Did you know that the average day trader makes about 10 trades a day, but only 1 in 10 of those trades actually hits the mark? Timing is everything in the high-speed world of scalping, where every second counts. This article delves into the essential best practices for timing your scalping trades effectively. We’ll explore what scalping is and why timing is crucial, how to determine optimal entry and exit points, and the impact of market volatility and economic news on your trades. Additionally, we’ll discuss key indicators, the best timeframes, and the tools you can use to enhance your timing strategy. Learn how to avoid common mistakes, the importance of liquidity, and how psychological factors can play a role. With insights from DayTradingBusiness, you'll be equipped to refine your scalping approach and maximize your trading success.

What is scalping in trading and why is timing important?

Scalping in trading is a strategy that involves making numerous quick trades to exploit small price movements. Timing is crucial because even a few seconds can determine profit or loss. Entering and exiting trades at the right moments maximizes gains and minimizes risks, especially given the fast-paced nature of scalping. Effective timing helps traders take advantage of market volatility, ensuring they capitalize on fleeting opportunities.

How can I determine the best time to enter a scalping trade?

To determine the best time to enter a scalping trade, focus on high volatility periods, like market openings or significant news releases. Use technical analysis tools, such as moving averages or RSI, to identify entry points. Monitor volume spikes; higher volume often signals stronger price movements. Set clear entry and exit points based on your risk management strategy. Finally, stay aware of market sentiment and trends to time your trades effectively.

What are the key indicators for timing scalping trades?

Key indicators for timing scalping trades include:

1. Price Action: Monitor candlestick patterns and support/resistance levels for quick entry and exit points.

2. Volume: Look for spikes in trading volume, indicating strong interest and potential price movement.

3. Moving Averages: Use short-term moving averages (like the 5 or 10 EMA) to identify trends and potential reversals.

4. Relative Strength Index (RSI): An RSI below 30 can indicate oversold conditions, while above 70 can signal overbought conditions.

5. Bollinger Bands: Watch for price touching the outer bands, suggesting possible reversals or momentum shifts.

6. Market News: Stay updated on news releases and economic events that can cause volatility.

These indicators help identify optimal entry and exit points for effective scalping.

How does market volatility affect scalping trade timing?

Market volatility directly influences scalping trade timing by creating opportunities and risks. High volatility can lead to rapid price movements, allowing scalpers to enter and exit trades quickly for profit. However, excessive volatility increases the likelihood of slippage and unexpected losses, which can disrupt tight profit margins.

To optimize timing, scalpers should look for periods of increased volatility, like economic news releases or major market events, while employing tools like stop-loss orders to manage risks. Monitoring technical indicators, such as the Average True Range (ATR), helps identify suitable moments to enter and exit trades. Always adjust strategies based on current market conditions to maximize profitability.

What role do economic news releases play in scalping timing?

Economic news releases are crucial for scalping timing because they can cause rapid price movements. Traders use these releases to anticipate volatility, entering or exiting positions quickly based on market reactions. For instance, a strong jobs report might drive prices up, presenting a short-term buying opportunity. Conversely, poor data can lead to swift declines, prompting quick sells. Monitoring the economic calendar helps scalpers plan trades around these events, maximizing profit potential while managing risk.

How can I use technical analysis to time my scalping trades?

To time your scalping trades using technical analysis, focus on these key practices:

1. Identify Key Levels: Use support and resistance levels to determine entry and exit points. Look for price action near these levels.

2. Utilize Indicators: Apply indicators like Moving Averages, RSI, or MACD to spot trends and reversals. Short-term moving averages can signal entry points.

3. Candlestick Patterns: Watch for candlestick formations that indicate momentum shifts, such as pin bars or engulfing patterns, to make quick decisions.

4. Volume Analysis: Monitor trading volume to confirm price movements. Increased volume on a breakout often indicates a stronger move.

