Did you know that the first computer to trade stocks was built in the 1980s and weighed over a ton? Fast forward to today, and machine learning is revolutionizing day trading in ways we could only dream of back then. This article dives into how machine learning enhances trading strategies by predicting price movements, reducing risks, and identifying optimal entry and exit points. We’ll explore the benefits of using these advanced algorithms, the types of data they utilize, common techniques, and their accuracy. Additionally, we’ll discuss how traders can integrate machine learning into their workflows, manage market volatility, and what tools to use. Finally, we’ll touch on the future of machine learning in day trading and how beginners can get started. Join DayTradingBusiness as we unlock the potential of machine learning in your trading journey!

How Does Machine Learning Improve Trading Strategies?

Machine learning analyzes vast market data to identify patterns and predict price movements, giving day traders an edge. It automates data processing, quickly spotting trends others might miss. ML models adapt to changing market conditions, refining strategies in real-time. It helps optimize entry and exit points, reducing emotional trading errors. By learning from past trades, it improves decision accuracy, boosting profitability.

What Are the Main Benefits of Using Machine Learning in Day Trading?

Machine learning improves day trading by detecting patterns in market data faster than humans, enabling more accurate predictions. It adapts to new data, refining strategies in real-time. ML algorithms identify profitable opportunities and minimize risks through automated, data-driven decision-making. It helps traders react quickly to market changes, reducing emotional bias. Overall, machine learning boosts trading efficiency, accuracy, and consistency.

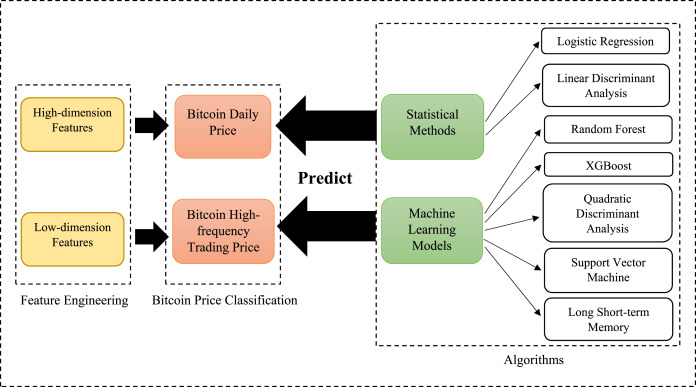

How Do Machine Learning Algorithms Predict Price Movements?

Machine learning algorithms analyze historical price data, identify patterns, and recognize signals that indicate future price moves. They use models like neural networks and decision trees to process vast amounts of market information, including news, volume, and technical indicators. By continuously learning from new data, they adapt to changing market conditions, helping day traders predict short-term price fluctuations more accurately.

Can Machine Learning Help Reduce Trading Risks?

Yes, machine learning helps reduce trading risks by analyzing vast market data to identify patterns and predict price movements more accurately. It can detect hidden trends and anomalies that human traders might miss, enabling better decision-making. Machine learning models adapt quickly to new information, minimizing losses and optimizing trade entries and exits. By automating risk management strategies, it helps set smarter stop-loss and take-profit levels, reducing emotional trading mistakes. Overall, it enhances day trading by making it more data-driven and responsive, lowering the likelihood of costly errors.

What Types of Data Do Machine Learning Models Use for Trading?

Machine learning models use historical price data, trading volumes, technical indicators, news sentiment, social media trends, and macroeconomic data to enhance day trading.

How Accurate Are Machine Learning Predictions in Day Trading?

Machine learning predictions in day trading are generally accurate within a small margin, often around 55-65%, but no system guarantees 100% success. They analyze patterns and market data to identify potential trades, improving decision speed and consistency. However, unpredictable market shifts and news events can still cause errors. Overall, machine learning enhances day trading by providing data-driven insights, but traders should use it as a tool, not a crystal ball.

What Are Common Machine Learning Techniques in Trading?

Common machine learning techniques in trading include supervised learning (like regression and classification), unsupervised learning (clustering and anomaly detection), reinforcement learning for strategy optimization, and neural networks for pattern recognition. These methods help identify market trends, predict price movements, and optimize trading decisions, making day trading more data-driven and responsive.

