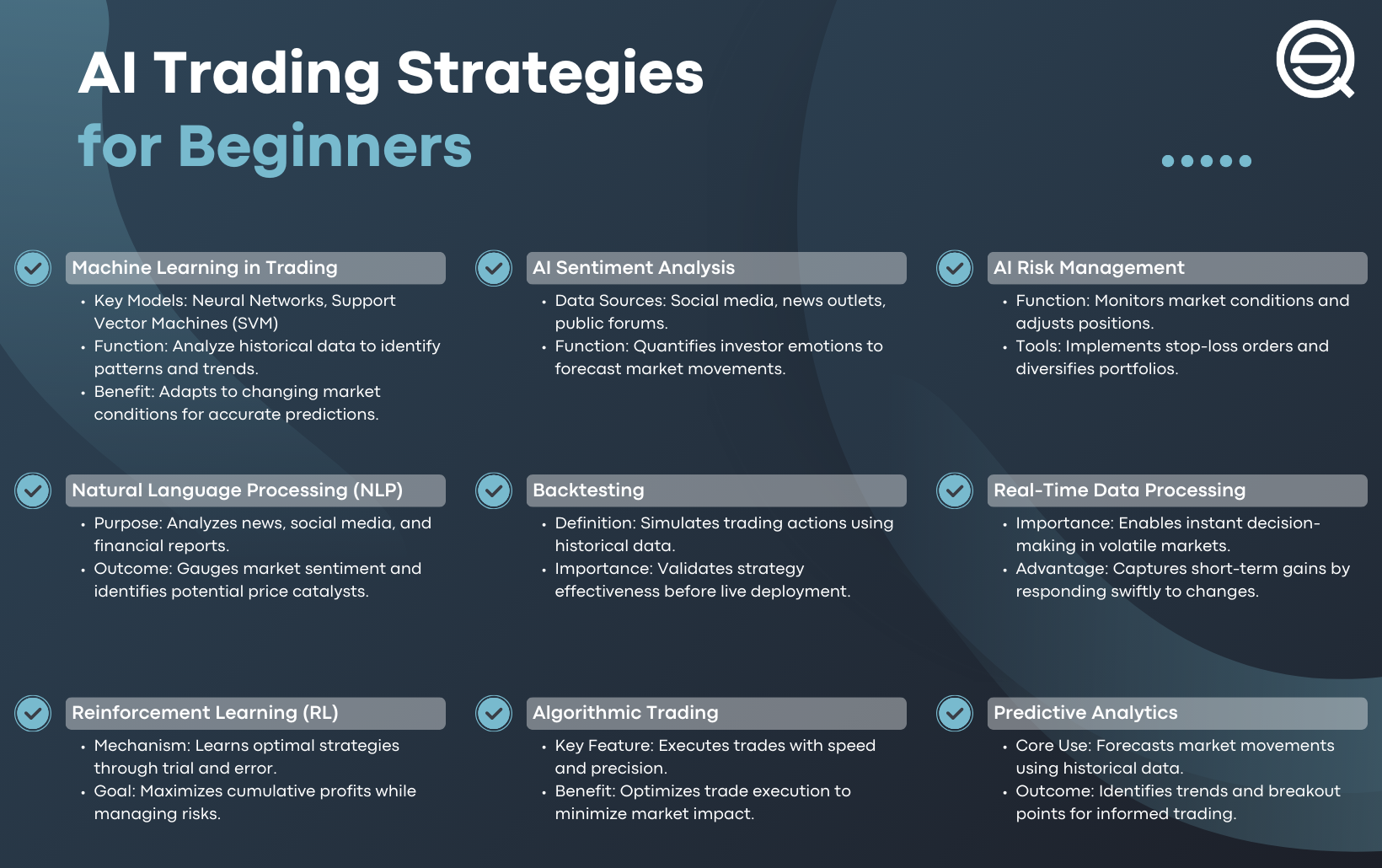

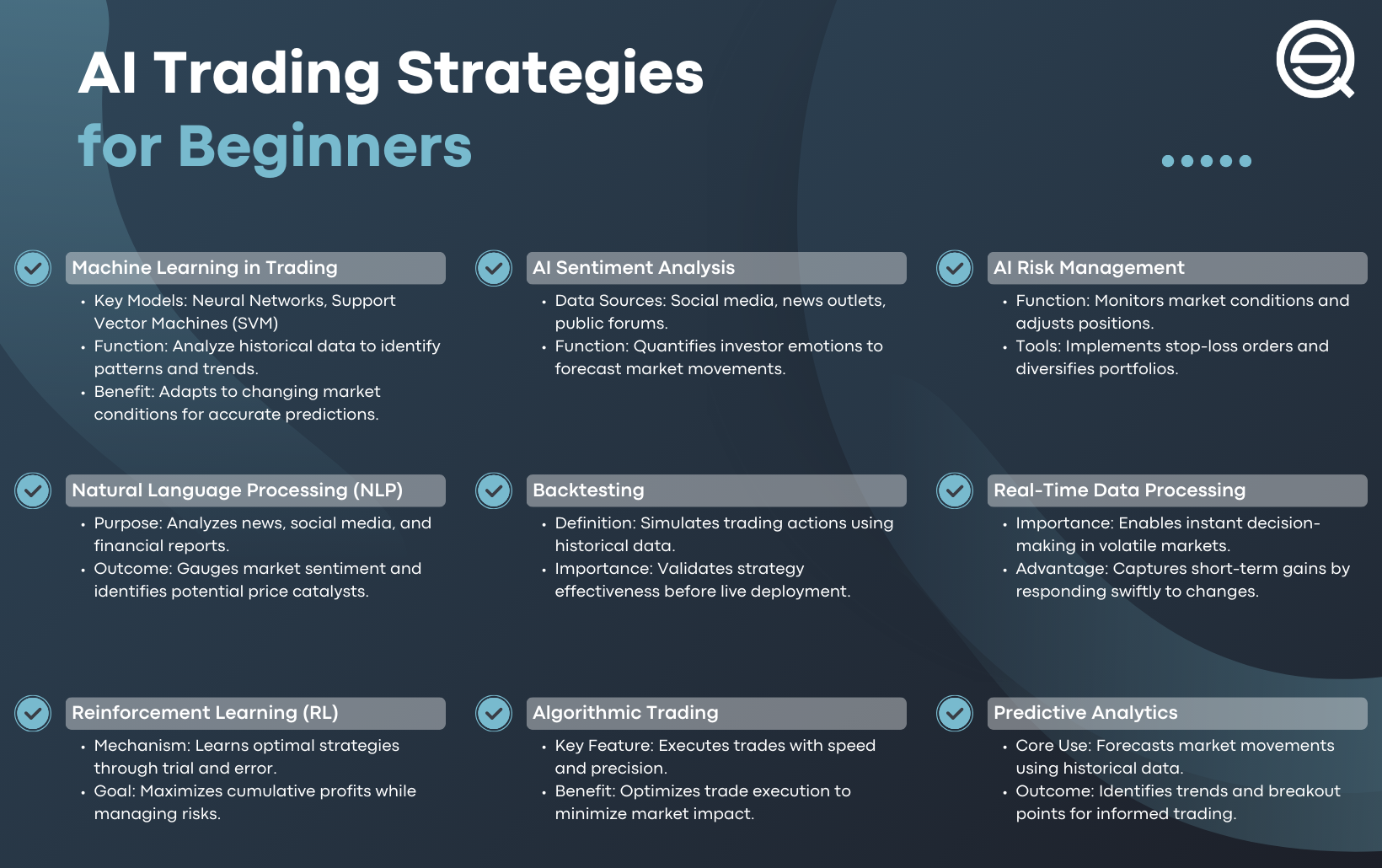

The best AI tools for day trading include Trade Ideas, TrendSpider, Kavout, MetaStock, and QuantConnect. They use machine learning to analyze market data, identify patterns, and generate trading signals. These tools help automate decision-making, optimize entry and exit points, and manage risk effectively.

How can AI improve day trading accuracy?

AI improves day trading accuracy by analyzing vast market data quickly, identifying patterns, and predicting short-term price movements. Machine learning models can adapt to market changes, spotting trends before human traders notice. AI tools like algorithmic trading bots execute trades instantly based on real-time signals, reducing emotional bias. Combining technical analysis with AI-driven insights helps traders make more precise buy and sell decisions. Overall, AI enhances accuracy by providing faster, data-driven decisions in the fast-paced world of day trading.

Which AI algorithms are best for predicting stock movements?

Neural networks, especially LSTM and CNN models, excel at capturing stock market patterns. Random forests and gradient boosting machines also perform well in predicting short-term price movements. Reinforcement learning, like Deep Q-Networks, adapts strategies through trial and error, making it effective for day trading. Combining these algorithms with technical analysis indicators enhances prediction accuracy.

How does machine learning enhance day trading strategies?

Machine learning analyzes vast data quickly, spotting patterns and trends that humans might miss. It predicts price movements by learning from historical market data, helping traders make faster, more accurate decisions. Algorithms adapt to new data, improving their predictions over time. Using AI strategies like pattern recognition and predictive modeling, day traders can optimize entry and exit points, reduce emotional bias, and increase profitability.

What data sources do AI trading systems use?

AI trading systems use data sources like real-time market prices, historical price data, order book information, news feeds, social media sentiment, economic indicators, and financial reports.

Can AI help reduce trading risks?

