Did you know that even a goldfish has a longer attention span than most day traders? In the fast-paced world of momentum day trading, having the right tools and software can make all the difference. This article dives into the essential tools for momentum trading, how software can enhance your strategies, and which platforms offer the best support. Discover key features to look for, effective charting techniques, and the benefits of automated trading. We’ll also explore how to set up alerts, the costs involved, and the importance of real-time data. Plus, learn about community forums, free resources, and common pitfalls to avoid. Let DayTradingBusiness guide you through optimizing your momentum trading approach for maximum success.

What are the best tools for momentum day trading?

The best tools for momentum day trading include:

1. Trading Platforms: Thinkorswim, TradeStation, and Interactive Brokers offer advanced charting and analytics.

2. Screeners: Finviz and Trade Ideas help identify stocks with high volatility and volume.

3. News Services: Benzinga Pro and MarketWatch provide real-time news that can impact momentum.

4. Charting Tools: TradingView and StockCharts offer customizable charts for technical analysis.

5. Brokerage Apps: Robinhood and Webull enable quick trades and real-time market data.

6. Risk Management Tools: Position size calculators and stop-loss orders protect your capital.

Using these tools effectively can enhance your momentum trading strategy.

How can software improve my momentum day trading strategy?

Software can enhance your momentum day trading strategy by providing real-time data analysis, automated trading, and customizable alerts. Tools like charting software help identify trends quickly, while algorithmic trading can execute trades based on your predefined criteria. Additionally, platforms with backtesting features allow you to refine your strategies using historical data. Using these tools effectively can increase your speed, accuracy, and decision-making efficiency in the fast-paced trading environment.

Which trading platforms support momentum day trading?

Popular trading platforms that support momentum day trading include:

1. Thinkorswim by TD Ameritrade – Offers advanced charting tools and customizable alerts.

2. TradeStation – Features powerful analytics and robust backtesting capabilities.

3. E*TRADE – Provides an intuitive interface with real-time data and research tools.

4. Webull – Known for commission-free trades and user-friendly mobile app.

5. Interactive Brokers – Offers low-cost trading and extensive market access.

6. Fidelity – Features comprehensive research tools and excellent customer service.

These platforms cater to active traders seeking to capitalize on price movements quickly.

What features should I look for in momentum trading software?

Look for real-time market data, customizable charts, and technical indicators like moving averages and RSI. Ensure it offers advanced order types, backtesting capabilities, and alerts for price movements. A user-friendly interface and mobile access are also essential for on-the-go trading. Lastly, check for integration with your brokerage and strong customer support.

How do I choose the right indicators for momentum trading?

To choose the right indicators for momentum trading, focus on these key tools:

1. Relative Strength Index (RSI): Helps identify overbought or oversold conditions, indicating potential reversals or continuations.

2. Moving Averages: Use short-term moving averages (like the 10 or 20-day) to spot trends and potential entry points.

3. MACD (Moving Average Convergence Divergence): Shows momentum shifts and can signal buy or sell opportunities.

4. Volume Indicators: Analyze trading volume to confirm momentum; increasing volume often validates price movements.

5. Bollinger Bands: Measure volatility and can indicate overbought or oversold conditions when price touches the bands.

Combine these indicators, backtest them, and adjust based on your trading style and asset class.

What are the top apps for momentum day trading on mobile?

The top apps for momentum day trading on mobile include:

1. TD Ameritrade Mobile – Offers advanced charting and research tools.

2. E*TRADE – Features real-time quotes and customizable watchlists.

3. Webull – Known for commission-free trading and detailed technical analysis.

4. Robinhood – User-friendly interface with commission-free trades.

5. Thinkorswim – Advanced trading tools and analytics for serious traders.

6. Fidelity Investments – Strong research capabilities and easy order execution.

7. TradeStation – Great for active traders with powerful analytics and tools.

These apps provide essential features for executing trades quickly and efficiently in a fast-paced market.

