Did you know that even the most experienced day traders sometimes flip a coin to make a decision? While luck can play a role, integrating AI into your day trading strategy may be a more reliable approach. In this article, we explore how AI can enhance your trading strategy, the best tools available, and the potential for predicting stock market trends. We’ll also discuss the benefits of machine learning, the risks involved, and how to effectively integrate AI into your trading platform. Additionally, we’ll cover important features to look for in AI software and the cost implications. With insights from successful case studies and an analysis of market sentiment, you'll gain a comprehensive understanding of how AI can help manage risk and adapt to changing market conditions. Dive in with DayTradingBusiness to unlock the potential of AI in your trading journey!

How Can AI Enhance My Day Trading Strategy?

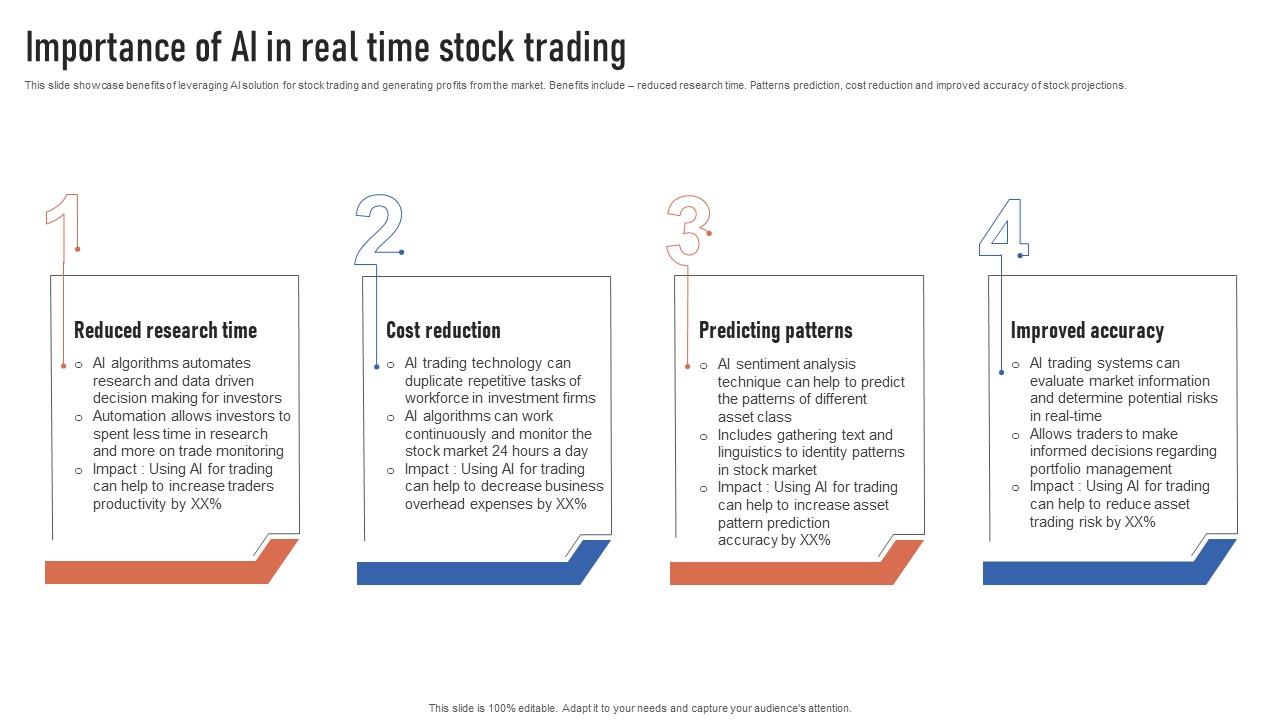

AI can enhance your day trading strategy by analyzing vast amounts of market data in real-time, identifying patterns, and making predictions. It can automate trades based on specific criteria, allowing for quicker execution. AI algorithms can also manage risk by analyzing your portfolio and suggesting adjustments. Additionally, AI can provide insights on market sentiment through news analysis and social media trends, helping you make informed decisions. Implementing AI tools can increase efficiency and improve your chances of profitability.

What Are the Best AI Tools for Day Trading?

The best AI tools for day trading include Trade Ideas, MetaTrader with Expert Advisors, and Alpaca. Trade Ideas offers real-time analytics and alerts, helping you spot patterns. MetaTrader allows for automated trading strategies through customizable bots. Alpaca provides a commission-free trading platform with AI-driven insights to optimize your trades. Each tool enhances your strategy by analyzing data and executing trades faster than manual methods.

Can AI Predict Stock Market Trends for Day Traders?

Yes, AI can predict stock market trends for day traders by analyzing vast amounts of data, identifying patterns, and providing insights based on historical performance. It improves your day trading strategy by offering real-time analytics, automating trades, and optimizing entry and exit points. However, while AI enhances decision-making, it cannot guarantee profits due to market unpredictability.

How Does Machine Learning Benefit Day Trading?

Machine learning enhances day trading by analyzing vast amounts of market data quickly, identifying patterns that humans might miss. It can forecast price movements using predictive analytics, optimize trading strategies through backtesting, and adapt in real-time to market changes. AI algorithms can also manage risk by setting stop-loss orders based on market volatility. Overall, incorporating machine learning can lead to more informed decisions, increased efficiency, and potentially higher profits in day trading.

What Are the Risks of Using AI in Day Trading?

The risks of using AI in day trading include reliance on algorithms that may misinterpret market signals, leading to poor decisions. AI can also amplify losses during volatile market conditions if not properly managed. Data bias is another concern; flawed training data can result in inaccurate predictions. Additionally, technical malfunctions or glitches can disrupt trading strategies. Finally, there's the risk of overfitting, where AI performs well on historical data but fails in real-time scenarios.

