Did you know that even the best day traders sometimes feel like they're throwing darts at a board? Backtesting day trading bots can transform that chaos into strategy by providing a structured way to analyze trading performance. This article dives into the essentials of backtesting, covering what it is, why it matters, and how to select the right trading strategy. You’ll learn about preparing historical data, crucial metrics to analyze, and how to avoid common pitfalls like overfitting. Additionally, we’ll explore tools for effective backtesting and how to simulate real market conditions. By understanding these principles, you can optimize your trading bot for improved performance and navigate the limitations of backtesting effectively. Join us at DayTradingBusiness as we guide you through mastering the art of backtesting.

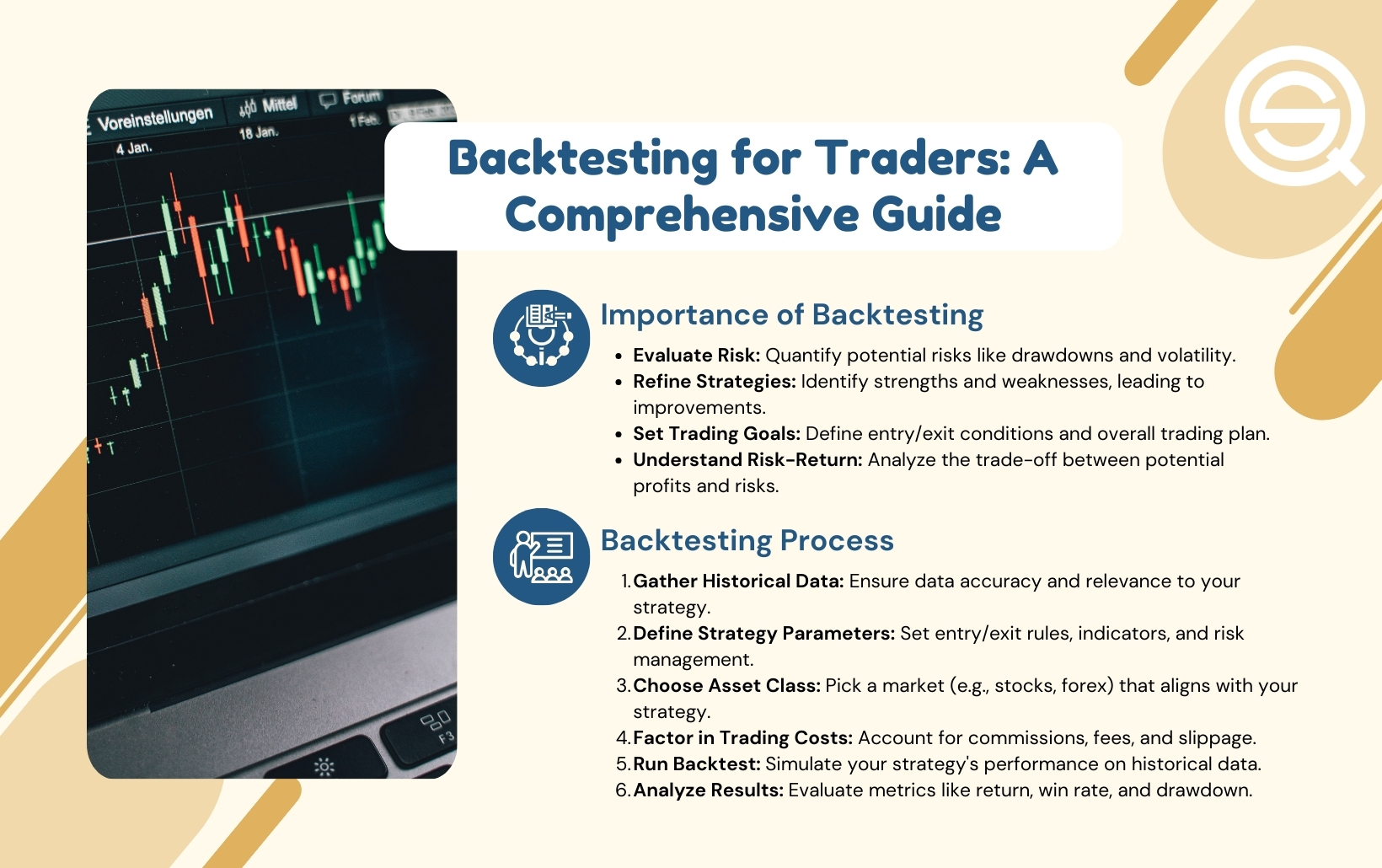

What is backtesting in day trading bots?

Backtesting in day trading bots is testing your trading strategy on historical market data to see how it would have performed. It involves running the bot’s rules against past price movements to identify potential profitability and risks. Effective backtesting helps refine your strategy, spot weaknesses, and improve accuracy before live trading.

Why is backtesting important for trading bots?

Backtesting is crucial for trading bots because it shows how the strategy would have performed historically, helping you identify strengths and weaknesses. It prevents costly real-money mistakes by testing parameters before live trading. Effective backtesting reveals if your day trading bot can adapt to different market conditions, boosting confidence. It saves time and money by optimizing strategies offline instead of trial-and-error in real markets. Ultimately, it ensures your bot is reliable, profitable, and ready for real trading scenarios.

How do I choose the right trading strategy for backtesting?

Identify your trading goals, risk tolerance, and preferred markets. Choose strategies that match your style—scalping, momentum, or breakout. Test with historical data that reflects current market conditions. Start simple, then refine based on performance metrics like win rate and drawdown. Use realistic assumptions for slippage and fees. Validate results with out-of-sample data. Focus on strategies that show consistent profitability over different periods.