How Does Machine Learning Detect Market Trends?

Machine learning detects market trends by analyzing vast amounts of historical and real-time data to identify patterns and signals. It uses algorithms like neural networks and decision trees to predict price movements and spot emerging trends. By continuously learning from new data, it adapts to changing market conditions, helping day traders make more informed decisions.

Can Machine Learning Help Identify Good Entry and Exit Points?

Yes, machine learning helps identify good entry and exit points by analyzing historical data, patterns, and market signals to predict price movements. It recognizes complex trends and anomalies that humans might miss, optimizing timing for trades.

How Do Machine Learning Models Adapt to Market Changes?

Machine learning models adapt to market changes by continuously analyzing new data, updating their algorithms, and recognizing emerging patterns. They use techniques like reinforcement learning and real-time data feeds to adjust predictions quickly. This allows day trading algorithms to respond to sudden price shifts, news events, or volatility, keeping strategies aligned with current market conditions.

What Are the Limitations of Machine Learning in Trading?

Machine learning in day trading struggles with market unpredictability, overfitting to historical data, and rapid changes in market conditions. It can generate false signals from noisy data and may miss rare events or black swan incidents. Models require constant updates to stay relevant, and computational complexity limits real-time decision-making. Additionally, reliance on historical patterns might lead to overconfidence, risking significant losses during unexpected market shifts.

How Do Traders Integrate Machine Learning Into Their Workflow?

Traders use machine learning to analyze large datasets, identify patterns, and predict market movements. They integrate algorithms into trading platforms to automate decision-making, reduce emotional bias, and execute trades faster. Machine learning models process historical price data, news, and social media signals to generate real-time insights. Traders also use it to optimize strategies by backtesting and adjusting based on model predictions. Overall, machine learning makes day trading more data-driven, precise, and responsive.

What Are the Best Tools or Platforms for Machine Learning Trading?

Tools like MetaTrader with ML plugins, QuantConnect, and Alpaca enable machine learning-enhanced trading. They analyze market data patterns, predict price movements, and optimize trades faster than manual methods. Platforms like Python with libraries such as TensorFlow, scikit-learn, and pandas are essential for building custom ML models. These tools improve day trading by automating decision-making, identifying trends early, and reducing emotional bias.

How Does Machine Learning Handle Market Volatility?

Machine learning analyzes vast market data to identify patterns and predict price movements during volatility. It adapts quickly to changing conditions, adjusting trading strategies in real-time. Algorithms can detect subtle signals that humans might miss, enabling faster decision-making. By learning from past volatility events, machine learning models improve their accuracy, helping day traders capitalize on short-term price swings.

What Is the Future of Machine Learning in Day Trading?

Machine learning boosts day trading by analyzing vast data quickly, spotting patterns, and predicting market moves with higher accuracy. It automates decision-making, allowing traders to react faster and more precisely. Future advances will likely improve real-time data processing, risk management, and adaptive algorithms that learn from new market conditions, making automated trading smarter and more reliable.

How Can Beginners Start Using Machine Learning in Trading?

Beginners can start using machine learning in trading by learning basic Python and data analysis tools, then exploring simple algorithms like linear regression or decision trees. Use pre-built machine learning models on historical trading data to identify patterns and improve predictions. Focus on small, manageable projects—like predicting stock price movements—before scaling up. Online courses, tutorials, and trading platforms with ML features make entry easier. Start with demo accounts to test ML-driven strategies without risking real money.

Conclusion about How Does Machine Learning Enhance Day Trading?

Incorporating machine learning into day trading offers significant advantages, from enhancing trading strategies to predicting price movements with increased accuracy. By leveraging diverse data sets and advanced algorithms, traders can effectively identify market trends, optimize entry and exit points, and mitigate risks associated with volatility. While there are limitations to consider, the potential for improved decision-making is substantial. For those looking to delve deeper into these innovative techniques, DayTradingBusiness provides the resources and insights necessary for successful integration of machine learning into trading practices.