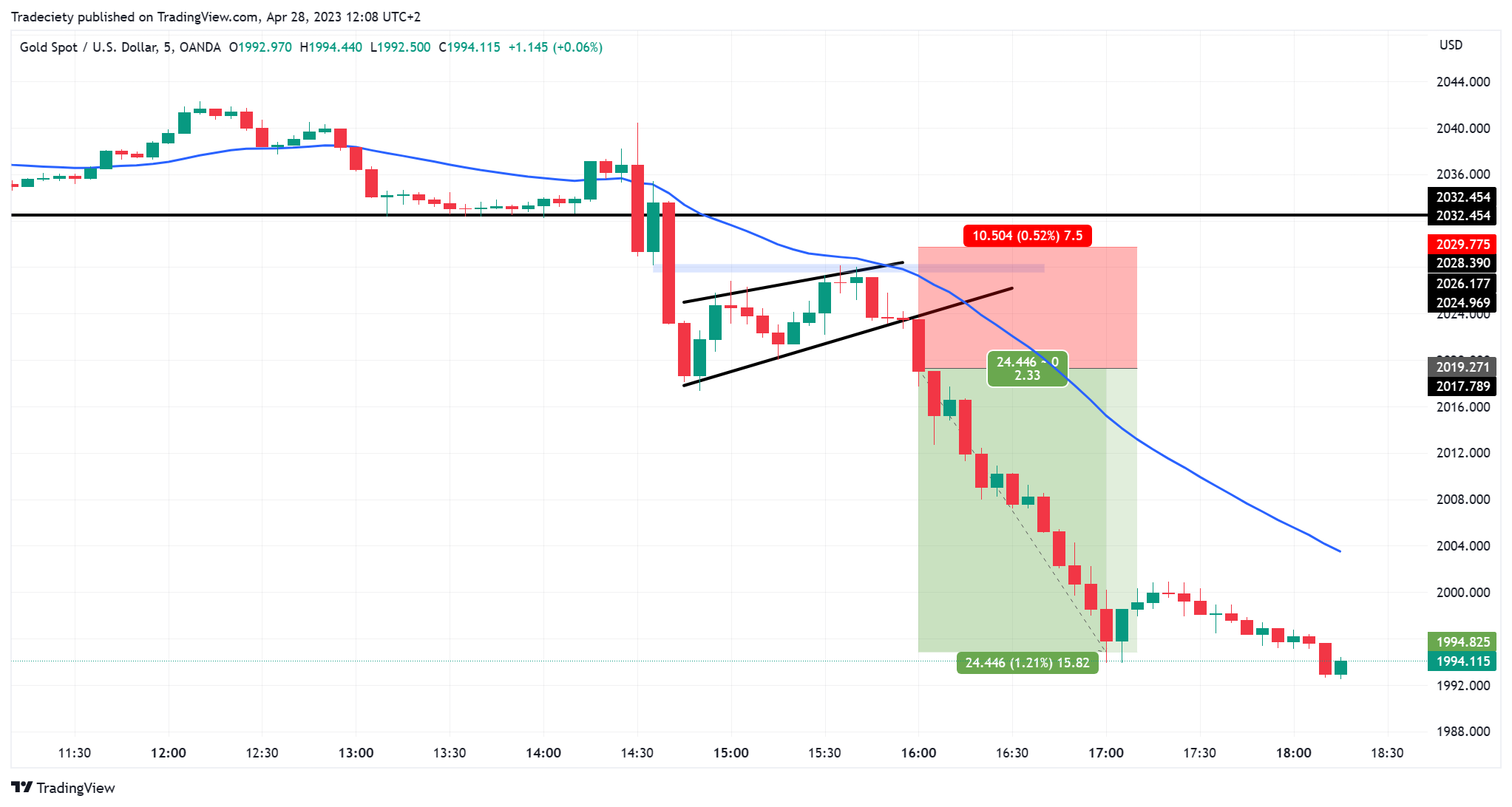

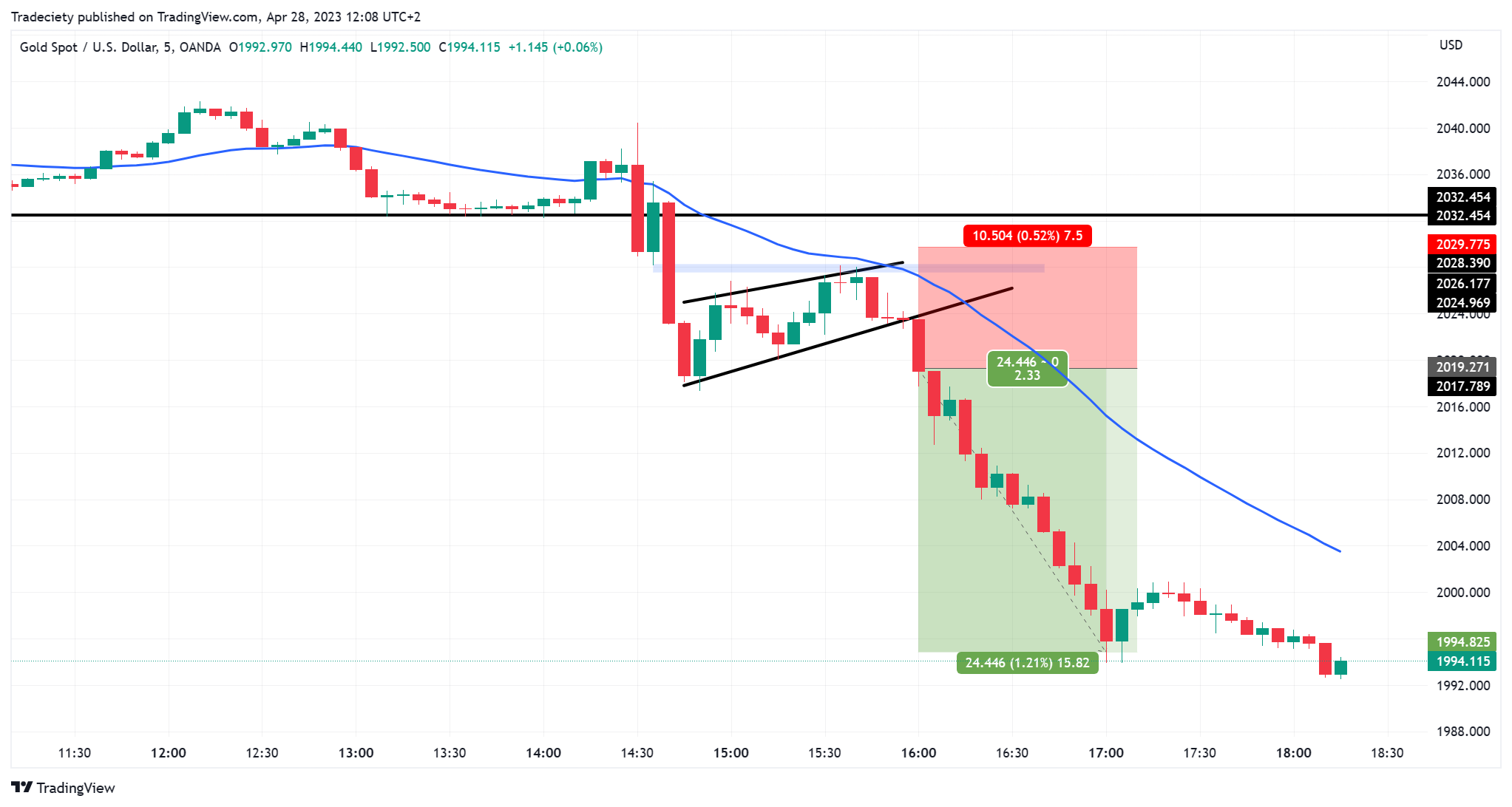

5. Time Frames: Use shorter time frames (1-minute to 5-minute charts) to capture quick price movements while keeping an eye on higher time frames for overall market direction.

