Did you know that the average day trader can make or lose money as fast as you can say “scalping”? In this article, we dive into the essentials of day trading scalping, a fast-paced strategy that distinguishes itself from other methods. Discover the key benefits of scalping, the tools you need for success, and how to select the best stocks. We also cover crucial topics like time frames, risk management, and common pitfalls to avoid. Plus, learn effective strategies, chart reading techniques, and the impact of market volatility on your trades. Whether you’re full-time or part-time, DayTradingBusiness is here to guide you through the intricacies of scalping to enhance your trading journey.

What is day trading scalping?

Day trading scalping is a trading strategy that involves making numerous quick trades throughout the day to profit from small price movements. Traders buy and sell securities within minutes or seconds, aiming to capitalize on tiny fluctuations in price. Scalpers typically focus on high-volume stocks or assets, using leverage and technical analysis to execute trades rapidly. The goal is to accumulate small gains that can add up to significant profits over time.

How does scalping differ from other day trading strategies?

Scalping focuses on making small profits from numerous trades throughout the day, often holding positions for seconds to minutes. Other day trading strategies, like momentum trading, involve holding positions longer to capitalize on larger price moves. Scalpers rely on quick trades and tight spreads, while other day traders may use technical indicators or news events to guide their decisions. Essentially, scalping prioritizes speed and volume over the size of individual profits.

What are the key benefits of scalping in day trading?

Key benefits of scalping in day trading include:

1. Quick Profits: Scalpers aim for small price changes, allowing for rapid gains.

2. High Frequency: Multiple trades increase the potential for profit within a single day.

3. Lower Risk Exposure: Short holding times reduce the impact of market volatility.

4. Capital Efficiency: Smaller trades require less capital, making it accessible for many traders.

5. Discipline Development: Scalping requires strict discipline and strategy, improving overall trading skills.

What tools do I need for successful scalping?

For successful scalping, you need a reliable trading platform with fast execution speed, a direct market access (DMA) broker, advanced charting software, real-time data feeds, and a good risk management tool. Additionally, a reliable internet connection and a multiple-monitor setup can enhance your efficiency.

How do I choose the best stocks for scalping?

To choose the best stocks for scalping, focus on high liquidity stocks with tight bid-ask spreads. Look for stocks that have significant daily volume and volatility, which allows for quick price movements. Use technical analysis to identify price patterns and support/resistance levels. Additionally, monitor news and earnings reports that could impact stock prices rapidly. Finally, consider stocks in sectors currently experiencing heightened activity or interest.

What is the ideal time frame for scalping trades?

The ideal time frame for scalping trades is typically between 1 minute to 15 minutes. Most scalpers use 1-minute or 5-minute charts to identify quick entry and exit points. This allows for rapid trades, often holding positions for just seconds to a few minutes.

How can I manage risk while scalping?

To manage risk while scalping, set strict stop-loss orders for every trade to limit losses. Use a small percentage of your trading capital on each trade, typically no more than 1-2%. Focus on high-liquidity stocks or assets to ensure quick entries and exits. Monitor your trades closely to adjust your strategy based on market movements. Additionally, avoid overtrading by sticking to a clear plan and only taking high-probability setups. Finally, keep your emotions in check; stay disciplined and follow your risk management rules consistently.

What are the common mistakes to avoid in scalping?

Common mistakes to avoid in scalping include:

1. Overtrading: Taking too many trades can lead to burnout and increased transaction costs.

2. Ignoring Risk Management: Not setting stop-loss orders can result in significant losses.

3. Poor Timing: Entering or exiting trades too late can diminish profits.

4. Neglecting Market Conditions: Failing to adapt to changing volatility can lead to missed opportunities or losses.

5. Lack of a Trading Plan: Trading without a clear strategy can cause impulsive decisions.

6. Emotional Trading: Letting fear or greed influence decisions can derail your strategy.

7. Inadequate Research: Not analyzing stocks or market trends can lead to uninformed trades.

Avoid these pitfalls to improve your scalping effectiveness.

How much capital do I need to start scalping?

To start scalping, you typically need at least $2,000 to $5,000 in your trading account. This amount allows you to manage risk effectively and meet margin requirements. However, having $10,000 or more can provide better flexibility and reduce the impact of fees on your profits.

What strategies can I use for effective scalping?

To effectively scalp, use these strategies:

1. Focus on Liquid Markets: Trade in highly liquid stocks or forex pairs to ensure quick entry and exit.

2. Use Technical Analysis: Rely on charts and indicators like moving averages, RSI, or MACD to identify short-term trends.

3. Set Tight Stop-Loss Orders: Protect your capital by placing stop-losses close to your entry point.

4. Manage Risk: Limit your risk per trade to 1% or 2% of your trading capital to avoid large losses.

5. Time Your Trades: Trade during peak market hours for more volatility and better price movement.

6. Maintain Discipline: Stick to your trading plan and avoid emotional decisions.

7. Monitor News Events: Stay updated on economic news that can impact volatility and price movements.

8. Use a Fast Execution Platform: Ensure your trading platform offers quick order execution to capitalize on small price changes.

Implementing these strategies can enhance your scalping effectiveness.

What Are the Most Effective Day Trading Scalping Strategies?

The best day trading scalping strategies include:

1. **Momentum Trading**: Focus on stocks with strong price movements.

2. **Technical Analysis**: Use indicators like moving averages and RSI to identify entry and exit points.

3. **Breakout Trading**: Enter positions when a stock breaks through resistance or support levels.

4. **News-Based Trading**: Act quickly on news releases that impact stock prices.

5. **High-Frequency Trading**: Utilize algorithms to make multiple trades in seconds.

These strategies aim for quick profits on small price changes.