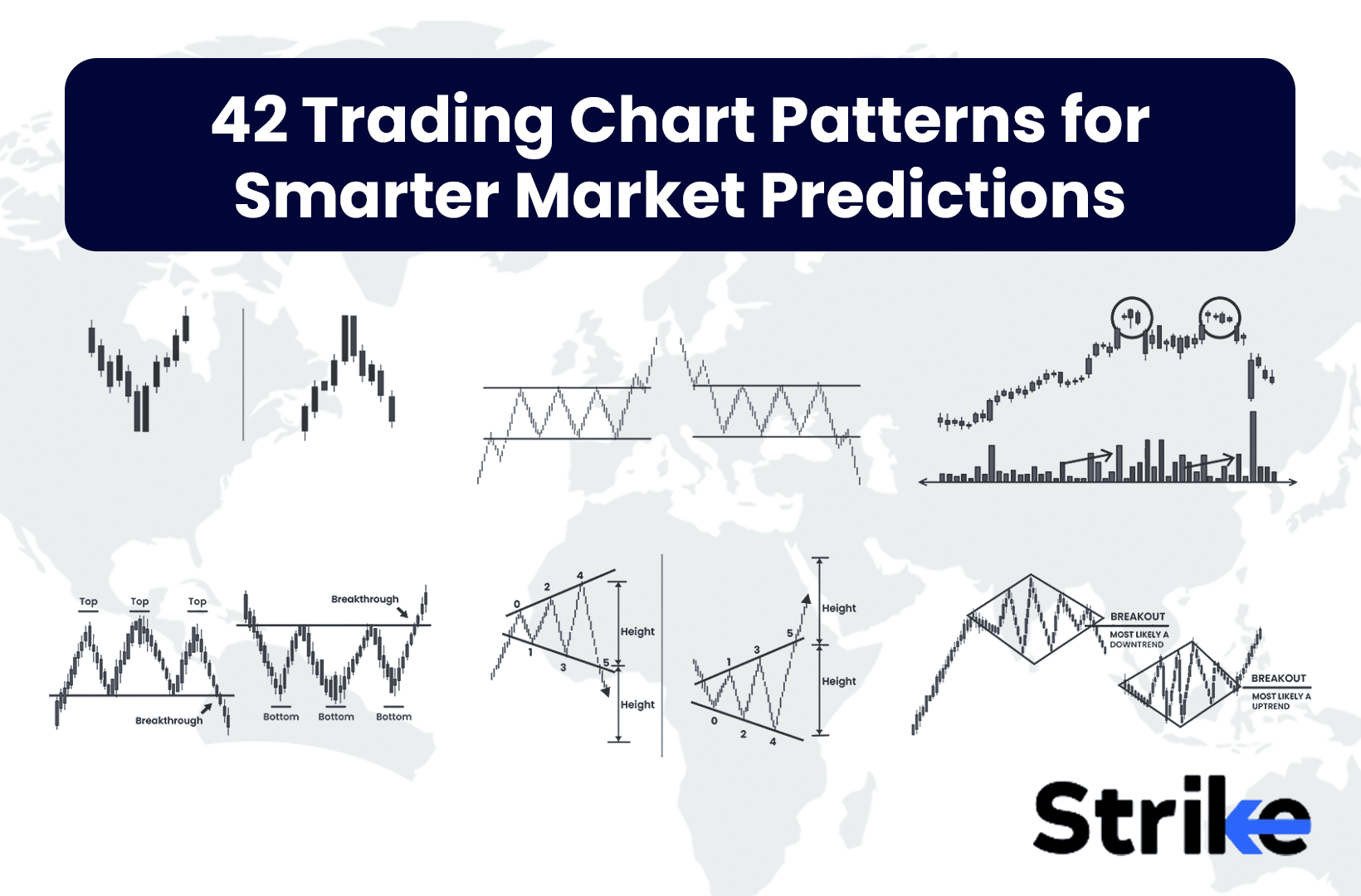

How can I use charts effectively for momentum day trading?

To use charts effectively for momentum day trading, focus on these key strategies:

1. Select the Right Chart Type: Use candlestick charts for detailed price action insights. They show open, high, low, and close prices, helping identify trends and reversals.