What data do I need for effective backtesting?

You need historical price data with high resolution, including open, high, low, close prices, and volume. Ensure data covers enough recent periods to match your trading strategy. Include timestamps and bid-ask spreads if relevant. Accurate, clean data prevents false signals during backtesting.

How do I prepare historical data for backtesting?

Clean and organize your historical data to match your trading strategy’s parameters. Ensure data quality by removing gaps, errors, and outliers. Use timestamped minute or tick data for accuracy. Adjust for splits, dividends, and market closures. Normalize data if needed, and include relevant variables like price, volume, and order book info. Store it in a format compatible with your backtesting software. Test data consistency by running small simulations before full backtests.

What metrics should I analyze during backtesting?

Focus on win rate, profit factor, maximum drawdown, average profit per trade, and Sharpe ratio. Track average hold time, number of trades, and consistency over different market conditions. Evaluate risk-reward ratio and expectancy to gauge overall strategy robustness.

How do I avoid overfitting in backtesting?

Use out-of-sample data to test your strategy, ensuring it’s not just fitted to historical patterns. Keep your backtest period diverse, covering different market conditions, to prevent overfitting to specific trends. Limit the complexity of your algorithm—avoid overly tailored parameters that only work on past data. Validate with walk-forward testing or forward simulation to check real-time performance. Regularly update and re-test your strategy with new data to ensure it remains robust.

What software or tools are best for backtesting day trading bots?

TradingView, MetaTrader 4 and 5, QuantConnect, and TradingSim are top tools for backtesting day trading bots. They offer real historical data, customizable strategies, and easy-to-use interfaces. Use TradingView for quick visual backtests, MetaTrader for forex and stocks, QuantConnect for algorithmic strategies, and TradingSim for intraday testing. Each provides the features needed to evaluate and refine your trading bot effectively.

How can I simulate real market conditions in backtests?

Use historical data that reflects current market volatility, liquidity, and spreads. Incorporate realistic slippage and transaction costs. Test across different market environments—bulls, bears, sideways. Use tick or minute data, not just daily prices, to capture intraday price movements. Include news events and economic releases that impact markets. Avoid overfitting by validating on out-of-sample data. Simulate order execution delays and partial fills. Continuously update your data to mirror recent market conditions.

How do I interpret backtest results accurately?

Look for consistent profitability, not just a few winning trades. Check the win rate and risk-reward ratio to see if the strategy can sustain losses. Evaluate the drawdowns—large drops indicate higher risk. Ensure the backtest period covers different market conditions, like bull and bear phases. Watch out for overfitting—if the bot performs too perfectly on past data, it may not work in real trading. Use realistic assumptions for slippage, commissions, and order execution. Compare backtest results with forward testing to confirm the strategy's robustness.

What are common pitfalls in backtesting trading bots?

Common pitfalls in backtesting trading bots include using unrealistic assumptions about order execution, ignoring slippage and transaction costs, overfitting the strategy to historical data, and neglecting market conditions that differ from past periods. Many traders also rely on limited data sets, leading to overly optimistic results. Failing to simulate real-time constraints, such as latency and order rejection, skews performance. Additionally, overlooking robustness tests across different market environments causes strategies to break down in live trading.

How often should I update my backtesting data?

Update your backtesting data at least monthly to ensure accuracy with recent market conditions. For more volatile markets or frequent trading strategies, update weekly or even daily. This keeps your backtests relevant and helps avoid outdated assumptions.

How do I incorporate transaction costs into backtests?

Include transaction costs by subtracting a fixed fee or percentage from each trade’s profit or loss. Model bid-ask spreads, slippage, and commissions explicitly in your backtest calculations. Adjust your entry and exit signals to account for these costs, ensuring your simulated results reflect real trading conditions.

Can backtesting predict future trading performance?

Backtesting can't predict future trading performance reliably. It shows how a strategy would have worked in past market conditions, but markets change. Good backtesting helps refine strategies, not guarantee results. Always test in live or simulated environments before trusting the bot with real money.

How do I optimize my trading bot based on backtest results?

Use backtest data to identify profitable strategies, then refine your bot’s algorithms accordingly. Focus on optimizing entry and exit points, adjusting stop-loss and take-profit levels, and testing different technical indicators. Validate your improvements with out-of-sample data before deploying live. Regularly revisit backtests to adapt to changing market conditions and ensure your trading bot stays effective.

What are the limitations of backtesting in day trading?

Backtesting in day trading has limitations like curve fitting, which makes strategies look good on past data but fail live. It also ignores real-time factors like slippage, transaction costs, and market impact. Historical data may not reflect future market conditions or sudden volatility. Overfitting to past patterns can lead to poor real-world performance. Additionally, it doesn't account for psychological factors or trader execution errors.

Conclusion about How to Backtest Day Trading Bots Effectively?

In conclusion, effectively backtesting day trading bots is crucial for developing a robust trading strategy. By selecting appropriate strategies, preparing accurate historical data, and utilizing the right tools, traders can gain valuable insights into their bots' performance. It's essential to be mindful of common pitfalls, avoid overfitting, and incorporate transaction costs to simulate real market conditions accurately. Regularly updating your data and interpreting results with clarity can enhance your trading outcomes. For comprehensive guidance on enhancing your trading strategies, DayTradingBusiness offers valuable resources and support to help you navigate the complexities of trading.

Learn about How to Backtest Day Trading Strategies Effectively