6. Market News: Stay alert to economic news releases that can cause volatility and impact your trades.

7. Risk Management: Set tight stop-loss orders to protect against sudden reversals and ensure quick exits when trades don’t go as planned.

By combining these technical analysis techniques, you can effectively time your scalping trades for better profitability.

What are the best timeframes for scalping trades?

The best timeframes for scalping trades are typically 1-minute to 5-minute charts. These shorter timeframes allow for quick entries and exits, maximizing profit potential on small price movements. Many scalpers prefer the 1-minute chart for rapid trades, while some may opt for the 5-minute chart to reduce noise and filter out false signals. Focus on high liquidity periods, like market openings or major news releases, to enhance trade opportunities.

How can I identify optimal entry and exit points for scalping?

To identify optimal entry and exit points for scalping, focus on these key practices:

1. Use Technical Indicators: Rely on moving averages, RSI, and MACD to spot trends and reversals. Look for convergence or divergence signals.

2. Check Support and Resistance Levels: Identify key price levels where the asset tends to bounce or reverse. Enter near support and exit near resistance.

3. Monitor Volume: High trading volume can indicate strong momentum. Enter positions when volume spikes, suggesting a significant move.

4. Set Tight Stop Losses: Limit your risk by placing stop losses just outside your entry point. This protects against sudden market reversals.

5. Time Your Trades: Trade during high volatility periods, like market open or major news releases, when price movements are more pronounced.

6. Practice Patience: Wait for clear signals before entering or exiting. Avoid impulsive decisions driven by emotion.

7. Keep an Eye on the Spread: Ensure the bid-ask spread is narrow to maximize profit potential on quick trades.

By combining these strategies, you can enhance your ability to time your scalping trades effectively.

What tools can help me time my scalping trades effectively?

To time your scalping trades effectively, consider using these tools:

1. Real-Time Charts: Platforms like TradingView or MetaTrader provide live price action and technical indicators.

2. Level 2 Quotes: Use tools that show bid and ask prices to gauge market depth and understand order flow.

3. Tick Charts: These display price movement based on a set number of trades, helping you spot trends quickly.

4. Economic Calendars: Keep track of news events that could impact volatility using sites like Forex Factory or Investing.com.

5. Automated Alerts: Set up alerts on price movements or indicators to notify you when conditions are ripe for a trade.

6. Risk Management Software: Tools that help calculate position sizes and stop-loss levels can enhance your decision-making.

Combine these tools for a comprehensive approach to timing your scalping trades.

How should I adjust my timing strategy for different markets?

Adjust your timing strategy for different markets by considering their volatility and trading hours. In fast-moving markets, like forex during major news events, focus on quick entries and exits. For less volatile markets, extend your holding period slightly to capture small price movements. Monitor market depth and order flow to gauge optimal entry points. Always align your strategy with market conditions and be ready to adapt if trends shift. Use technical indicators to refine your timing for trades, ensuring you stay responsive to real-time changes.

What are common mistakes to avoid when timing scalping trades?

Common mistakes to avoid when timing scalping trades include:

1. Ignoring market conditions: Always assess volatility and liquidity before entering trades.

2. Overtrading: Avoid taking too many positions at once; focus on high-probability setups.

3. Lack of a clear strategy: Have a defined entry and exit plan; don’t rely on impulsive decisions.

4. Neglecting stop-loss orders: Always set stop-losses to manage risk effectively.

5. Failing to monitor news: Be aware of economic events that can impact price movements.

6. Poor risk management: Don’t risk more than a small percentage of your capital on a single trade.

7. Letting emotions drive decisions: Stick to your strategy and avoid chasing losses or profits.

8. Ignoring technical indicators: Utilize charts and signals to refine your timing for entries and exits.

Avoiding these mistakes can enhance your scalping success.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

How do trading sessions impact the timing of scalping trades?