2. Incorporate Technical Indicators: Add indicators like Moving Averages, RSI, and MACD to spot momentum shifts. For example, a crossover in Moving Averages can signal entry or exit points.

3. Analyze Volume: Look at volume alongside price movements. Increased volume during price increases indicates strong momentum, supporting your trading decisions.

4. Set Clear Timeframes: Use shorter timeframes (like 1-minute to 15-minute charts) for quick trades, while keeping an eye on longer timeframes to understand overall trends.

5. Identify Support and Resistance Levels: Mark these levels on your charts to predict potential price reversals or breakouts. They help establish entry and exit points.

6. Use Chart Patterns: Recognize patterns like flags, pennants, or triangles. These can indicate continuation or reversal of momentum.

7. Stay Updated with News: Integrate real-time news feeds into your charting software. Major news impacts momentum, so be prepared to react quickly.

8. Practice Risk Management: Use chart analysis to set stop-loss orders effectively, minimizing potential losses while allowing for momentum trades.

By combining these elements, you can enhance your effectiveness in momentum day trading using charts.

What are the benefits of using automated trading tools for momentum?

Automated trading tools for momentum offer several benefits:

1. Speed: They execute trades faster than manual trading, capitalizing on fleeting price movements.

2. Emotion-Free Trading: Automation removes emotional decision-making, ensuring consistent strategy execution.

3. Backtesting: You can test strategies on historical data to refine and improve performance without risking real capital.

4. 24/7 Monitoring: Automated tools can monitor the markets continuously, allowing you to seize opportunities even when you’re not actively trading.

5. Precision: They enable precise entry and exit points, helping to maximize profits and minimize losses.

6. Diversification: You can simultaneously trade multiple assets, spreading risk and increasing potential returns.

Using these tools effectively enhances your momentum day trading strategy.

How do I set up alerts for momentum trading opportunities?

To set up alerts for momentum trading opportunities, use trading platforms like Thinkorswim, TradeStation, or MetaTrader.

1. Choose a Platform: Select a platform that supports alerts.

2. Identify Criteria: Define your momentum criteria, like price movement percentage, volume spikes, or RSI levels.

3. Create Alerts: Navigate to the alerts section and input your criteria. For example, set an alert for a stock that rises 5% within an hour.

4. Select Notification Method: Choose how you want to be notified—via email, SMS, or app notification.

5. Test Alerts: Monitor how alerts trigger during different market conditions to ensure effectiveness.

By following these steps, you can efficiently capture momentum trading opportunities as they arise.

What are the costs associated with momentum trading software?

Momentum trading software costs vary widely. Basic platforms range from $0 to $50 per month, while more advanced options can cost between $100 and $300 monthly. Some premium software, offering extensive features and data, may charge $1,000 or more annually. Additional costs can include commissions per trade, data feeds, and potential training resources. Always factor in your trading volume and specific needs when choosing software to ensure it aligns with your budget.

What Tools and Software Enhance Day Trading Momentum Strategies?

Day trading momentum strategies involve buying stocks that are moving significantly in one direction, typically based on news or market trends. Key tools and software for momentum day trading include charting platforms like TradingView, stock scanners such as Finviz, and brokerage tools that offer real-time data and fast execution. Essential features to look for are customizable alerts, technical indicators, and backtesting capabilities to optimize trading strategies.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about Day Trading Software with Risk Management Tools

How does backtesting work with momentum day trading tools?

Backtesting in momentum day trading involves using historical price data to evaluate trading strategies. You input your strategy parameters into backtesting software, which simulates trades based on past market conditions. The tool measures key performance metrics like profit, loss, win rate, and drawdowns. This helps traders assess the effectiveness of momentum indicators and refine their strategies before live trading. Popular backtesting tools include TradingView, NinjaTrader, and MetaTrader, which allow for customization and detailed analysis.

Learn about How to Choose the Right Backtesting Software for Day Trading

What is the role of real-time data in momentum trading?