How Can I Integrate AI into My Trading Platform?

Integrating AI into your trading platform can enhance your day trading strategy by using algorithms for real-time data analysis, pattern recognition, and predictive analytics. Start by selecting AI tools that fit your needs, such as machine learning models that analyze historical price movements and news sentiment. Implement automated trading bots to execute trades based on predefined criteria. Utilize AI for risk management by setting alerts for unusual market activity and optimizing your portfolio. Finally, continuously refine your AI models with new data to improve accuracy and adapt to changing market conditions.

What Data Do AI Models Use for Day Trading Analysis?

AI models for day trading analysis use various types of data, including historical price data, trading volumes, market news, economic indicators, and social media sentiment. They analyze patterns, trends, and correlations in this data to make predictions about future price movements. Additionally, they may incorporate technical indicators like moving averages and RSI, as well as fundamental data from earnings reports and company news. By leveraging this data, AI can enhance your day trading strategy through better risk management and more informed decision-making.

Are There Successful Case Studies of AI in Day Trading?

Yes, there are several successful case studies of AI in day trading. For example, firms like Renaissance Technologies use AI algorithms to analyze vast amounts of market data, leading to substantial returns. Another example is Numerai, which crowdsources predictions from data scientists, leveraging AI to inform trading strategies. These cases demonstrate that AI can enhance decision-making, identify trends, and execute trades more efficiently, ultimately improving day trading strategies.

How Accurate Are AI Predictions in Day Trading?

AI predictions in day trading can be quite accurate, but their effectiveness varies based on the algorithms used and market conditions. Many traders find that AI can identify patterns and trends faster than humans, giving them an edge. However, AI is not infallible; it can misinterpret data or react to sudden market changes unpredictably. Incorporating AI into your day trading strategy can improve decision-making, but it’s crucial to combine AI insights with your analysis and risk management.

What Features Should I Look for in AI Trading Software?

Look for AI trading software that offers real-time data analysis, advanced algorithms, customizable trading strategies, and backtesting capabilities. Ensure it includes features like risk management tools, user-friendly interfaces, and integration with your trading platform. Additionally, check for automated trading options and performance tracking to refine your day trading strategy effectively.

Can AI Help Me Manage Risk in Day Trading?

Yes, AI can help you manage risk in day trading. It analyzes vast amounts of market data quickly to identify patterns, predict trends, and assess potential risks. AI tools can provide real-time alerts for price movements, helping you make informed decisions. Additionally, machine learning algorithms can optimize your trading strategy by simulating various scenarios and adjusting your risk exposure accordingly. Using AI can enhance your ability to manage risk effectively and improve your overall day trading strategy.

Learn about How Do Institutional Traders Manage Risk During Day Trading?

How Does AI Analyze Market Sentiment for Day Traders?

AI analyzes market sentiment for day traders by processing vast amounts of data from news articles, social media, and financial reports. It uses natural language processing (NLP) to gauge public sentiment, identifying bullish or bearish trends. Real-time analysis allows AI to spot patterns and predict price movements. This helps traders make informed decisions, optimizing buy and sell points. By integrating sentiment analysis with technical indicators, AI enhances day trading strategies, increasing the potential for profit.

Learn about How to Analyze Market Sentiment for Day Trading Success

What Is the Cost of AI Tools for Day Trading?

The cost of AI tools for day trading varies widely, ranging from free platforms to subscriptions costing hundreds of dollars per month. Basic tools might be around $20 to $50 monthly, while advanced AI systems with comprehensive features can exceed $500. Additionally, some platforms charge based on usage or performance. Always consider what features align with your trading strategy before investing.

How Do I Choose the Right AI Model for Trading?

To choose the right AI model for trading, consider these factors:

1. Trading Goals: Define your objectives—are you looking for short-term gains or long-term investments?

2. Data Type: Identify the data you have access to (historical prices, news sentiment, etc.) and ensure the AI model can process it.

3. Model Complexity: Decide between simpler models for quick insights or complex models for nuanced predictions.

4. Backtesting: Look for models that allow extensive backtesting on historical data to validate their effectiveness.

5. Risk Management: Ensure the model incorporates risk management strategies to protect your capital.

6. Real-Time Processing: If day trading, select models capable of real-time data analysis for quick decision-making.

7. User Experience: Consider how user-friendly the model is; you want something that fits your skill level.

Evaluate multiple options to find the AI model that aligns best with your trading style and resources.

Can AI Adapt to Changing Market Conditions in Day Trading?

Yes, AI can adapt to changing market conditions in day trading by analyzing vast amounts of data in real-time. It uses machine learning algorithms to identify patterns, predict market trends, and adjust strategies accordingly. By continuously learning from new data, AI can enhance your day trading strategy, improving decision-making and potentially increasing profitability.

What Are the Limitations of AI in Day Trading Strategies?

AI can enhance day trading strategies but has limitations. It struggles with unpredictable market conditions, often reacting poorly to sudden news or events. AI relies on historical data, which may not always predict future movements accurately. Additionally, it can miss nuanced market sentiment and human behavioral factors that influence trading. Overfitting models to past data can lead to poor performance in live trading. Finally, technical issues or algorithm biases can result in significant losses.

Conclusion about Can AI Improve My Day Trading Strategy?

Incorporating AI into your day trading strategy can significantly enhance decision-making, risk management, and market analysis. By leveraging advanced tools and machine learning algorithms, traders can gain insights into stock market trends and sentiment. However, it's crucial to remain aware of the associated risks and limitations. For optimal results, consider integrating AI tools that align with your trading goals and continuously adapting to market changes. Leveraging resources like DayTradingBusiness can guide you in navigating this evolving landscape, ensuring you maximize the benefits of AI in your trading endeavors.