Trading sessions significantly impact scalping trades due to varying market volatility and liquidity. During major sessions like London and New York, price movements are usually more pronounced, providing better opportunities for quick profits. Scalpers should focus on trading during these peak hours to capitalize on increased volume and tighter spreads. Additionally, avoid trading during low-activity periods, like late evenings or early mornings, as these can lead to slippage and less favorable executions. Timing your trades with market sessions in mind enhances your scalping strategy and boosts potential gains.

Can I use automated tools for better timing in scalping?

Yes, you can use automated tools for better timing in scalping. Tools like trading bots, algorithms, and technical indicators help identify optimal entry and exit points quickly. They can analyze market data in real-time, execute trades faster, and minimize emotional decision-making. Popular options include automated trading platforms and indicators like moving averages or Bollinger Bands to enhance your strategy. Just ensure you test and fine-tune these tools to match your specific trading style and risk tolerance.

What Are the Best Practices for Timing Scalping Trades in Day Trading?

The best practices for timing your scalping trades include:

1. **Use Technical Indicators:** Rely on indicators like moving averages and RSI to identify entry and exit points.

2. **Monitor Market Conditions:** Pay attention to market volatility and liquidity; optimal times are often during major market hours.

3. **Set Tight Stop-Loss Orders:** Protect your capital by placing stop-loss orders close to your entry price.

4. **Look for High-Volume Stocks:** Target stocks with high trading volume to ensure quick executions.

5. **Be Aware of News Events:** Avoid trading during major news releases that can cause sudden price movements.

These practices will help enhance your timing and efficiency in day trading scalping strategies.

Learn more about: What Are the Best Day Trading Scalping Strategies?

Learn about What Are the Best Practices for Using AI in Day Trading?

How does liquidity influence the timing of my scalping trades?

Liquidity directly impacts your scalping trade timing by affecting spread sizes and order execution speed. High liquidity means tighter spreads and quicker fills, allowing you to enter and exit positions swiftly. In contrast, low liquidity can lead to slippage and wider spreads, making it harder to execute trades at your desired price. Therefore, focus on trading during high-volume periods, such as market openings or key economic releases, to optimize your scalping effectiveness.

What psychological factors should I consider when timing scalping trades?

When timing scalping trades, consider these psychological factors:

1. Emotional Control: Stay calm and avoid impulsive decisions. Fear and greed can cloud judgment.

2. Discipline: Stick to your trading plan and avoid overtrading based on market noise.

3. Patience: Wait for the right setups. Rushing can lead to poor entries.

4. Market Sentiment: Gauge the mood of the market. Positive or negative trends can affect price movements.

5. Focus: Minimize distractions to enhance decision-making speed and accuracy.

6. Risk Tolerance: Know your limits and accept losses quickly to maintain a clear mindset.

Implementing these factors can improve your timing and success in scalping trades.

How can backtesting improve my timing for scalping trades?

Backtesting helps improve your timing for scalping trades by allowing you to analyze historical price data and test your strategies under various market conditions. By identifying patterns, you can fine-tune entry and exit points. It reveals the effectiveness of your indicators and helps you understand market volatility. This data-driven approach enhances your decision-making, reduces emotional trading, and increases your chances of executing successful scalps. Regularly backtesting ensures that your strategies adapt to changing market dynamics, leading to better timing and profitability.

Conclusion about Best Practices for Timing Your Scalping Trades

Effective timing is crucial for successful scalping trades, as it directly impacts profitability. By understanding market volatility, utilizing key indicators, and staying informed about economic news, traders can make informed decisions. Technical analysis and the right tools further enhance the ability to pinpoint optimal entry and exit points. Adjusting strategies for different markets and avoiding common mistakes are essential for consistent performance. Incorporating backtesting can refine your approach, while being mindful of psychological factors ensures better decision-making. For comprehensive insights and support, DayTradingBusiness is your go-to resource in mastering the art of timing in scalping trades.