Did you know that AI can analyze market data in the blink of an eye, while most humans still struggle to find their socks in the morning? In the quest to determine whether AI can fully replace human traders in day trading, we explore its accuracy, limitations, and decision-making capabilities. This article delves into how AI analyzes market data, the unique skills human traders possess, and the risks associated with relying on AI. We also discuss the collaboration between AI and human traders and the ethical implications of AI in trading. Finally, we look at future trends and regulatory factors impacting AI in the trading landscape. Join us as we unpack these vital topics with insights from DayTradingBusiness, your go-to source for trading expertise.

Can AI Fully Replace Human Traders in Day Trading?

No, AI cannot fully replace human traders in day trading. While AI can analyze data quickly and execute trades efficiently, it lacks intuition, emotional judgment, and adaptability to unpredictable market shifts. Human traders bring experience, risk assessment, and strategic thinking AI can't replicate entirely. AI enhances trading but isn't a complete substitute for human oversight and decision-making.

How Accurate Are AI Predictions in Day Trading?

AI predictions in day trading are generally accurate for identifying patterns and quick trades, but they aren’t foolproof. Market volatility, news surprises, and black swan events can still throw off AI models. AI can assist and improve decision-making but can't fully replace human judgment, especially during unpredictable market swings.

What Are the Limitations of AI in Day Trading?

AI in day trading struggles with unpredictable market shifts, emotional factors, and news events it can't interpret accurately. It lacks intuition and human judgment needed for sudden volatility. AI models can overfit data, leading to poor real-time decisions. They also depend on historical data, which may not reflect future market conditions. Additionally, AI can't fully grasp market sentiment or geopolitical impacts influencing prices.

Can AI Make Better Trade Decisions Than Humans?

AI can analyze data faster and spot patterns humans might miss, making more precise trades in day trading. However, it lacks human intuition, emotional judgment, and adaptability to unpredictable market news. AI can outperform humans in speed and data processing but often struggles with sudden, unexpected events. So, AI can make better trade decisions in certain scenarios, but it doesn't fully replace human traders who interpret news, sentiment, and market psychology.

How Does AI Analyze Market Data for Day Trading?

AI analyzes market data for day trading by processing massive amounts of real-time information, including price movements, trading volumes, and news feeds, using algorithms and machine learning models. It detects patterns, trends, and anomalies faster than humans, enabling quick decision-making. AI also adapts to new data, refining its strategies through continuous learning. However, while AI can outperform humans in speed and pattern recognition, it lacks the intuition, emotional judgment, and contextual understanding that human traders bring.

What Skills Do Human Traders Have That AI Cannot Replicate?

Human traders excel at intuition, emotional judgment, and adapting to unpredictable market shifts. They can interpret news, social cues, and geopolitical events in ways AI struggles to replicate. Humans also make nuanced decisions based on experience, intuition, and context that aren’t purely data-driven. This blend of emotional insight and flexible thinking gives traders an edge AI can't fully imitate.

Is AI More Consistent Than Human Traders?

Yes, AI can be more consistent than human traders because it processes data faster and avoids emotional biases, leading to steadier decision-making.

Can AI Adapt Quickly to Market Changes?

AI can adapt quickly to market changes by analyzing vast data in real-time and adjusting strategies instantly. However, it still struggles with unpredictable market shocks and human intuition. AI can enhance day trading but rarely fully replaces human traders, especially in volatile conditions requiring judgment and experience.

What Are the Risks of Relying on AI in Day Trading?

Relying on AI in day trading risks missing market nuances AI can't interpret, like sudden news or emotional shifts. AI models can misjudge volatile moves or data anomalies, leading to big losses. Overconfidence in AI may cause traders to ignore alternative strategies or human intuition. Technical failures or data inaccuracies can cause costly errors. Additionally, AI-driven trading often lacks adaptability in unpredictable market conditions.

How Do Human Traders Use Intuition in Day Trading?

Human traders use intuition in day trading by trusting their gut feelings developed through experience, recognizing subtle market signals, and making quick decisions when data isn't clear. They rely on intuitive judgment to spot patterns, anticipate market moves, and react faster than algorithms can when unexpected events occur. This instinct helps them adapt in volatile situations where data alone might lag.

Learn about How Do Institutional Traders Use Leverage in Day Trading?

Will AI Reduce the Need for Human Traders?

AI can handle data analysis and execute trades faster than humans, but it can't replace human traders' intuition, experience, or understanding of market sentiment. While AI automates routine tasks, human traders adapt to unpredictable events and make strategic decisions that AI can't replicate fully. So, AI may reduce the number of manual trades but won't eliminate the need for human oversight and judgment in day trading.

How Do AI Trading Algorithms Work in Practice?

AI trading algorithms analyze market data, identify patterns, and execute trades automatically. They use machine learning to adapt to new data, making split-second decisions based on predefined strategies. While they can process vast information faster than humans, they lack intuition and emotional judgment. AI can outperform humans in speed and consistency but can't fully replace human traders' experience and nuanced understanding, especially in unpredictable market conditions.

Can AI Help Minimize Trading Losses?

