Did you know that day traders can execute more trades in a single day than some people make in a month? In the fast-paced world of trading, understanding the nuances between scalping and momentum trading is crucial for success. This article breaks down the essential differences, strategies, and risks associated with both styles. You'll learn about the ideal time frames, market conditions, and tools that traders use to maximize profits. Whether you’re just starting or looking to refine your approach, DayTradingBusiness provides the insights you need to navigate these strategies effectively.

What is Scalping in Trading?

Scalping in trading is a strategy focused on making small profits from numerous trades throughout the day, often holding positions for just seconds or minutes. It relies on quick decision-making and high trading volume to capitalize on minor price fluctuations.

In contrast, momentum trading involves buying stocks that are trending up or selling those trending down, aiming to catch larger price moves over a longer timeframe. While scalpers thrive on speed and volume, momentum traders look for sustained price movements and typically hold positions longer.

What is Momentum Trading?

Momentum trading involves buying stocks or assets that are trending upward and selling those that are trending downward, capitalizing on the strength of price movements. Scalping, on the other hand, focuses on making quick trades to profit from small price changes, often holding positions for seconds to minutes. While both strategies aim to profit from market movements, momentum trading relies on sustained trends over a longer period, whereas scalping seeks immediate, rapid gains.

How Do Scalping and Momentum Trading Differ?

Scalping focuses on making quick profits from small price changes, executing many trades throughout the day. Momentum trading, on the other hand, aims to capitalize on existing trends, holding positions longer to benefit from sustained price movements. Scalpers rely on high-frequency trades and tight spreads, while momentum traders look for significant price shifts over time.

What Are the Key Strategies for Scalping?

Key strategies for scalping include:

1. Quick Trades: Focus on making numerous trades throughout the day, aiming for small profits on each.

2. Tight Spreads: Choose assets with low spreads to maximize gains on small price movements.

3. High Leverage: Use leverage to amplify profits, but be cautious of increased risk.

4. Technical Analysis: Rely on charts, indicators, and patterns for entry and exit points.

5. Risk Management: Set strict stop-loss orders to protect against significant losses.

6. Market Depth: Monitor order books to gauge buying and selling pressure.

7. Time Frame: Operate on very short time frames, like 1-minute or 5-minute charts.

In contrast, momentum trading focuses on capturing larger price movements over a longer period, typically using trend analysis and fewer trades.

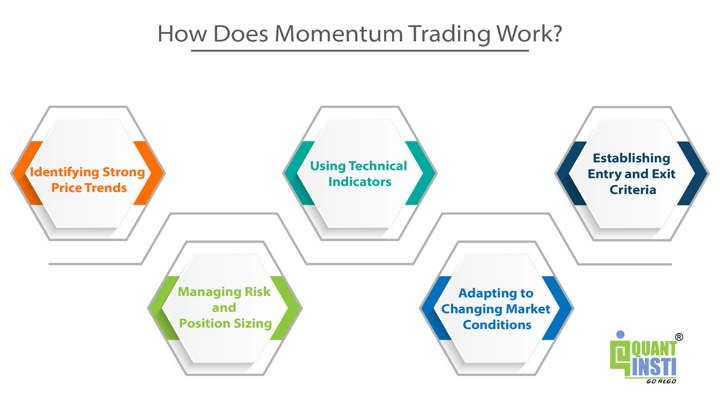

What Are the Key Strategies for Momentum Trading?

Key strategies for momentum trading include identifying stocks with strong price movements, using technical indicators like moving averages and RSI to confirm trends, and employing tight stop-loss orders to manage risk. Traders often look for breakout patterns, volume spikes, and news catalysts that can drive momentum. Unlike scalping, which focuses on quick, small profits from minor price changes, momentum trading aims for larger gains from sustained price movements over a longer timeframe.

What Time Frames Are Best for Scalping?

For scalping, the best time frames are typically 1-minute to 5-minute charts. These shorter intervals allow traders to make quick trades based on small price movements. In contrast, momentum trading often uses longer time frames, like 15-minute to hourly charts, to capture larger price swings. Scalping focuses on speed and precision, while momentum trading emphasizes trend-following over a broader period.

What Time Frames Are Best for Momentum Trading?

For momentum trading, the best time frames are typically 15-minute to 1-hour charts. These allow traders to capture short-term price movements while filtering out noise. Scalping, on the other hand, often uses 1-minute to 5-minute charts for rapid trades. Focus on the 15-minute to 1-hour range for effective momentum trading strategies.

What Are the Risks of Scalping?

The risks of scalping include high transaction costs due to frequent trades, market volatility leading to rapid losses, and the potential for slippage during fast market movements. Additionally, scalpers may face emotional stress from constant decision-making and the pressure to react quickly. Lack of liquidity can also hinder executing trades at desired prices, increasing overall risk.

What Are the Risks of Momentum Trading?

Momentum trading carries several risks:

1. Volatility: Rapid price changes can lead to significant losses if the market reverses unexpectedly.

2. False Signals: Traders may act on misleading trends, resulting in poor entry or exit points.

3. Overtrading: The fast pace can lead to excessive trades, increasing transaction costs and the chance of emotional decision-making.