Real-time data is crucial in momentum trading as it allows traders to identify and react to price movements instantly. It helps in spotting trends, confirming entry and exit points, and managing risk effectively. With real-time data, traders can track volume changes, news events, and market sentiment, which are essential for making quick, informed decisions. Additionally, this data aids in executing trades promptly, maximizing potential profits, and minimizing losses. Without it, traders would struggle to capitalize on rapid market shifts.

How can community forums help with momentum day trading?

Community forums can provide real-time insights, trading strategies, and market analysis that are crucial for momentum day trading. They allow traders to share tips on stocks showing rapid price movements and discuss news events impacting those stocks. Engaging with experienced traders can enhance your understanding of market trends and help refine your trading approach. Additionally, forums can be a source for alerts on sudden price changes, allowing you to react quickly to capitalize on momentum opportunities.

What are the best free tools available for momentum day trading?

The best free tools for momentum day trading include:

1. TradingView – Offers advanced charting and social features for real-time analysis.

2. Thinkorswim Paper Money – A robust platform with real-time data and virtual trading capabilities.

3. Yahoo Finance – Provides news, stock quotes, and basic charting tools.

4. Finviz – A powerful screener for finding stocks with strong momentum and technical setups.

5. CoinMarketCap – Ideal for cryptocurrency traders tracking price movements and trends.

These tools help you analyze price action, identify potential trades, and stay updated on market news.

Learn about Best Free Day Trading Software Available

How do I evaluate the performance of my momentum trading tools?

To evaluate the performance of your momentum trading tools, follow these steps:

1. Backtesting: Use historical data to test how your tools would have performed in past market conditions. Focus on metrics like win rate and profit factor.

2. Real-time Testing: Apply the tools in a live trading environment with a small amount of capital to assess their effectiveness in current market conditions.

3. Performance Metrics: Analyze key metrics such as average trade duration, percentage of profitable trades, and maximum drawdown to understand risk and reward.

4. Comparative Analysis: Compare your tools against a benchmark or other momentum strategies to gauge relative performance.

5. User Feedback: Gather insights from other traders using the same tools to identify strengths and weaknesses.

6. Regular Review: Continuously monitor and review tool performance to adapt to changing market conditions.

By focusing on these methods, you can effectively evaluate and refine your momentum trading tools.

What are common mistakes to avoid with momentum trading software?

1. Ignoring Backtesting: Failing to backtest your strategy can lead to unexpected losses. Always test your approach on historical data before live trading.

2. Overtrading: Using momentum software can create the temptation to trade too frequently. Stick to your strategy and avoid impulsive decisions.

3. Neglecting Risk Management: Not setting stop-loss orders or position size limits can amplify losses. Always implement strict risk management practices.

4. Relying Solely on Software: Momentum trading software is a tool, not a guarantee. Combine it with your own analysis and market understanding.

5. Not Keeping Up with Market News: Software might not account for breaking news that affects momentum. Stay informed about market developments.

6. Misunderstanding Indicators: Misinterpreting momentum indicators can lead to bad trades. Ensure you understand how to use them effectively.

7. Focusing on Short-Term Gains: Chasing quick profits can result in missed opportunities. Look for sustainable momentum rather than just immediate spikes.

Learn about Common Mistakes in Day Trading Analysis to Avoid

Conclusion about Tools and Software for Momentum Day Trading

In conclusion, selecting the right tools and software is crucial for successful momentum day trading. By utilizing the best trading platforms, leveraging effective indicators, and employing automated trading tools, traders can enhance their strategies and capitalize on market opportunities. Furthermore, utilizing charts, setting alerts, and engaging with community forums can provide valuable insights and support. With the guidance of resources like DayTradingBusiness, traders can navigate these tools effectively to optimize their momentum trading performance.

Learn about Day Trading Software with Risk Management Tools

Sources:

- Digital transformation: A multidisciplinary reflection and research ...

- Market intraday momentum: APAC evidence - ScienceDirect

- A profitable trading algorithm for cryptocurrencies using a Neural ...

- Artificial intelligence and machine learning approaches to energy ...

- Predicting stock market index using LSTM - ScienceDirect

- Stock selection with random forest: An exploitation of excess return ...