AI can help minimize trading losses by analyzing vast data quickly, detecting patterns, and executing trades faster than humans. It can identify risks and adapt strategies in real-time, reducing emotional errors. However, AI doesn't fully replace human judgment, especially in unpredictable market conditions, but it significantly enhances risk management and decision-making in day trading.

Is AI-Based Trading Suitable for Beginners?

AI-based trading can help beginners by providing automated analysis and reducing emotional decisions, but it shouldn't replace understanding market fundamentals. AI tools can assist with day trading strategies, but beginners still need to learn core concepts and risk management. Relying solely on AI without knowledge increases risks, so it's best as a supplement rather than a complete replacement for human traders.

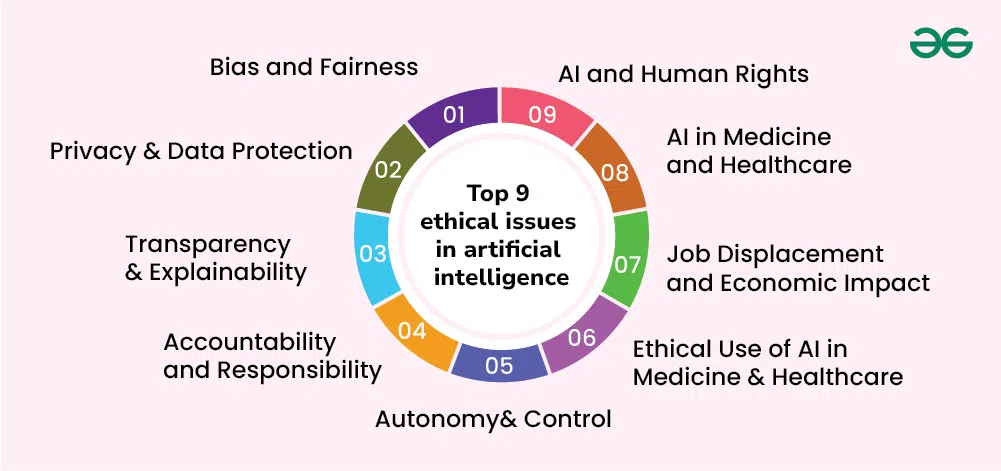

What Ethical Issues Are Associated With AI in Trading?

AI in trading raises ethical issues like market manipulation, insider trading, and lack of transparency. It can be used to execute manipulative strategies or exploit privileged information, risking unfair advantages. There's concern over accountability if AI causes significant financial losses or crashes. Using AI may also widen the trading gap, favoring firms with advanced tech over individual traders. Additionally, reliance on AI reduces human oversight, potentially overlooking ethical considerations in decision-making.

How Do Human Traders and AI Collaborate?

Human traders and AI collaborate by using AI for data analysis, real-time market predictions, and automation of trades. Humans set strategy, interpret AI insights, and make final decisions. AI handles quick calculations and pattern recognition, while traders apply judgment and experience. Together, they improve speed, accuracy, and adaptability in day trading. AI can't fully replace human intuition and risk management.

What Are Future Trends in AI and Day Trading?

Future trends in AI and day trading include advanced machine learning models that analyze real-time data faster and more accurately. AI will increasingly predict market movements using deep learning, sentiment analysis, and alternative data sources like social media. Automation will grow, enabling AI to execute trades instantly based on complex algorithms. However, human traders will still be vital for strategic decisions, interpreting nuanced market signals, and managing risks. AI may augment but not fully replace human intuition and experience in day trading.

How Do Regulatory Factors Affect AI Trading?

Regulatory factors limit AI trading by imposing rules on data use, market manipulation, and transparency, which can restrict algorithm flexibility. Compliance costs increase as firms adapt AI systems to meet legal standards, impacting speed and innovation. Regulations also create uncertainties, forcing AI models to incorporate safeguards that may reduce their agility. Overall, strict or evolving regulations can slow AI adoption in day trading and influence how effectively AI can replace human traders.

Can AI Detect Market Manipulation Better Than Humans?

AI can detect market manipulation faster and more accurately than humans due to its ability to analyze large data sets and spot patterns in real-time. However, AI struggles with understanding context, intuition, and sudden market shifts that human traders can interpret. So, while AI enhances detection of manipulation, it doesn't fully replace human traders in day trading.

What Are the Cost Implications of Using AI for Trading?

Using AI for trading can lower costs by reducing human error, minimizing emotional bias, and increasing execution speed. However, developing and maintaining advanced AI systems requires significant investment in technology, data, and expertise. Over time, AI can cut trading fees and improve profit margins, but initial setup and ongoing updates can be expensive. Overall, AI can be cost-effective compared to human traders, but the upfront investment is substantial.

Conclusion about Can AI Replace Human Traders in Day Trading?

While AI offers remarkable capabilities in analyzing market data and making predictions, it cannot fully replace human traders due to their unique skills, intuition, and adaptability. The limitations of AI, including its inability to navigate complex market emotions and ethical considerations, highlight the ongoing need for human insight in trading. As technology evolves, collaboration between human traders and AI, supported by resources from DayTradingBusiness, will likely yield the most effective trading strategies. Balancing AI's efficiency with human judgment will shape the future of day trading.