Learn more about: What Are the Best Day Trading Scalping Strategies?

Learn about Effective Risk Management for Scalping in Day Trading

How do I read charts for scalping?

To read charts for scalping, focus on short time frames like 1-minute or 5-minute charts. Look for key indicators such as moving averages, RSI, and volume spikes to identify trends. Use candlestick patterns to gauge market sentiment and entry points. Pay attention to support and resistance levels to set your stop-loss and take-profit orders. Keep an eye on news events that could affect volatility. Finally, practice with a demo account to refine your skills before trading live.

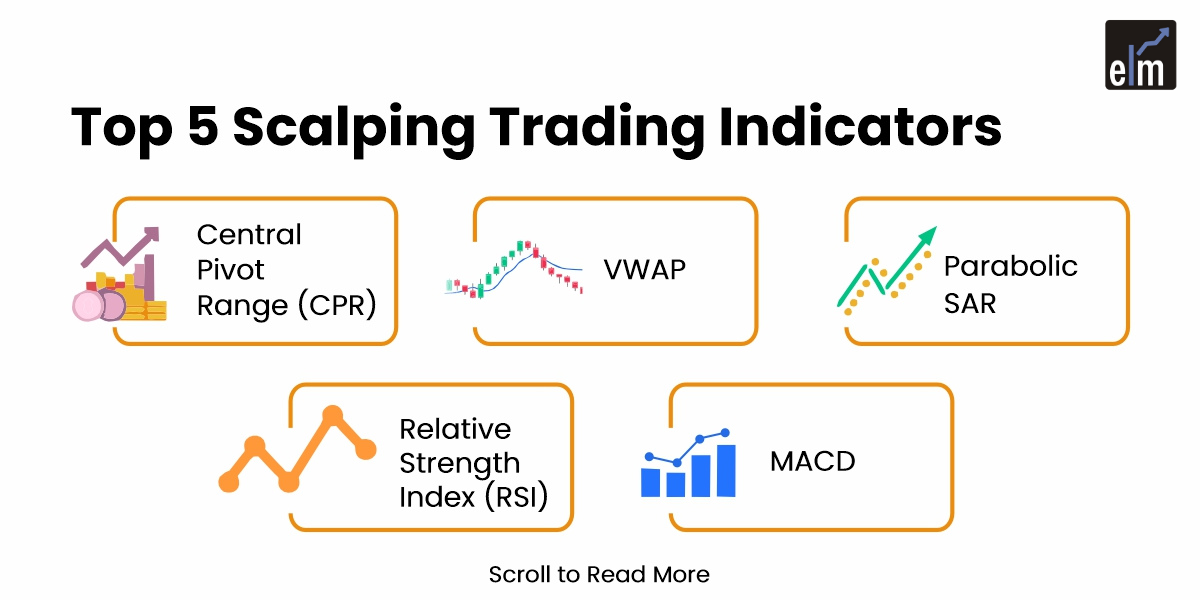

What indicators work best for scalping trades?

The best indicators for scalping trades include:

1. Moving Averages: Short-term moving averages (like the 5 or 10 EMA) help identify quick trends.

2. Relative Strength Index (RSI): Use it to spot overbought or oversold conditions.

3. Bollinger Bands: They indicate volatility and potential price reversals.

4. Volume: High volume confirms the strength of price movements.

5. MACD: This helps identify momentum shifts.

Combine these for better accuracy and to make quick, informed trading decisions.

How can I improve my scalping skills?

To improve your scalping skills, focus on these key strategies:

1. Practice with a Demo Account: Use a demo account to refine your techniques without risk.

2. Master Technical Analysis: Learn to read charts quickly and spot patterns that indicate entry and exit points.

3. Use Fast Execution Tools: Invest in a reliable trading platform that offers quick order execution.

4. Set Strict Risk Management Rules: Define your stop-loss and take-profit levels before entering trades.

5. Stay Disciplined: Stick to your trading plan and avoid emotional decisions.

6. Analyze Your Trades: Review past trades to identify mistakes and areas for improvement.

7. Keep an Eye on News: Monitor economic news that can impact price movements and volatility.

Regularly implementing these practices will enhance your scalping effectiveness.

What is the role of market volatility in scalping?

Market volatility is crucial for scalping as it creates the price movements needed for quick trades. High volatility allows scalpers to enter and exit positions rapidly, capturing small profits from price fluctuations. Without sufficient volatility, potential gains shrink, making it harder to achieve the rapid returns scalpers seek. Effective scalping strategies often rely on identifying volatile stocks or currency pairs to maximize these short-term opportunities.

How do fees and commissions affect scalping profits?

Fees and commissions can significantly reduce scalping profits. Since scalping relies on making numerous small trades, high transaction costs can eat into margins. For example, if each trade has a $5 commission, and you make 20 trades a day, that's $100 gone before you even factor in losses. Even if you make a profit on trades, fees can turn a winning strategy into a losing one. Therefore, choosing a broker with low fees is crucial for successful scalping.

Can scalping be done successfully with a part-time schedule?

Yes, scalping can be done successfully on a part-time schedule. Focus on specific market hours when volatility is high, like the opening or closing of the market. Use effective strategies, manage risk, and stay disciplined. Prioritize quick decision-making and limit trades to maximize your time efficiency.

Conclusion about Frequently Asked Questions About Day Trading Scalping

In summary, day trading scalping is a fast-paced strategy that requires precision, discipline, and effective risk management. By understanding its unique characteristics and utilizing the right tools, traders can capitalize on short-term price movements. Remember to avoid common pitfalls and continuously refine your skills. For more in-depth insights and support, consider exploring resources from DayTradingBusiness to enhance your scalping approach.

Learn about Frequently Asked Questions About Day Trading Backtesting