4. Market Dependency: Momentum strategies rely on strong trends; if the market consolidates, profits may dwindle.

5. Liquidity Issues: In times of high volatility, finding buyers or sellers at desired prices can be challenging.

Understanding these risks is crucial for effective momentum trading.

How Do Market Conditions Affect Scalping?

Market conditions significantly impact scalping by influencing volatility and liquidity. In high volatility markets, scalpers can capitalize on rapid price movements but face increased risk. Low volatility can limit profit opportunities, making it harder to execute trades quickly. Additionally, during periods of high liquidity, scalpers can enter and exit positions with minimal slippage, enhancing profitability. Conversely, in thinly traded markets, spreads widen, and execution becomes challenging, reducing effectiveness. Understanding these dynamics helps scalpers adapt their strategies to current market conditions.

Learn about How Market Conditions Affect HFT Strategies

How Do Market Conditions Affect Momentum Trading?

Market conditions significantly impact momentum trading by influencing price trends and volatility. In strong bullish markets, momentum traders thrive as prices rise, creating opportunities for quick gains. Conversely, in bearish or choppy markets, momentum trading can be riskier due to unpredictable price movements. Scalping, on the other hand, focuses on capturing small price changes regardless of the broader market trend, making it less affected by overall market conditions. Thus, while momentum trading relies on sustained trends and clear market directions, scalping adapts to short-term fluctuations.

Learn about How Do Market Makers and Liquidity Providers Affect Day Trading?

What Are the Key Differences Between Scalping and Momentum Trading Strategies in Day Trading?

Day trading momentum strategies involve buying stocks that are trending upwards and selling those that are declining, focusing on short-term price movements. Scalping is a specific momentum trading strategy that aims for small profits on numerous trades throughout the day, often holding positions for seconds to minutes. In contrast, general momentum trading may involve holding positions longer, from minutes to hours, based on the strength of price movements.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about Differences Between Momentum and Other Day Trading Strategies

What Tools Do Scalpers Use?

Scalpers use tools like high-speed internet connections, trading platforms with low latency, and advanced charting software. They rely on direct market access (DMA) to execute trades quickly and often utilize algorithmic trading systems for speed and efficiency. Key indicators include moving averages, volume analysis, and level II market data for real-time insights. Additionally, scalpers often use risk management tools like stop-loss orders to protect against significant losses.

What Tools Do Momentum Traders Use?

Momentum traders typically use technical analysis tools, including moving averages, relative strength index (RSI), and MACD. They rely on chart patterns and volume analysis to identify trends. Scalpers, on the other hand, focus on very short-term price movements, using tools like Level II data, time and sales, and tick charts. While both strategies use similar indicators, momentum trading emphasizes longer time frames and larger price moves, whereas scalping targets quick profits from minor price changes.

Can You Combine Scalping and Momentum Trading?

Yes, you can combine scalping and momentum trading. Scalping focuses on making quick profits from small price changes, while momentum trading seeks to capitalize on existing trends. By integrating both strategies, you can identify strong momentum stocks and execute quick trades to profit from short-term fluctuations within those trends. This approach allows for potentially higher returns by leveraging both rapid trades and the strength of market momentum.

Which Trading Style Is More Profitable?

Scalping is generally more profitable for traders who thrive on quick, small gains from numerous trades throughout the day. It requires a high level of focus and quick decision-making. Momentum trading, on the other hand, focuses on riding trends for larger gains over a longer period. It can be more profitable when markets are trending strongly. Ultimately, profitability depends on the trader's skill, market conditions, and risk management strategies.

What Should Beginners Know About Scalping vs. Momentum Trading?

Beginners should know that scalping focuses on making quick profits from small price changes, often executing dozens or hundreds of trades in a day. It requires a strict exit strategy and quick decision-making. Momentum trading, on the other hand, aims to capitalize on existing market trends, holding positions for longer periods, from minutes to days. Scalpers rely on technical analysis and high leverage, while momentum traders look for strong price movements and may use both technical and fundamental analysis. Understanding these differences can help beginners choose a trading style that fits their personality and risk tolerance.

Learn about What should beginners know about legal compliance in day trading?

Conclusion about Scalping vs. Momentum Trading: Key Differences

In summary, both scalping and momentum trading offer distinct approaches to day trading, each with unique strategies, time frames, and risk profiles. Scalping focuses on rapid trades to capitalize on small price movements, while momentum trading seeks to harness larger trends. Understanding these differences is crucial for traders to align their strategies with market conditions and personal risk tolerance. For those looking to deepen their knowledge and refine their trading techniques, DayTradingBusiness provides valuable insights and resources to enhance your trading journey.

Sources:

- Algorithmic Trading in Financial and Sports (Exchanges)

- Fight or freeze? Individual differences in investors’ motivational ...

- Building a High-Frequency Trading Algorithm Using An Ordinary ...

- Beat the Market An Effective Intraday Momentum Strategy for ...

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Reinforcement Learning for Quantitative Trading