Yes, AI can help reduce trading risks by analyzing market data quickly, identifying patterns, and predicting potential price movements. It enables real-time decision-making, minimizes emotional bias, and manages risk through automated stop-loss and take-profit orders. Using AI-driven tools like machine learning models and algorithmic trading systems enhances accuracy and helps traders avoid costly mistakes.

How do AI-based trading bots work?

AI-based trading bots analyze market data using algorithms and machine learning models to identify patterns and predict price movements. They process real-time information from charts, news, and social media faster than humans. The bots execute trades automatically based on predefined strategies or adaptive learning, aiming to maximize profits and minimize risks. They constantly refine their algorithms through historical data and ongoing market trends. The best AI strategies for day trading combine technical analysis, sentiment analysis, and risk management to stay ahead in volatile markets.

What are the advantages of using AI in day trading?

AI in day trading offers faster data analysis, enabling quick decision-making. It identifies patterns and trends humans might miss, boosting accuracy. AI algorithms can execute trades instantly, reducing emotional bias. It adapts to market changes in real-time, improving strategy responsiveness. Overall, AI enhances efficiency, consistency, and the ability to capitalize on short-term opportunities.

Are AI strategies suitable for beginners or experienced traders?

AI strategies for day trading are generally better suited for experienced traders who understand market patterns and can interpret AI insights effectively. Beginners might find them complex without foundational trading knowledge.

How to implement AI in your day trading workflow?

Use AI for real-time market analysis by deploying machine learning models to identify patterns and predict price movements. Incorporate AI-driven algorithms for automated trade execution, reducing emotional bias. Leverage AI tools for sentiment analysis on news and social media to gauge market mood. Implement backtesting with AI to refine strategies quickly. Use AI-powered risk management to set optimal stop-loss and take-profit levels. Combine these strategies to enhance decision-making and improve trading efficiency.

Learn about How to Implement Risk Management in Day Trading Algorithms

What are common challenges in AI-driven day trading?

Common challenges in AI-driven day trading include data quality issues, overfitting models to historical data, market volatility unpredictable by algorithms, and delays in real-time data processing. AI strategies can struggle with adapting to sudden market shifts, false signals, and maintaining consistent performance across different assets. Additionally, high computational costs and the need for continuous model updates pose significant hurdles.

How does AI analyze market trends?

AI analyzes market trends by processing vast amounts of real-time data—prices, news, social media, and economic indicators—to identify patterns and signals. It uses machine learning algorithms to detect emerging trends, predict price movements, and generate trading signals. AI models continuously learn from new data, refining their predictions and adapting to market changes for more accurate day trading decisions.

Can AI predict market crashes or volatility?

AI can identify patterns and indicators that suggest increased volatility or potential market crashes, but it can't predict them with certainty. For day trading, the best AI strategies involve real-time data analysis, machine learning models that adapt quickly, and sentiment analysis from news and social media. These tools help traders react faster to market shifts, but no AI can guarantee precise predictions of crashes or sudden volatility.

What are the ethical considerations of using AI in trading?

Using AI in trading raises ethical concerns about market fairness, as AI can give certain traders an unfair advantage. It can also lead to market manipulation if algorithms exploit vulnerabilities or execute manipulative strategies. Transparency is key—traders and firms should disclose AI use to avoid deceptive practices. There's also the risk of bias in AI models, which could cause unfair trading outcomes. Finally, reliance on AI might diminish human oversight, increasing the potential for unforeseen errors or crashes.

How do backtesting and AI improve trading strategies?

Backtesting tests AI-driven trading strategies on historical data to see how they'd perform, revealing strengths and weaknesses before real money is at risk. AI improves strategies by analyzing vast market data, identifying patterns humans miss, and adapting quickly to market changes. Combining backtesting with AI creates robust, data-driven decisions, making day trading strategies more accurate and responsive.

Learn about How to Use Backtesting to Improve Your Day Trading Performance

Conclusion about What Are the Best AI Strategies for Day Trading?

Incorporating AI strategies into day trading offers significant advantages, including enhanced accuracy, risk reduction, and efficient analysis of market trends. By utilizing top AI tools and algorithms, traders can better predict stock movements and adapt their strategies accordingly. Whether you are a beginner or an experienced trader, the integration of AI can streamline your trading workflow and improve overall performance. However, it is essential to remain aware of the challenges and ethical considerations involved. For those looking to elevate their trading game, DayTradingBusiness provides valuable insights and resources to effectively leverage AI in your trading journey.

Sources:

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- A Profitable Day Trading Strategy For The US Equity Market

- Beat the Market An Effective Intraday Momentum Strategy for ...

- Statistical arbitrage powered by Explainable Artificial Intelligence ...

- Optimising quantile-based trading strategies in electricity arbitrage ...